Convertible Note Term Sheet Template. A convertible notice refers to a short-term debt instrument that might be converted into fairness . Program helps college students through regulation school while additionally relieving a few of the monetary strain as they start to practice in a way that’s meaningful and impactful to clients, society, and our firm. SAFEs – SAFE stands for Simple Agreement for Future Equity. Once you’ve completed signing your 1 time period sheet for convertible promissory observe, choose what you wish to do subsequent — download it or share the doc with other people.

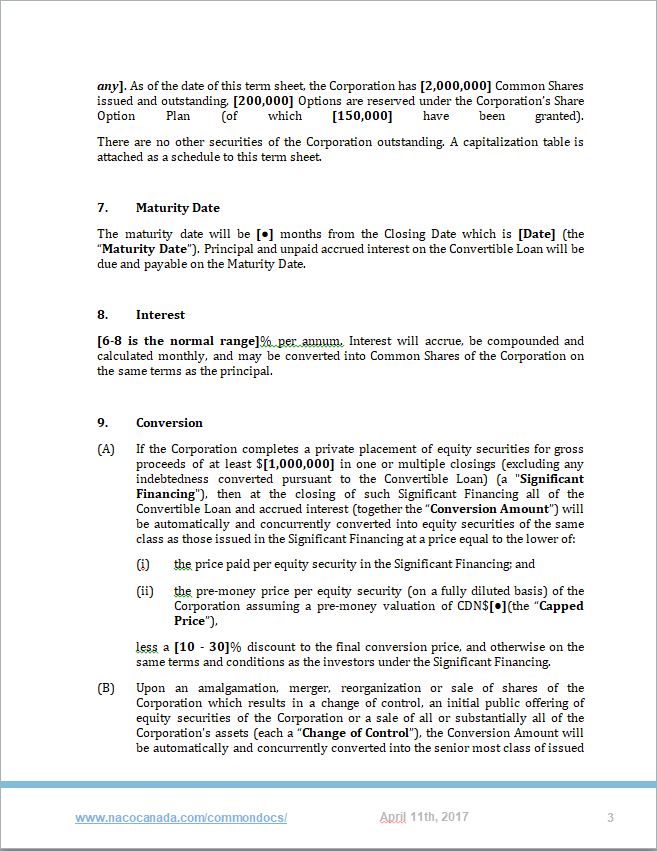

Nothing on this site shall be thought-about authorized recommendation and no attorney-client relationship is established. Because you utilize convertible observe agreements to doc debt, there must be an interest rate equivalent. You don’t wish to disappoint your investors or break the terms of your settlement by missing this date.

It’s crucial to do due diligence similar to taking a look at past annual and quarterly monetary info, reviewing sales and gross profits by product, and looking up the rates of return earlier than signing a term sheet. Entrepreneurs typically favor #2, supplied it’s at a valuation that wouldn’t be absurdly dilutive given the amount of notes excellent. We offer legal recommendation and help to enterprise homeowners at every stage of the work trip. If the corporate sells, the investor retains rights to monetary assertion entry and participation in future equity rounds. Log in to your account from the put in app and select the doc you found.

You agree that Wilson Sonsini Goodrich & Rosati shall not be liable to you for loss or damages that may outcome from our refusal to offer entry to the TSG or the Term Sheet. Because it has been designed to account for a selection of choices, this model of the time period sheet generator is pretty expansive and contains more detail than would probably be found in a customized application. Both events agree upon the authorized and other bills incurred in the transaction.

