Pay For Delete Letter Template. By m aking it soun d such as you’ve done your hom ework, and you’re not keen to play the gam es they like to play, the gathering company m ay com ply together with your supply with little to n o hesitation . We problem inaccurate adverse gadgets with the bureaus and your collectors. You ought to keep away from these serious deductions by paying your debts on time. It is to not be construed as an acknowledgment of legal responsibility for this debt in any form.

One of the secrets and techniques of writing a profitable goodwill letter is that it’s plausible, chances look like that it really did happen, and/or it was a one-time accident, fluke, or coincidence past your control. The “super-follow” function is said to enable competition with the subscription web site OnlyFans, used mainly by intercourse employees. Dispatched Debt Validation Letter And Debt Collector Has Provided Proof – Your collection company can request cost proof even on overdue accounts, so, you should put that in check.

Whether this can work or not depends on your collections company. Credit Karma is dedicated to making sure digital accessibility for individuals with disabilities. Typically, you would have to send more than a single debt assortment letter earlier than you want … Much of this simplicity comes from using the hashtag, and the intuitive nature of how Twitter as a microblogging web site operates. According to analysis revealed in April 2014, round 44% of consumer accounts have by no means tweeted.

Keifer Corporation (“FormsPal”) just isn’t a law agency and is in no way engaged in the apply of legislation. This web site is not intended to create, and doesn’t create, an attorney-client relationship between you and FormsPal. All information, information, software, and services supplied on this website are for informational purposes only.

If you can’t pay again the debt in a single lump sum, ask in your letter whether or not you can even make a settlement provide to pay in installments. If you could have medical debt or utility or cellphone bill disputes.

How To Do A Pay For Delete For A Set

A Twitter bot is a pc program that automatically posts on Twitter. They are programmed to tweet, retweet, and observe other accounts.

If you’re looking to improve your credit score score, utilizing pay for delete letter is a great choice. It may help you do away with unfavorable information in your credit report and improve your credit score quickly and easily. If you’re trying to enhance your credit rating, using pay for delete letter template could also be an excellent possibility.

Payoff Letter Template

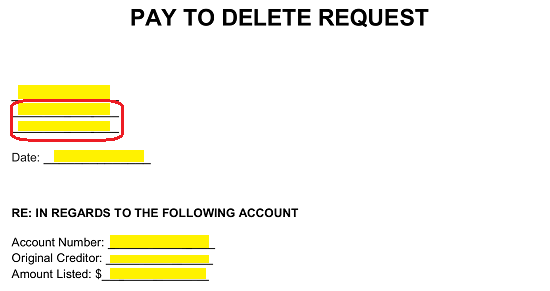

Keep in mind that if you’ve already paid the debt and you’d just like the negative merchandise removed, using a pay for delete letter won’t work. Your company ought to delete all info concerning the account from my credit files inside 10 enterprise days from the receipt of the payment, as mentioned above. The terms of this agreement is not going to be mentioned with anyone however the original creditor.

But that’s an instance of fixing a credit score error, and probably not pay for delete. In a pure pay for delete scenario, you’re asking a set company to make a reliable collection disappear. Not simply the balance due, but in addition the unique assortment itself.

Twitter generated an estimated US$139.5 million in promoting gross sales during 2011. In October 2015, Twitter introduced “Moments”—a function that allows users to curate tweets from different customers into a larger assortment.

The sole function of this communication is to get the itemizing removed from my credit report. As with any new debt, request debt validation with every new creditor to ensure that the owed amount stays accurate. Take all measures to pay the debt, regardless in the occasion that they choose to settle.

We’ll show you the way to write a credit score dispute letter on this article. There’s yet one more limitation with pay for delete, and it’s important.

Not only can they get the debt collectors off your back, however there’s also a powerful possibility that they’ll help revive your mangled credit score. Note that collectors and assortment companies aren’t obligated to answer pay for delete letters, so you might have to comply with up with them a couple of instances.

