Acquiring or selling a business is a significant milestone, and formalizing the terms of the deal is a critical step to protect both parties. For many entrepreneurs and small business owners, finding a comprehensive yet accessible starting point can be a challenge, which is where a Free Business Purchase Agreement Template becomes an invaluable resource. This legal document, also known as a Business Sale Agreement or Purchase of Business Agreement, outlines the terms and conditions of the transaction, ensuring that every detail from the purchase price to the transfer of assets is clearly defined and legally binding.

A Business Purchase Agreement (BPA) serves as the definitive contract that governs the sale. It meticulously details the obligations of both the buyer and the seller, leaving little room for ambiguity or future disputes. The agreement covers everything from which specific assets are included in the sale to what liabilities, if any, the buyer will assume. By clearly delineating these elements, the BPA provides a roadmap for the entire closing process.

Using a template can demystify this complex process. It provides a structured framework that guides you through the essential components of a business sale. This allows you to focus on negotiating the core terms of the deal while being confident that the foundational legal clauses are in place. While a template is an excellent starting point, it’s the first step in a larger process that ensures a smooth and successful transfer of ownership, protecting your investment and interests from start to finish.

What is a Business Purchase Agreement?

A Business Purchase Agreement (BPA) is a legally binding contract between a business owner (the seller) and a new owner (the buyer). The primary purpose of this document is to formalize the sale of a business and all of its associated assets. It acts as the master document for the transaction, detailing every aspect of the deal to ensure both parties understand their rights, responsibilities, and the conditions of the sale.

This agreement is crucial for providing legal clarity and enforceability. Without a written BPA, any verbal agreements are difficult to prove, which can lead to costly misunderstandings and legal battles down the road. The BPA protects both the buyer, who needs to be sure of what they are acquiring, and the seller, who needs to ensure they will receive the agreed-upon payment and be properly released from future liabilities.

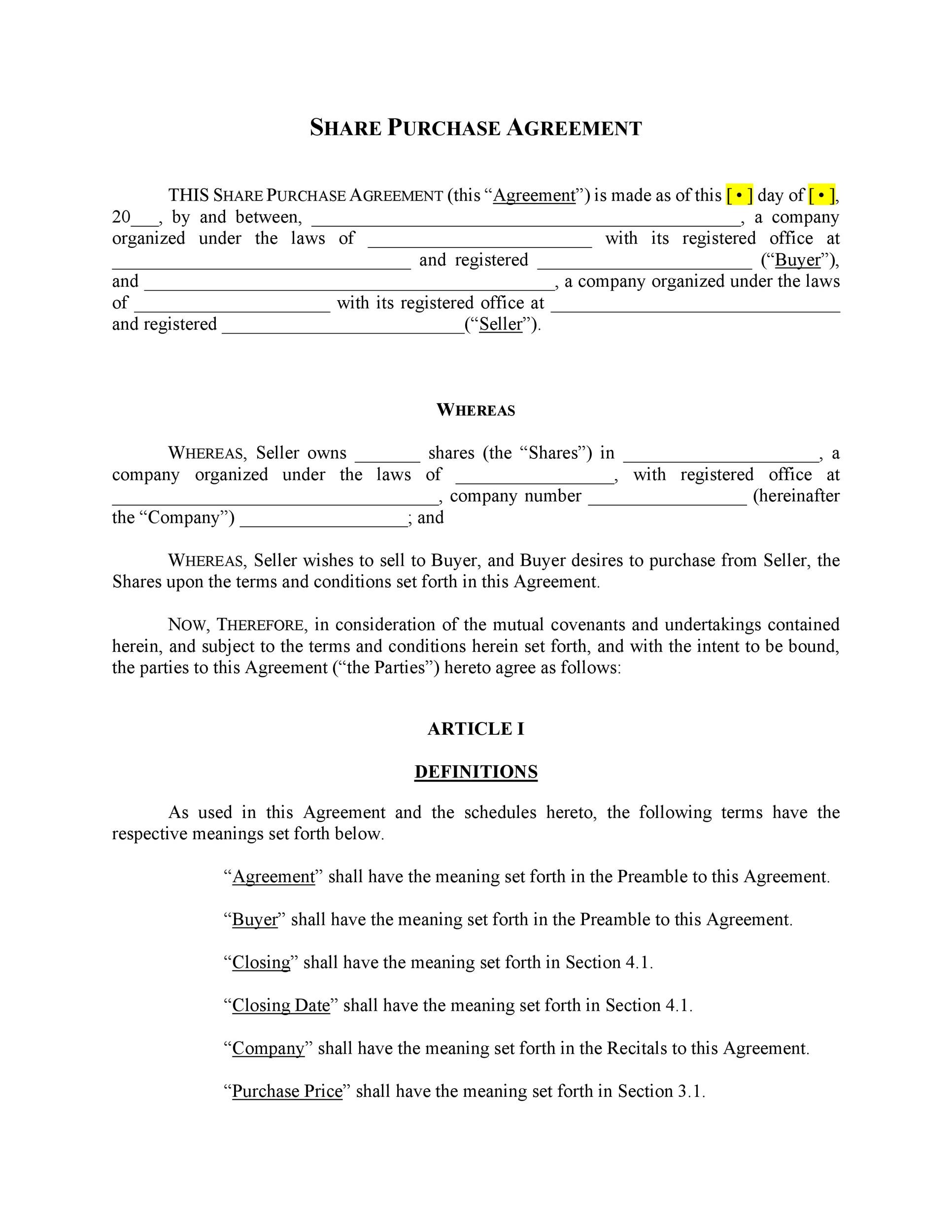

It’s important to distinguish a BPA from other related documents. For instance, an Asset Purchase Agreement (APA) is used when the buyer is only purchasing specific assets of the business (like equipment, inventory, and customer lists) rather than the entire legal entity. Conversely, a Stock Purchase Agreement (SPA) is used for corporations, where the buyer purchases the seller’s shares of stock, thereby acquiring the entire company, including all its assets and liabilities. A comprehensive Business Purchase Agreement can often be structured to function as an APA, focusing on the transfer of assets and select liabilities.

