Taking control of your company’s financial health is one of the most critical steps toward sustainable growth, and the right Small Business Budget Template Excel Free can be the perfect tool to achieve this. Many entrepreneurs and small business owners feel overwhelmed by the thought of creating a detailed financial plan, often assuming they need expensive, complicated accounting software. The reality is that a well-structured spreadsheet is a powerful, accessible, and highly customizable solution for tracking income, managing expenses, and making informed strategic decisions. This guide will demystify the process and show you how to leverage the power of Excel to build a robust budget that empowers your business.

A budget is more than just a list of numbers; it’s a financial roadmap for your business. It allows you to set clear financial goals, allocate resources effectively, and anticipate potential cash flow issues before they become critical problems. Without a budget, you are essentially flying blind, making decisions based on gut feelings rather than concrete data. This can lead to overspending, missed opportunities, and a constant state of financial uncertainty. A clear budget helps you understand your business’s profitability, identify areas where you can cut costs, and plan for future investments, such as hiring new staff or purchasing new equipment.

For a small business, every dollar counts. The beauty of using a free Excel template is its combination of power and affordability. Microsoft Excel, or free alternatives like Google Sheets, provides all the necessary functionality to create a comprehensive budget without adding another monthly subscription to your list of expenses. These spreadsheet programs are designed for flexibility, allowing you to tailor your budget specifically to your industry, business model, and unique financial categories.

This article will serve as your complete guide to mastering small business budgeting with Excel. We will explore why Excel remains a top choice for financial planning, break down the essential components that every effective budget must have, and provide a step-by-step guide on how to use a template. We’ll also cover common mistakes to avoid and offer expert tips to ensure your budgeting efforts lead to greater financial clarity and long-term success.

Why Excel is a Powerful Tool for Small Business Budgeting

In an age of specialized software-as-a-service (SaaS) products for every conceivable business need, you might wonder if a classic tool like Microsoft Excel is still relevant for budgeting. The answer is a resounding yes. For small businesses, in particular, Excel offers a unique blend of accessibility, flexibility, and power that makes it an ideal starting point for financial management.

Unmatched Customization and Flexibility

Unlike rigid accounting software that forces you into pre-defined categories, Excel gives you a blank canvas. Every business is unique, and a small business budget template in Excel can be molded to fit your specific needs perfectly. Whether you run a coffee shop with daily variable costs, a consulting firm with project-based revenue, or an e-commerce store with fluctuating marketing spend, you can create categories and formulas that reflect your actual operations. You can add, remove, or rename expense lines, create custom summary dashboards, and build a financial model that is a true representation of your business.

Cost-Effectiveness

The most obvious benefit is the cost. Most business computers already have Microsoft Office installed. Even if they don’t, Microsoft 365 for Business plans are affordable, and Microsoft even offers a free web-based version. This eliminates the need for another monthly subscription, which can quickly add up for a small business trying to manage its overhead. Starting with a free tool allows you to allocate that capital to more critical, revenue-generating areas of your business.

Widespread Familiarity

Excel has been a staple in the business world for decades. Most business owners and their employees have at least a basic understanding of how to navigate a spreadsheet, enter data, and read charts. This low learning curve means you can get your budget up and running quickly without needing to invest significant time in training. This familiarity also makes it easier to share and collaborate on the budget with partners, accountants, or key team members.

Powerful Analytical Features

Modern Excel is far more than a simple grid for numbers. It contains a suite of powerful features that can help you gain deeper insights into your financial data. You can use formulas to automate calculations for totals, variances, and percentages. Charts and graphs can visualize your revenue streams and expense breakdowns, making complex information easy to digest at a glance. For more advanced analysis, you can use features like PivotTables to summarize large datasets and Conditional Formatting to highlight key figures, such as budget overruns.

