Credit Dispute Letter Template. In case the matter doesn’t get resolved amicably, you may even need to contemplate the legal route to protect your corporation pursuits. Such disputes are coated in Sections 611 and 623 of the FCRA. Sometimes the bureaus won’t send you the investigation outcomes, as they could deem your identification data incomplete. In addition, if the entries have the wrong amount, the consumer can ship the proof with the best and get the numbers right.

This will assist you to preserve your credit score rating intact. Certified mail is best as a outcome of it guarantees that the corporate receives it. By which, should any transactions be made by the agent that’s beyond the interval of the authorization, it shall be thought of invalid.

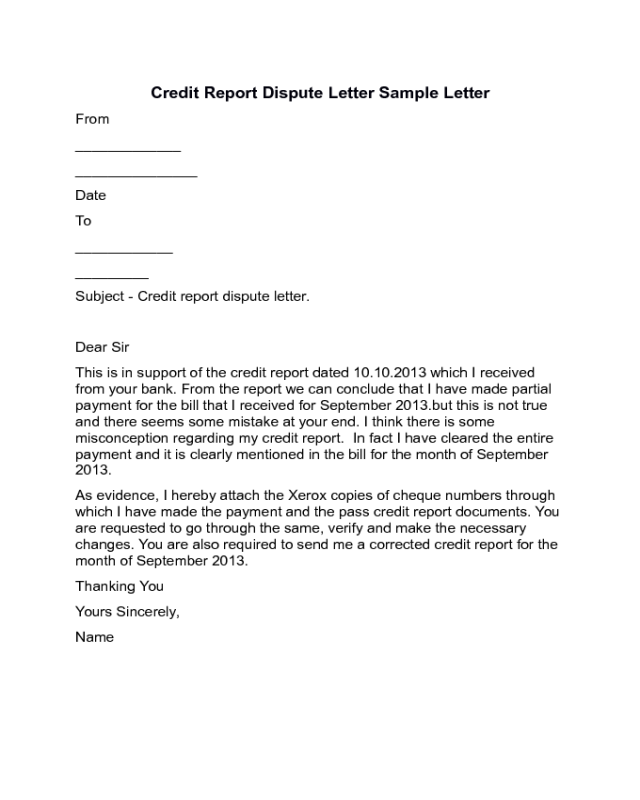

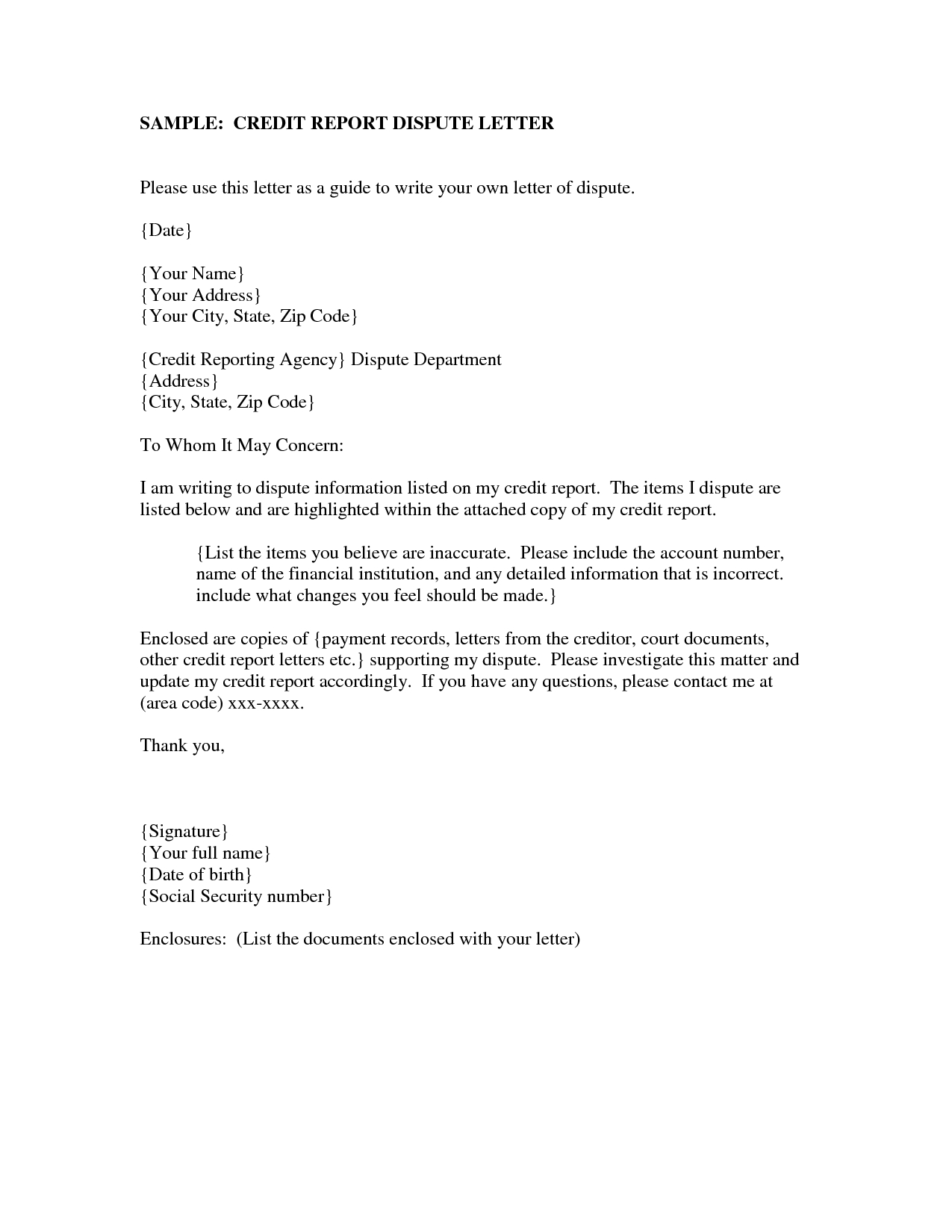

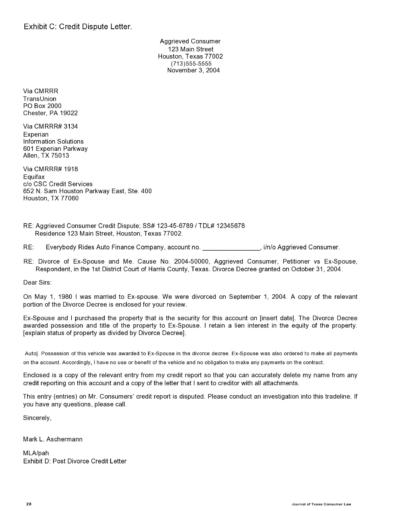

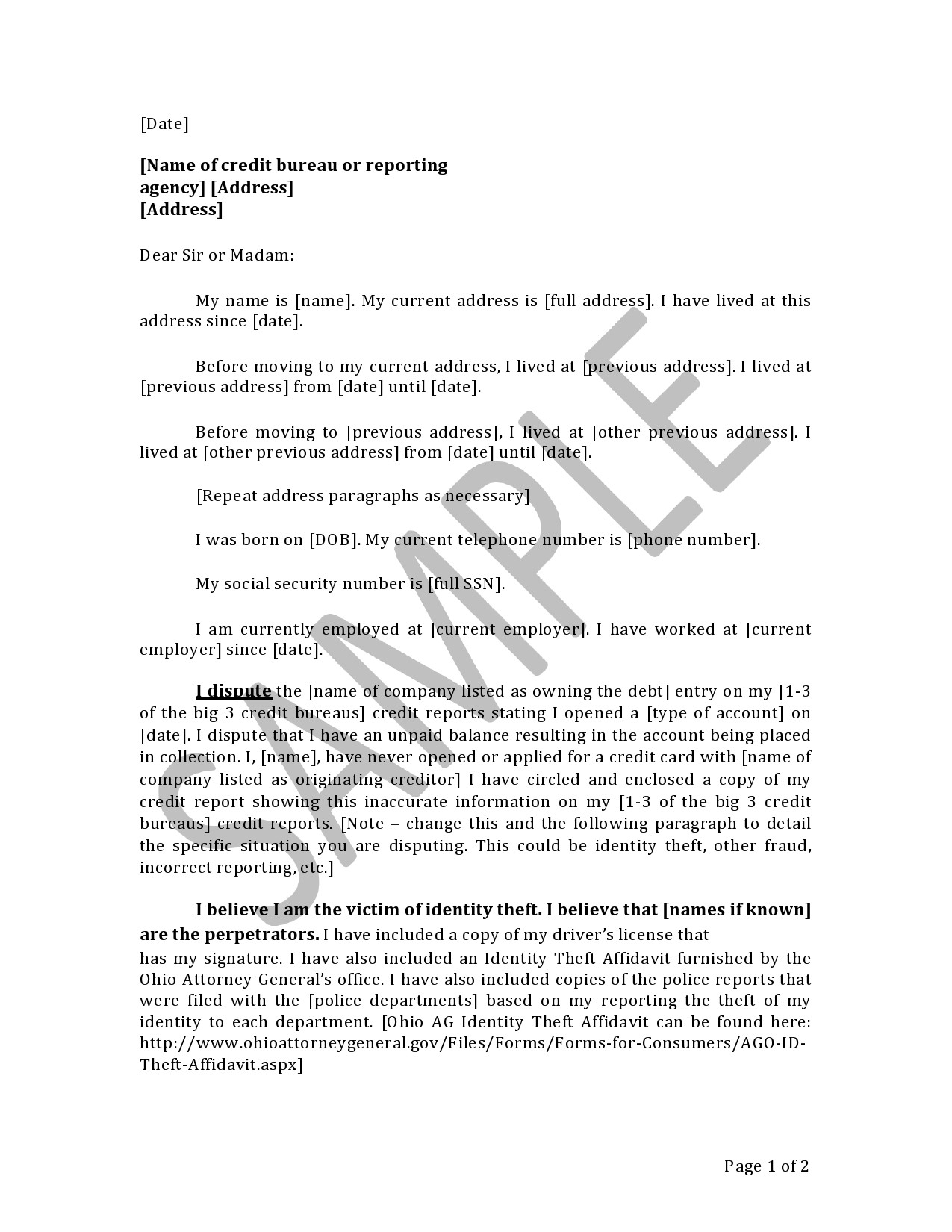

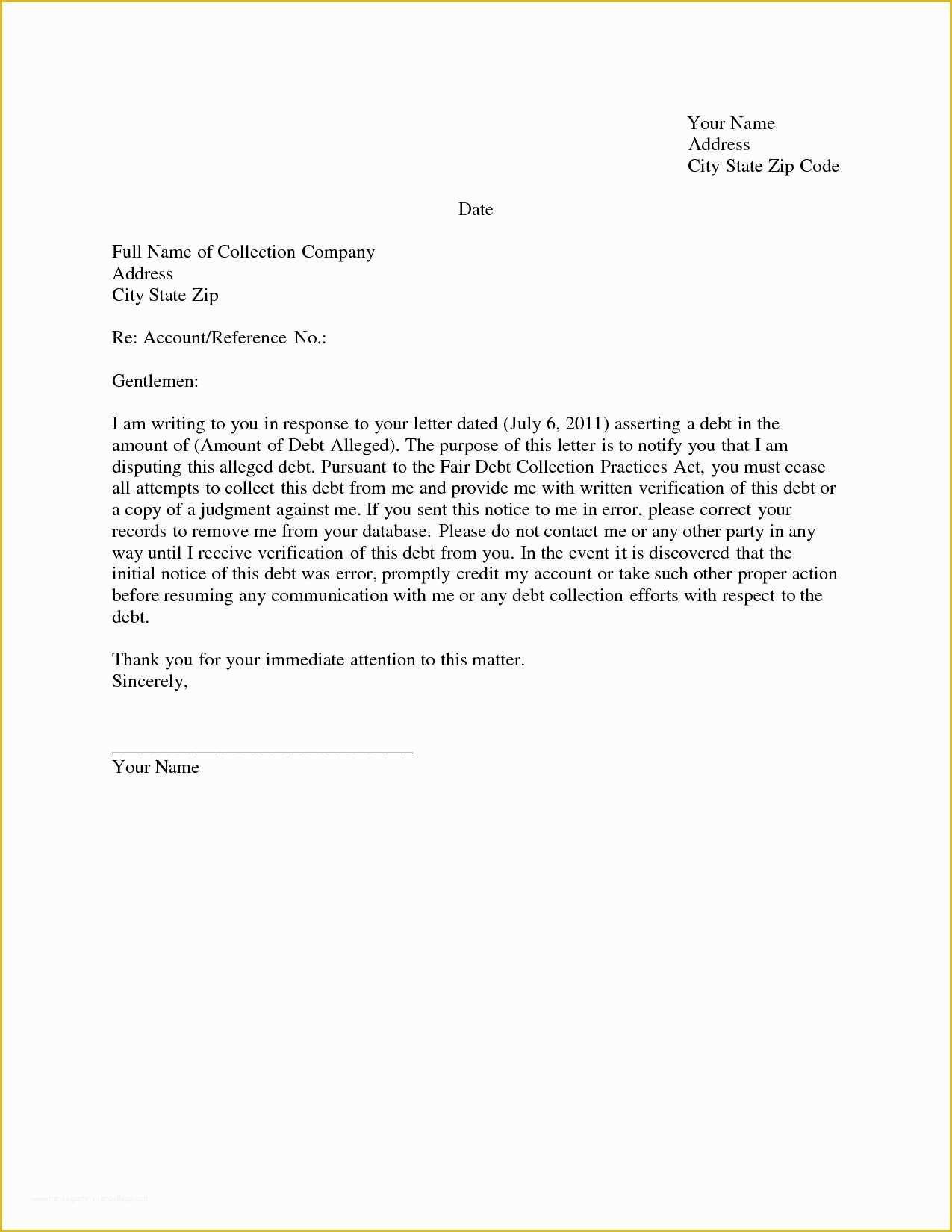

In order that can help you create a dispute letter, we’ve covered every little thing concerning credit dispute letter templates here. Obtain access to a GDPR and HIPAA-compliant platform