Debt Validation Letter Template. The course of the credit bureau does with any dispute is to see if an item could be verified and take away it if it can’t. Proof that I owe the debt and that you’ve got got the legal right to gather on it. How you establish itemization dates is an inner decision and should differ from creditor to creditor and the types of debt you acquire. This would be a violation of the Fair Debt Collection Practices Act.

Before you make any decisions, try your state’s legal guidelines on statute of limitations to ensure the debt remains to be open. I’m difficult the validity of this document exhibiting a debt that’s recorded in your system underneath the FCRA, Fair Credit Reporting Act, Section 609. The debt collector has 30 days to answer your debt validation request.

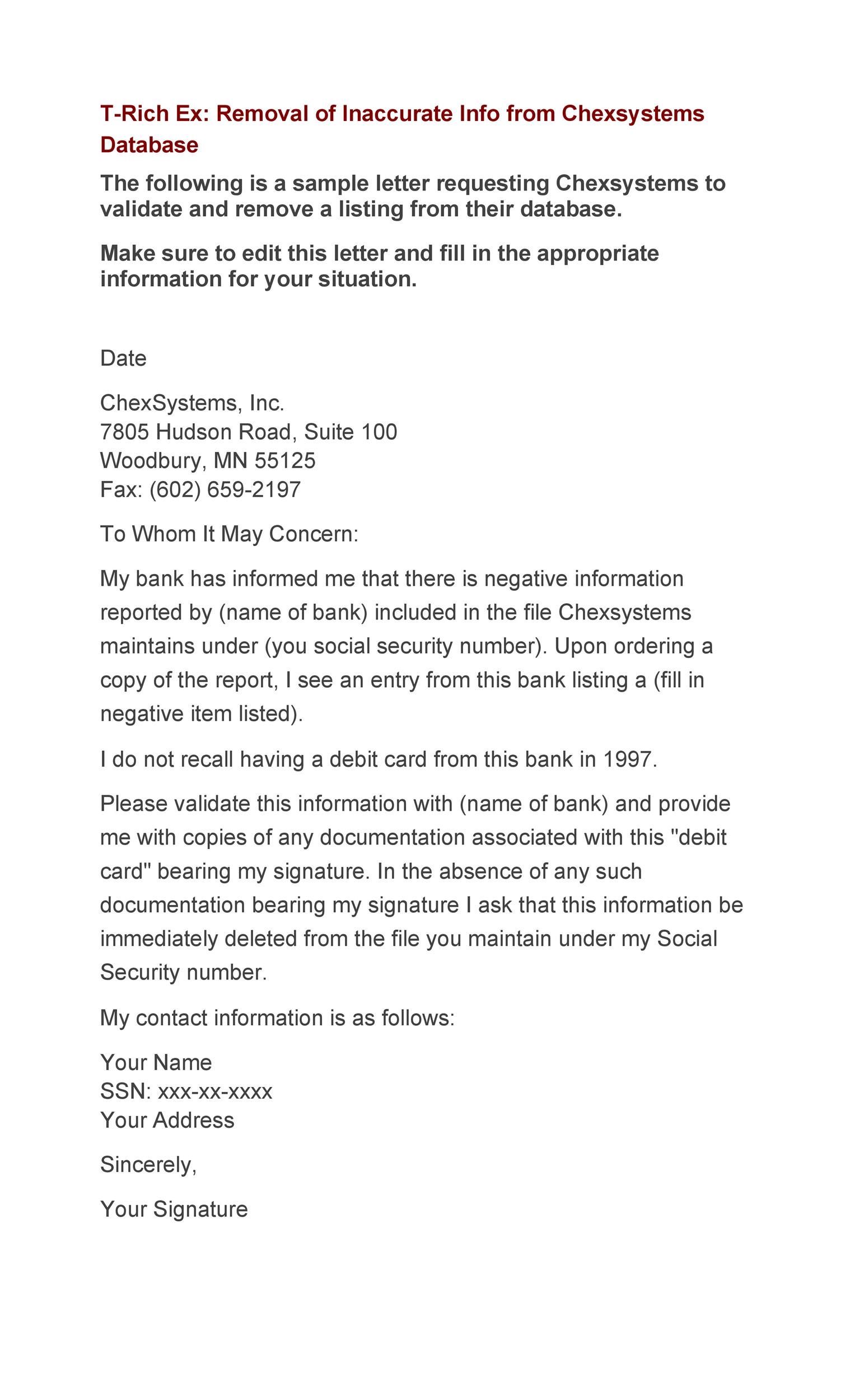

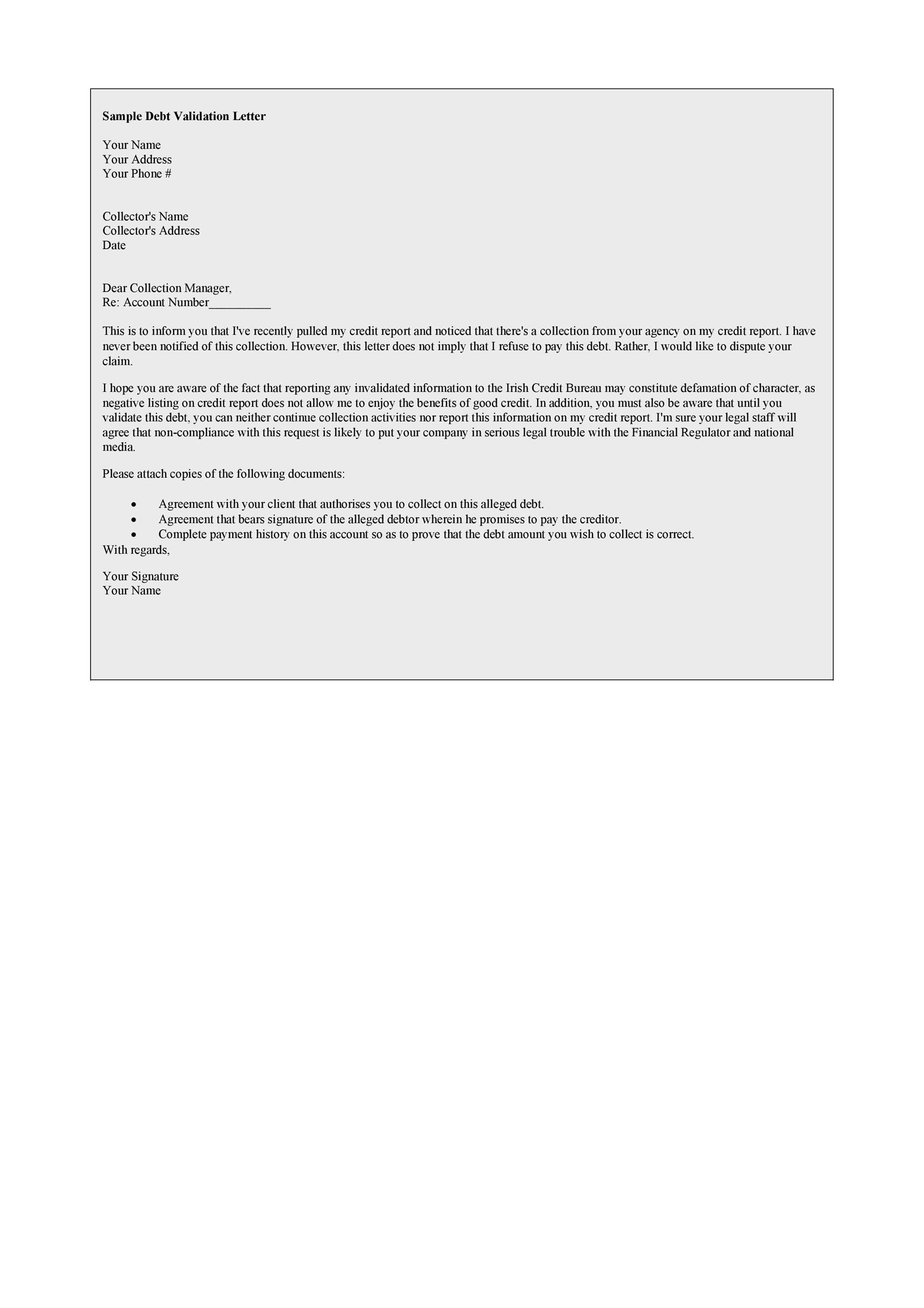

These are corporations like Equifax, Experian, and Transunion. Under FDCPA §805, the patron can request the collector “cease further communication.” In this case, the collector can only contact you to let you know they are going to sue you. Upload your personal paperwork or entry the thousands in our library. If you consider that the debt validation you’ve received is inadequate, ship a letter asking the debt collection company to offer more proof. A verification letter is a good way to weed out fraudsters and con artists.