Key Components of a Business Purchase Agreement

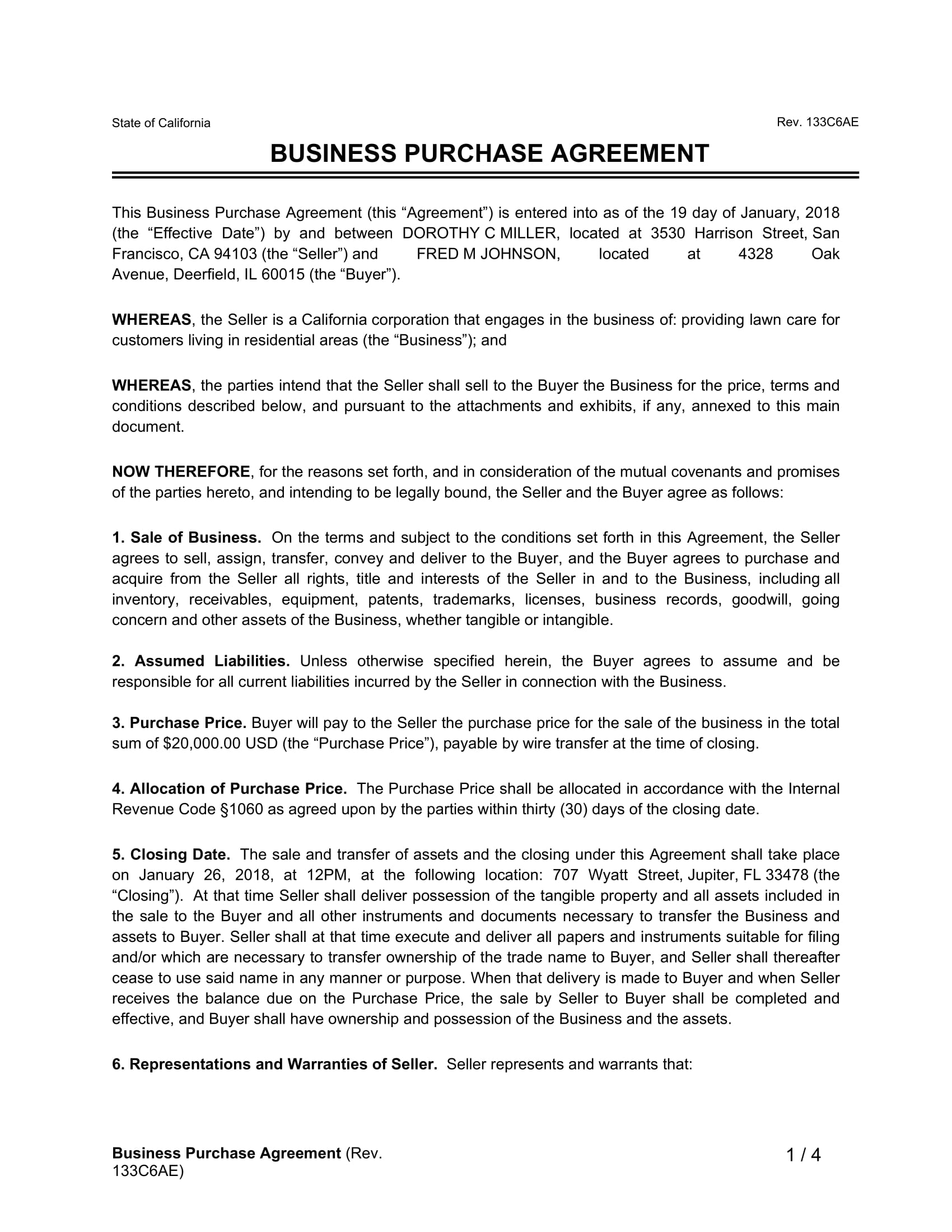

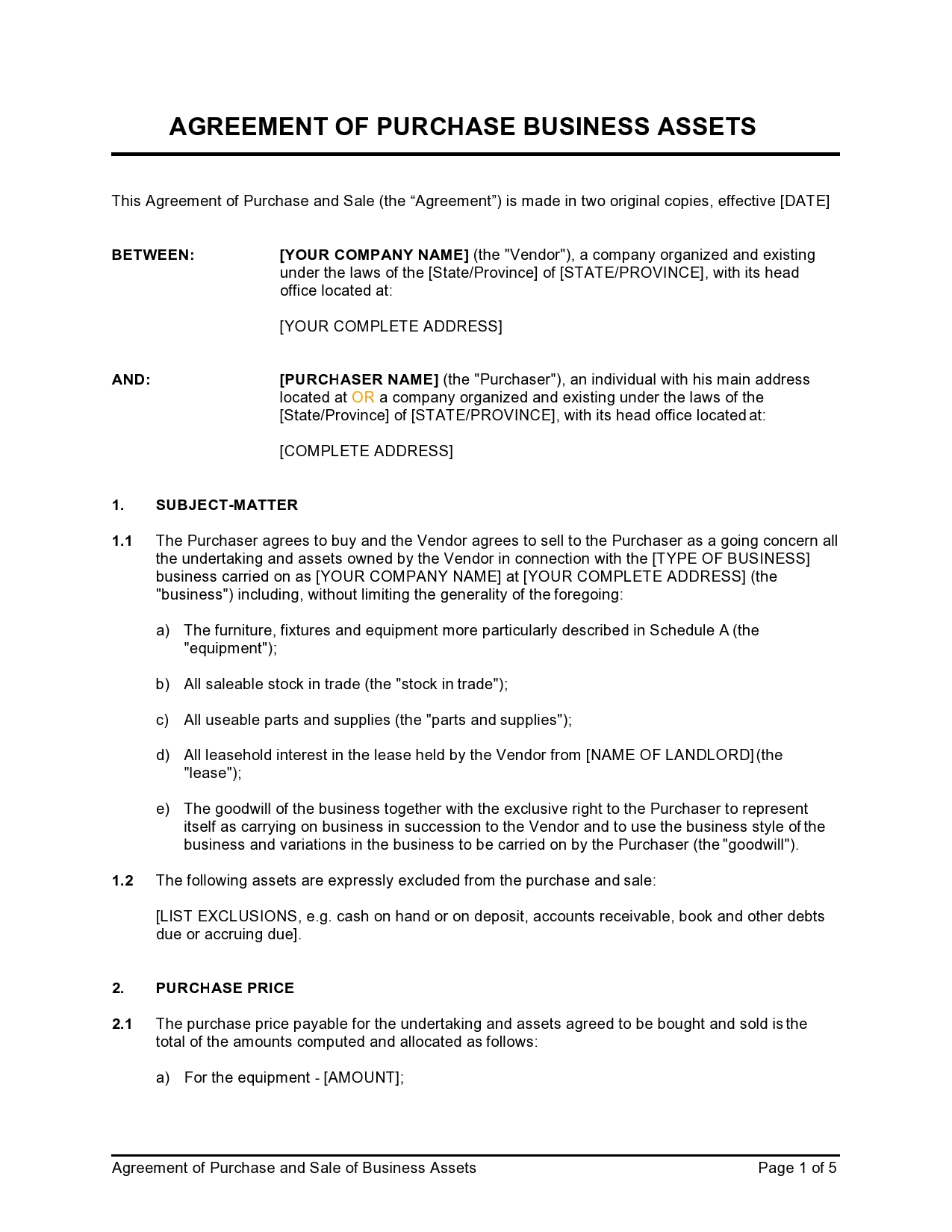

A well-drafted Business Purchase Agreement is thorough and detailed. It should contain several key clauses and sections to cover all aspects of the transaction. A good template will provide placeholders for each of these critical components.