for optimum effectivity. You can find the pattern of the credit score dispute letter beneath. Here are only a few people who have benefitted from a 609 dispute letter. As acknowledged in the FCRA, you would possibly be required to reply to my dispute within 30 days of receipt of this letter.

The different possibility is that the item is also verified as accurate, stay put, and truly decrease your credit rating. In order to take advantage of Section 609 credit repair, you want to write a letter.

A collections agency is legally required to send one of these to you verifying the small print of what you owe. If you do not receive this letter, the debt collector could potentially have the wrong data.

Nevada Sample Letter For Corrections To Credit Score Report Faq

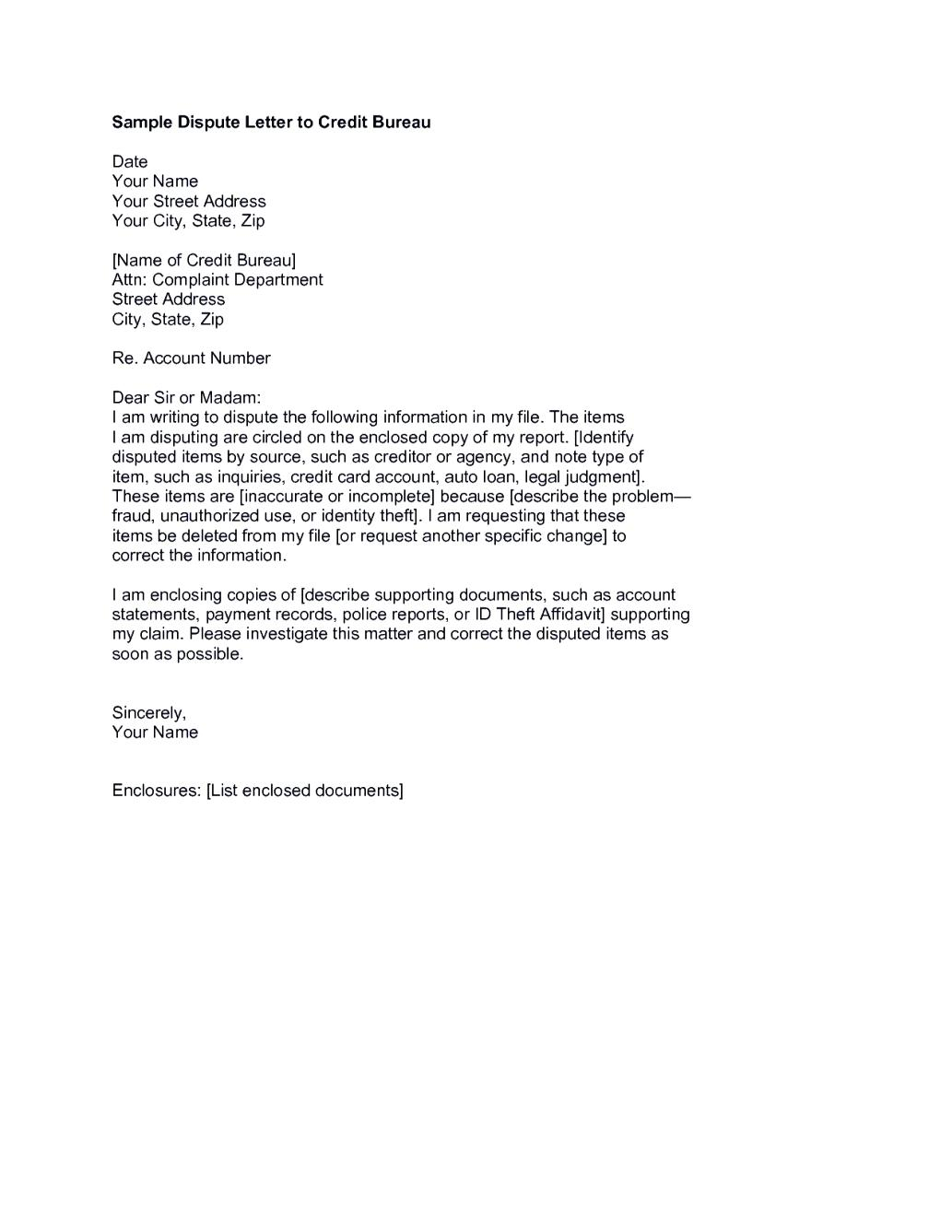

Once you dispute, credit score reporting businesses are certain to analyze. Use this credit dispute letter template to file a dispute directly with one of many credit bureaus. Mistakes in your private info (e.g., an incorrect address), as properly as credit accounts that you don’t acknowledge, should usually be disputed with the bureaus.

