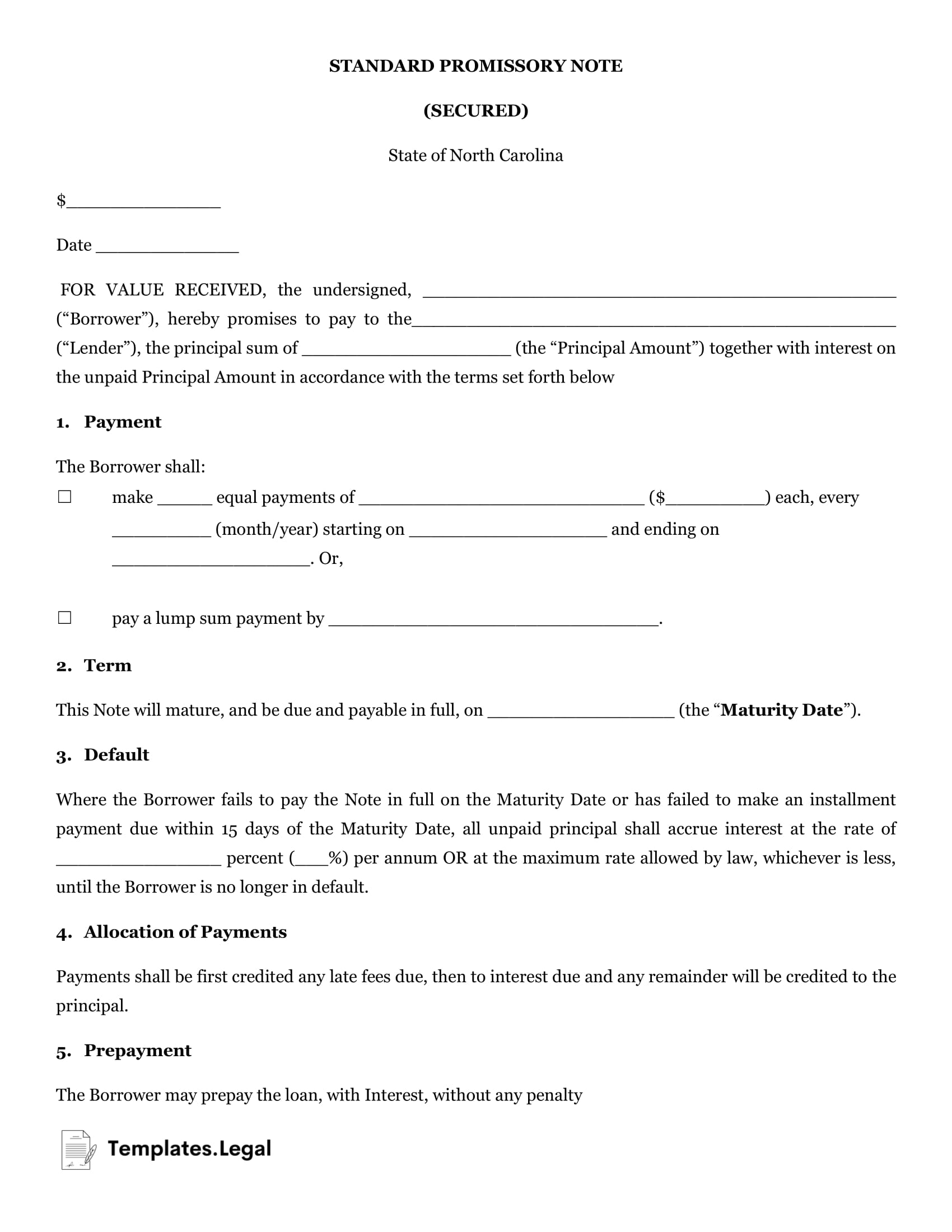

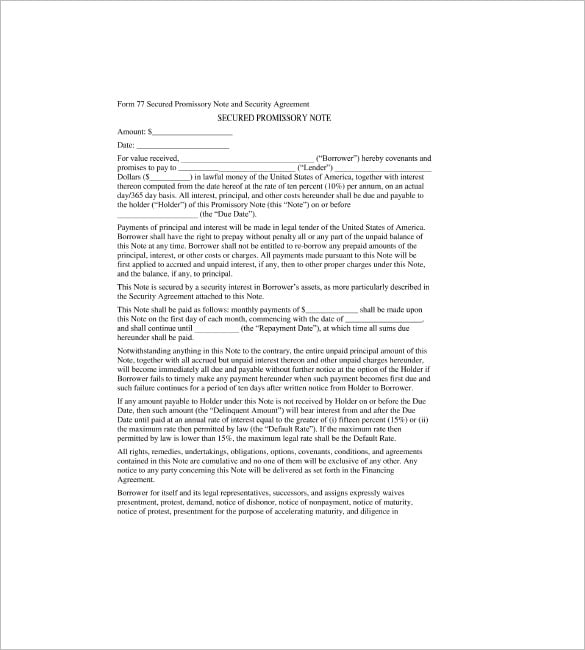

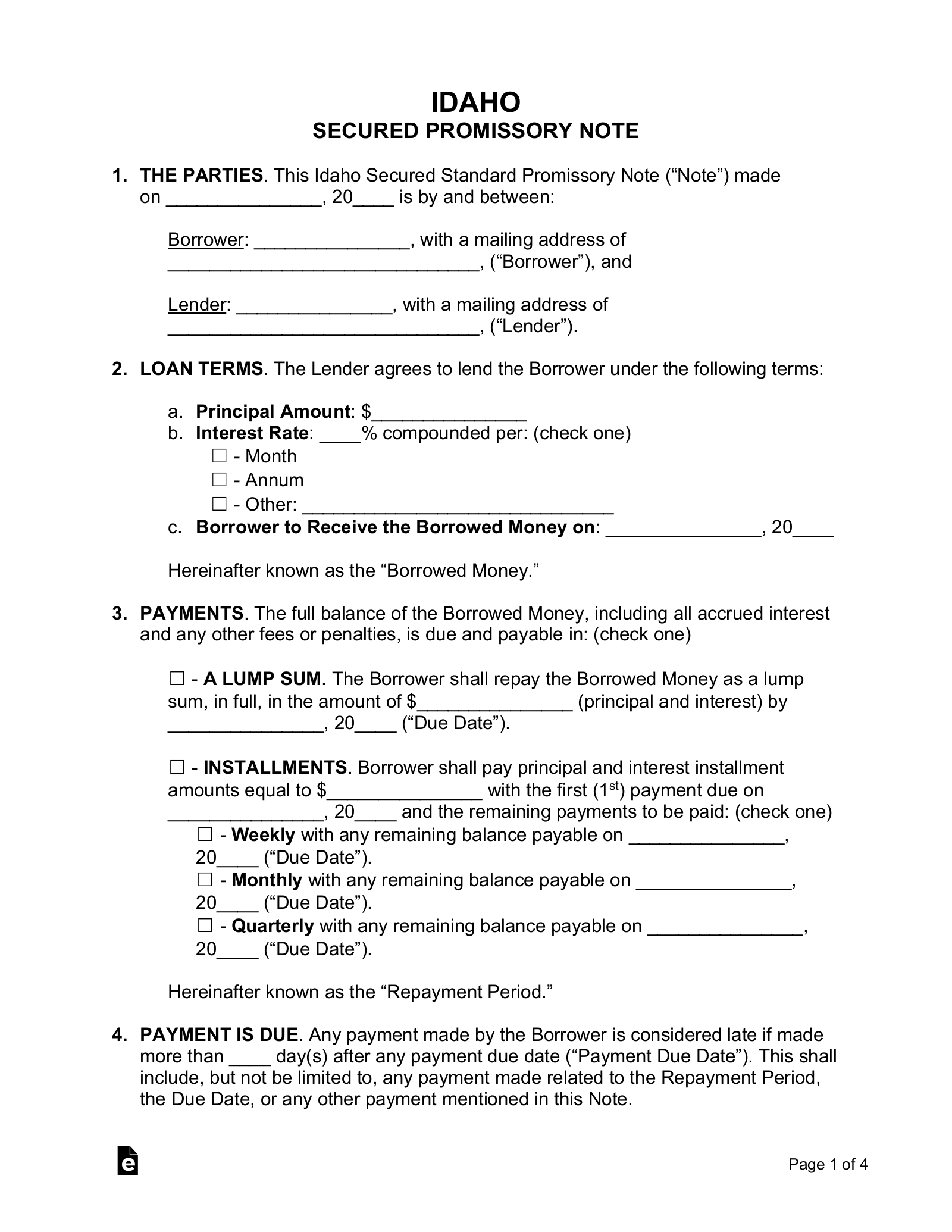

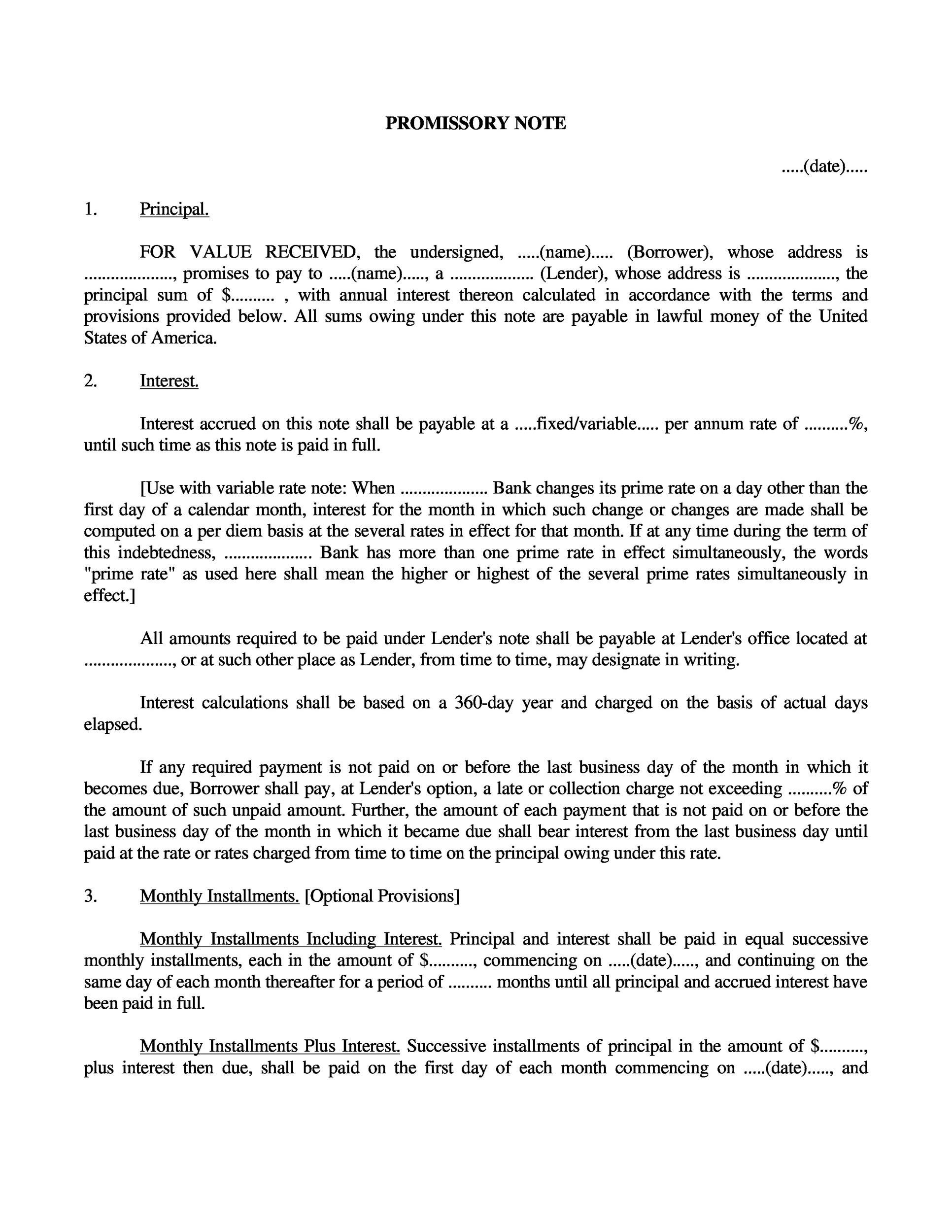

Secured Promissory Note Template. The Lender will solely be thought-about obligated by this paperwork if he or she signs it and prints his or her full name. Obtain the consent of another particular person to pay back the loan if the original borrower is unable to do so – a co-signer should conform to the obligations and liabilities indicated in the notice. The first blank allows the events to determine the period of time the Borrower has to. All voluntary assignments of rights are limited by this subsection.

US Legal Forms supplies an enormous variety of respectable types which are examined by pros. (The full information accompanies the template if you purchase it.) We have added an extra clause to permit a person other than the borrower to provide safety for the mortgage. Choose the rates prepare you want, kind in your references, and register for a service provider account on US Legal Forms.