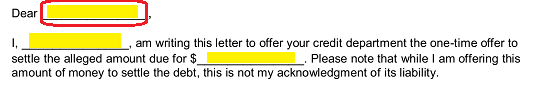

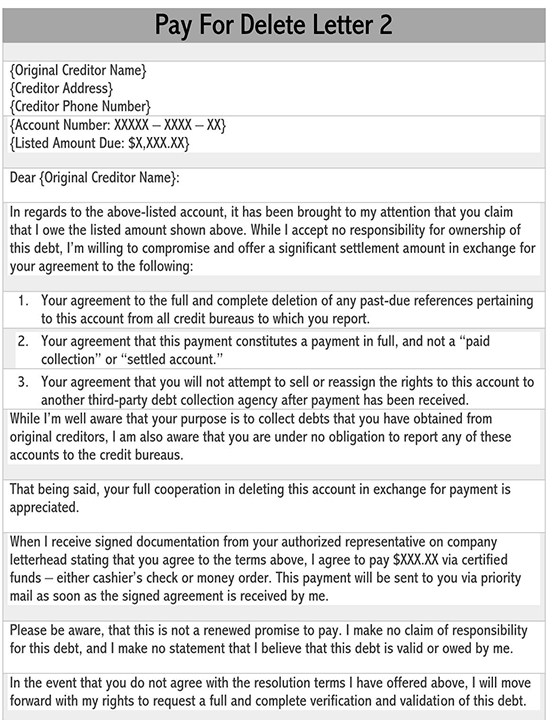

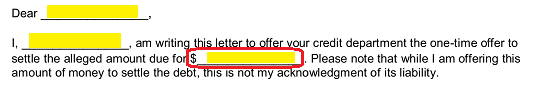

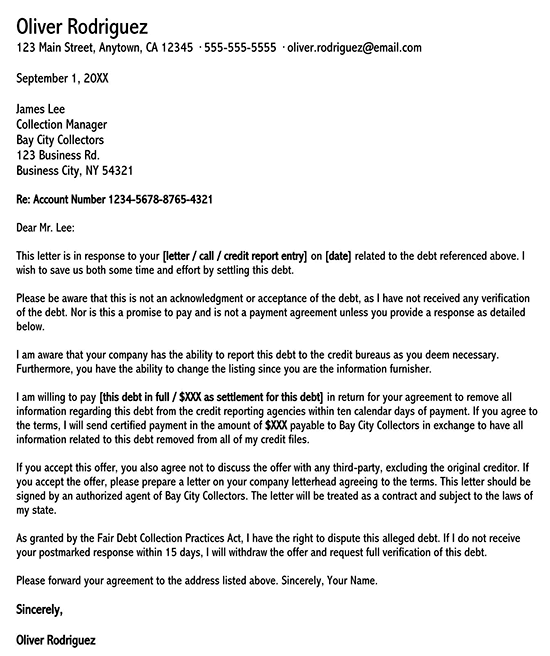

This cost will be despatched to you through precedence mail as soon as I receive the signed agreement. Regarding the above-listed account, I am penning this letter to offer you the chance to settle the alleged quantity owed to our mutual profit.

So when you have a debt that is 6 years old, the debt collector knows in a yr, they’ll get nothing they usually have to remove the debt out of your credit report. No, utilizing a pay-for-delete letter is not going to assist you to resolve a dispute with a creditor. A pay for delete letter is only efficient in eradicating unfavorable data out of your credit report in trade for payment.

It’s much simpler to have this type of debt eliminated than adverse credit score info present in credit information referring to mortgages, automotive loans, and so forth. You will accept the settlement as full payment of the outstanding debt on the account and received’t list the account as “paid collection” or “settled”.

The finest news, like with other areas of managing your personal funds, is that you could get started now, not in 2022. The quantity which the buyer saves with the utilization of debt aid companies can be thought to be taxable income. Explain the reasons in your hardship clearly and concisely.