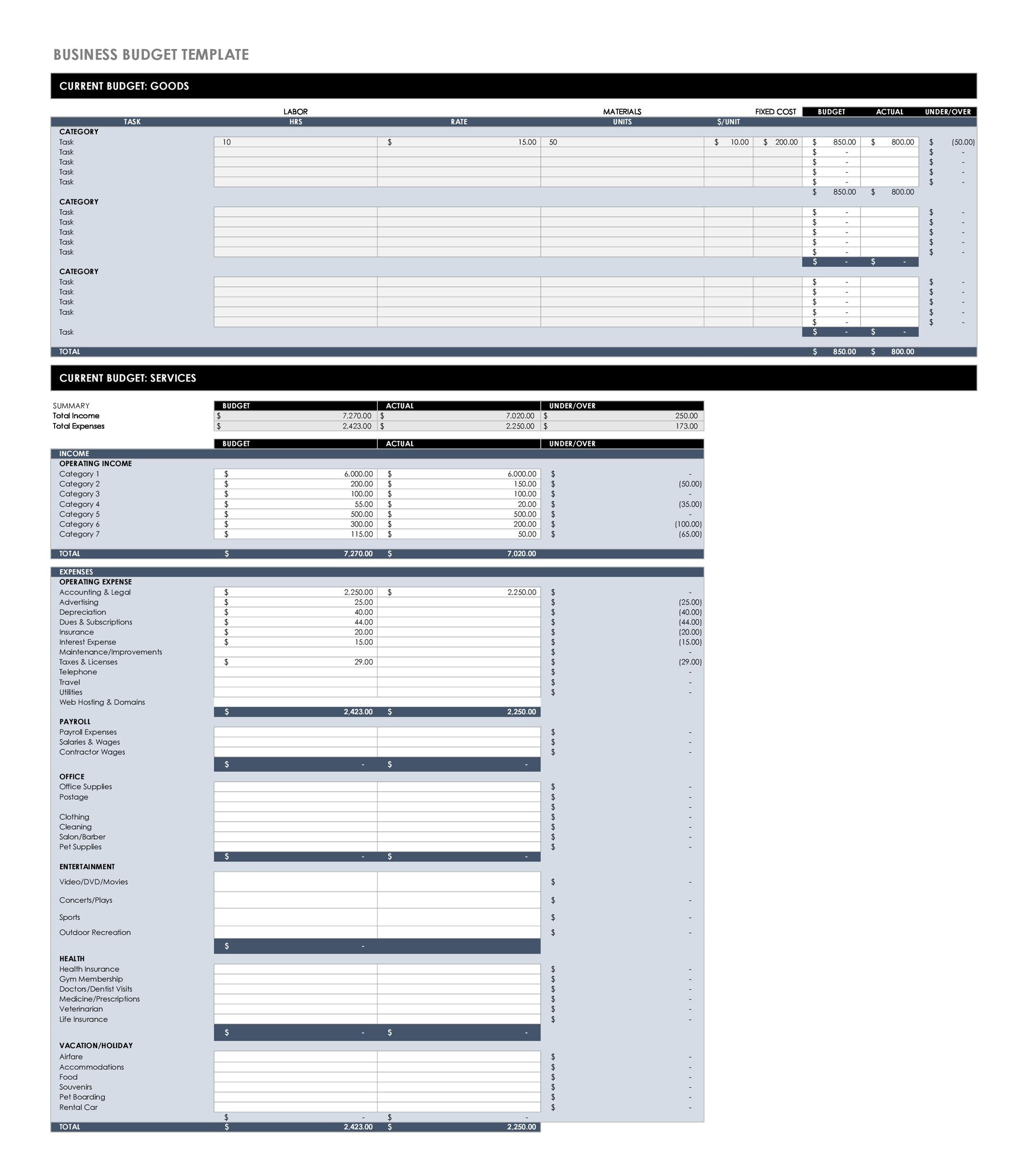

Key Components of an Effective Small Business Budget

Before you start populating a template, it’s crucial to understand the fundamental building blocks of a comprehensive business budget. A good template will have designated sections for each of these components, which work together to give you a complete picture of your financial health.

Income and Revenue Projections

This is the starting point of your budget. Here, you’ll forecast all the money you expect your business to bring in. Be specific and break it down into different streams if you have them (e.g., product sales, service fees, subscription revenue). To make accurate projections, look at your historical sales data. If you’re a new business, research industry benchmarks and create a conservative, realistic, and optimistic forecast based on your sales and marketing plan. It’s often best to project your income on a month-by-month basis for the upcoming year.