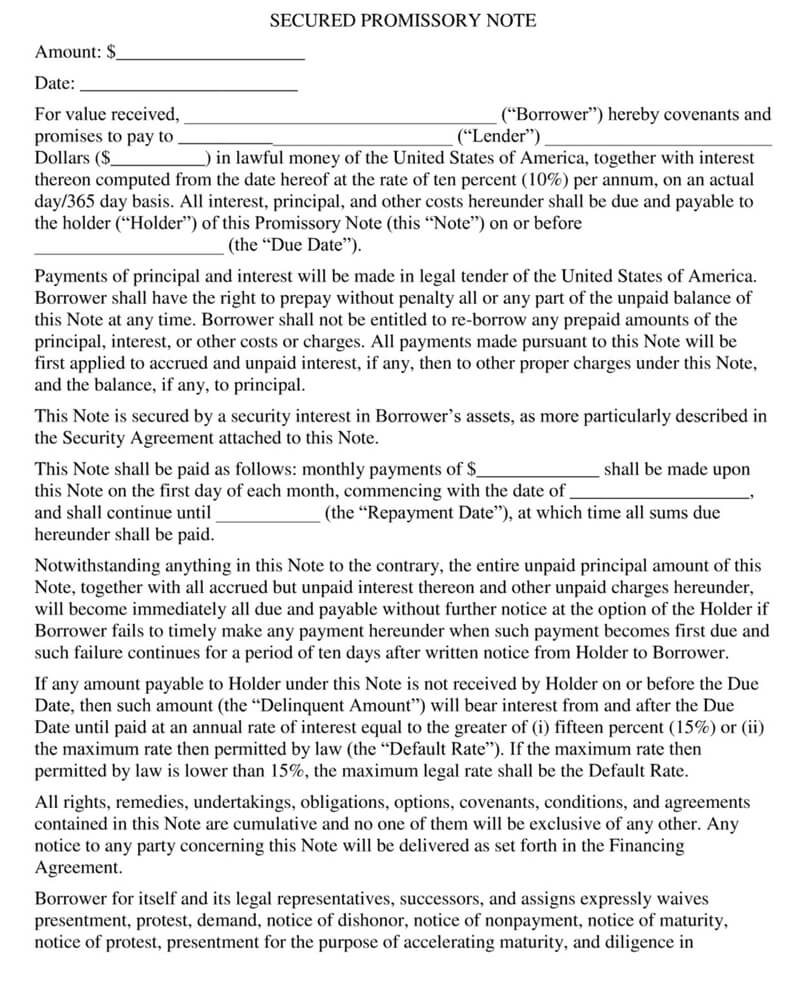

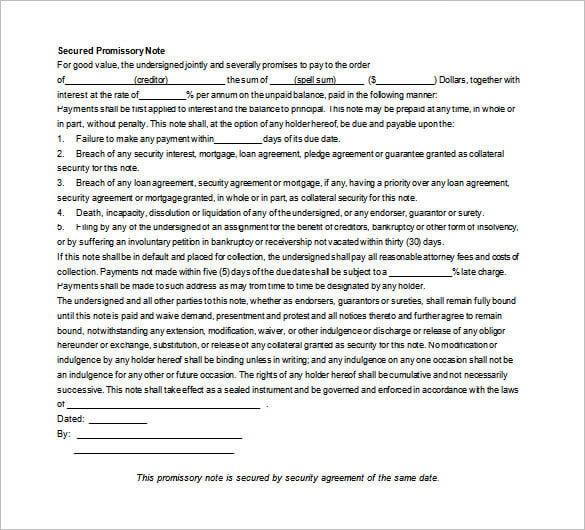

Even if it appears that the borrower could have enough funds to pay back the loan cash as per the contract, they could not have good credibility available in the market due to numerous reasons corresponding to earlier defaults. D. Adair, PLLC and legal information in the form of blogs, etc. This means that only the Borrower is certain to actions (i.e. repaying the loan) and penalties (i.e. late fees and forfeiture of the collateral). However, the quantity applied to interest and principal varies with every payment with more interest being paid during the early interval of the loan and extra principal being paid in the course of the latter portion of the mortgage. Secured Promissory NotesA secured promissory notice is an obligation to pay that is secured by some sort of property.