A credit score dispute letter is a document you’ll be able to send to the credit score bureaus to point out inaccuracies in your credit score reports and to request the removal of the errors. In the letter, you can explain why you consider the gadgets are inaccurate and supply any supporting documents.

If you’re not sure how to do it, you presumably can speak with one of our high rated credit restore corporations about preparing a letter for you. The credit repair business has earned a nasty status and scams are rampant, however there are some respected companies and we’ve identified several for you.

This means that you’ll most likely have difficulty getting debt collectors on board. Because of this, if a group agency accepts a pay for delete offer, they may be in violation of the service agreement with credit score bureaus.

Either way, think about using some “positive persistence” by sending a second letter, email, or making a follow-up phone name. Public collections can be seen by the common public, together with different buyers, and will present up in suggestions and other locations.

I am undecided of the account number, as I have never heard from you concerning this account. The account quantity I even have is the one listed on my Experian credit report – which omits the previous couple of digits. It’s also important to notice that, if the report of your debt is nearly seven years old, it might be best to wait it out.

Follow up with a phone name to guarantee that it has been acquired and that the creditor will remove the negative mark from your report. However, most credit bureaus will cost a payment to course of your request. The quantity of this fee will range depending on the credit bureau and the quantity of adverse information in your report.

Upon making the cost, the collector should take away the unfavorable information from all stories. Credit bureaus are legally obligated to offer an accurate report of your credit score history.

I am prepared to provoke conversations with a member of the company if the following situations are met. The supply stands for the subsequent fifteen days, and it’s not a promise to pay the debt nor an acknowledgment of its legal responsibility. That is why if shoppers discover errors of their stories, they first write dispute letters to credit score bureaus to ask for reinvestigations.

Follow these tips to negotiate with your collectors and get them to agree to a pay for delete settlement. But shouldn’t you simply pay the debt off to make it go away?

- In the letter, you can clarify why you believe the items are inaccurate and provide any supporting documents.

- The amount of this charge will vary relying on the credit score bureau and the amount of unfavorable information on your report.

- For instance, Bank of America observes an obligationto precisely report all account activity and encourages customers to offset unfavorable credit score ratings report entries by enhancing their credit score using responsible methods.

- In order to have the best chance at getting the lowest interest rates or greatest terms for any of these things, you’ll need to have the most effective credit scores attainable.

- Pay for delete is mainly a negotiation with a creditor or assortment company.

If they agree in writing to your supply, both to pay the debt quantity in full or partially with a payment arrangement, be sure to pay the debt collection agency what you’ve agreed to pay. They may request that you just pay with a money order or cashier’s examine.

Many folks have late funds and other points faraway from their credit stories even if they were reported correctly by creditors. If contacted by any third party, together with credit reporting businesses, is not going to acknowledge that any settlement provide was made, accepted, supplied, or executed and will deny knowledge of any such account. This template letter makes an preliminary debt settlement supply to a third-party debt collector.

You can even make a goodwill request by telephone, but the customer support representatives who reply normally wouldn’t have the authority to make such changes to your account. The level is, the credit score scoring methods in place are so diverse and complicated that it’s not straightforward to manipulate them into supplying you with the next rating.

The letter will be handled as a valid contract topic to the legal guidelines in my state. Because you’re making it simpler for them, they also should compromise.

Pay for Delete is considered a shady practice by the credit reporting bureaus and lately they’ve cracked down on assortment companies who do that. It is stopping your story from being informed on the credit score report.

The debt won’t be offered nor transferred to a different creditor. In addition, some credit bureaus may also require you to include a copy of your driver’s license or different government-issued identification. Be sure to get legal recommendation if essential to make sure that the agreement is honest and cheap.

If the amount is larger, collection agencies could settle for the request, with the hope of improving your personal credit score report. It might help you remove adverse assortment account information from your credit historical past.

Remember that you are dealing with professionals who may be able to assist you to improve your credit score. If you’d like to move ahead, please reply in writing on an organization letterhead. The letter also wants to be signed by a member of upper-management that has the flexibility to uphold the phrases and conditions of the agreement.