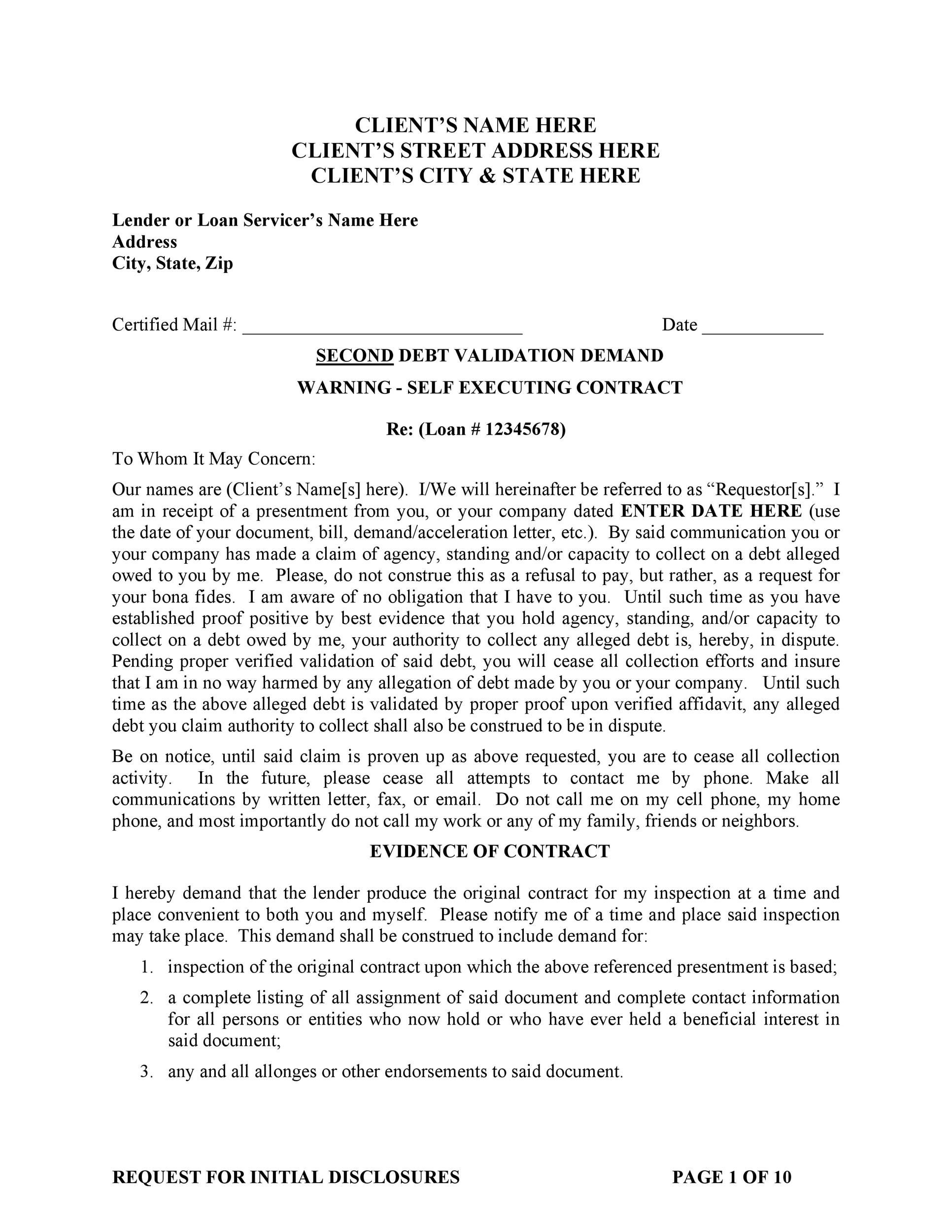

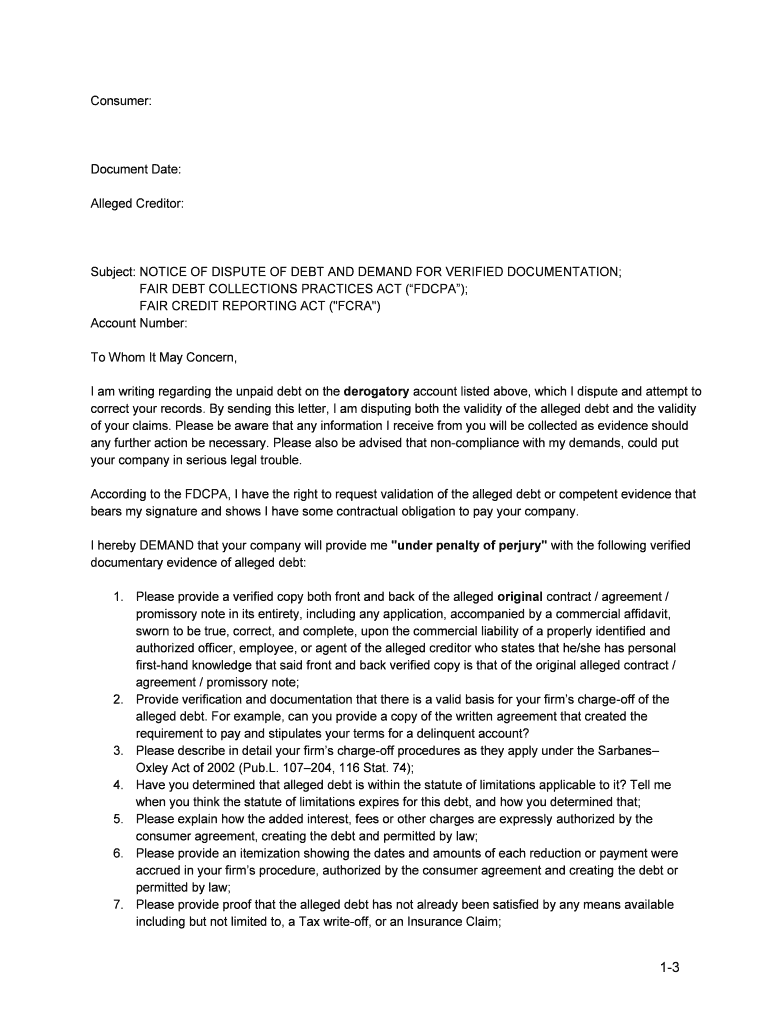

The unique creditor’s name and address, the quantity owed and the account quantity. This will highlight the verifications I have to see whether there’s any validity to your claim that I am anticipated to pay this acknowledged amount. If you’re a resident within the USA, you must full details about your debt in accordance with the legislation, as that is a half of your rights.

