For many small business owners, navigating the administrative requirements of a limited liability company can feel overwhelming. One of the most critical, yet often overlooked, compliance tasks is the yearly filing of a state-mandated report. Using a reliable Llc Annual Report Template can simplify this process, ensuring you provide the correct information and meet your deadlines without unnecessary stress. This report is not a detailed financial statement like one a corporation might file; rather, it’s a way for the state to keep its records current and verify that your LLC is still active and compliant with its regulations.

Think of the annual report as your LLC’s yearly check-in with the state. Its primary purpose is to confirm or update key details about your business, such as your principal address, the names of your members or managers, and your registered agent’s information. States use this document to maintain an accurate public record and to ensure they can contact your business for official legal and tax correspondence. Failure to file this report on time can lead to serious consequences, ranging from hefty late fees to the state administratively dissolving your company.

This is where a well-structured template becomes an invaluable tool. It acts as a checklist, guiding you through the necessary fields and preventing you from omitting crucial information. While many states provide their own specific forms, understanding the common components found in a general template helps you gather the required information in advance. This guide will break down everything you need to know about LLC annual reports, from their fundamental purpose to the specific details you’ll need to provide, empowering you to handle this essential task with confidence.

What is an LLC Annual Report?

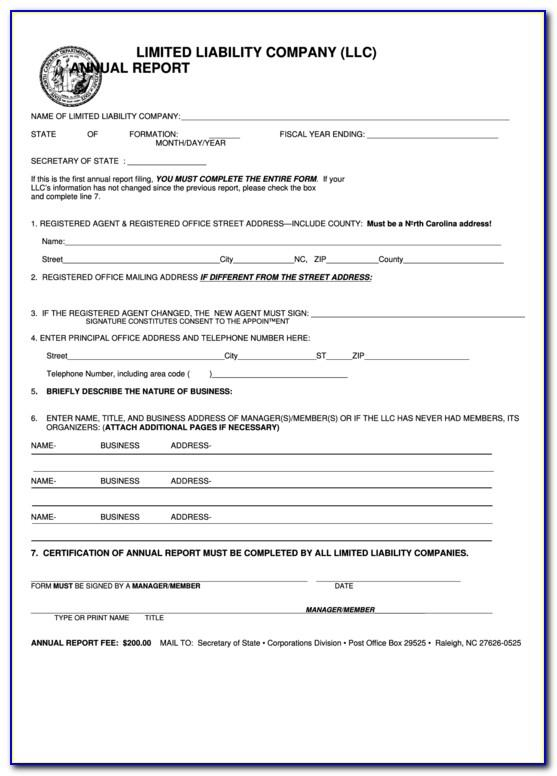

An LLC annual report is a mandatory filing required by most states to keep a limited liability company in good standing. Despite its name, it isn’t always filed annually. Depending on the state, it may be called a “Statement of Information,” “Biennial Report” (filed every two years), or “Periodic Report.” The core function remains the same: it provides the state’s business filing agency, typically the Secretary of State, with up-to-date information about your LLC.