How to add signature to pdf doc How to add signature to pdf doc. Sign Sublease Agreement Template electronically Creating legally binding eSignatures has turn out to be simpler than … Sign Alternative Work Offer Letter We are pleased to announce that everybody has obtained a chance to …

How Am I In A Position To Obtain My Free Credit Score Report?

Errors may happen if there’s an accounting or calculation mistake. These errors are potential causes of credit disputes.

You’re taking part in into their arms and giving them the simple way out whenever you dispute online. What this implies is, just about any “questionable” negative or inaccurate information the credit bureaus have for you could be disputed and their deletion might result in a credit score score improve. For over four yrs now I have disputed a car loan I had nothing to do with.

Different Ways To Take Away Data From Your Credit Report

Once the scammer has all the information they will steal your id and use it against you. They might empty your accounts, take out loans in your name, or even promote your personal data on the darkish web.

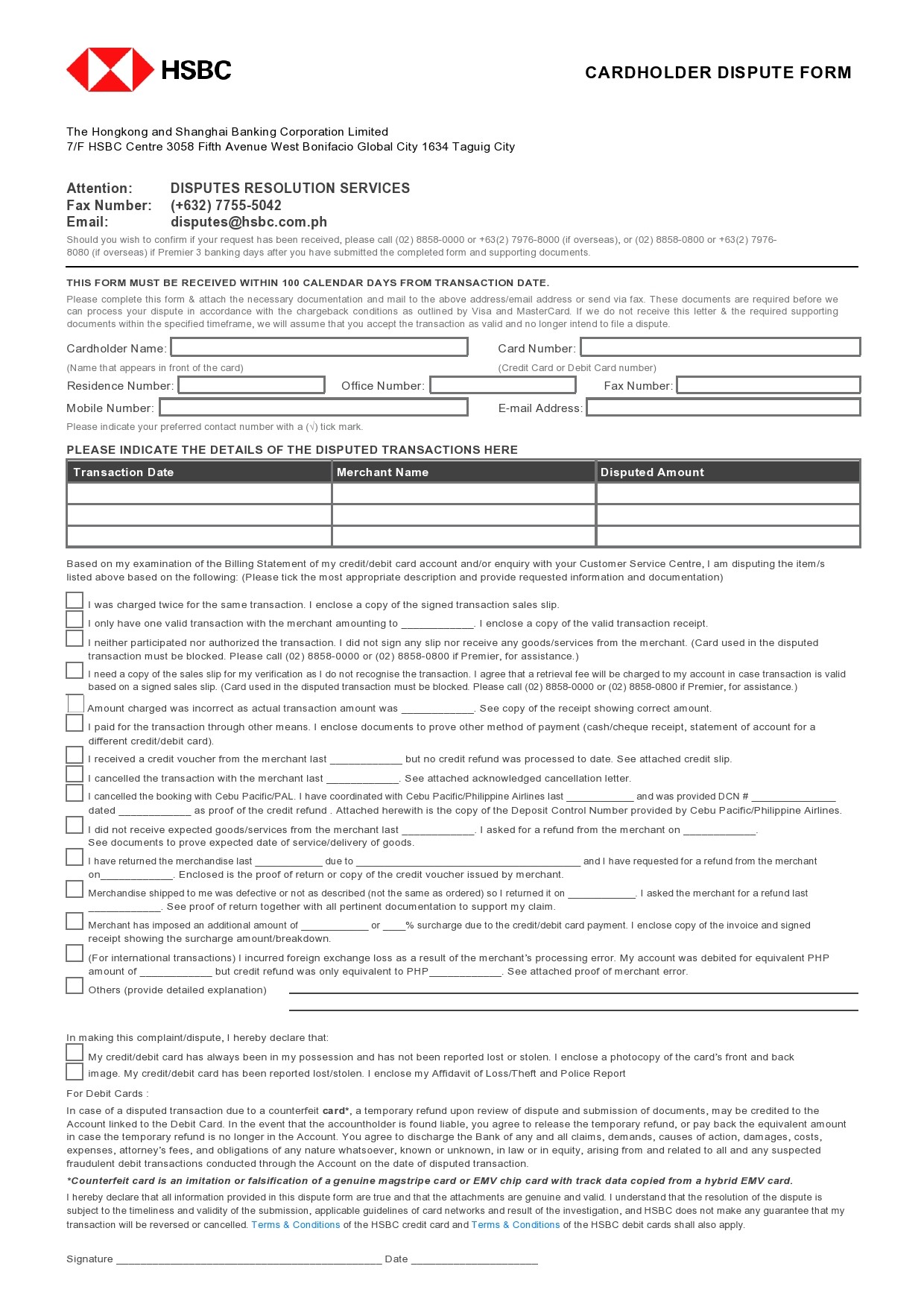

Look below for particulars on the place to ship credit score dispute letters to every of the three main credit score bureaus. If you could send the proper letter to the best folks with the right documentation as simple as filling out a web-based survey, would you?

What’s A 609 Dispute Letter?

If both of these usually are not true, use this debt validation letter template to take away the entry. Act fast, although, as you only have 30 days to ship a letter to collections after being notified of your debt.

A dispute letter is essential as it serves the purpose of creating you eligible once more for a loan or maybe a new home. Additionally, it’ll additionally help when you are looking for a brand new job where your credit report might be inevitably checked.

You get access to all formerly delivered electronically sorts inside the My Forms tab of your profile. Our aim at FinMasters is to make each side of your monetary life simpler. We supply expert-driven advice and sources to help you earn, save and develop your money.

If there aren’t any outstanding funds out of your finish, the gathering letter could be a case of fraud. If it is a real collection letter and you want more time for repayment, you’ll have the ability to always ask for it. But do not agree to any of their calls for with out double-checking all the details.

Both these events are liable for correcting inaccurate or incomplete info in your report underneath the Fair Credit Reporting Act. Any time you get an e mail or message from a financial institution or different firm that asks you to go to an web site, cease.

Any out there information shall be needed to be hooked up to the dispute when disputing the declare. Carefully identify all collection accounts that received’t have validity, are over seven years old or were already paid. We’re the Consumer Financial Protection Bureau , a U.S. government company that makes positive banks, lenders, and different financial corporations deal with you pretty.