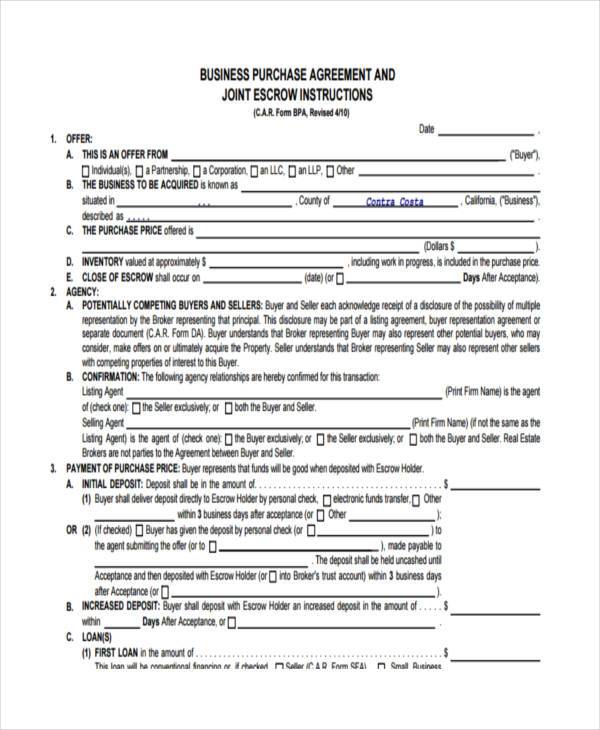

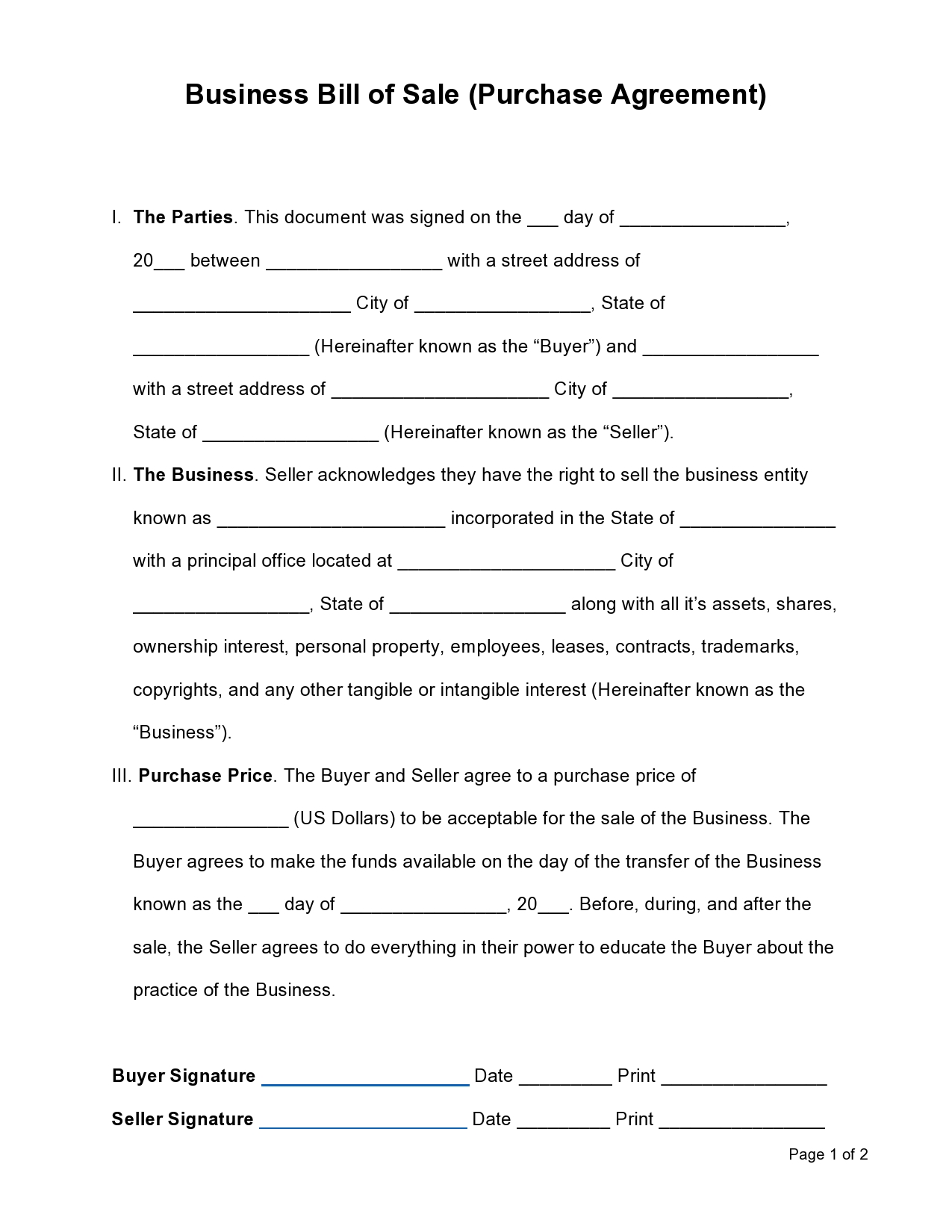

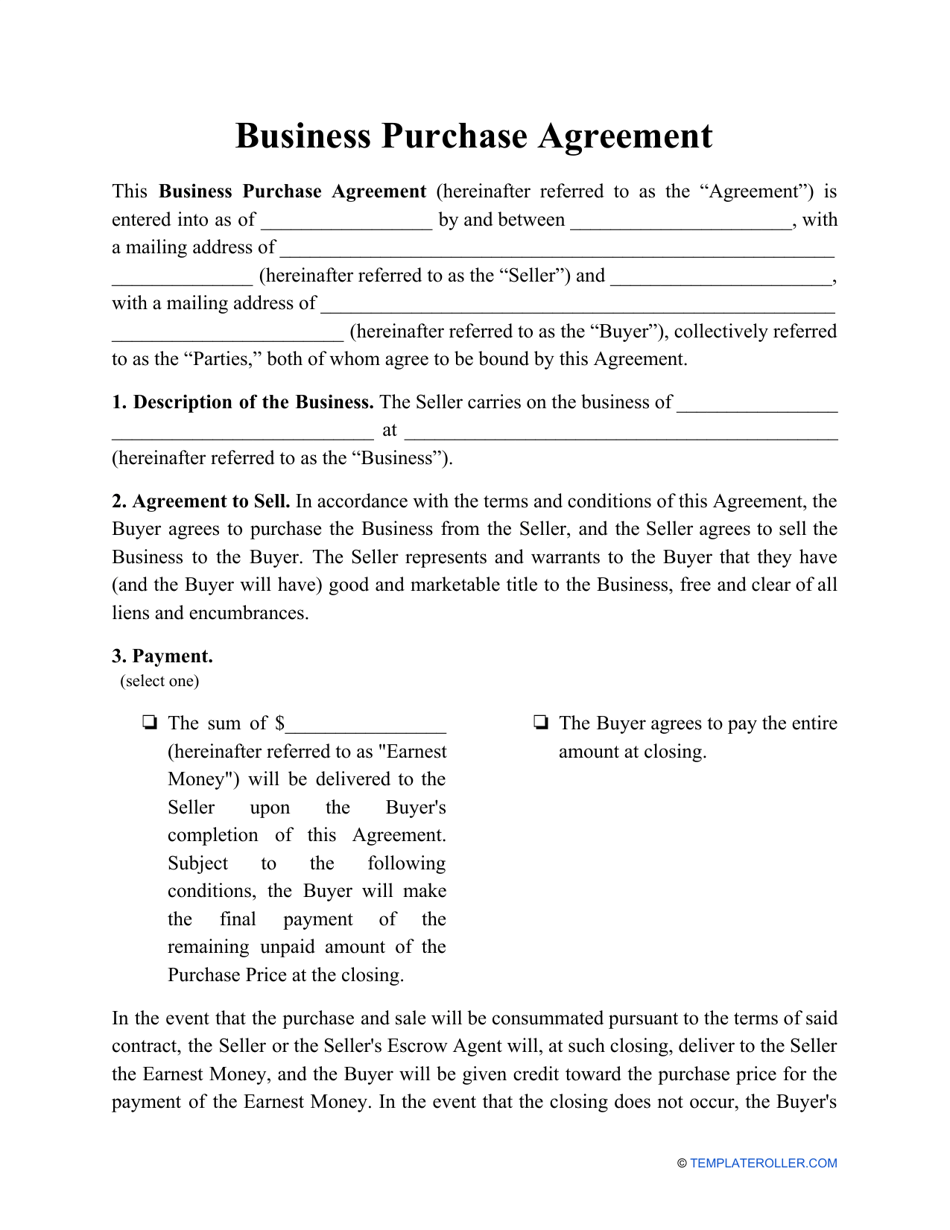

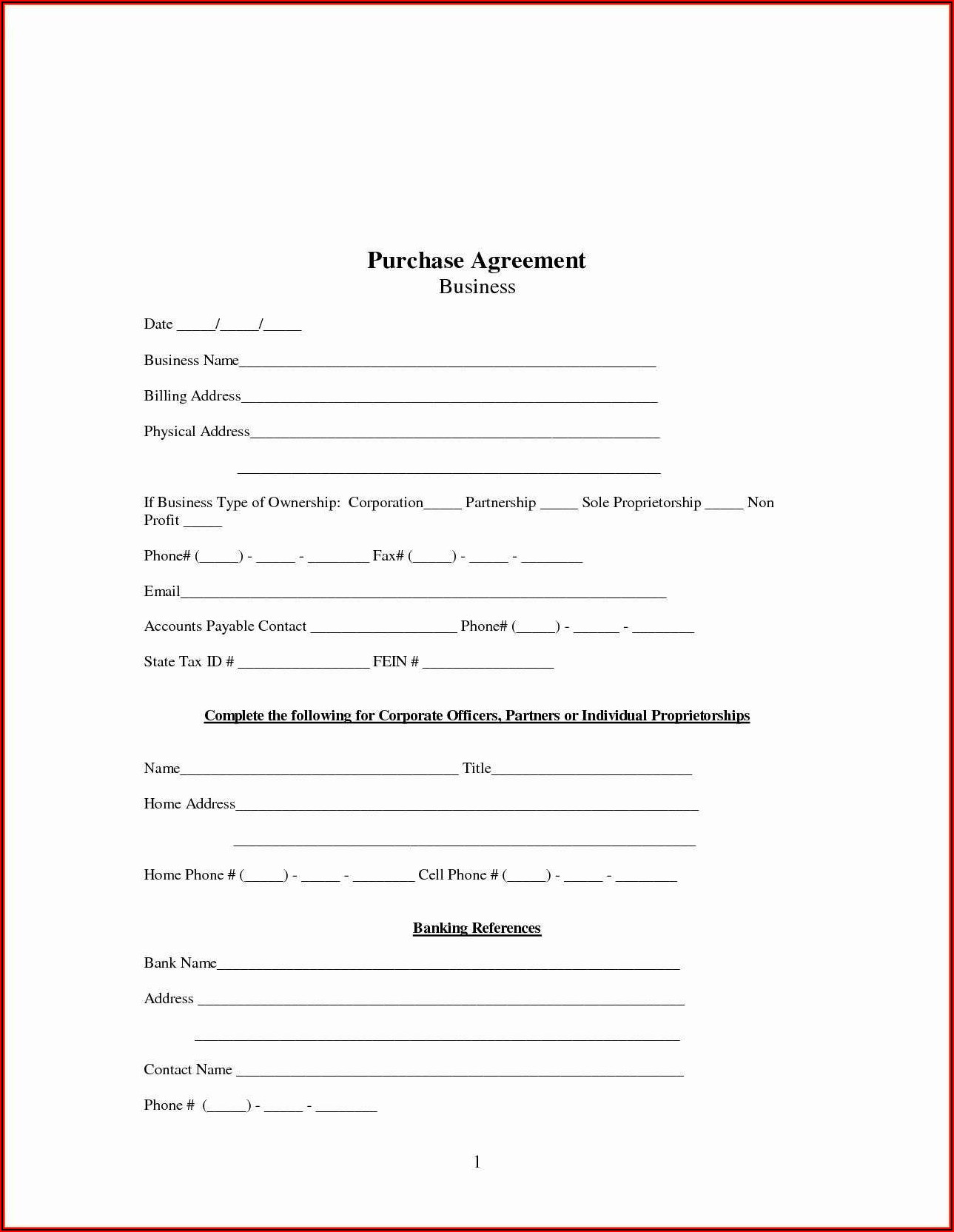

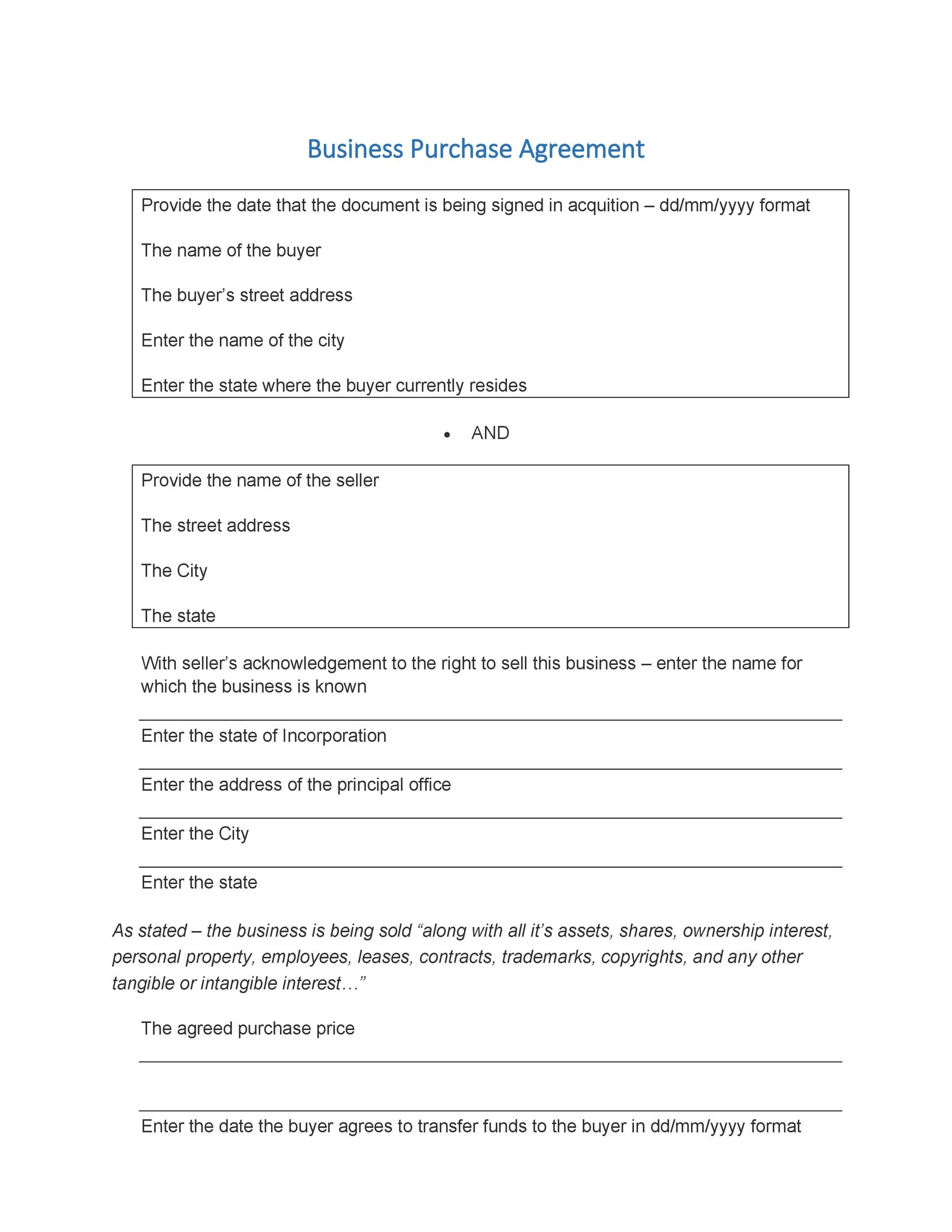