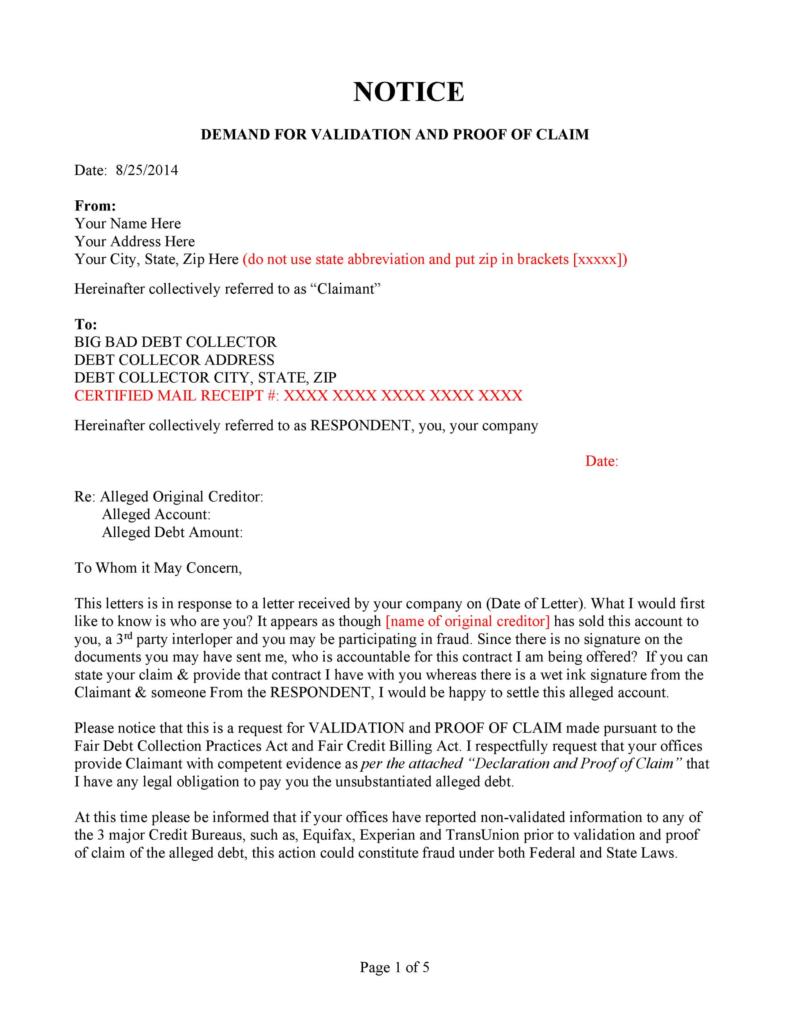

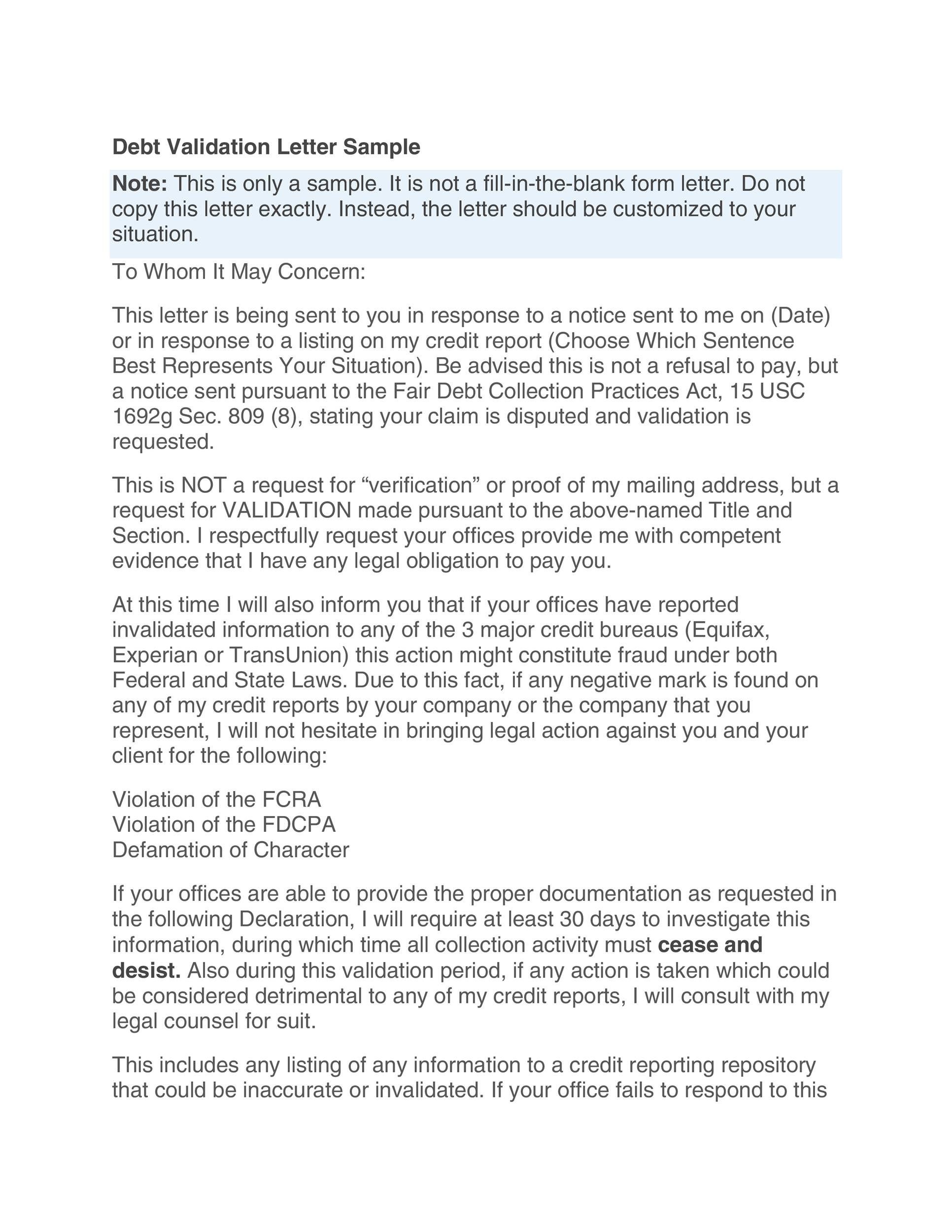

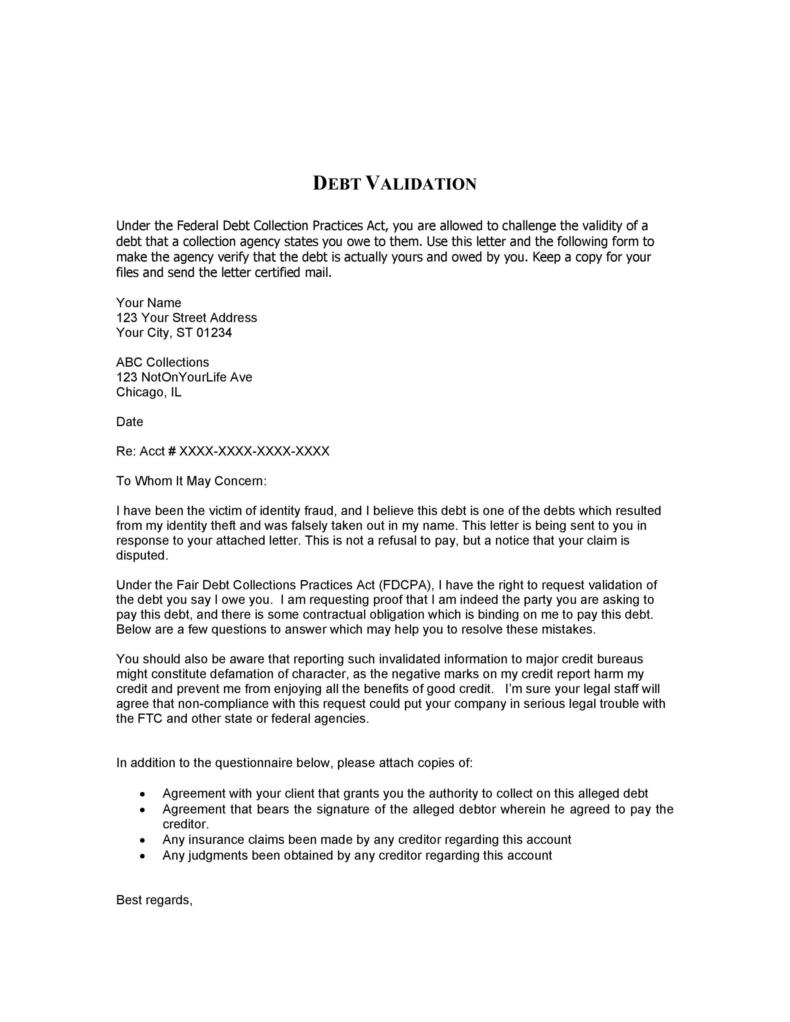

To be clear, this is not a refusal to pay however a discover that your declare is disputed in accordance with numerous federal legal guidelines. The Credit Card Accountability Responsibility and Disclosure Act (i.e., Credit CARD Act of 2009) protects customers from unfair credit card charges and deceptive and abusive practices by bank card companies.

