Dispute Letter To Creditor Template. Credit scorers perceive this is merely a shopper out looking for the best rate they can get. Every day, Steven speaks with individuals and families within the on-line credit restore group to solutions questions and offer assist to individuals on their journey to restore and improve their credit standing. A few of the perks embrace free ebooks even though you have not applied for the credit score fix program. The main factor to remember with your letter is that it’s all about technicalities.

Pay attention to spelling and grammar, too, as you need to be as clear and concise as potential. It demands that late fee data be removed if no such documentation exists. Otherwise, we will not hesitate to hunt authorized help on this matter.

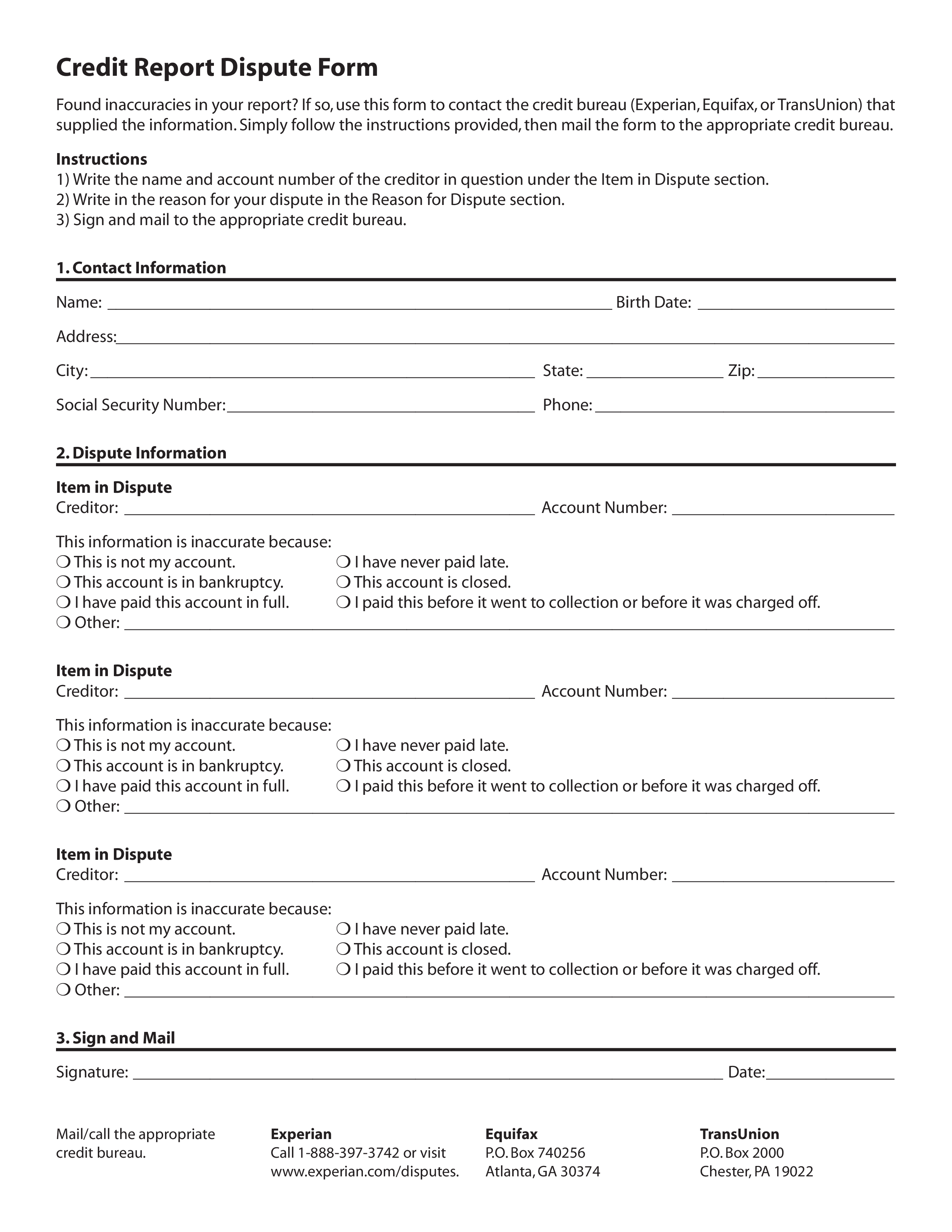

Inquiry Dispute to Credit Bureau, round 1 — Despite the efforts of many unscrupulous credit restore vendors to let you know in any other case, credit bureaus have little regulatory incentive to remove inquiries. Use this template to dispute an invalid repossession with one of the three major credit score bureaus that produce your credit reviews . Before using it, make certain you know tips on how to talk effectively with your creditors. Verification Of Employment LetterBring your human resource or administrative workplace work wherever as long as you have internet entry. As always, maintain copies of your communications and mail all letters first-class, return receipt requested.