Fixed Costs

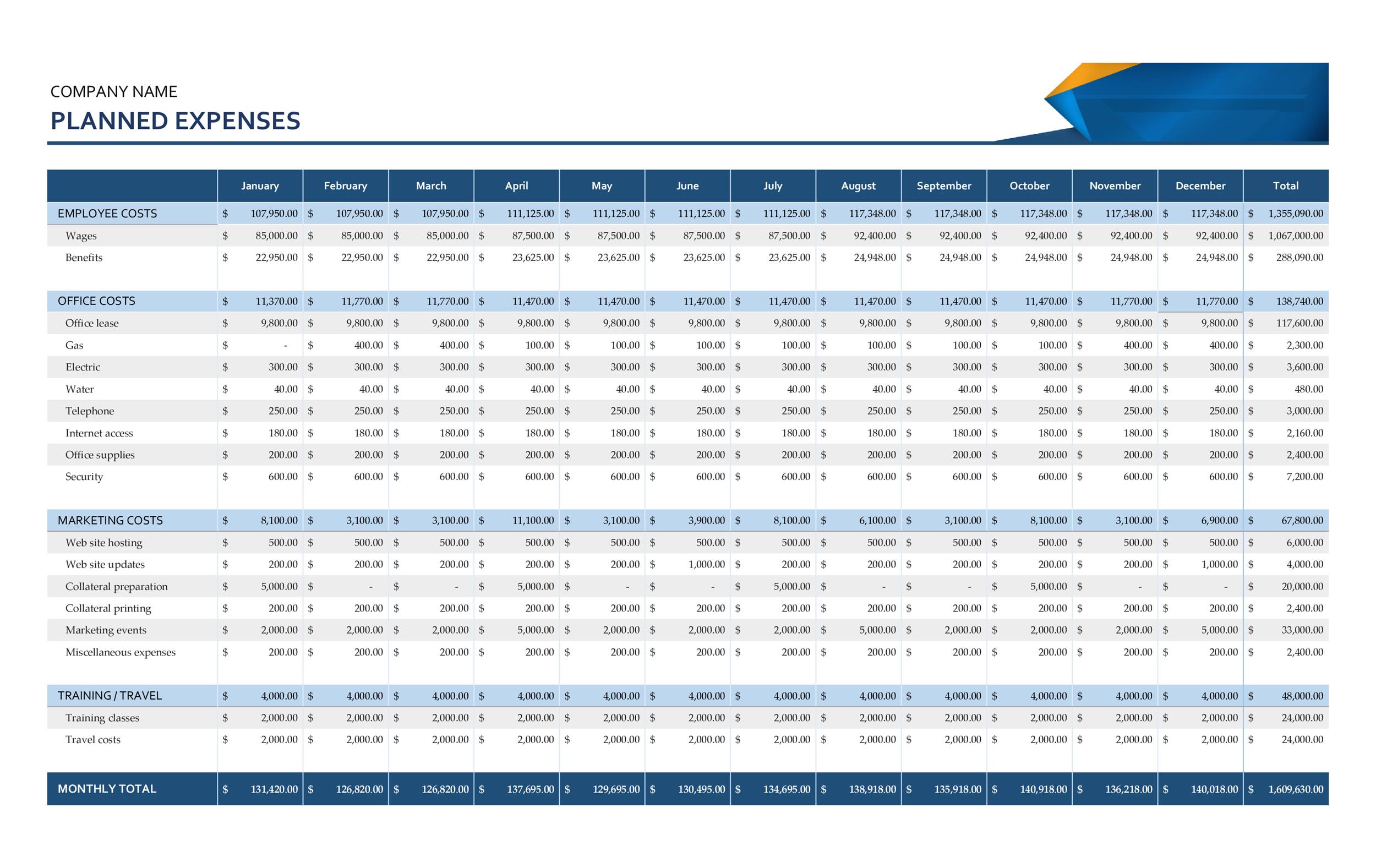

Fixed costs, also known as overhead, are the consistent expenses you incur every month regardless of your sales volume. These are typically the easiest to predict. Common examples of fixed costs include:

- Rent or mortgage for your office or retail space

- Salaries for full-time employees

- Insurance premiums (liability, health, property)

- Software subscriptions (e.g., accounting software, project management tools, website hosting)

- Loan repayments

- Utilities (internet, phone)

List every single fixed expense you can think of. These form the baseline of what you need to earn just to keep the lights on.

Variable Costs

Variable costs are expenses that fluctuate in direct proportion to your sales and business activity. As your revenue increases, these costs will likely increase as well. Understanding your variable costs is key to determining your gross profit margin. Examples include:

- Cost of Goods Sold (COGS): The direct costs of producing your products, including raw materials and direct labor.

- Shipping and packaging costs

- Sales commissions

- Transaction fees (e.g., credit card processing fees)

- Advertising spend (e.g., pay-per-click campaigns)

- Contract or freelance labor hired for specific projects

Tracking these carefully helps you understand the true profitability of each sale.

One-Time or Unexpected Expenses

Not every expense fits neatly into a monthly category. Your budget should also account for one-time capital expenditures (CapEx) and have a buffer for unexpected costs. This could include purchasing new equipment like a computer or machinery, office furniture, or paying for a major website redesign. You should also build in a contingency fund—typically 5-10% of your total expenses—to cover emergencies like unexpected repairs or a sudden market downturn.