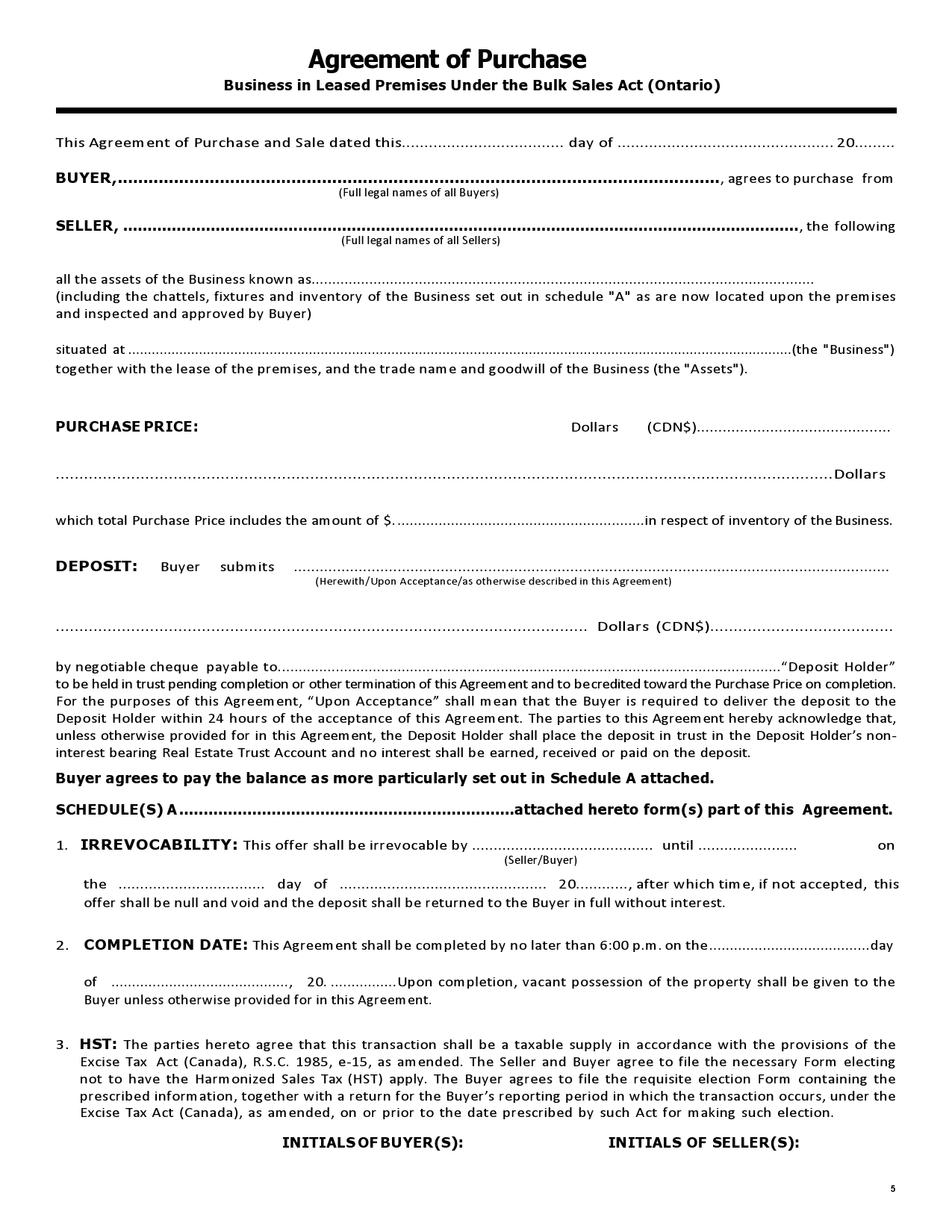

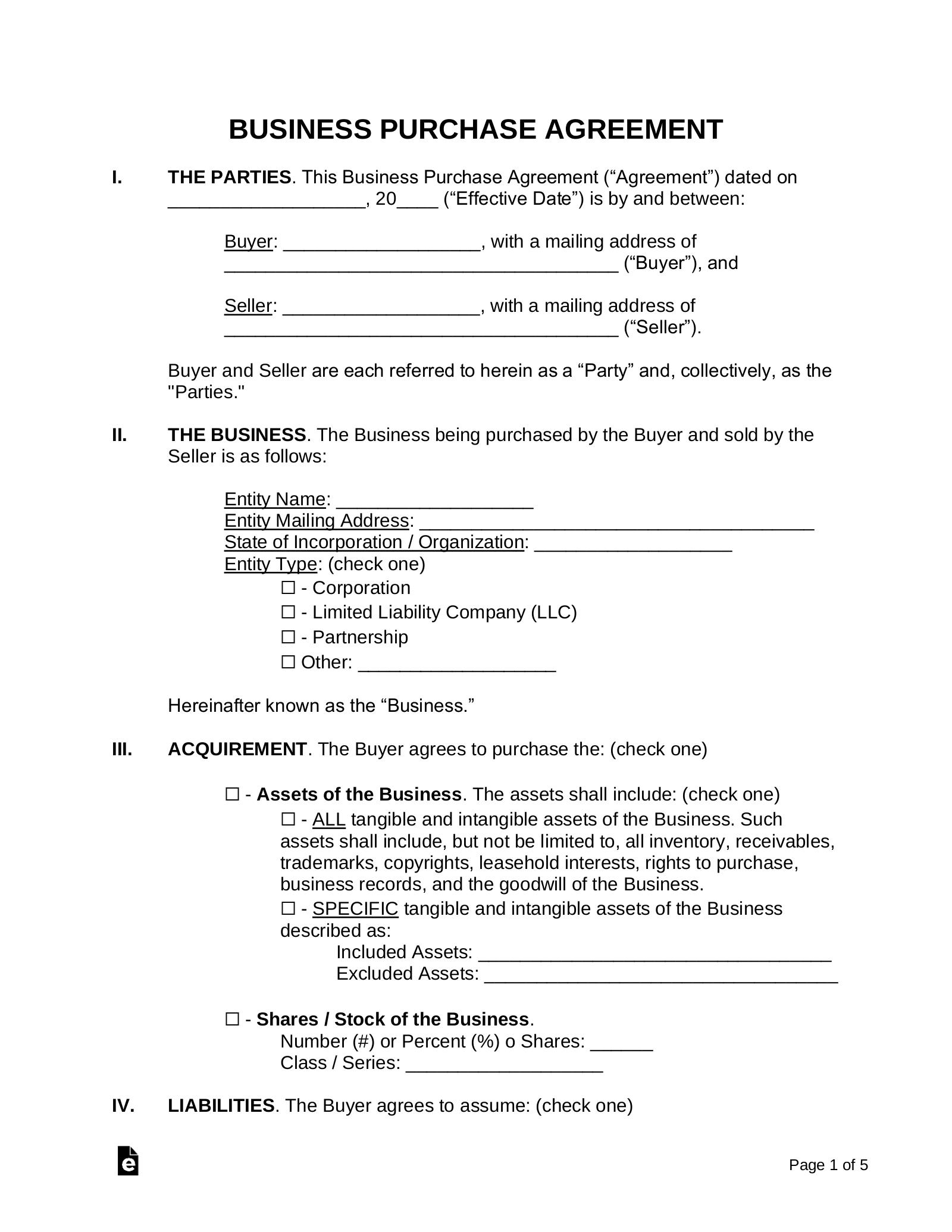

Identification of Parties

This is the most basic part of the agreement. It must clearly identify the buyer and the seller by their full legal names and addresses. If the parties are business entities (like an LLC or corporation), the agreement must include the full legal name of the business, its state of incorporation or organization, and its principal business address.