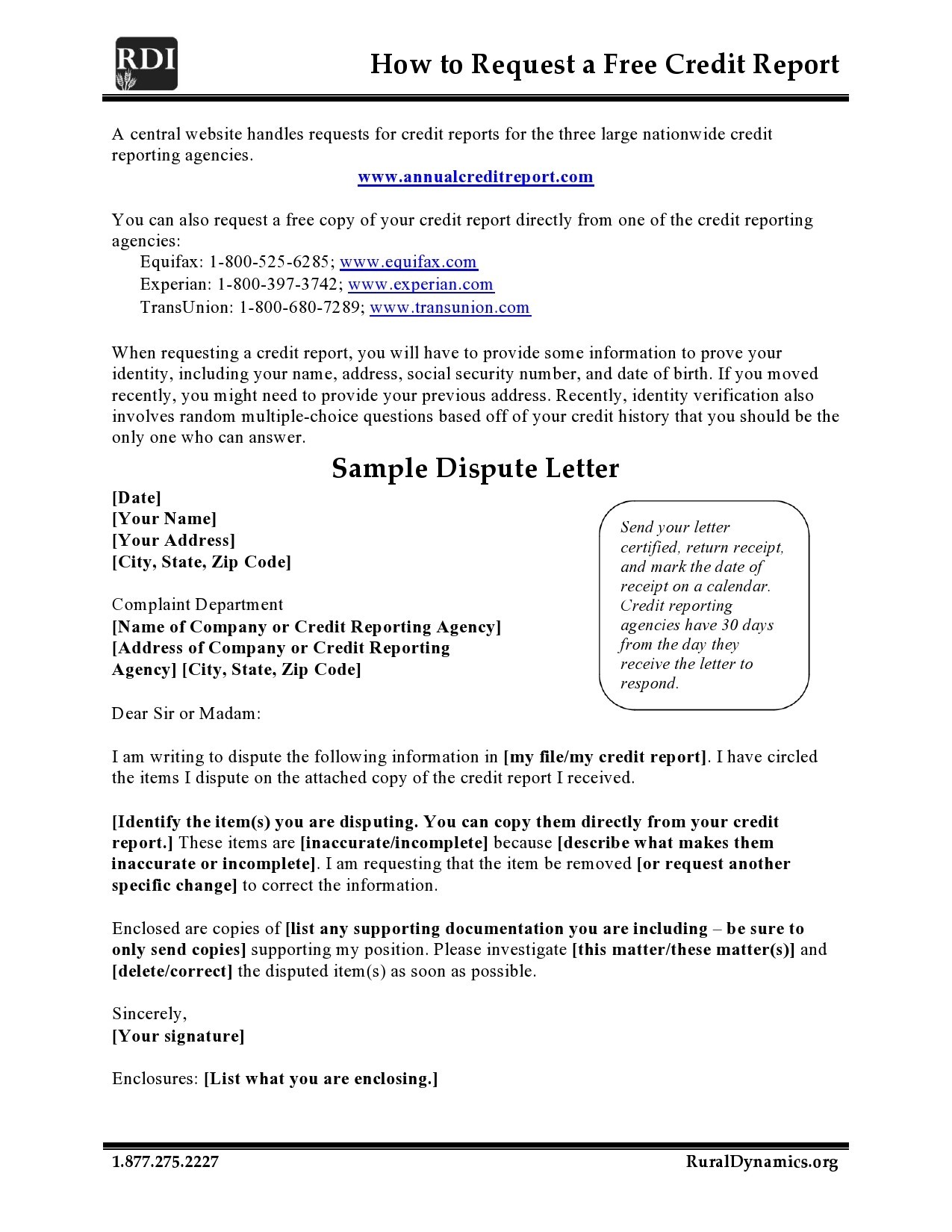

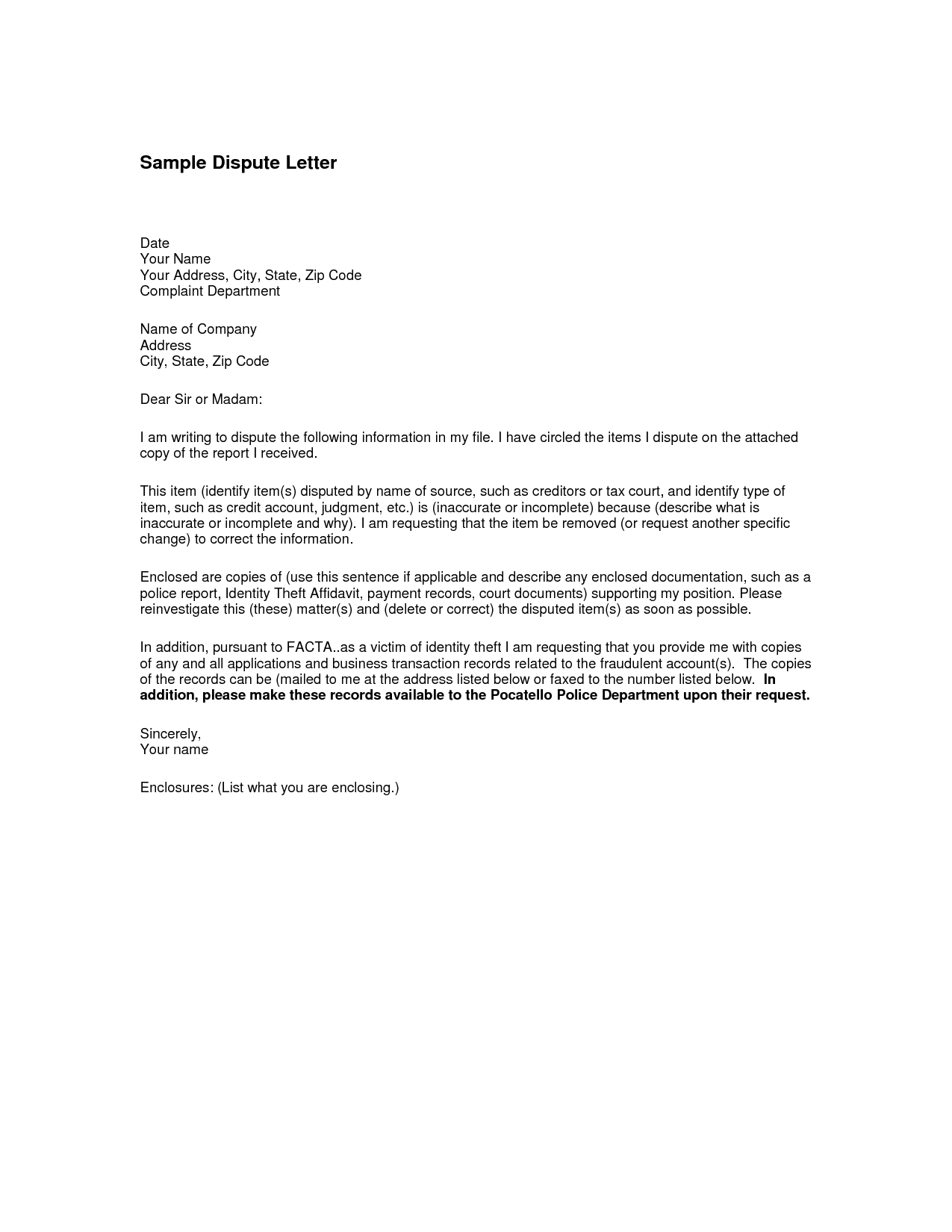

I am writing to dispute the next data in my file. Our group of credit score repair experts are just a click on or call away.