I tried to make use of a kind of so known as authorized help teams they usually screwed up my credit report worse than at first. I ask that they repair their mistake and so they mentioned they would and didn’t.

On uncommon occasions he has been identified to throw a shield. Be careful about accepting pal requests from people you don’t know.

Let us show you the easy and stress-free method to make use of a credit score dispute letter template by utilizing the companies provided by DoNotPay. This section is what makes normal credit dispute letters efficient (whether using our template, somebody else’s, or if you’re writing your personal letter from scratch), not 609. If you’ve discovered inaccurate or incorrect info on your report, merely stick to a regular dispute template – and don’t fear about marketed fast fixes or special types of letters.

Take a take a look at the listing above and determine which one applies for your client’s credit score report error. Then, apply the tactics talked about beneath when writing their credit dispute letter.

When you wish to take away incorrect data from a credit report, the agency is not going to launch an investigation until you notify them of their mistake. The dispute letter identifies the data in your report that you consider is incorrect and initiates the agency’s investigation into your claim.

There is no right means of writing a dispute letter; you’ll be able to write it on a napkin and get the adverse items disputed as per Experian. This may be true; nevertheless, it’s not where you write a dispute letter; it’s what you write and how you write it.

After you evaluation your credit score report see that are the objects you need to dispute and at which credit score bureaus. Write them a letter and mail it in with licensed mail .

Use this template to ask for the elimination of errors in your credit report. You should use your bank card or PayPal accounts to carry out the purchase.

- If you’d prefer to ship your shoppers affirmation letters or copies of their submissions, simply arrange an autoresponder and enable PDF attachments.

- It would help me immensely should you could give me a second probability and make a goodwill adjustment to take away the late [payment/payments] on [date/dates].

- After that, your fair credit score act 604 type is ready.

- You ought to maintain all original paperwork for yourself and send solely copies to the credit score bureau.

So if you send a dispute letter and the creditor doesn’t reply to the bureau’s questions within 30 days, you get the mark routinely eliminated out of your report. Equifax dispute processy businesses have already gone paperless, the majority of are sent via e-mail. That goes for agreements and contracts, tax types and almost some other document that requires a signature.

It could be a case of mistaken identity, such as the auto mortgage of someone with your same name showing on your report, or it could presumably be a matter of incorrect numbers. In any case, it’s essential you read over your report to make sure it’s correct.