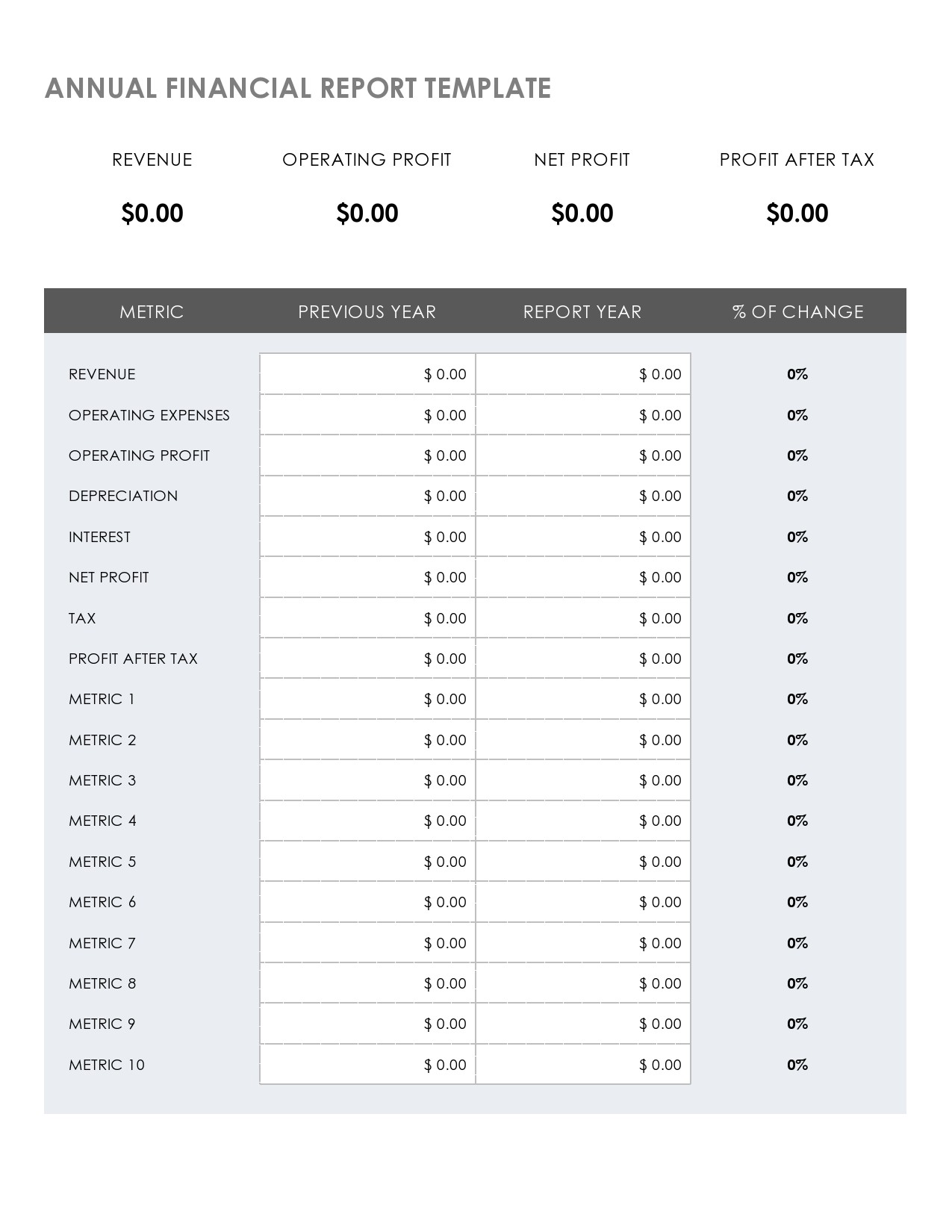

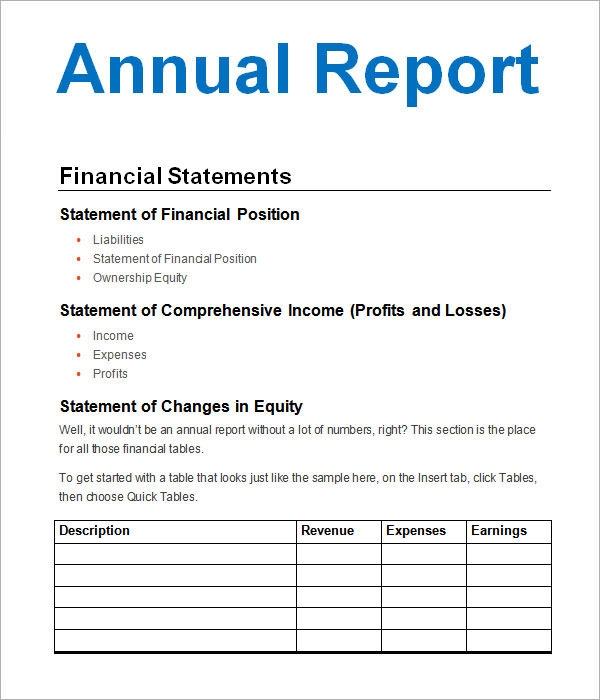

This report is fundamentally a compliance document, not a financial one. You generally won’t be asked to provide detailed profit and loss statements, balance sheets, or revenue figures. Instead, the focus is on the operational and structural details of your company. It ensures the state has accurate contact information and knows who is responsible for the business.

The information gathered through these reports is often made public, allowing consumers, potential business partners, and legal entities to look up basic facts about your LLC. It serves as an official confirmation that your business exists and is authorized to operate within that state’s jurisdiction. Filing this report demonstrates your commitment to transparency and legal compliance, which is essential for the long-term health and credibility of your business.