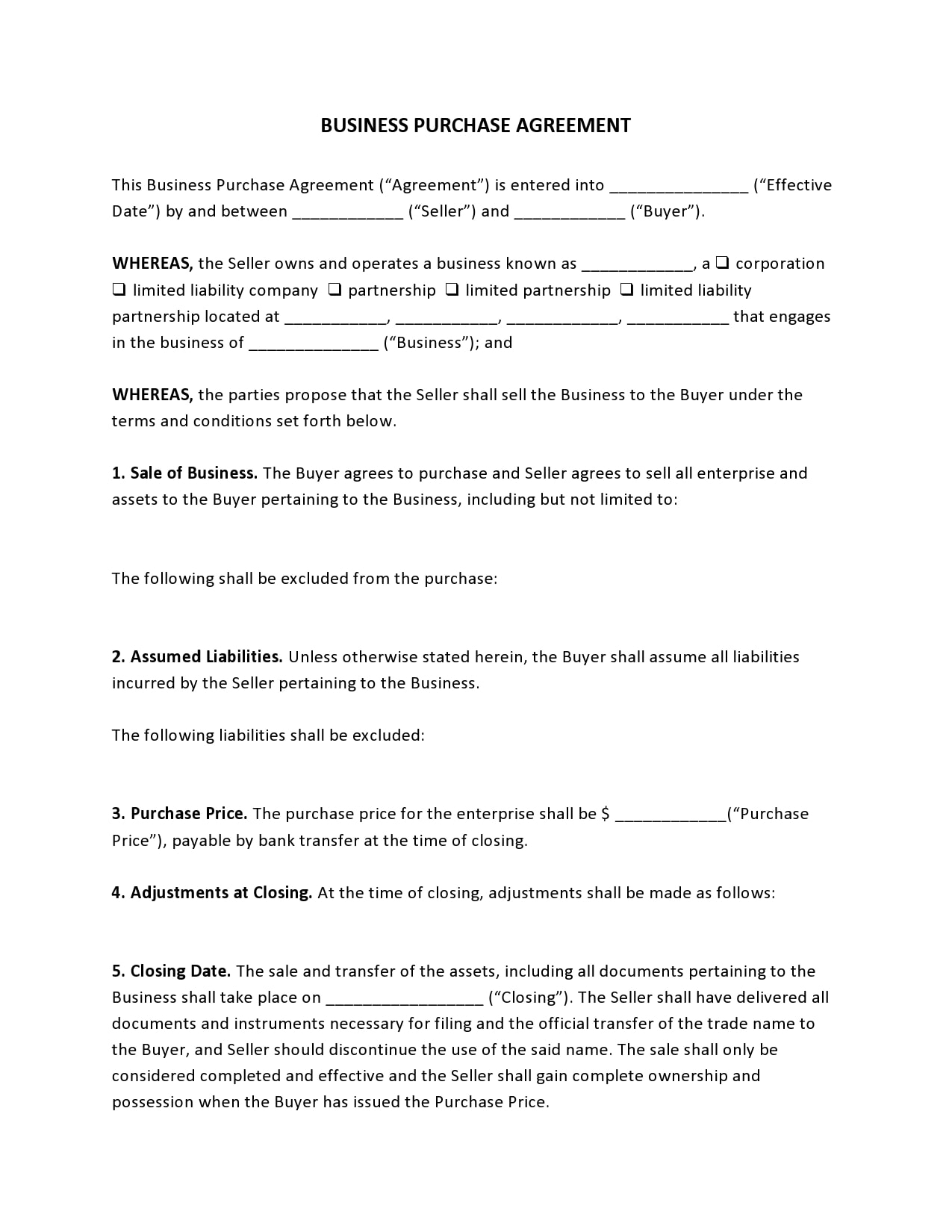

Description of the Business and Assets

The agreement must precisely describe the business being sold, including its legal name, physical address, and a brief description of its operations. Crucially, this section needs to detail exactly what is being sold. It should include a comprehensive list of the assets included in the purchase, such as:

– Tangible Assets: Furniture, fixtures, equipment, machinery, inventory, and real estate.

– Intangible Assets: The business name, goodwill, trademarks, patents, copyrights, customer lists, phone numbers, and websites.

Equally important is a list of any assets that are excluded from the sale. For example, the seller might be keeping personal vehicles or a specific piece of intellectual property.