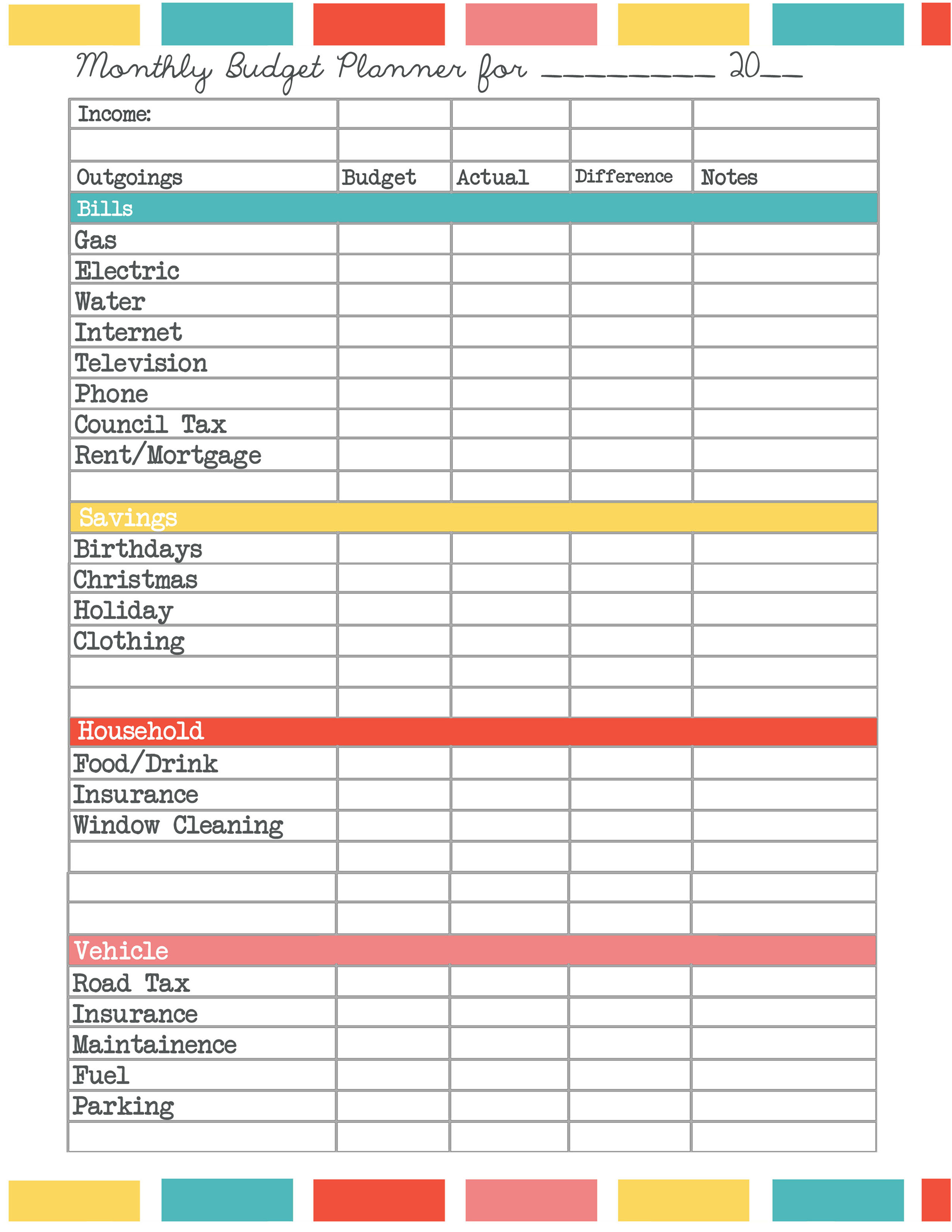

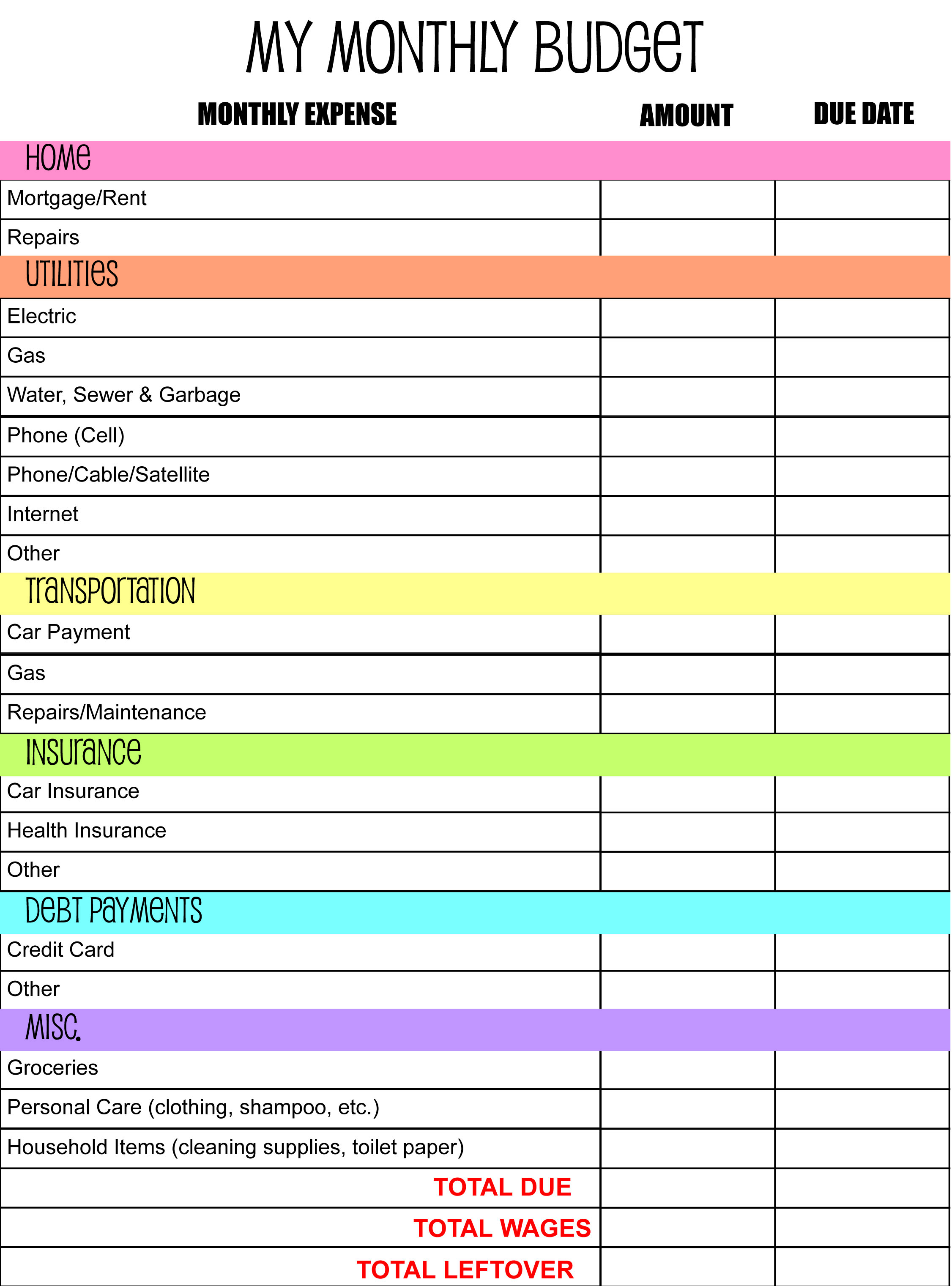

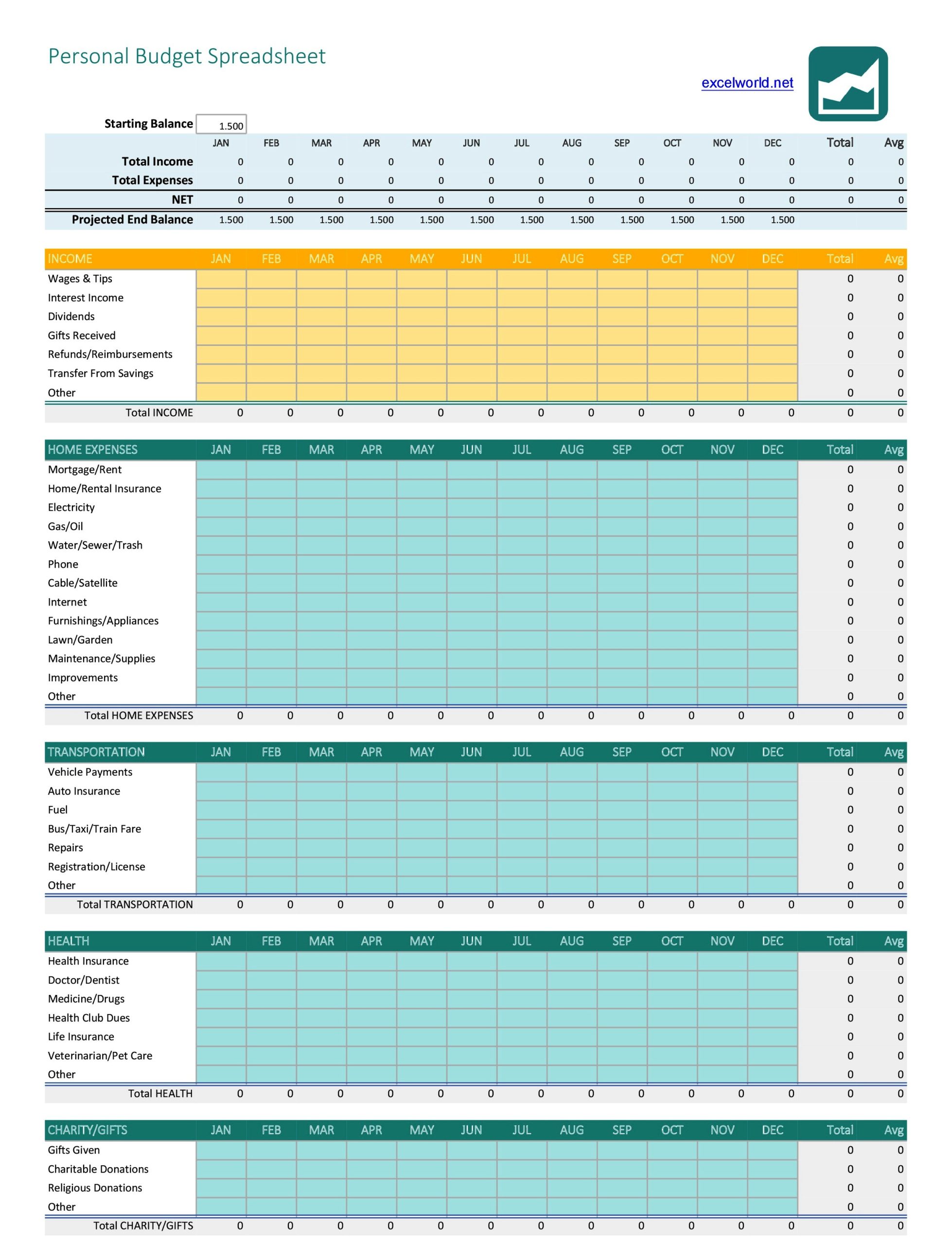

How to Use a Small Business Budget Template Excel Free

Once you’ve found a template you like, the real work begins. Using it effectively is a systematic process of customization, data entry, and regular analysis. Following these steps will transform a blank spreadsheet into an indispensable financial tool.

Step 1: Download and Customize Your Template

The first step is to tailor the generic template to your business. A template is a starting point, not a final product. Go through the pre-listed income and expense categories. Delete any that don’t apply to your business and add any that are missing. For example, a restaurant will need categories for “Food Supplies” and “Linens,” while a software company will need “Server Costs” and “Software Licenses.” Be as detailed as possible. The more granular your categories, the more insight you’ll gain.