Why Filing an Annual Report is Crucial for Your LLC

Filing your LLC’s annual report on time is not just another administrative task to check off a list; it’s a foundational element of maintaining your business’s legal status. Neglecting this responsibility can have a cascading effect of negative consequences that can threaten the very existence of your company.

Maintaining Good Standing

The most immediate benefit of timely filing is keeping your LLC in “good standing” with the state. Good standing is an official designation that confirms your business is fully compliant with all state requirements. This status is vital for many business operations. For example, you typically need a Certificate of Good Standing to open a business bank account, apply for loans or lines of credit, or register to do business in another state (a process known as foreign qualification). Without it, your financial and expansion opportunities can be severely limited.

Avoiding Penalties and Fines

States impose financial penalties for failing to file your annual report by the deadline. These can range from a modest late fee to hundreds of dollars, depending on the state and how long the filing is overdue. These fines are an unnecessary expense that can easily be avoided with proper planning. The cost of filing on time is almost always significantly lower than the penalties for being late.

Preventing Administrative Dissolution

If you ignore filing requirements for an extended period, the state has the authority to administratively dissolve your LLC. This is the corporate equivalent of a death penalty. Administrative dissolution means your LLC legally ceases to exist, and you lose the liability protection that is the primary benefit of forming an LLC in the first place. If your company is dissolved, your personal assets could be at risk if the business faces a lawsuit or accrues debt. Reinstating a dissolved LLC is often a complex and expensive process, assuming it’s even possible in your state.

Updating Your Business Information

The annual report serves a practical purpose by creating a regular opportunity to ensure your official business information is correct. Over a year, things can change—your business might move to a new location, a manager might leave, or you might switch to a different registered agent. The annual report filing forces you to review and officially update these details, ensuring that important legal notices and tax documents are sent to the right place and person.

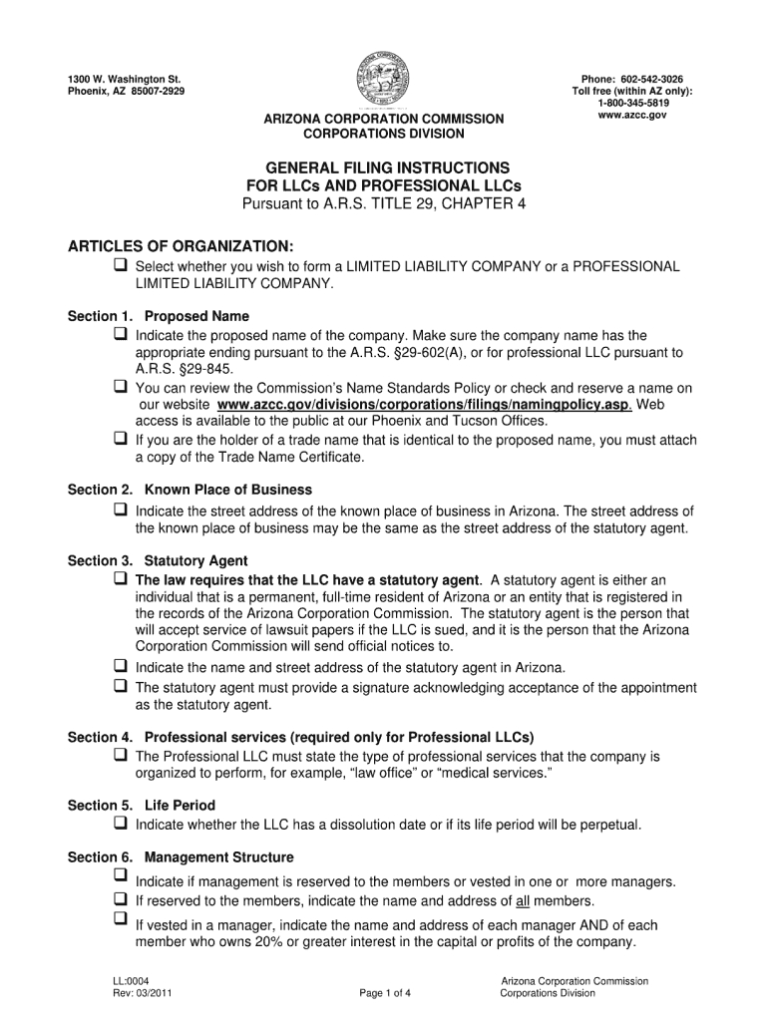

Key Components of an Llc Annual Report Template

While the exact format varies by state, most annual report forms and templates request the same core pieces of information. Understanding these components will help you prepare everything you need before you start filling out the form, making the process smooth and efficient.