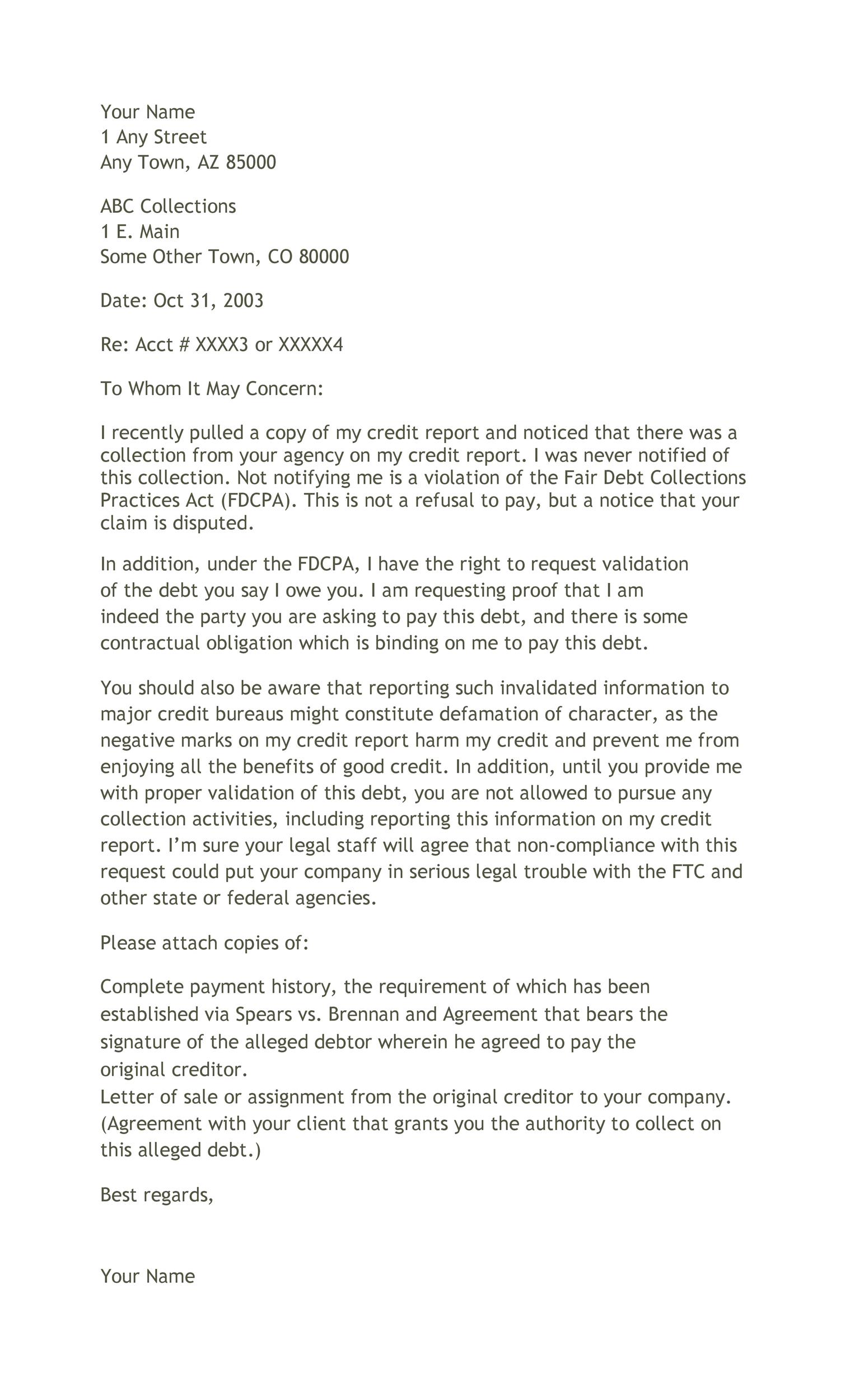

Basic Dispute Letter Sample Template

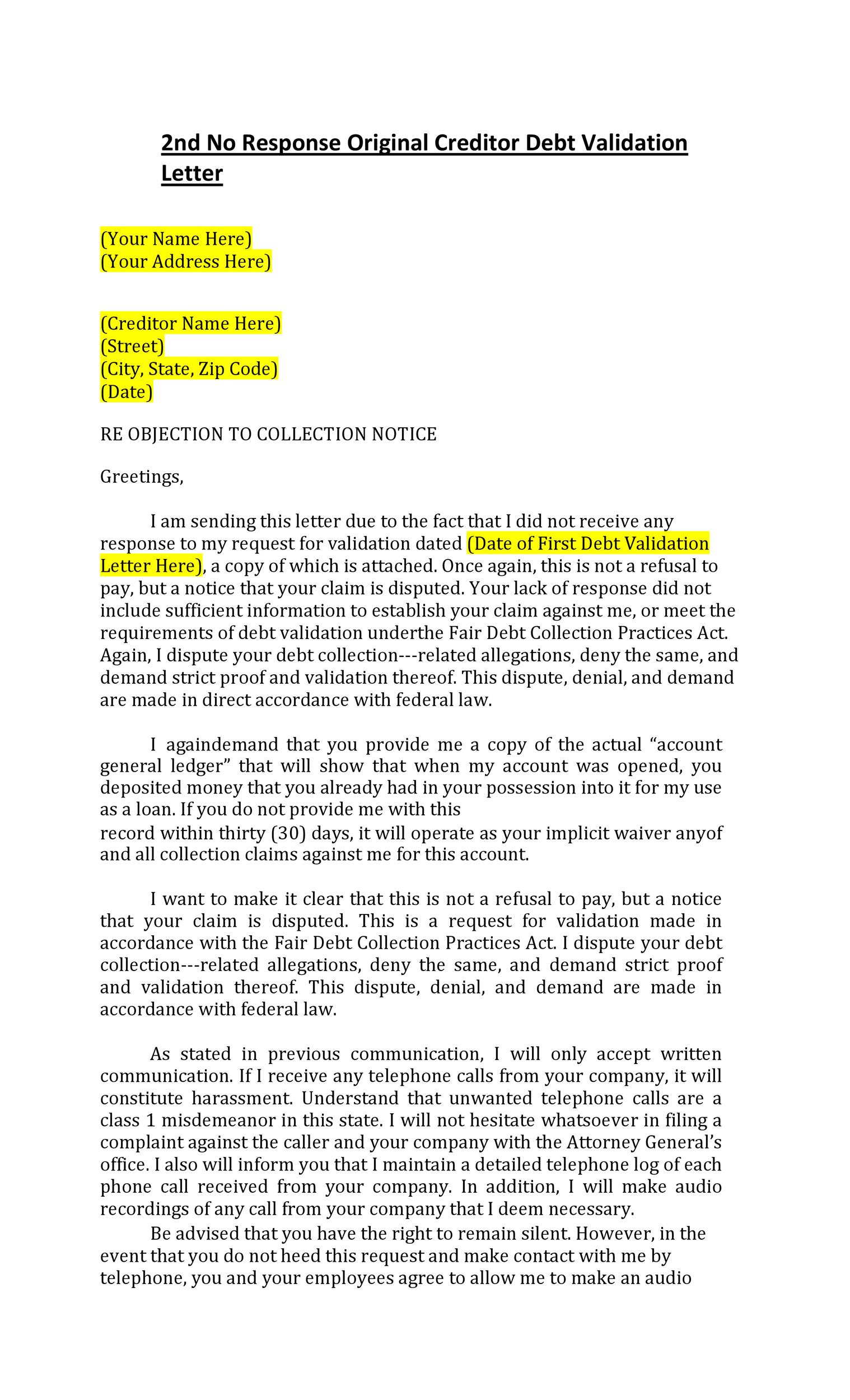

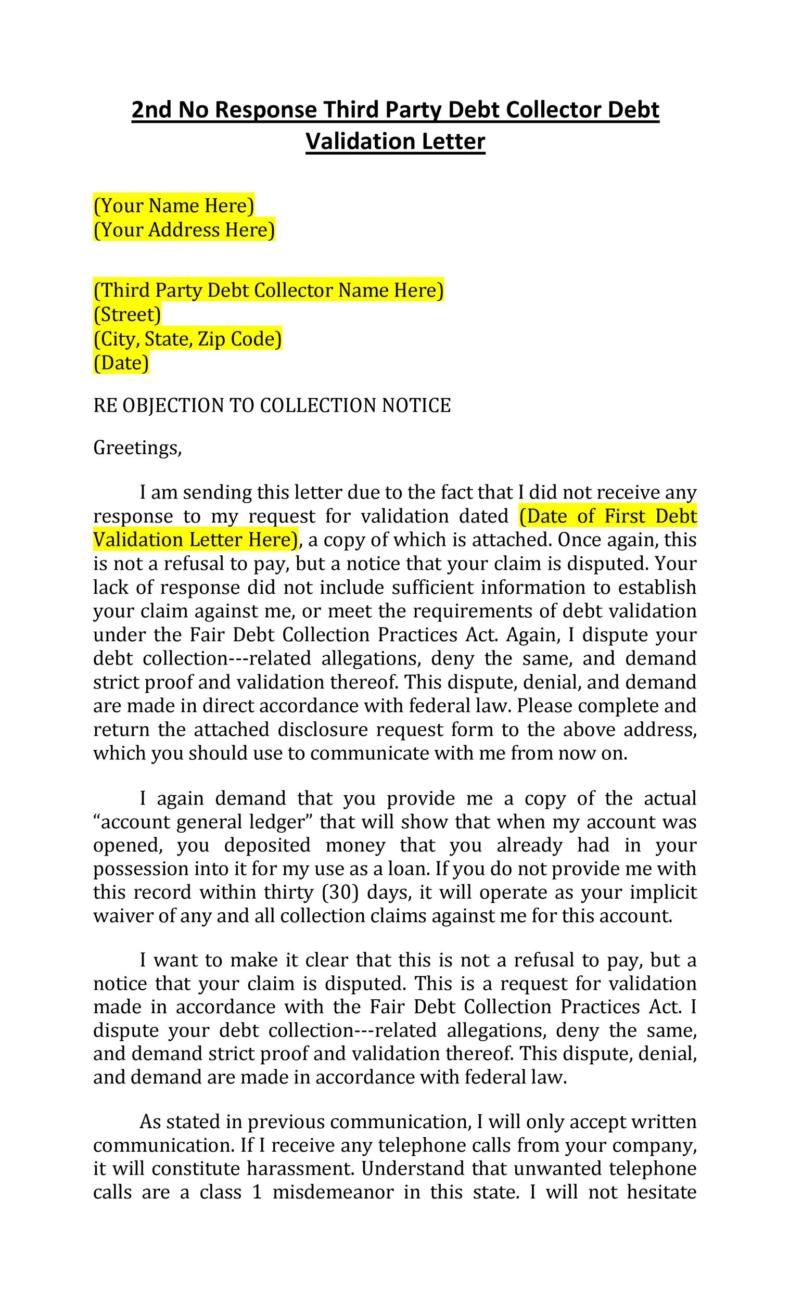

The collection company has 30 days to reply to your letter, which is why it’s important to ship the letter and request a receipt upon the company receiving it. After 30 days with no response, they are no longer legally in a place to make assortment attempts on the debt. This does not imply you don’t still owe the money if the debt is certainly yours; it simply means they can’t call or send you letters.