Step 2: Input Your Financial Projections

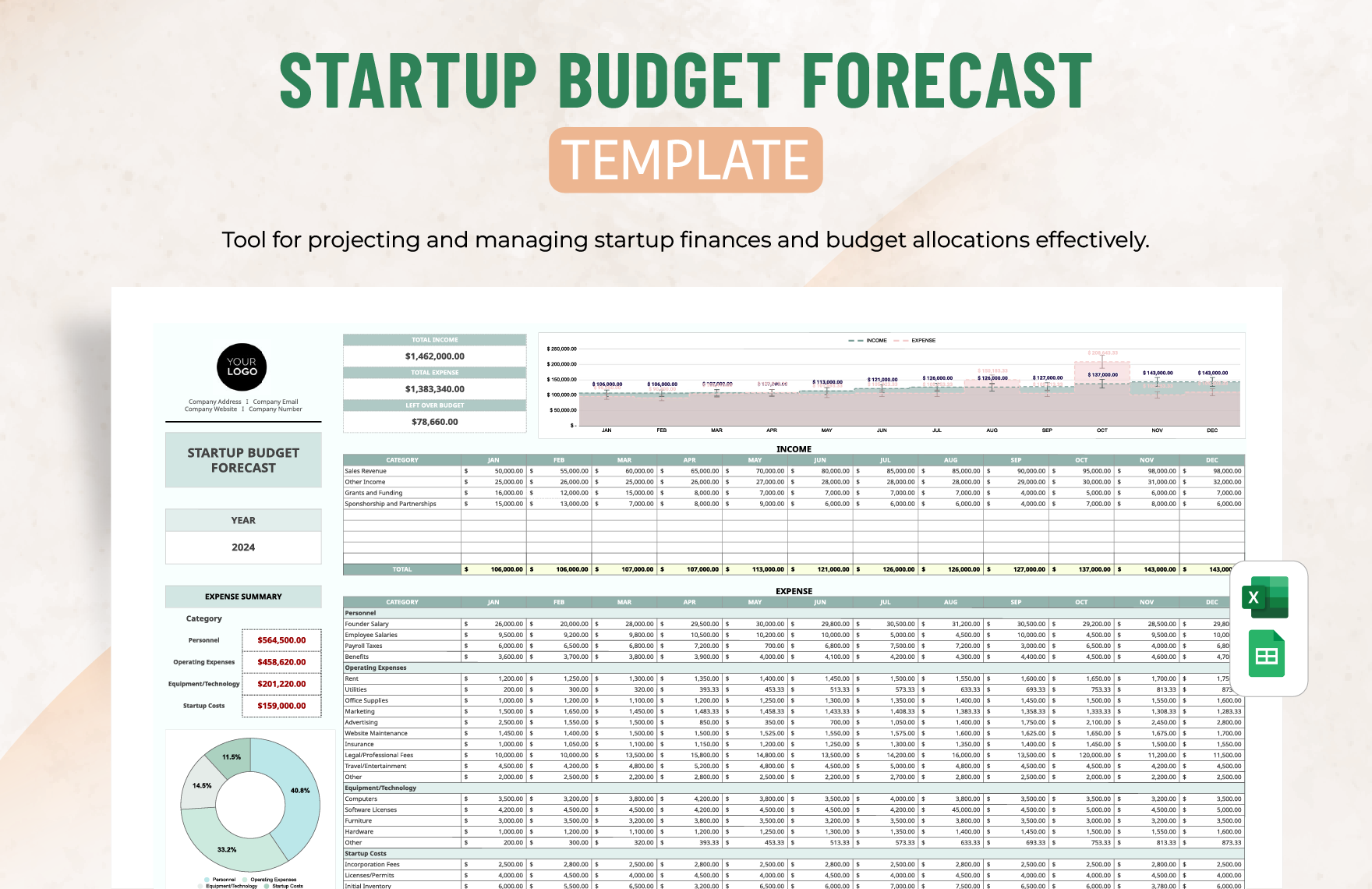

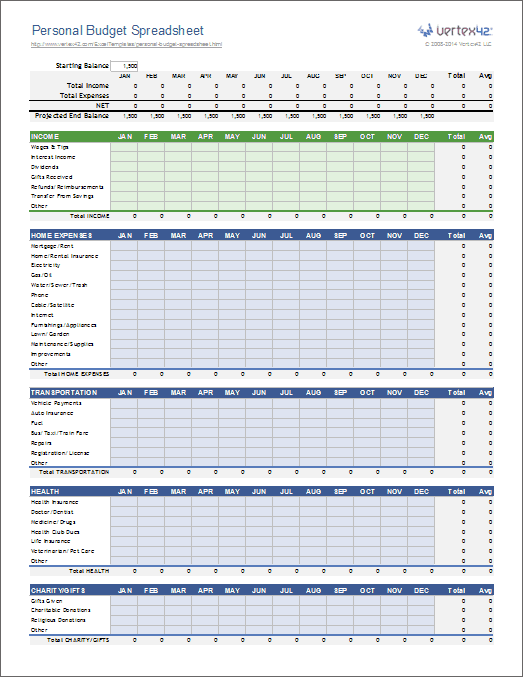

Start with the top line: your revenue. Fill in your projected income for each month of the year. If you created best-case, realistic, and worst-case scenarios, consider making separate versions of the budget or using a dropdown to switch between them. This helps you understand how your profitability and cash flow would be affected by different sales outcomes.

Step 3: Enter All Your Known and Estimated Expenses

Move on to the expenses sections. Begin with your fixed costs, as these are the easiest to determine. Enter the monthly amounts for rent, salaries, insurance, and other consistent overhead.

Next, tackle your variable costs. This requires a bit more estimation. For example, if your credit card processing fee is 2.9%, you can create a formula that automatically calculates this fee based on your projected monthly revenue (=Projected_Revenue * 0.029). For COGS, estimate the cost based on your sales forecast. Look at past data to see what percentage of revenue your variable costs typically represent and use that as a guide.

Finally, don’t forget to budget for one-time expenses. If you know you need to buy a new laptop in June, enter that projected cost in the appropriate month.

Step 4: Analyze the Summary and Key Metrics

A good template will automatically calculate your key financial metrics using formulas. The most important numbers to watch are:

- Net Profit/Loss: This is your total income minus your total expenses. The template should show you this on a monthly and year-to-date basis. A positive number means you’re profitable; a negative number means you’re operating at a loss.

- Cash Flow: This tracks the actual cash moving in and out of your bank account. It’s crucial because you can be profitable on paper but run out of cash if your clients pay late. Your template should have a running cash balance so you can foresee any potential shortfalls.