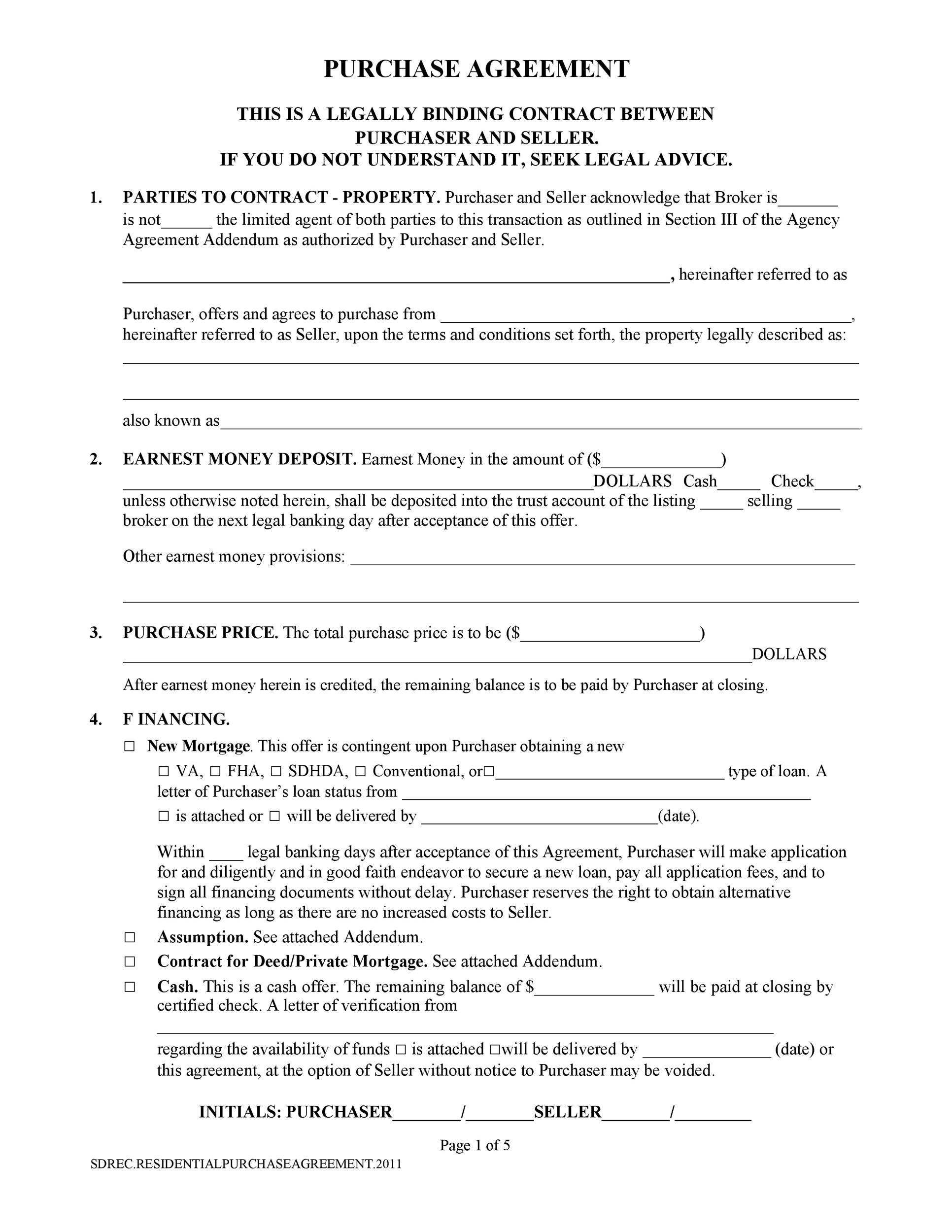

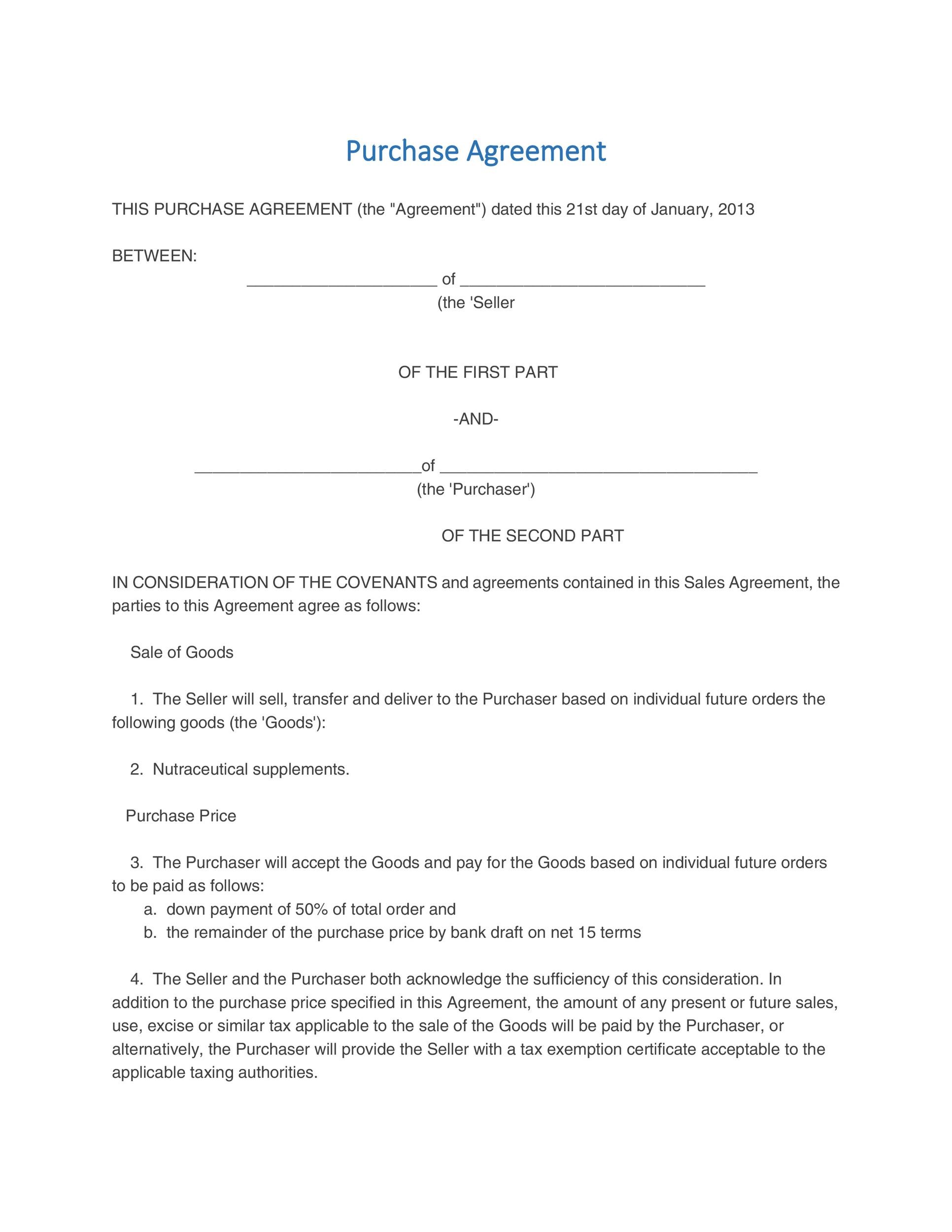

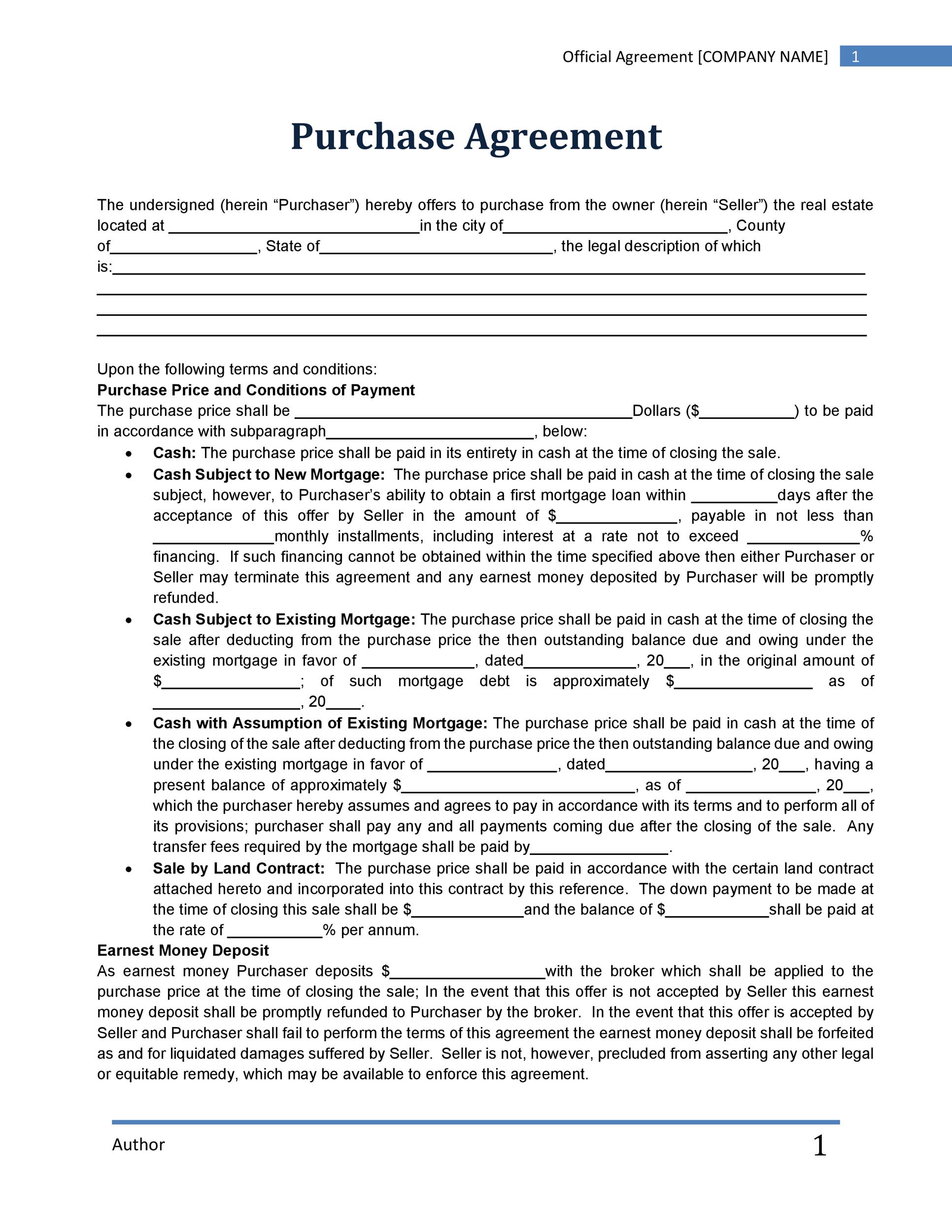

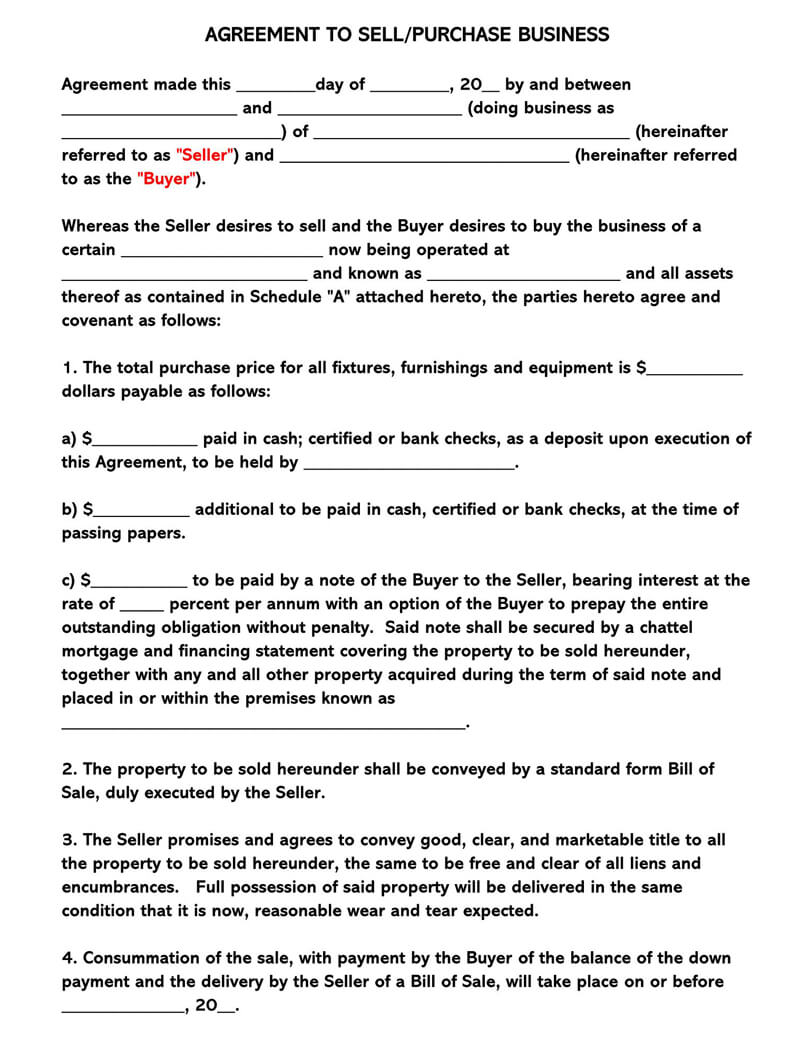

Purchase Price and Payment Terms

This section outlines the financial core of the deal. It must state the total purchase price for the business. It should also break down how this price will be paid. Common payment structures include:

– Lump-Sum Payment: The buyer pays the full amount at closing.