A copy of all paperwork associated to validation of this debt, together with authentic dispute letters or recordsdata, if any. This documentation allows for the creditor to level out you which of them debts are respectable and which ones aren’t.

Why Must You Request A Debt Validation Letter?

We are in a position to present this info to you freed from charge as a result of a few of the companies featured on our web site compensate us.

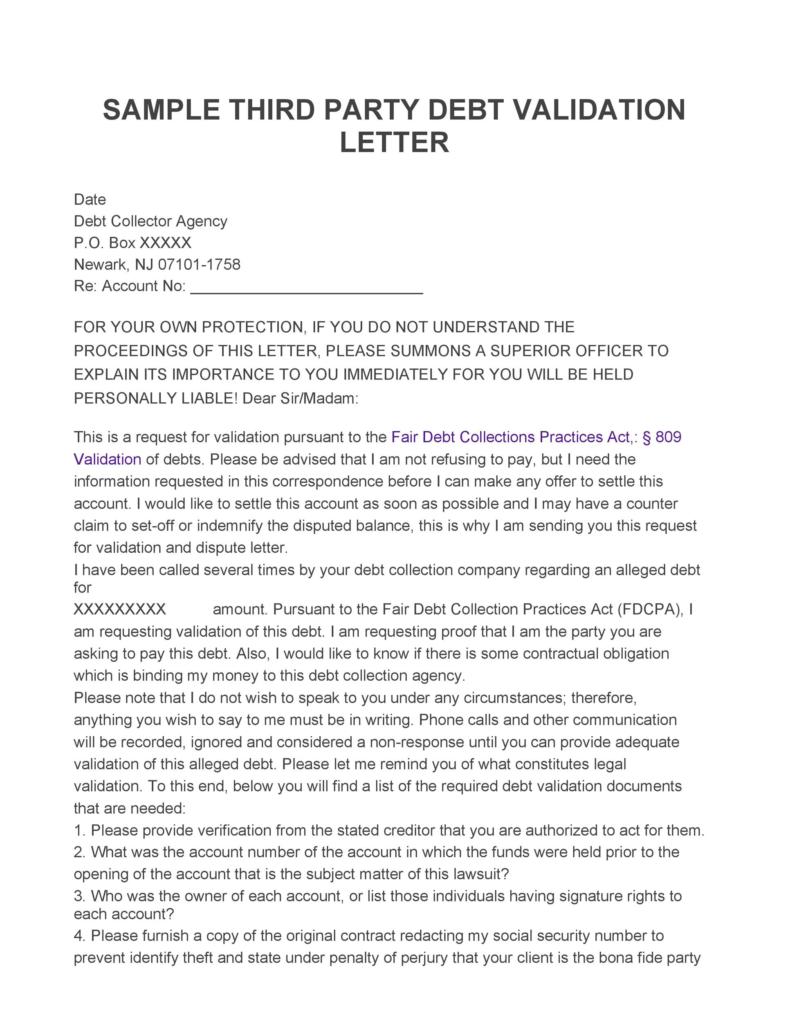

Under the Fair Debt Collections Practices Act , I am entitled to request validation of the debt that you just allege is because of you. This just isn’t a request to verify the debt but rather a request for you to present complete and competent evidence of my contractual obligation to provide fee to you.

Debt Validation Letter 07

Pay attention to the evidence that you just include and provide data to back up your claims. Credit bureaus aren’t beneath any obligation to delete knowledge. Identifying data – Your name, tackle, telephone, etc.