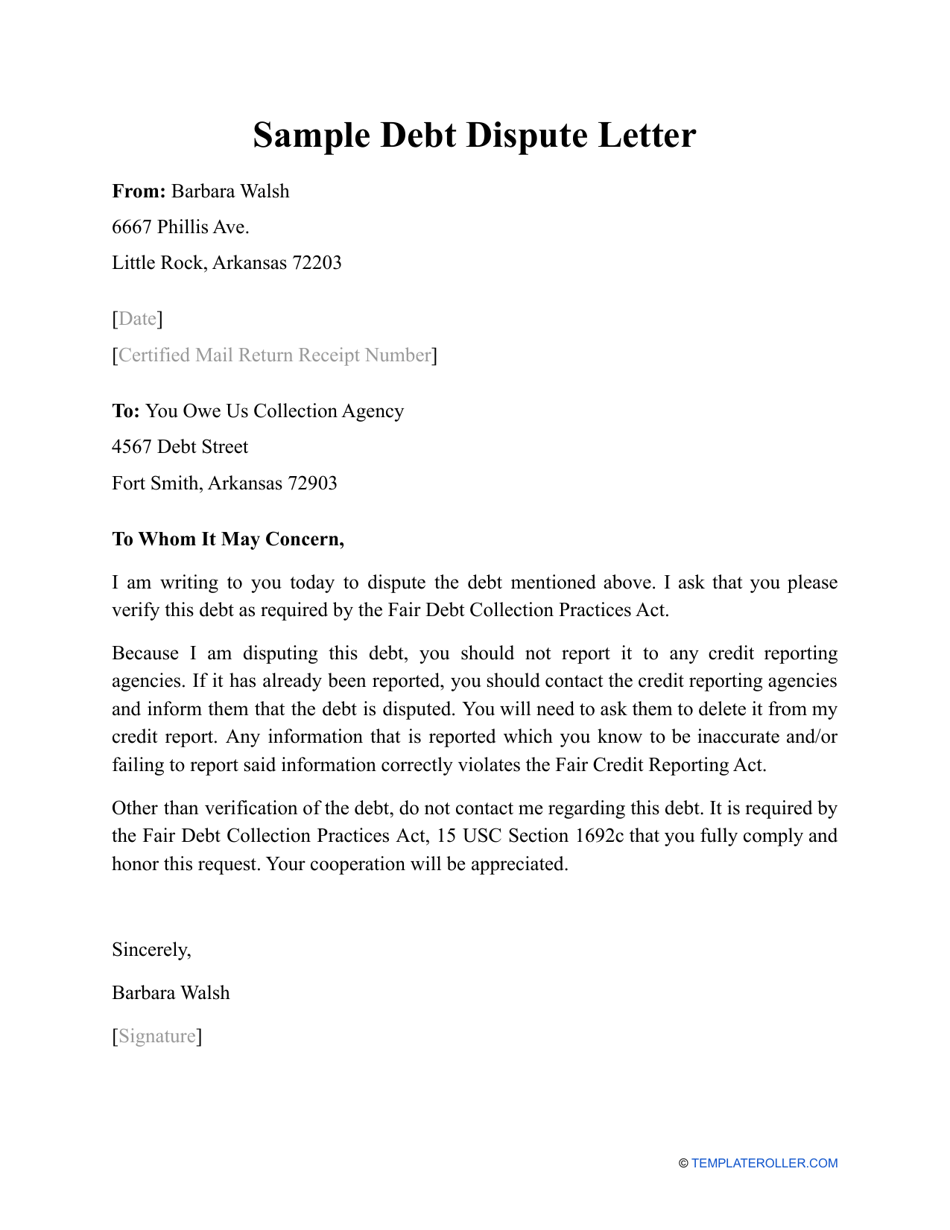

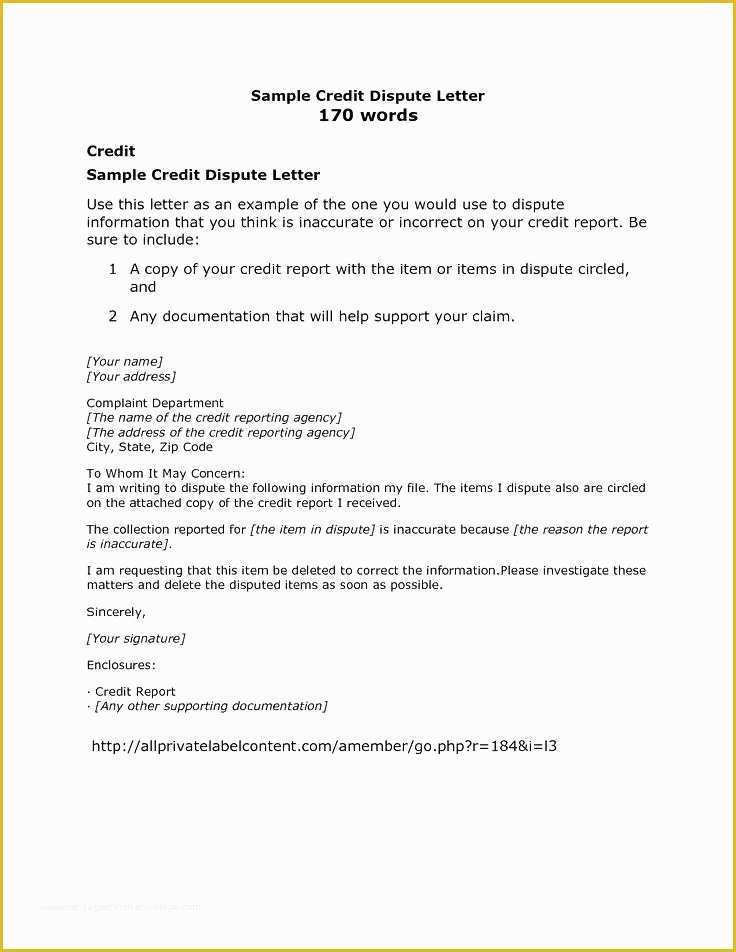

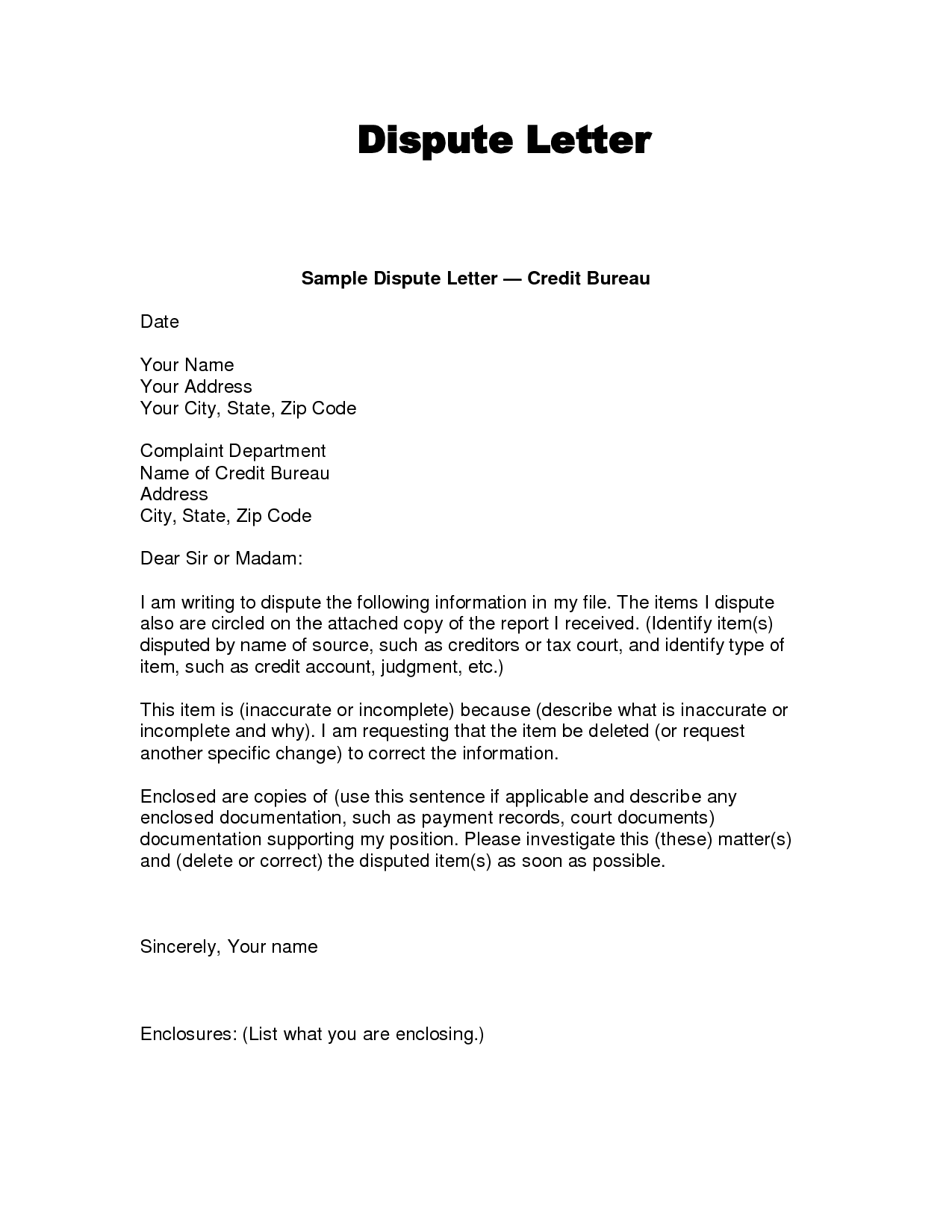

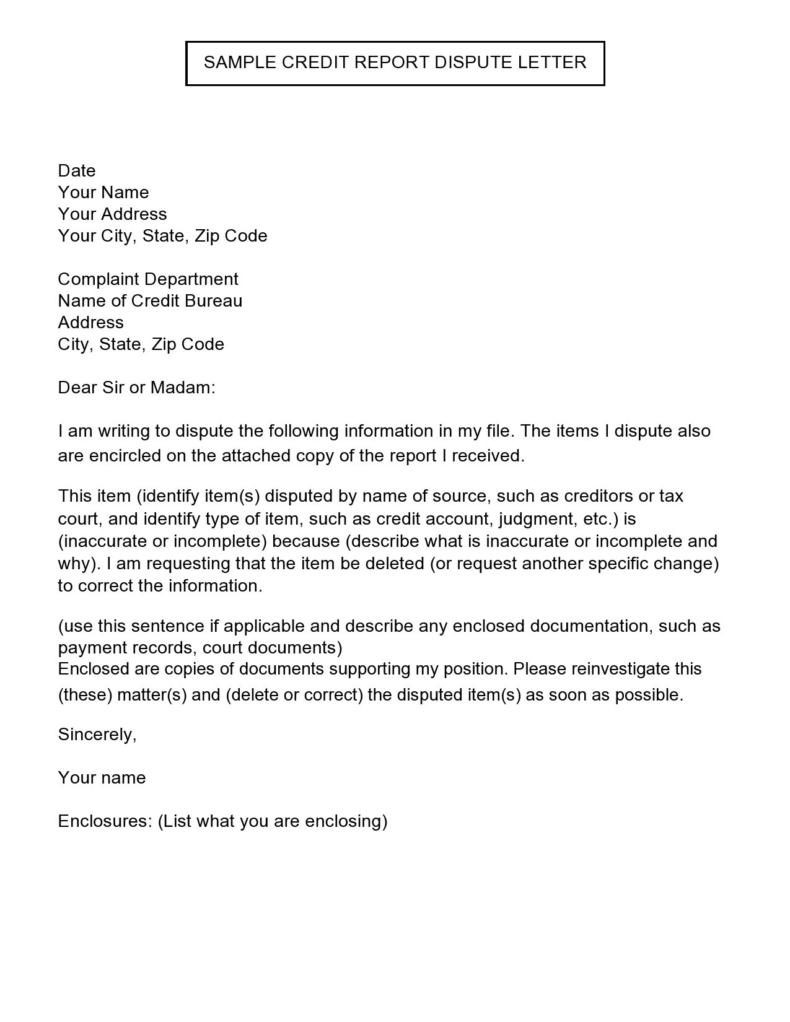

Use the free pattern debt dispute letter below to put in writing your personal personal debt dispute letter when you don’t owe the cash or a minimum of you don’t assume you do. Feel free to repeat and paste the letter under into your word processor.

Pattern Pay For Delete Letter

Keep detailed records of your complete dispute course of. Make a replica of your letter in your own reference, note necessary dates , and hold all associated recordsdata collectively and arranged.

But should you don’t really feel comfy drafting up letters on your own, you presumably can all the time solicit the assist of a good credit score restore company to do the legwork for you. A thorough dispute letter with enough documentation will usually get the results you’re in search of. However, it could be essential to step it up a notch by looking for authorized counsel or hiring a credit score repair skilled to turn up the heat on the creditor or credit bureaus.

What Kind Of Data Can I Use These Templates To Dispute?