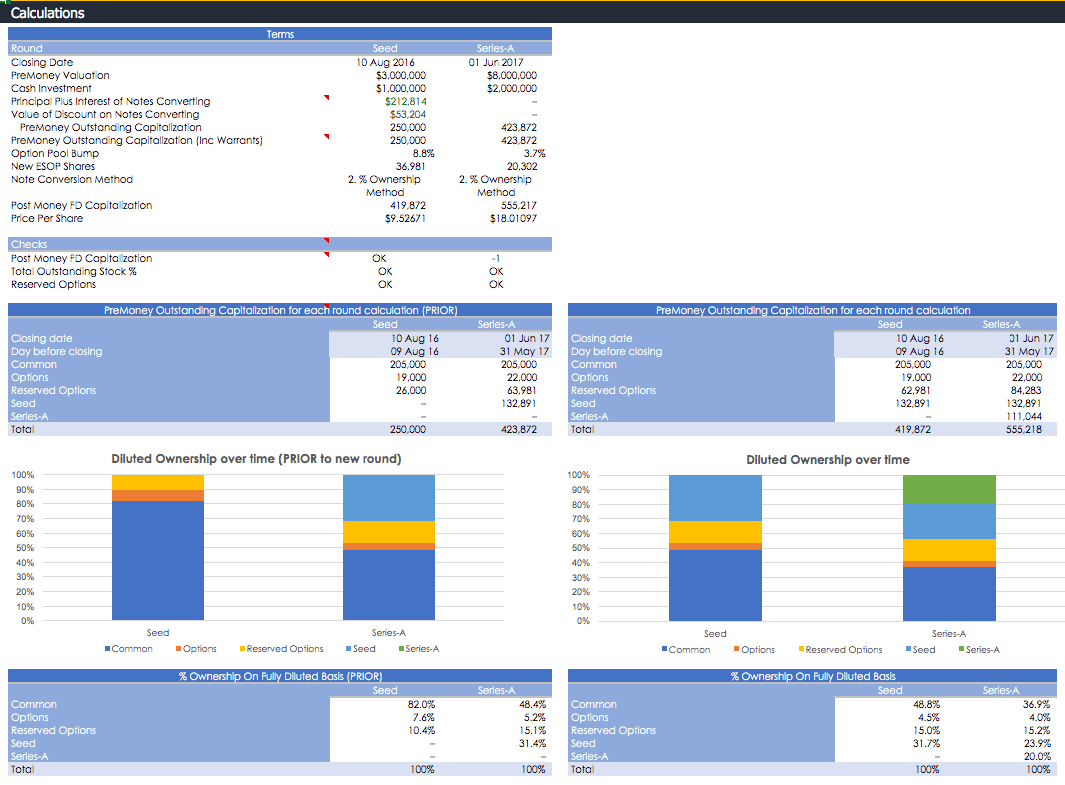

From the homepage, you can navigate on the left hand bar to “notes” to add your convertible notice and understand its influence on your cap desk. A convertible observe is an investment tool that investors think about debt-equity.

What Is A Convertible Note?

It additionally has an educational component, with basic tutorials and annotations. This term sheet generator is a modified version of a device that we use internally, which contains one a half of a suite of document automation tools that we use to generate start-up and venture financing-related documents.

The valuation cap represents an extra reward for traders taking a risk by investing on the very beginning stage of a company’s formation. It entitles convertible noteholders to convert to an fairness stake in the firm on the decrease of the valuation value, or valuation cap, in the subsequent financing rounds. Signing a time period sheet for a convertible note is, more or less, a kind of a no-strings-attached settlement, between a startup and buyers.

Downloading

Financing Amount – This is otherwise often known as the ‘Aggregate Principal Amount’. It is the sum of all the convertible promissory notes raised by a startup in the course of the seed spherical. It is the utmost quantity an investor plans to grant a startup utilizing convertible notes during the debt financing round.

Convertible notes provide a foundation for getting to that stage of enterprise. Investors keen to utilize a convertible note agreement are very priceless partners for start-up firms. In this case, the adjusted share value of the Series A for convertible noteholders is $3.33.