Business Information

This is the most basic section. You’ll need to provide the exact legal name of your LLC as it is registered with the state, along with your state-issued business identification number (sometimes called a file number or entity number). You will also be asked to confirm or update the LLC’s principal office address, which is the main location where the business operates.

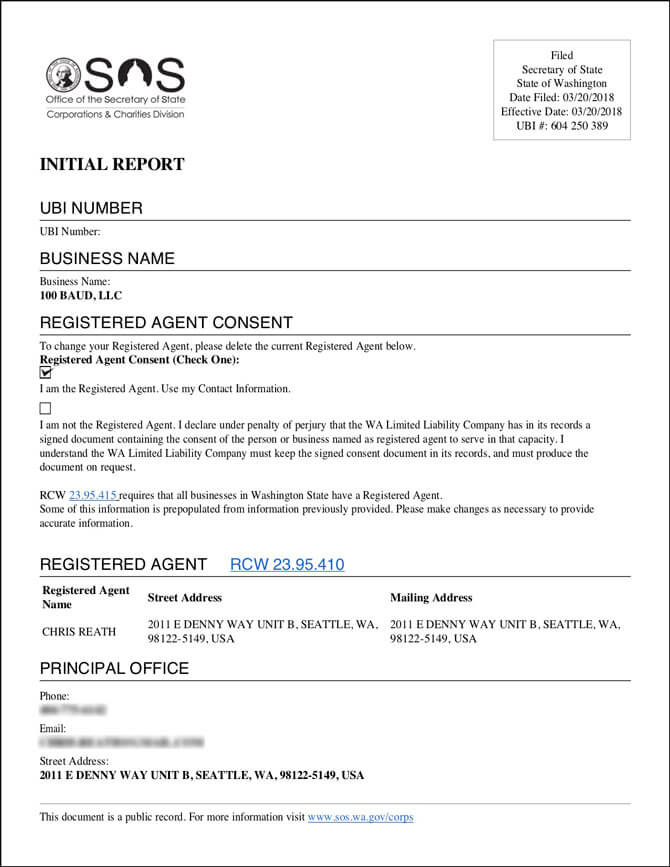

Registered Agent Details

Every LLC is required to have a registered agent—a person or service designated to receive official legal documents (like lawsuit notices) on behalf of the company. In your annual report, you must confirm the name and physical street address of your current registered agent. This address must be a physical location in the state of formation, not a P.O. Box. If you have changed your registered agent since your last filing, this is the official opportunity to update that information with the state.

Principal Office Address

You will need to list the primary street address of your business. This may be different from your mailing address or your registered agent’s address. It’s the physical location where your business’s primary activities take place or where its records are kept. Some states may also ask for a separate mailing address if it differs from the principal office address.

Member/Manager Information

The state needs to know who is in charge of your LLC. The template will have a section to list the names and business addresses of all members (if it’s a member-managed LLC) or all managers (if it’s a manager-managed LLC). This information is often part of the public record, so be prepared to provide complete and accurate details for each individual.

Brief Statement of Business Purpose

Some states require a short, general statement describing the nature of your business. You often don’t need to be overly detailed. Simple descriptions like “real estate investment,” “consulting services,” or “retail sales” are usually sufficient. This is typically to confirm that the business’s purpose hasn’t drastically changed from what was originally filed.

Signatures and Filing Fees

Finally, the report must be signed by an authorized person, such as a member, manager, or another individual permitted by your operating agreement. The report is not complete until the required filing fee is paid. Fees vary widely from state to state, ranging from as little as $10 to several hundred dollars. Most states now allow for online filing and payment, which is the fastest and most reliable method.

How to Find and Use a Template for Your LLC Annual Report

Finding the right form or template is the first step in the filing process. While general templates can help you prepare, it’s almost always best to use the official form provided by your state to ensure full compliance.

State-Provided Forms vs. General Templates

A generic Llc Annual Report Template found online can be an excellent tool for understanding the information you’ll need to gather. It can act as a worksheet before you begin the official filing. However, you should not submit a generic template to the state.