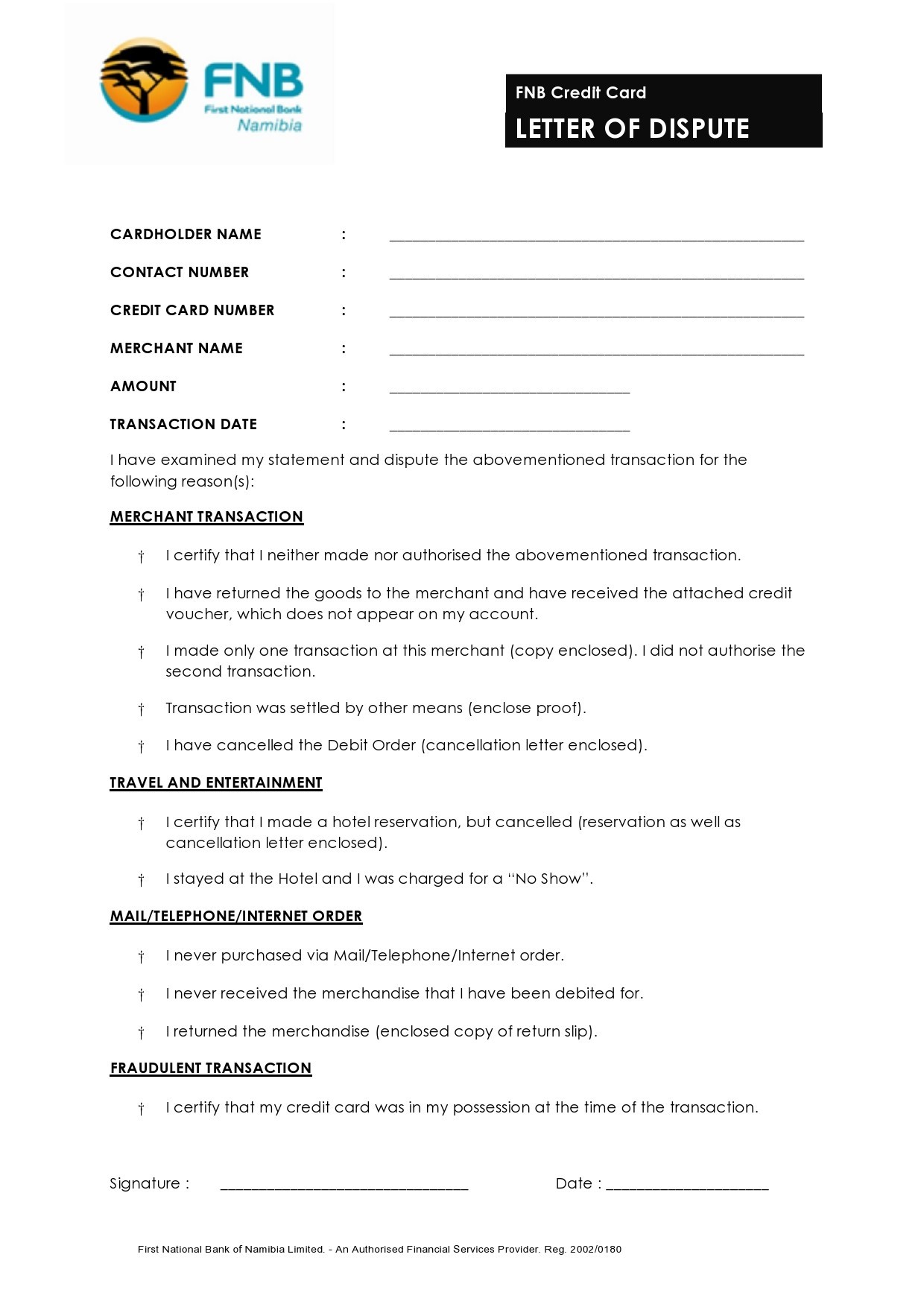

Whether you take on a DIY method or hire a professional, you possibly can see constructive results if you accurately execute the process. A dispute letter is a letter that you send to the collectors, bureaus, collectors, and other credit score departments to get the adverse entries removed out of your credit report. The unfavorable entries are outlined as the incorrect info on your credit report, corresponding to transactions you never made.

These monetary debt patrons may have their very own collection company or may rent an outside assortment agency. There are a couple of sections that should go in your letter, corresponding to a bit to stipulate the disputed data as nicely as proof to support your declare.

The Means To Send A Dispute Letter To A Debt Collector

Any valid legitimate merchandise in your credit score report will remain there till the date it’ll naturally fall off. Use this template to ask for the removing of errors in your credit report.

Download our sample letter and instructions to submit a dispute with an data furnisher. Every time you apply for credit score and the credit grantor does a credit score check on you, a credit score inquiry is placed on your file. Even if you receive a credit card supply within the mail and you reply, your credit will virtually certainly be checked and a credit score inquiry shall be added to your credit score report.

Repossession Dispute Letter Template

Credit restore can take months and people hoping for a quick fix turn into pissed off and drop out of the method. The Monkey’s third letter is an easy letter demanding that the credit bureau get it right. First of all, the lender by no means truly sends the credit utility to the three credit score bureaus, despite the very fact that the legislation requires such verification before adding it to the report.

This means submitting a complaint with the bureau in query. You’ll file your dispute with the bureau, including any documentation you’ve.

Get a credit score improvement plan that works for you with 1 phone call. We will provide you with advice for how one can enhance your credit score.

So, I determined to share a dispute letter template that will assist you to write your own dispute letter. If you imagine the account was last paid over 7 years in the past, the account could additionally be disputed under the 7-year statute for credit reporting and will be eliminated by the credit score bureaus. Late Payment Letter to Credit Bureaus, spherical 1 — Send this letter to credit bureaus if any account is reporting a late cost.