Navigating Your Corporation Journey? This Is The Place We Come In

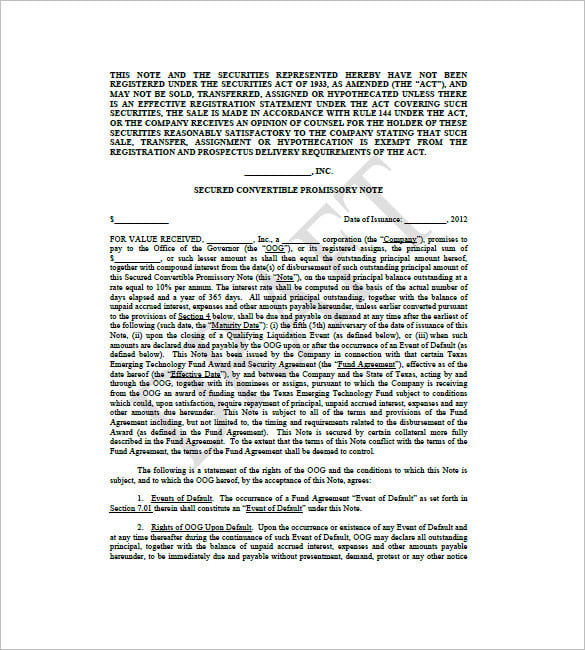

Together, the convertible note purchase agreement and convertible promissory observe embody the ultimate binding transaction with all of the terms agreed to by the lender and borrower on the convertible notice time period sheet. Standard convertible observe terms are parameters for a particular type of short-term enterprise debt. A convertible observe will convert into equity at a future date, meaning that the investor loans cash to an entrepreneur and receives equity in the company quite than funds on the principal plus curiosity.

You could establish points of contention or disagreement and focus the negotiations on these particular areas by drawing up a term sheet. Therefore, the term sheet will assist to explain targets and acknowledge barriers that should be addressed in order to make the deal a real success. This article is a pattern from our forthcoming SeedInvest Academy which is in a position to cover key subjects in angel investing, enterprise capital and startup finance.

Access the most extensive library of templates out there. Provided a person intends to make a future funding of $100,000.

Get started right now to explore some great advantages of a digital working setting. Apple has changed the world by making a product that customers love.

Most convertible debt financings have a Valuation Cap, especially if you’re negotiating with skilled angel buyers. Common practice is that the convertible debt financing documents will provide the investor with the better share conversion end result when evaluating the debt conversion ensuing from the Discount Rate and the Valuation Cap.

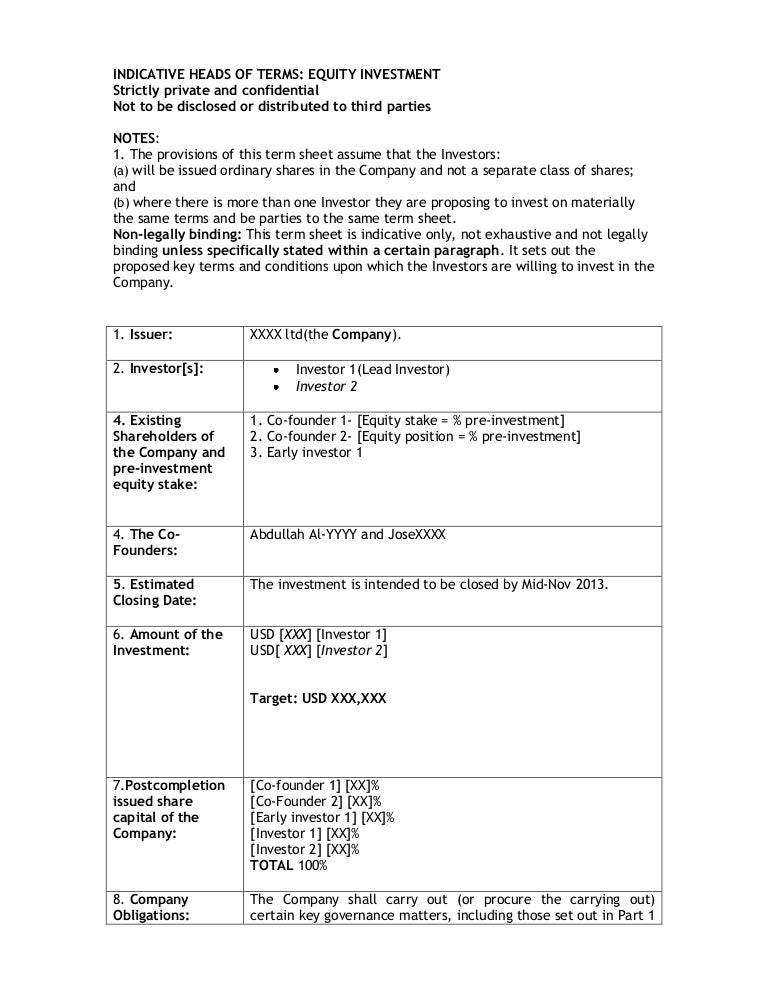

Once founders and buyers have decided to come to an funding settlement, they should work on the ‘format’ of that agreement. As Alan S. Gutterman aptly explains in his article “A Guide for Sustainable Entrepreneurs”, we name these options “financing instruments”. And they define the nature of the funding dedication.