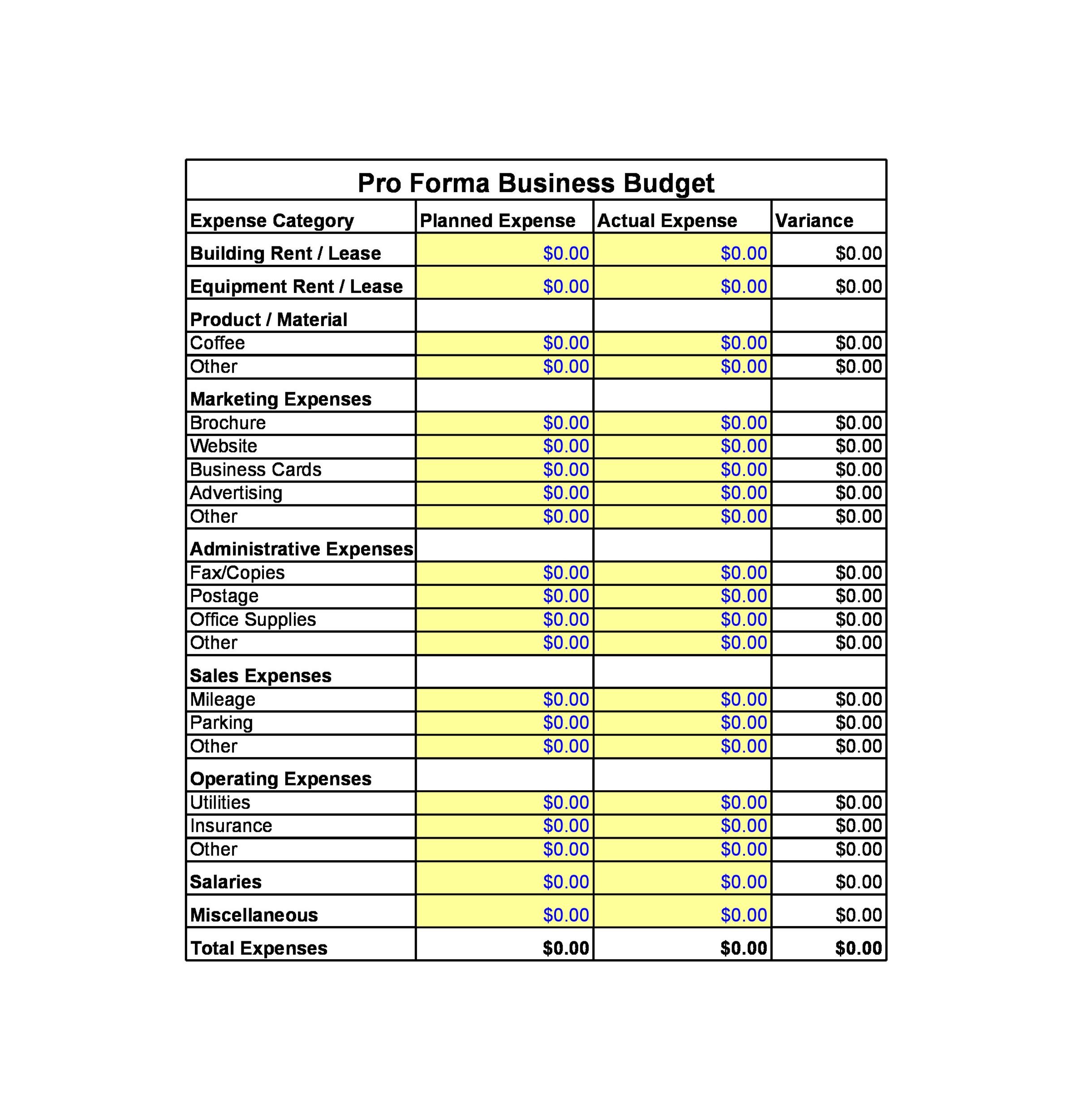

- Budget vs. Actual Variance: As the months go by, you’ll enter your actual income and expense figures next to your budgeted amounts. The variance column will show you the difference. This is the most critical part of ongoing budget management, as it highlights where you were over or under your plan.

Finding the Best Small Business Budget Template Excel Free: What to Look For

A quick search will reveal thousands of free templates, but not all are created equal. Knowing what to look for will help you choose a high-quality template that is both easy to use and powerful enough to provide real insights.

Essential Features of a Quality Template

A robust template should include more than just a list of expenses. Look for these key features:

- Pre-built Formulas: The template should automatically calculate totals, subtotals, net profit, and cash flow. You shouldn’t have to manually sum up columns.

- Separate Tabs for Organization: A well-structured template often uses different worksheets (tabs) for different sections, such as a summary dashboard, a detailed income tracker, and a detailed expense tracker. This keeps the information clean and easy to navigate.