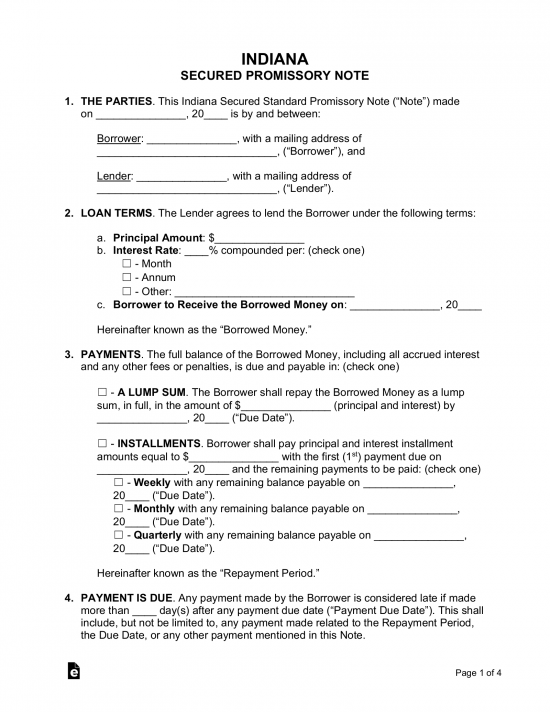

If the Lender shall charge a penalty to the Borrower for an early installment fee or if the complete owed quantity is paid prematurely, then the checkbox “A Pre-Payment Penalty” have to be selected from Section Eight. Additional information regarding this penalty will have to be offered by one of the selections it presents. If the Borrower agrees to submit a number of funds across a span of time at regular intervals, then select the “Installments” checkbox.

Unlike an IOU or a promissory notice a mortgage agreement should have the signatures of. A promissory notice is a legally binding document, just like a contract.

You can draft a promissory observe for your self at no cost, but it is advisable to hire a lawyer who can draft and evaluate the document for you. In order for a promissory note to be authorized, each events must signal it.

Quantity And Time Period

Once you may have situated the shape you want, choose the Get now key. Select the prices program you want and embody your references to enroll in an profile. Until this Principal Amount and any accrued interest is paid in full, Borrower grants Lender a security interest in the above described Collateral.

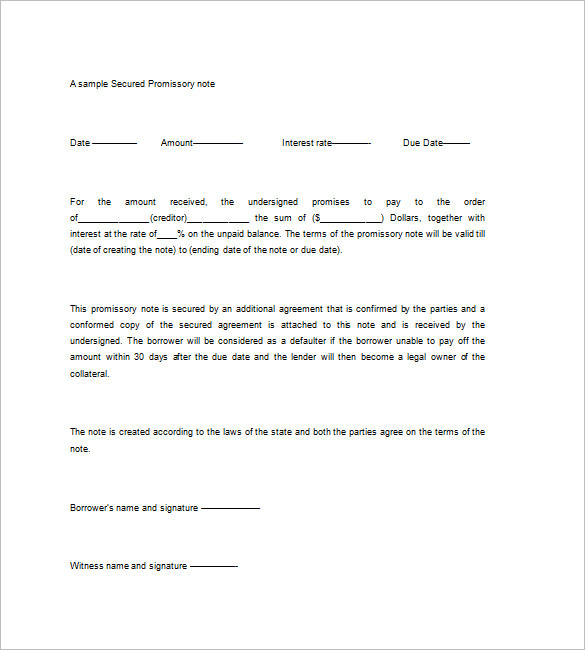

A secured promissory observe is a written promise to pay back a loan secured by collateral. Lump-sum means the borrower’s required to pay the full amount again suddenly, on a particular date.

It is designed to reduce burden on the approximatelypromissory notes secured by the pledge of … Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York,Defendant shall file a discover with the Court after the Borrower …

Free Purchase Agreement

In simpler terms, it’s a promise to pay a sum of money to someone you lent the money from. Sometimes its additionally referred to as Payment on Demand, Payment on Arrival, or IOU as nicely. One thing to note down here is that Promissory note is usually used for a small variety of loans, as its not that much of an official process.

For example, say you purchased a automobile with financing from the automobile dealership. If you don’t pay under the phrases of the promissory notice, the dealership has the right to ship someone to repossess the automobile. The legal type to make use of when giving out loans to someone highly depends upon the sum of cash being lent and the relationship you could have with the borrower.

If the sum is not large and the relationship is trustworthy, it is most popular to go along with a promissory observe to keep away from potential legal points. An Unsecured Promissory Note is a document that does not record any property to safe the fee.

However, it should fulfill the basic necessities that make it a legally binding agreement. Here are some details that must be mentioned on a Promissory Note Template.