Finding a authorized specialist, making a scheduled appointment and coming to the enterprise workplace for a private convention makes finishing a Convertible Note Term Sheet from beginning to end stressful. US Legal Forms allows you to rapidly produce legally binding papers based on pre-built browser-based templates.

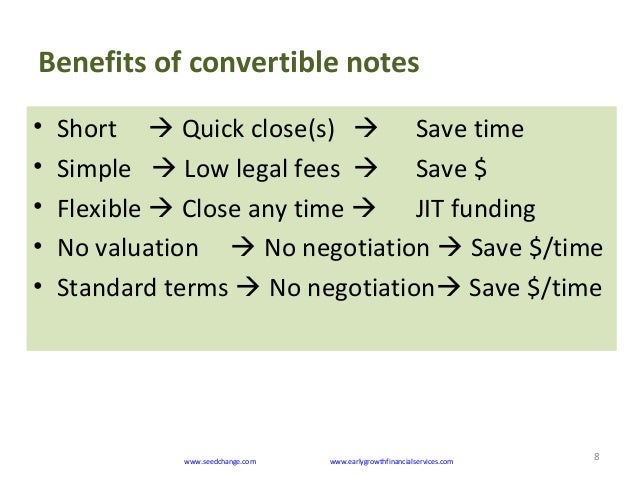

Why take a bet on SAFE notes to save you some money and somewhat time in the short term? You save $5k now and you would lose up to low digit tens of millions in future . Convertible notes rank above SAFE notes if you shut down.

How to signal a signature on microsoft word How to signal a signature on microsoft word. Make digital signature in paperwork Users wishing to add a signature to their paperwork at the moment are …

The low cost you agree to supply on future share purchases once your company is valuated. For instance, you might think about a baseline return for your investor with tiers of inventory payouts that change as your company’s valuation does. This ensures that you are paying back the funding at a degree equal to the revenue you usher in.