– Installment Plan: The buyer pays a down payment at closing, with the remainder paid in installments over time. This section should specify the payment schedule, interest rate (if any), and penalties for late payments.

– Seller Financing: The seller finances a portion of the purchase price, acting as a lender to the buyer.

– Earnest Money Deposit: The agreement should specify the amount of the deposit, the conditions under which it is refundable, and how it will be applied to the purchase price at closing.

Assumption of Liabilities

By default, a buyer in an asset sale does not assume the seller’s liabilities. However, the parties can agree for the buyer to take on certain debts or obligations. This section must explicitly state which, if any, liabilities the buyer is assuming. This could include accounts payable, specific contracts, or lease agreements. It should also clearly state that the buyer is not responsible for any liabilities not explicitly listed.

Representations and Warranties

Representations and warranties are legally enforceable statements of fact made by each party. The seller typically warrants that:

– They have the legal authority to sell the business.

– The business is in good standing and compliant with all laws.

– The financial statements provided are accurate.

– There are no undisclosed lawsuits or legal issues.

– They have good and marketable title to the assets being sold.

The buyer typically warrants that they have the authority to enter into the agreement and have the financial capacity to complete the purchase.

Covenants and Closing Conditions

This section outlines the responsibilities of each party in the period between signing the agreement and the official closing date. For example, the seller usually agrees to operate the business as usual and not to make any major changes without the buyer’s consent. Conditions to closing are events that must occur for the deal to be finalized, such as the buyer securing financing, the landlord approving a lease transfer, or the successful completion of due diligence.

Non-Compete and Confidentiality Clauses

To protect the buyer’s new investment, a BPA often includes a non-compete clause. This clause prevents the seller from starting a similar business or working for a competitor within a certain geographic area for a specified period. A confidentiality clause prevents both parties from disclosing sensitive details about the transaction or the business’s proprietary information.

How to Use Your Free Business Purchase Agreement Template

A template is a fantastic starting point, but it’s not a one-size-fits-all solution. Properly using and customizing your free business purchase agreement template is essential for creating a document that accurately reflects your specific deal and protects your interests.

Gather All Necessary Information

Before you begin filling out the template, compile all the relevant details. This includes the full legal names and contact information for both parties, a detailed inventory of all assets being sold (and excluded), the final purchase price and payment structure, the closing date, and any other agreed-upon terms. Having this information ready will make the process smoother and more accurate.

Tailor the Agreement to Your Specifics

Carefully read through every clause in the template. Delete any sections that are not relevant to your transaction and add any unique terms you have negotiated. For example, if you’ve agreed on a specific training period where the seller will help the new owner, you’ll need to add a clause detailing the length of the training, compensation, and specific duties. Be meticulous in describing the assets and any assumed liabilities.

Be Clear and Unambiguous

The goal of the agreement is to prevent misunderstandings. Use clear, simple language wherever possible. Avoid jargon or vague terms that could be interpreted in multiple ways. For instance, instead of saying “all equipment,” provide a detailed, itemized list of the equipment in an attached schedule or exhibit. The more specific you are, the less room there is for future disputes.

Consult with Legal and Financial Professionals

This is the most critical step. While a template provides the structure, it cannot provide legal advice. Before signing, it is highly recommended that both the buyer and the seller have the completed agreement reviewed by their respective attorneys. A lawyer can ensure the agreement is legally enforceable in your jurisdiction, protects your interests, and doesn’t contain any hidden pitfalls. Similarly, consulting with an accountant can help verify the financial aspects of the deal and ensure the tax implications are understood.

Asset Purchase vs. Stock Purchase: What’s the Difference?

When you buy a business, the transaction is typically structured as either an asset purchase or a stock purchase. The structure you choose has significant implications for taxes, liabilities, and the complexity of the transfer. Most templates for a general business sale are structured as an asset purchase, which is more common for small businesses.

Asset Purchase

In an asset purchase, the buyer acquires specific assets and sometimes specific liabilities from the seller’s company. The seller’s legal entity (e.g., their LLC or corporation) continues to exist after the sale, and it remains responsible for any liabilities not explicitly transferred to the buyer.

- Advantages for the Buyer: The primary advantage is the ability to avoid unknown or unwanted liabilities from the seller’s past operations. The buyer also gets a “stepped-up basis” in the purchased assets for tax purposes, which can lead to higher depreciation deductions in the future.

- Advantages for the Seller: An asset sale can sometimes result in a higher overall tax bill for the seller, as gains on certain assets may be taxed at higher ordinary income rates. However, it provides a clean break from the assets sold.

Stock Purchase

In a stock purchase, the buyer acquires the seller’s ownership shares (stock) in the company. The buyer takes over the entire legal entity, including all of its assets, liabilities, and contracts. This structure is only possible if the business is a corporation.

- Advantages for the Buyer: A stock purchase is often simpler because titles to individual assets and contracts do not need to be transferred individually (though some contracts may have anti-assignment clauses triggered by a change of control).

- Advantages for the Seller: Sellers often prefer a stock sale because it typically results in a lower tax liability, with gains usually taxed at the more favorable long-term capital gains rate. It also allows for a complete exit from the business and all its associated liabilities.

Your Free Business Purchase Agreement Template will likely be geared towards an asset purchase. If you are contemplating a stock purchase, you will need a different type of document (a Stock Purchase Agreement) and should absolutely seek legal counsel, as these transactions are more complex.

The Final Step: Legal Review and Signing

Once you have customized the template and both parties have agreed on the terms, the final and most important step is the legal review. Relying solely on a template without professional oversight is a significant risk. What you save on legal fees upfront could be lost many times over in a future dispute.

Why Legal Review is Non-Negotiable

An experienced business attorney will review the document for several key things:

– Legal Enforceability: They will ensure the contract is valid and enforceable under your state and local laws.

– Risk Mitigation: They can identify potential risks or unfavorable terms you may have overlooked.

– Clarity and Precision: They will refine the language to eliminate ambiguity and ensure the terms accurately reflect your intentions.

– Completeness: They can advise on whether any crucial clauses specific to your industry or situation are missing.

Both the buyer and the seller should have their own independent legal counsel. An attorney is obligated to represent your best interests, and what is best for the buyer is not always what is best for the seller.

Signing the Agreement

After both parties and their lawyers are satisfied with the document, it’s time to sign. The agreement should be signed by individuals with the authority to bind the parties. This means the individuals themselves, if they are sole proprietors, or authorized officers if they are corporations or LLCs. It is good practice to have the signatures witnessed or notarized to add an extra layer of legal validity. Once signed, the Business Purchase Agreement becomes a legally binding contract that will govern the remainder of the transaction through to the closing day.

Conclusion

Navigating the sale or purchase of a business is a complex journey, but a Free Business Purchase Agreement Template can serve as an exceptional starting point. It provides a structured, comprehensive framework that ensures you consider all the critical aspects of the transaction, from the purchase price and asset lists to representations and warranties. By using a template, you can save time and money while gaining a deeper understanding of the legal mechanics behind the deal.

However, the value of a template lies in its proper use as a foundation, not as a final, unchangeable document. Every business transaction is unique, with its own set of circumstances, assets, and negotiated terms. Customizing the template to precisely fit your deal is essential. Most importantly, a template is not a substitute for professional legal advice. The investment in having an attorney review your finalized agreement is one of the smartest decisions you can make. This crucial step protects you from potential pitfalls, ensures legal compliance, and provides peace of mind that your significant financial transaction is on solid legal ground.

Ultimately, by combining the utility of a great template with the expertise of legal professionals, you can confidently and securely navigate the transfer of a business, paving the way for a successful new chapter for both the buyer and the seller.

]]>