The official and required form will always be available on your state’s Secretary of State website. These forms are tailored to that state’s specific legal requirements. Most states now have an online portal for filing, which guides you through the process step-by-step. Using the official state portal is the most secure and direct way to file.

Step-by-Step Guide to Filling Out the Form

- Locate the Form: Visit your state’s Secretary of State or Division of Corporations website. Look for a section on “Business Filings” or “Annual Reports.”

- Gather Your Information: Using the components listed in the previous section as a guide, collect all necessary details. This includes your LLC’s file number, registered agent address, and the names and addresses of all members/managers.

- Complete the Form: Fill out the form carefully, whether online or on a physical copy. Most online portals will pre-populate some of your LLC’s current information, which you will then need to confirm or update.

- Review for Accuracy: Double-check every entry for typos or errors, especially addresses and names. An incorrect registered agent address could cause you to miss a critical legal notice.

- Sign and Submit: An authorized person must sign the document. If filing online, this is usually done with a digital signature.

- Pay the Fee: Submit the filing fee using the accepted payment methods. Online portals typically accept credit cards.

- Keep a Copy: Always save a copy of the submitted report and your payment confirmation for your business records.

Common Mistakes to Avoid When Filing

- Missing the Deadline: Set multiple calendar reminders for your filing due date.

- Using a P.O. Box: A registered agent address must be a physical street address.

- Forgetting to Update Information: If your address or managers have changed, you must update the form. Filing with outdated information defeats the purpose.

- Failing to Pay the Fee: The state will reject your report if the filing fee is not included.

- Incorrect Signatory: Ensure the person signing the report is legally authorized to do so on behalf of the LLC.

State-Specific Annual Report Requirements

One of the most important things to understand is that annual report rules are not universal; they are dictated by individual state laws. What is required in one state may be completely different in another.

For example, California requires LLCs to file a “Statement of Information” every two years. Florida requires an “Annual Report” to be filed each year between January 1st and May 1st. Delaware, a popular state for incorporation, has no annual report requirement for LLCs but does require them to pay an annual flat-rate franchise tax of $300.

In contrast, some states have no annual reporting requirement at all for LLCs. As of now, states like Arizona, Missouri, New Mexico, and Ohio do not require an ongoing annual or biennial report. This simplifies compliance significantly for businesses in those states.

Because of this wide variation, you must never assume the rules from one state apply to yours. The absolute best source of information is the official website for the Secretary of State (or equivalent agency) in the state where your LLC was formed. Check their website for three key pieces of information:

1. The official name of the report (e.g., Annual Report, Statement of Information).

2. The filing deadline.

3. The filing fee.

What Happens if You Miss the Filing Deadline?

Missing your annual report deadline is not a minor oversight; it triggers a series of escalating consequences that can jeopardize your business. The process typically begins with financial penalties and can end with the termination of your LLC.

First, you will be assessed a late fee. This fee is in addition to the standard filing fee and can sometimes be quite substantial. The state will send a notice of delinquency to your registered agent, informing you that your LLC is no longer in good standing.

Losing good standing status has immediate practical implications. You may find yourself unable to secure business financing, as lenders will not loan money to a non-compliant entity. You could also lose the ability to file a lawsuit in the state’s courts. Perhaps most critically, you might be prevented from renewing necessary professional licenses or business permits.

If you continue to ignore the filing requirement after receiving a delinquency notice, the state will initiate proceedings for administrative dissolution. They will provide a final window of time to correct the issue by filing the report and paying all associated fees and penalties. If you fail to act within this grace period, the state will formally dissolve your LLC. At that point, your company’s name becomes available for others to use, and you lose your personal liability shield. Reinstating the LLC, if possible, is often far more costly and complicated than simply filing the report on time in the first place.

Conclusion

The LLC annual report is a fundamental pillar of business compliance. While it may seem like just another piece of paperwork, it is the mechanism that keeps your company in good legal standing with the state, preserving the liability protection that is the core benefit of an LLC. Using an Llc Annual Report Template or your state’s official online form simplifies this critical task by providing a clear roadmap of the information you need to provide.

By understanding the key components of the report, knowing your specific state’s requirements and deadlines, and submitting your filing accurately and on time, you can easily avoid steep penalties and the catastrophic risk of administrative dissolution. Treat your annual report not as a burden, but as a routine health check for your business. Mark your calendar, gather your information in advance, and file with confidence, ensuring your LLC remains compliant and strong for years to come.

]]>