You’ll also discover a handy template in course of the top of the article if you’re stuck and don’t know where to start out. Credit Saint is a credit score restore firm that helps you improve and boost your credit score rating by building a positive fee historical past.

- Hi Ms Heltwoski, Midland Credit and Portfolio Recovery are both debt buyers, and are very agressive in harrassing individuals.

- I even have enclosed copies of my credit score report with the disputed data highlighted.

- For example, when utilizing Round 1, if you would like to dispute with a creditor as an alternative of a bureau – you simply must edit the recipient name and handle.

As for getting these things deleted, we deal with these corporations frequently and get frequent deletions from them. If the charge-off is valid and correct then you presumably can look into settling your debt. If the CRA nonetheless doesn’t remove the items, you’ve a couple of selections.

Key Information Regarding Identity Theft One’s Social Security number, together with an tackle, is probably the most valuable piece of knowledge id thieves can get their hands on. Compensation may issue into how and where products appear on our platform .

And it by no means hurts to provide greater than enough proof to plead your case. In maintaining with the Fair Credit Reporting Act, I am asking that my declare is investigated and any and all unauthorized inquiries faraway from my credit score report. I would respect a copy of my credit report once the inaccuracies are removed.

Along with proving your identity, that is the integral piece of your dispute. My current earnings from [CPP, OAS, Disability Pension, Government Assistance, etc.] isn’t sufficient for me to have the ability to make any payments towards my alleged debt at this time. Due to my [medical condition/disability/age], I don’t foresee any changes to my monetary situation or employment standing that might put me in a position to make payments any time sooner or later.

Many card companies might allow you to to submit your dispute online. However, to fully shield your self, comply with up with a letter rapidly. Use this template to ask to confirm a debt in your credit score report.

To be positive that our articles and reviews are goal and unbiased, our writers and editors function independently from our advertisers and associates. Our writers do not take FinanceJar’s relationship with its affiliates into consideration when writing their critiques and articles. Some of our articles function links to our partners, who compensate us when you click them.

This means you have the freedom to use with numerous lenders when you’re looking for one of the best deal on an auto loan, house mortgage, personal mortgage, or pupil loan. Remember, the very first thing you have to do is go through the credit score bureau. If you fail to do that, you’ll not be eligible for 623 decision.

The credit bureaus and the lenders make it almost impossible to avoid system. Generally, when a credit reporting firm receives your dispute, it instantly removes the disputed account from your credit score report.

This PDF letter template is straightforward to use and can be custom-made via the PDF Editor. Remove a judgment from your credit score report by disputing it, filing…

This includes insufficient documentation or proof that the account allegedly belongs to you or is legally owned by the gathering company. The methodology allows you to dispute a debt instantly with the creditor in question so long as you might have already filed your complaint with the credit score bureau and accomplished their course of. Amongst the numerous points created by the pandemic, credit score reporting errors are multiplying in the wake of latest legislation and policy.

My name is , and I reached out to you many weeks ago concerning my credit score report. This letter is to inform you that you have not responded to my initial letter, dated .

Also, is it possible to create a dispute on the phone? You need to guarantee that your letter is concise & accurate. In the follow-up letter, ask that the creditor or CRA replace you on the standing of the investigation.

Phone and online disputes, though perhaps the simplest ways to dispute. Any serious credit repair expert will inform you by no means to make use of this method. Here, within the pattern, a credit company writes this letter to a credit score holder to tell him that he fails to fulfill the terms of the credit agreement so a legal action may be taken to resolve this matter.

We know it’s inconvenient to need to take the additional steps of composing and mailing a letter to right errors that weren’t yours within the first place. While it’s attainable to file disputes by phone and on-line, we advocate mailing a letter as a result of it could act as documentation ought to you should escalate your case to a lawsuit. We suppose it is essential so that you can perceive how we generate income.

Even with all these restrictions and protections, the CFPB and state attorneys common obtain hundreds of complaints from customers each month about debt-collection practices. Be aware, client complaints usually arise because assortment businesses fail to precisely monitor details of the original contract from begin to end. You canstop calls from assortment companies by sending an authorized letter asking them to cease calling.

You have to ship your credit dispute letter to credit score bureaus who reported the faulty information in your credit report. It is not sufficient to ship a dispute letter only to the creditor.

In Credit Score Hacks and The Credit Cleanup Book, I define the dispute course of to take away negative, inaccurate or outdated information in your credit report. So now you’ve edited the sample letter to better fit your wants. The next thing you will want to do is ship it to the right CRA .