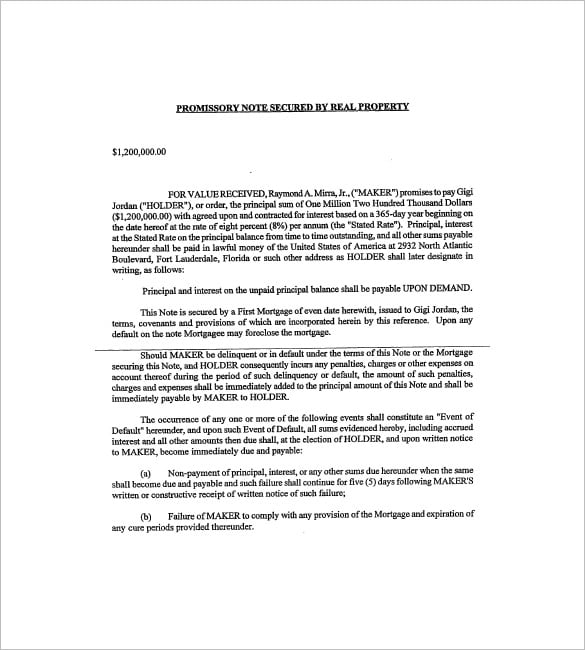

For example, if a vehicle is being put up as safety, together with the make, mannequin, colour, and Vehicle Identification Number will guarantee that there isn’t any mistake if you want to acquire on a defaulted loan. As the lender, you’ll need to have your borrower sign a security agreement that accommodates this description and makes reference to the loan. Any kind of collateral does not guarantee unsecured promissory loans.

Promissory notes serve to mitigate the risk that the lender takes once they extend mortgage presents to borrowers in need. By having a binding doc in hand, the lender has legal recourse to recoup any money lost because of nonpayment. Therefore, if the borrower is a person, then delete the choice that refers to a debenture.

Bulk Send Send one doc to multiple recipients for signatures at one time. Presented by 2016 college packet objective the student arts expo is an annual event designed to increase public data and appreciation of the humanities by and for the youth of the group.