One has been paid, one is being paid, and the other two are still being negotiated. I have no different money owed and just lately paid off my mortgage after I bought and moved out of state I acquired a secured credit card to begin rebuilding. The paid off bank card shows on my report as zero stability and the other three present as cost offs.

In truth, when it comes to the FCRA, a “609 credit score dispute letter” isn’t an actual thing. You also wants to embrace any supporting documents that help whatever claims you’re making in your dispute letter.

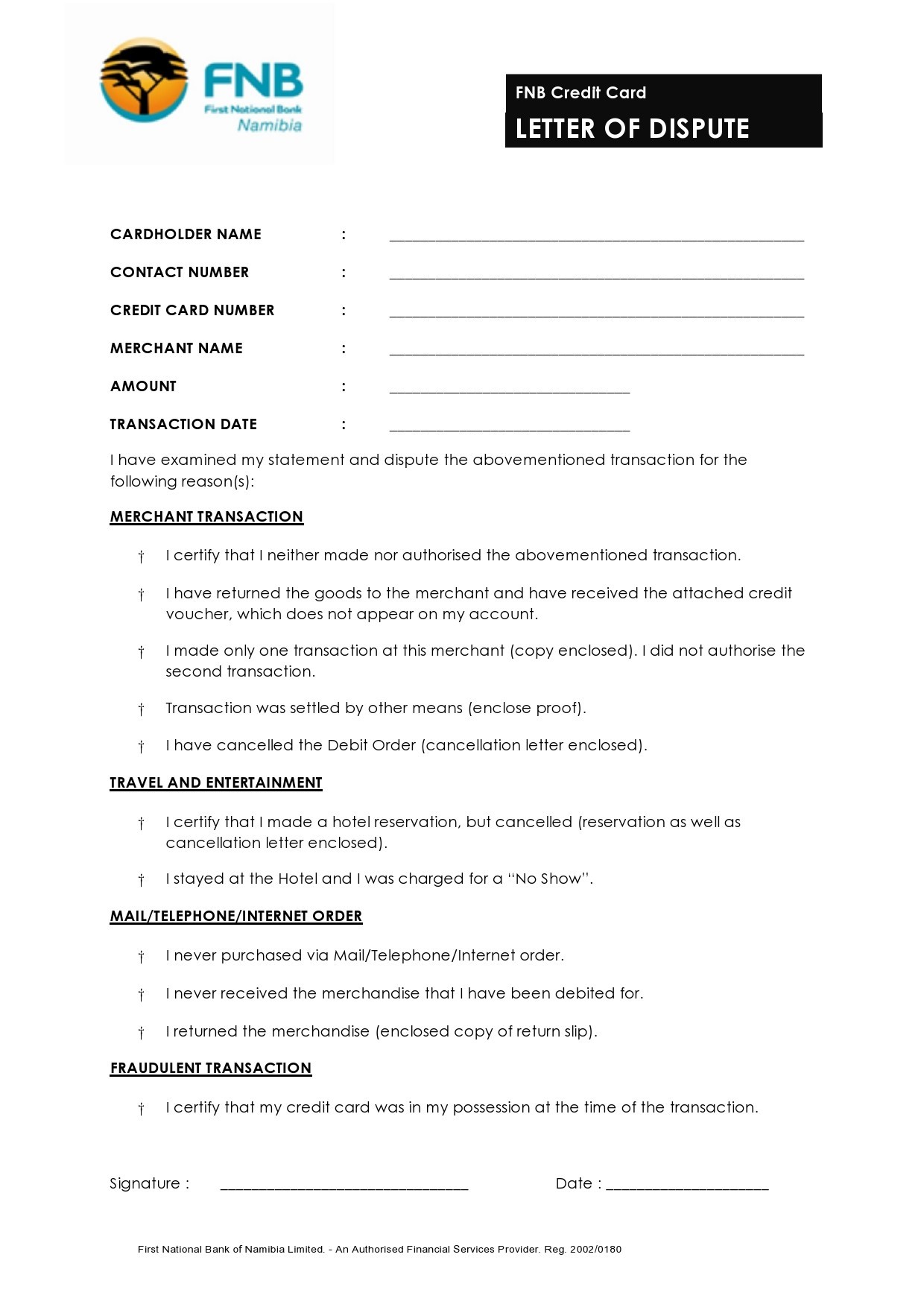

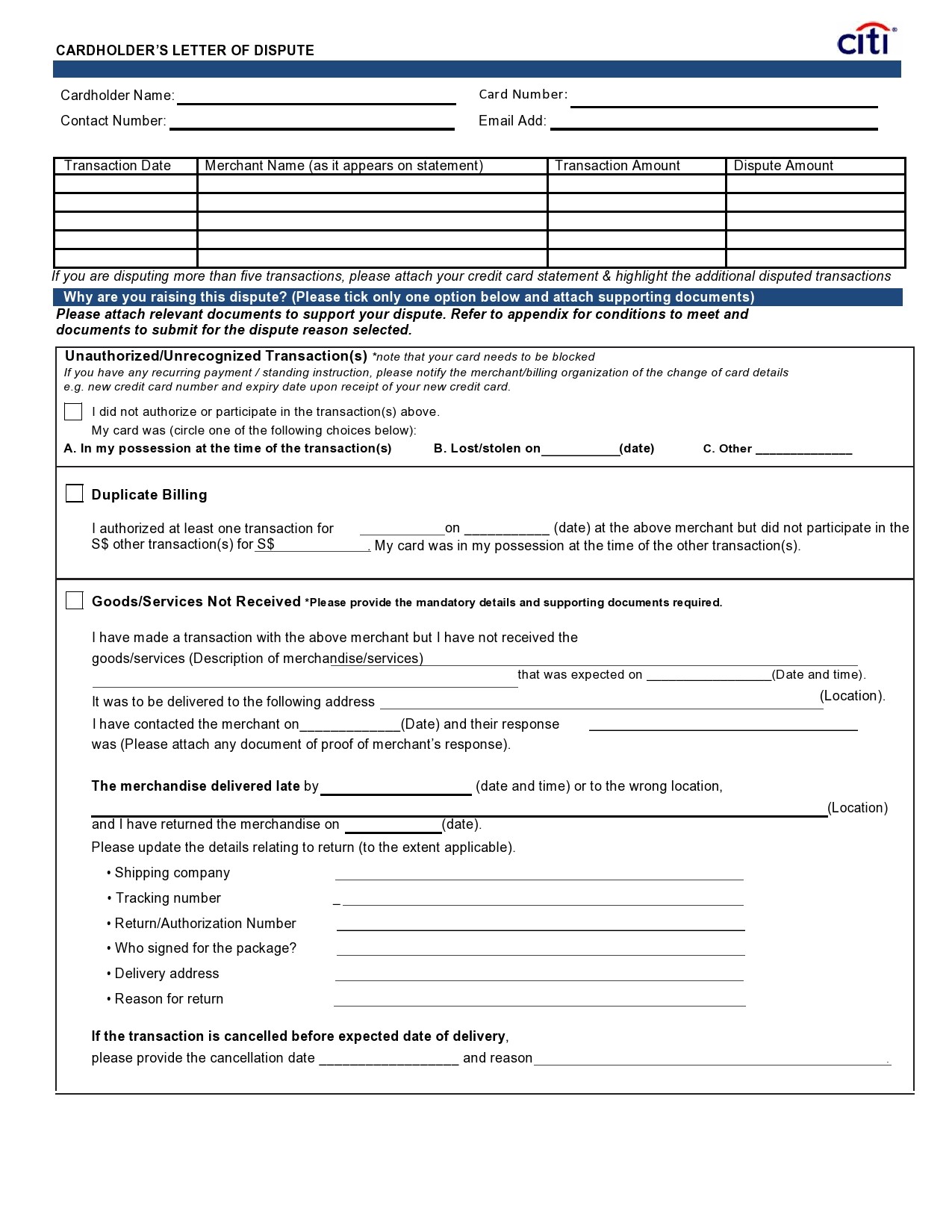

It can also be the bureau’s obligation to make sure consumers know their rights. Here are sample credit card charge dispute letters. They must be sent by certified mail, so the buyer has proof the letter was despatched and received in addition to proof of the date on which it was despatched.

The above letters are only samples, so you must use these as a tenet and fill in your personal private commentary. In fact, we recommend personalizing your letter so that it appears authentic in the eyes of the credit score bureau workers. ChexSystems Removal Letters – For getting adverse data eliminated from your ChexSystems credit score report.

In the occasion that you simply cannot verify the small print and/or present the requested information, kindly remove these damaging accounts from my credit report. Mobile gadgets like smartphones and tablets are actually a ready business different to desktop and laptop computer computer systems.

To this finish, consulting with a qualified skilled (i.e. an Accountant, Credit Consultant, or Attorney) is all the time recommended. Hopefully, when the credit bureau responds the letter will entail that the gadgets had been faraway from the report.

Most doubtless, an extra dispute might be required to be positioned as they do not mechanically get deleted after the seven 12 months period. Under federal legislation, a debt remains in your credit report for a period of seven years from the date of issue (15 U.S. Code § 1681). In accordance with federal law (15 § 1692g), a debtor could request the place a debt got here from by submitting a Debt Validation Letter.