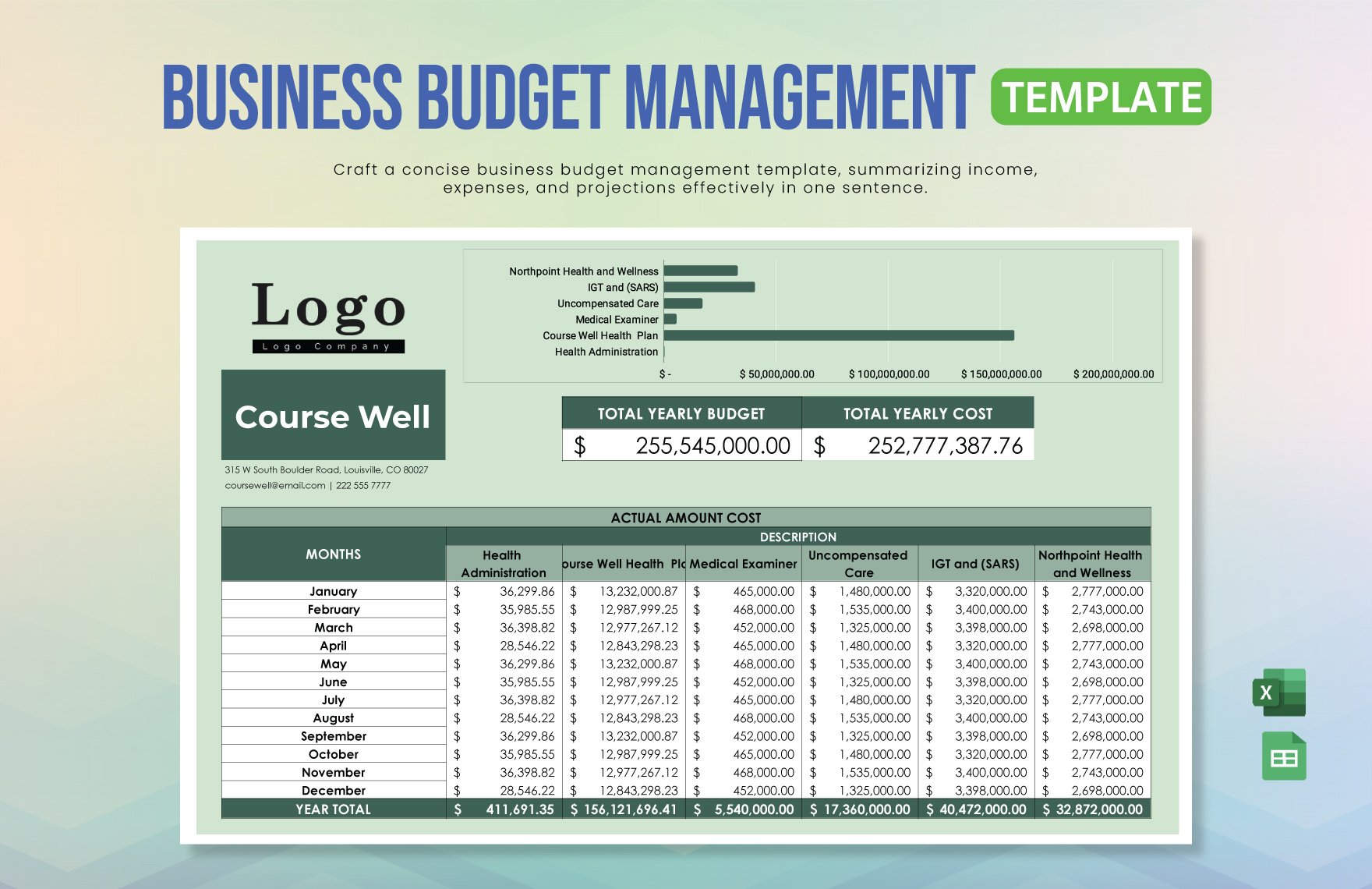

- Summary Dashboard: The first tab should provide a high-level overview of your financial health. This dashboard should prominently display key metrics like total revenue, total expenses, net income, and cash balance, often accompanied by charts for quick visualization.

- Budget vs. Actual Columns: The template must have dedicated columns for both your projected (budget) numbers and your actual results. A third column for “variance” (the difference between the two) is essential for analysis.

- Charts and Graphs: Visual aids can make it much easier to spot trends. Look for templates that include charts for revenue breakdown, expense categories, or profit over time.

Common Types of Budget Templates

Different templates are designed for different purposes. Consider which type best suits your current needs:

- Startup Budget Template: This is designed for new businesses and includes sections for one-time startup costs like legal fees, equipment purchases, and initial inventory, in addition to regular operating expenses.

- Annual Operating Budget Template: This is the most common type, designed for established businesses to plan for the upcoming fiscal year on a month-by-month basis.

- Cash Flow Template: While most budgets track cash flow, a dedicated cash flow template focuses specifically on the timing of cash inflows and outflows to help you manage your bank balance and avoid shortfalls.

Common Budgeting Mistakes to Avoid

Creating a budget is a huge step forward, but there are several common pitfalls that can undermine its effectiveness. Being aware of these mistakes will help you create a more accurate and useful financial plan.

Forgetting Irregular or “Hidden” Expenses

It’s easy to remember your monthly rent, but what about the annual software subscription that renews every July? Or the quarterly tax payments you have to make? Many business owners forget to budget for these non-monthly expenses, leading to unpleasant surprises. Go through your bank and credit card statements from the previous year to identify all annual, semi-annual, and quarterly costs and ensure they are included in the correct months in your budget.

Being Overly Optimistic

While optimism is a vital trait for an entrepreneur, it can be a detriment when forecasting revenue. Basing your entire budget on a best-case sales scenario is a recipe for disaster. If you fail to hit those lofty goals, your entire financial plan will fall apart. It’s far better to be conservative with your income projections and pleasantly surprised if you exceed them.

The “Set It and Forget It” Mentality

A budget is not a static document that you create once in January and never look at again. It is a living document that should be your financial guide throughout the year. You must commit to a regular review process. At the end of each month, sit down and enter your actual income and expense figures into the template. Compare them to your budget and analyze the variances. This regular review is where the true value of budgeting lies.

Confusing Profit with Cash Flow

This is one of the most critical and common financial misunderstandings. Profit is the amount of money left over after all expenses are paid (Revenue - Expenses = Profit). Cash flow, however, is the actual movement of cash into and out of your business. You can have a profitable month on paper but negative cash flow if your clients haven’t paid their invoices yet. A business can fail even while being profitable if it runs out of cash to pay its bills. Your budget must track both.

Conclusion

Mastering your business’s finances is a non-negotiable step on the path to long-term success, and you don’t need expensive software to do it. A Small Business Budget Template Excel Free is a powerful, flexible, and cost-effective tool that puts you in the driver’s seat. By understanding the core components of a budget, choosing a well-designed template, and committing to a process of customization and regular review, you can transform a simple spreadsheet into a strategic roadmap for your company.

The process of building and maintaining a budget provides invaluable insights into your operations, helping you identify opportunities for growth, trim unnecessary costs, and make confident, data-driven decisions. It moves you from a reactive state of financial management to a proactive one. Take the time to set up your budget today. The clarity, control, and peace of mind it provides will be one of the best investments you ever make in your business.

]]>