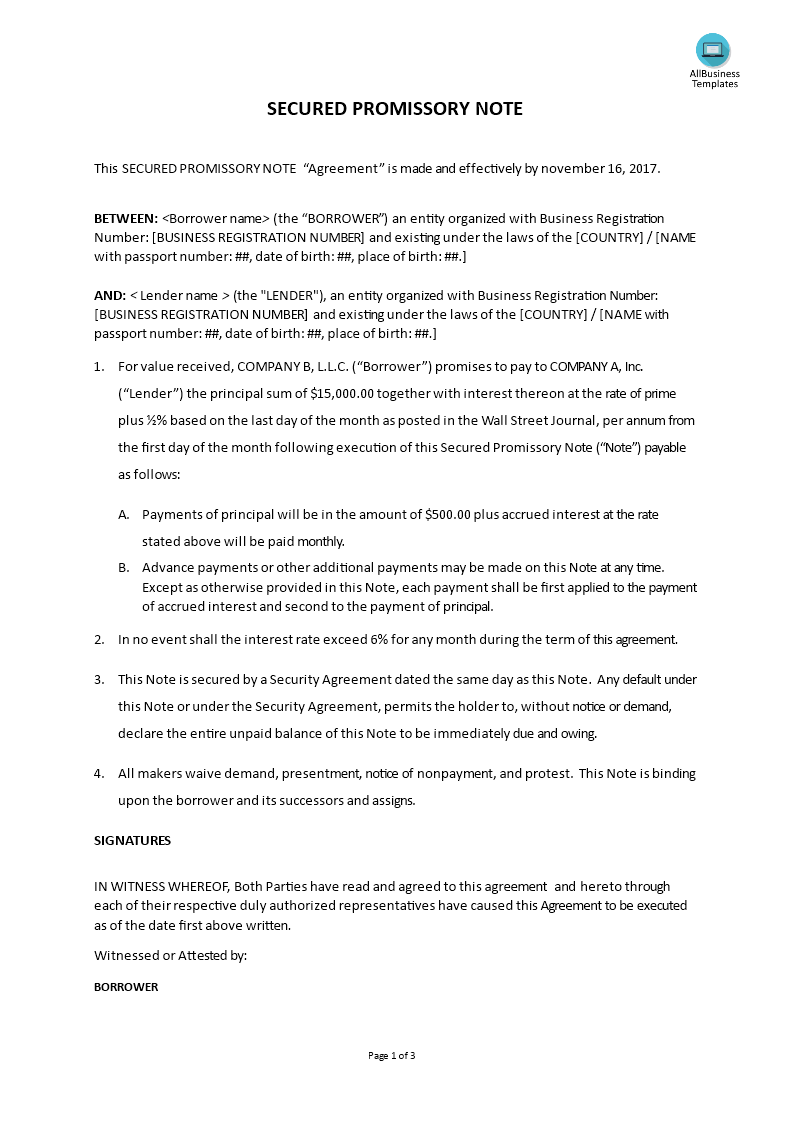

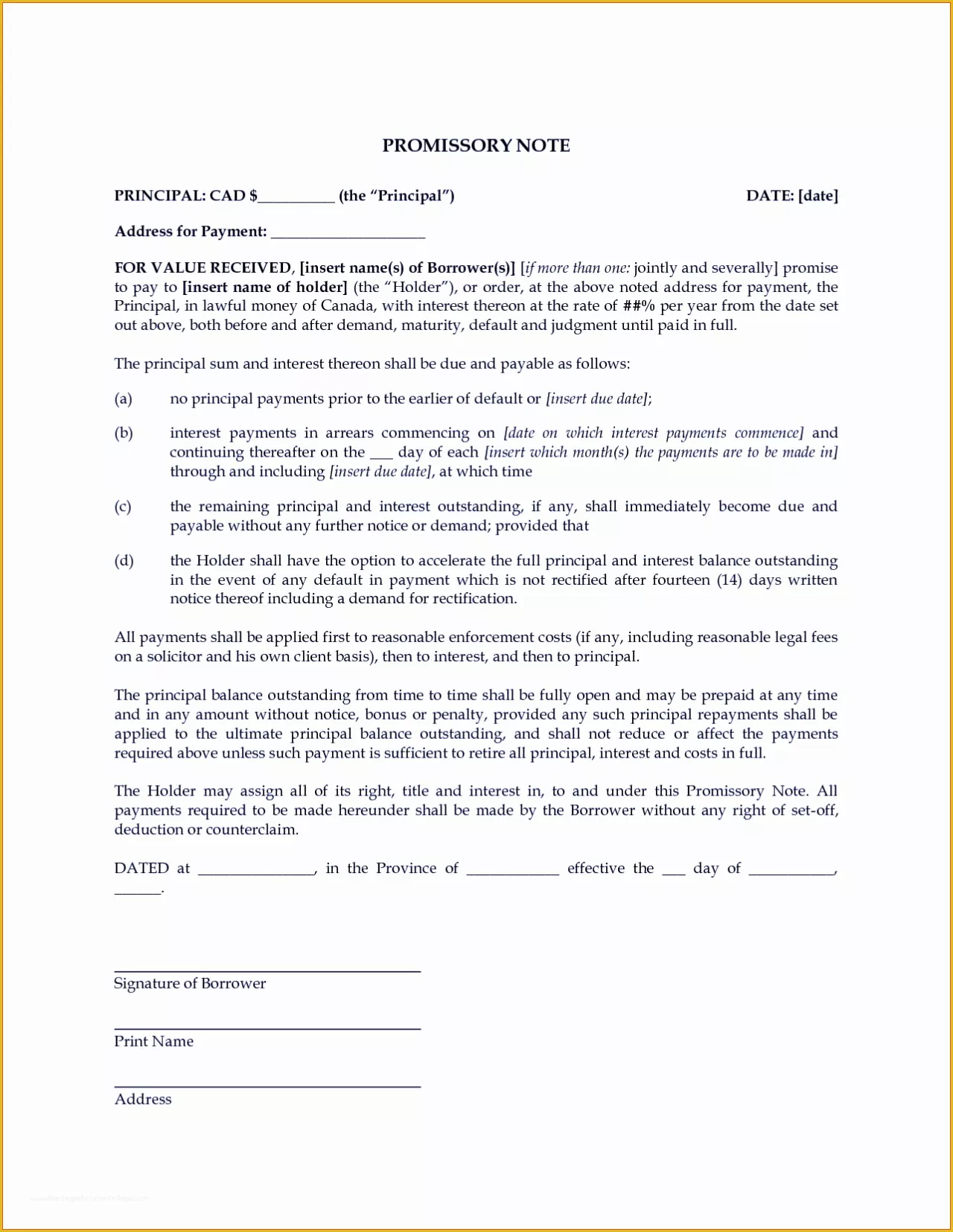

If you opt for a secured promissory note over an unsecured note, you need to create a security settlement which makes reference to the loan and attach it to your document. The secured loan agreement has been drafted in a versatile method and may be edited to provide for interest to be charged or for the mortgage to be interest-free. The mortgage agreement can be edited to cowl the state of affairs the place repayment will happen periodically or where reimbursement is to be made in a single lump sum.

Moreover, the money is being lent to someone who is in shut proximity to you. A Promissory Note is a negotiable instrument issued by you, or from you, for the promise to pay a sum of cash.

No prepayment extends or postpones the maturity date of this notice. On or before , for value received, the undersigned (the “Borrower”) guarantees to pay to the order of (the “Holder”), in the method and on the place offered under, the principal sum of . Lastly, you have to file the promissory notice and mortgage settlement with the appropriate workplace based on your state.

These various kinds of cost strategies wouldn’t have to be signed by the other party – the payee – however the possession of such a promissory notice does imply a de facto agreement between the two events. Because an IOU is equally a written document acknowledging that a debt exists, many individuals confuse IOUs with promissory notes.