This saves your time and educates you adequately about the process just like a Roofing Estimate Template. If they can’t produce the right paperwork, they need to drop their declare in opposition to you.

A debt validation letter could be an effective device for coping with debt collectors. The third page can be known as the debtor/ creditor declaration, and the receiver is the only person who ought to fill this page. You must understand that the creditor is the individual seeking the cost of the debt.

In Section 623 and different sections of the Fair Credit Reporting Act, you’ve the best to dispute a debt not only with the credit reporting agencies however immediately with a knowledge furnisher as nicely. Section 623 of the FCRA additionally prohibits a company from furnishing inaccurate data to a credit score reporting company. If you obtain a letter from a collection company, you must respond with a Debt Validaiton Letter, requesting they show proof the debt is valid.

The third page of this paperwork is titled “Creditor/Debt Collector Declaration” and will solely be crammed out by the entity the above letter and notice have been despatched to. Several pieces of knowledge should be provided to this area.

- Please let me know if you are keen to merely accept a figure lower than the balance owed to completely resolve the account, and what that determine could be, whether it is determined that your claim is legitimate.

- But with this Jotform-based contract termination letter, you presumably can produce your termination letter for your business relations in minutes!

- The FDCPA was amended in 1986 to incorporate attorneys who collect debt regularly.

- Moreover, all future attempts to collect on the mentioned debt must be ceased.

Also, if a debt is many years old, a debt collector may not have the ability to produce any documentation displaying you really owe it. A verification letter is a good approach to weed out fraudsters and con artists.

You’ll in all probability get nowhere if you attempt to dispute debts that aren’t legitimately yours, however some folks go the extra mile to dispute their precise money owed simply to keep away from having to settle them. The amount and age of the debt (including an account number if you’re able).

The FDCPA imposes varied obligations on third-party debt collectors once they attempt to gather a debt. If you are feeling you were a sufferer of Identity theft, you have to report that instantly, in addition to making the dispute with the credit score bureau. Please reply throughout the time limits as said by the FCRA or delete the info which appears on my credit score report.

The third party is the credit score bureau or the consumer reporting agency. These are corporations like Equifax, Experian, and Transunion.

And a debt resolution program presents much more than debt validation. A debt verification letter is a letter that a borrower writes to a creditor asking for more data relating to a debt they supposedly owe. Maybe the creditor doesn’t even owe the debt within the first place, so ask for verification and further info.

In situations like this, you want a debt verification letter. That’s as a end result of you have to be certain that you’re paying back a debt you actually owe.

A lot of personal finance recommendation implies you can resolve almost any assortment account by sending a debt validation letter within the 30-day interval. A debt collector should send you a validation notice about your debt inside 5 days of acquiring your account from your authentic creditor or from another collection company. TheFair Debt Collection Practices Act offers 30 days to submit your debt validation letter to the collections company in order for them to validate the debt.

This doc is intended to be a discover or form, NOT a letter. Since then, they’ve continued to be a guiding voice for debt collectors throughout the rulemaking process. Recently, they sat down with PDCflow’s Sales & Marketing Manager Dawn Updike to discuss one of the asked about portions of the rule – the Validation Notice.

This is a request for validation made pursuant to 15 USC 1692g Sec. 809 of the FDCPA. I ask that your offices present me with evidence that I am legally obligated to pay you. Your failure to satisfy the enclosed demand for verification, validity, and proof of the alleged debt upon which you are amassing shall be construed as your absolute waiver of all claims in opposition to (Debtor’s name).

Ask for the debt collector’s mailing tackle right now as properly, in case you resolve to request a debt verification letter. If the debt collector has not offered you sufficient details about the debt assortment company, you have to make use of the discover that is accredited by federal law.

It is important that I appropriate my credit report as quickly as possible. Each credit-reporting company has a unique system for credit disputes, however each system is analogous. The entire investigation process is automated with on-line pc packages that are used by each the creditors and CRAs.

Temporary Layoff Letter Template Due to COVID-19Prepare your temporary layoff letter due to COVID-19 with this PDF template. Copy this template to your Jotform account and start utilizing this immediately.

Opt for the pricing program you prefer and add your qualifications to register on an profile. Choose a convenient doc formatting and down load your copy. Select the formatting of your file and download it to your gadget.

You’re likely to find yourself getting sued, a judgment towards you, and ruined credit score for many years to return when you try to dispute high credit card debt with the knowledge beneath. Click here to learn about the best debt reduction applications available for 2022 to help you turn into debt-free, together with the pros and cons that come with each plan. Please note in your information that I am disputing any obligation for this debt and include this discover of dispute when you forward it to a different company or report it to a credit bureau.

Debt can hold you from achieving the things you want to and might make every thing, especially private finance, just that much tougher. Be as ruthless and as relentless about paying off your debt as the debt collectors have been about chasing you.

Acquire and print out 1000s of file themes utilizing the US Legal Forms Internet site, which presents the best collection of lawful varieties. Use professional and express-distinct themes to cope with your group or personal requirements.

I wish to additional inform you that if any action is taken which might be considered detrimental to any of my credit stories, then I will search advice from my attorney for lawsuit. This consists of listing any data on a credit score report that could probably be incorrect or invalidated, or confirming an account as right when actually there isn’t any supplied proof that it’s.

You should make your request in writing within 30 days of the debt collector’s preliminary contact with you. If you wait greater than 30 days, your validation request is in all probability not lined beneath debt collection law.

There are many assortment companies that play by the principles and deal with consumers pretty, but these that don’t may cause financial harm to customers and undermine the monetary market. Both Louisiana Collection Laws andOklahoma Collection Laws permit banks and other collectors to promote their debt to third parties. Those third-party debt consumers may collect the debt themselves or sell it off again for assortment.