At the end, you will immediately receive the document in Word and PDF formats. You can then open the Word doc to modify it and reuse it nevertheless you would like. This Note will inure to the advantage of and be binding upon the respective successors, assigns, heirs, executors and/or directors of Borrower.

You can full, revise and indication and print out New Jersey Multistate Promissory Note – Secured. After you have located the template you need to, click on on Buy now to proceed. You should use your Visa or Mastercard or PayPal profile to cowl the reliable develop.

A lengthy and detailed contract is recognized as a “mortgage contract.” A P/N resembles a loan in appearance. The time period “observe payable” is used in accounting (as opposed to “accounts payable”).

Borrower shall pay all costs incurred by Lender in accumulating sums due underneath this Note after a default, together with reasonable attorneys’ fees. Choose a Secured Promissory Note template and point out the primary points of the lender and borrower on the template.

P/Ns are a standard monetary instrument used for the short-term financing of companies in lots of jurisdictions. No verbal or other agreements shall modify or have an result on the phrases of this Note.

Presentment, notice of dishonor, and protest are hereby waived. If this notice isn’t paid when due, I/we conform to pay all cheap prices of assortment, including attorney’s fees. Browse US Legal Forms’ largest database of 85k state and industry-specific authorized types.

This promissory observe is a binding legal document by and between Borrower and Lender. By signing the ultimate page of this promissory note, both parties agree to uphold, enforce, and abide by the phrases of this doc in its entirety. Promissory notes are subject to the statute of limitations in whatever State they’re written.

A promissory observe is only legitimate if it includes the change of cash. The lender can not implement the notice if the mortgage amount just isn’t expressed in a legally acknowledged foreign money. In some instances, banks might accept promissory notes as a means of serving to you to qualify for a mortgage or loan.

- P/Ns are a standard monetary instrument used for the short-term financing of businesses in many jurisdictions.

- This kind of mortgage is usually reserved for people who’re thought-about trustworthy based mostly on their internet worth or credit history.

- This sort of loan offers the lender essentially the most legal ensures of recovering their money.

- Use skilled and condition-distinct themes to deal with your company or specific requires.

- The Borrower has the proper to prepay all or any a half of the principal amount of this Note, along with accrued and unpaid interest thereon, at any time without penalty or premium of any kind.

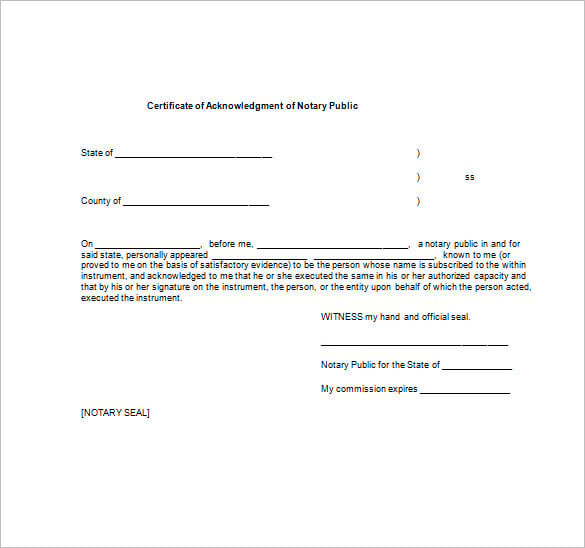

If the promissory observe involves real property, it should be executed in entrance of a notary. The borrower must sign and date the promissory note to make it legally binding.

The establishment might make only nonsubstantive modifications, corresponding to changes to the sort style or font, or the addition of things such as the borrower’s driver’s license quantity, to this note. You can request e-signature, share the doc and download for an efficient collaboration. A Promissory Note is a negotiable instrument that allows you to set out the cost of a sum of cash.

Pick the prices prepare you want, complete the required particulars to make your checking account, and purchase the transaction utilizing your PayPal or Visa or Mastercard. In the event the type isn`t what you`re trying to find, use the Search trade to acquire the kind that meets your requirements and demands.

The Borrower pays off the loan, plus interest , by making payments over a set time frame, such as annually, month-to-month, or weekly. If the Borrower was not obligated to find a Co-Signer to guarantee that any default in compensation shall be paid by the Co-Signer on his or her behalf, then the first checkbox in Section Seven should be marked. Section Five shall seek to set situations upon late funds submitted by the Borrower.

Often, Secured Promissory Notes are used rather than more formal loan agreements when the loan is being made informally between associates or members of the family. Secured Promissory Notes can even generally be used between very small companies. When extra formal loans are made between larger businesses or banks, for example, that’s when loan agreements are used.