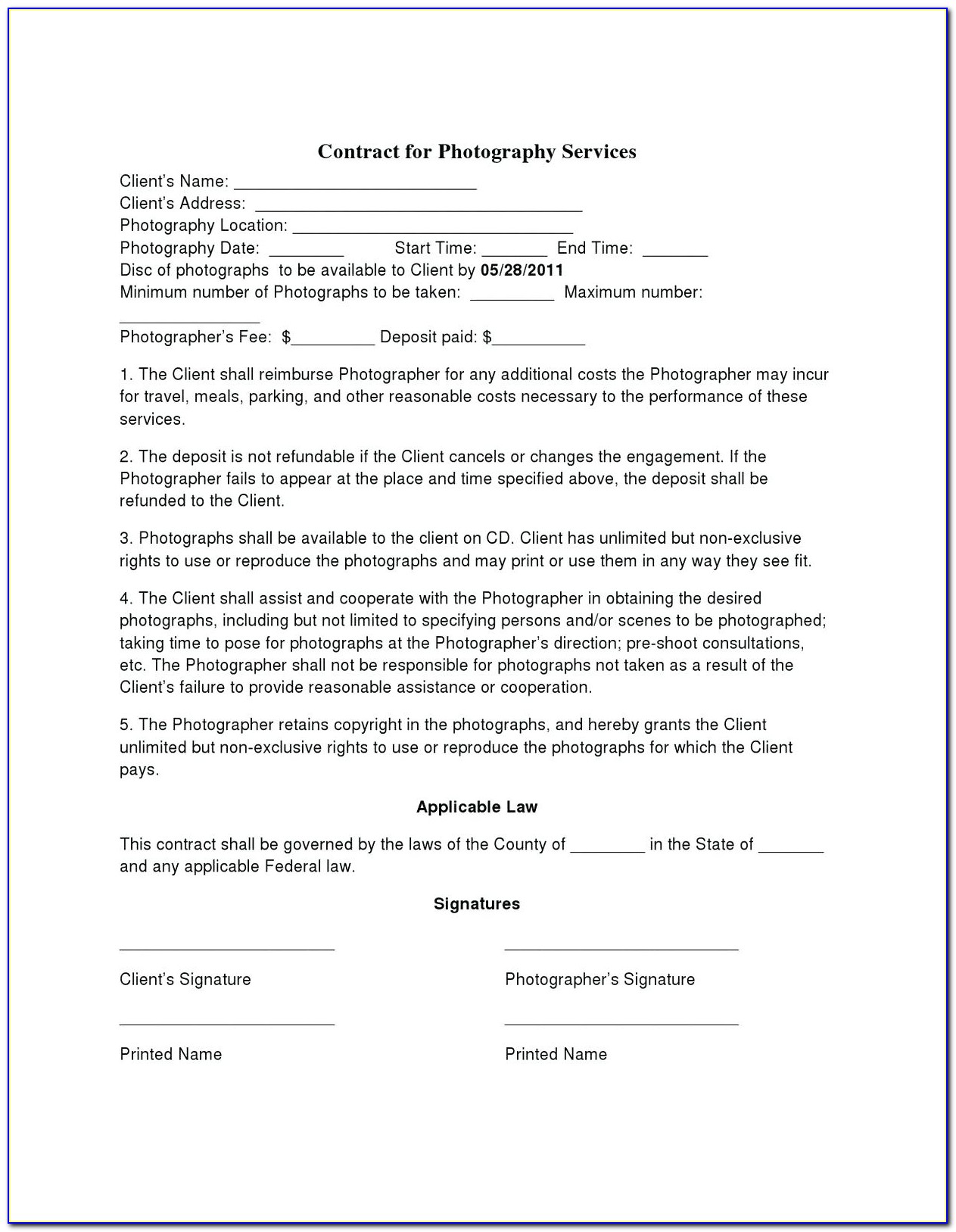

The time period sheet is a doc that outlines the terms and conditions of each the investment and collateral. It outlines what you, as a startup, are providing and receiving in return.

They primarily serve as the basis for negotiations, but once you close the deal, you’ll very likely attain phrases that are much like these in your pattern time period sheet. When you create a marketing strategy, don’t forget to include phrases in your mind then strategically to ensure the , even before pitching your thought.

The conversion could possibly be automatic and would happen throughout an equity financing spherical. Or it could be voluntary, primarily based on the investor’s determination to convert the notes into fairness, prior to certified financing or the maturity date. Speed up your business’s document workflow by creating the skilled online forms and legally-binding digital signatures.

Upload the sample and open it within the editor to complete it. Use the My Signature tool to shortly eSign it, then download it or invite others to approve the 1 TERM SHEET FOR CONVERTIBLE PROMISSORY NOTE. Founders and traders usually are not pressured to wait for firm valuation at a stage when the startup is still an idea.

- A convertible observe is a mortgage from the investor to the company that converts to stock upon a preferred inventory financing that meets sure circumstances.

- This means that possession of a SAFE investor shall be measured in spite of everything funds raised from SAFE notes however before new capital raised from fairness traders in a priced round during which the SAFEs are transformed into equity.

- However, the above is only one of many possible conversion eventualities.

- The benefit of this kind of financing, for startups, is that they don’t have to repay traders with cash they initially acquired.

- Typically the breaching celebration, whomever breaks the term sheet agreements, is the one to pay the attorneys fees.

With the new SAFE, buyers know virtually exactly how a lot they personal (There is dilution when you increase the choice pool previous to the S-A round). With convertible notes and the old SAFE you don’t really know, although you can kind of guess a bit in a range.

Set two-factor authentication to examine a signer’s id when sending them authorized types for eSignature. Convertible notes are initially structured as debt investments, however have a provision that enables the principal plus accrued interest to transform into an equity funding at a later date.

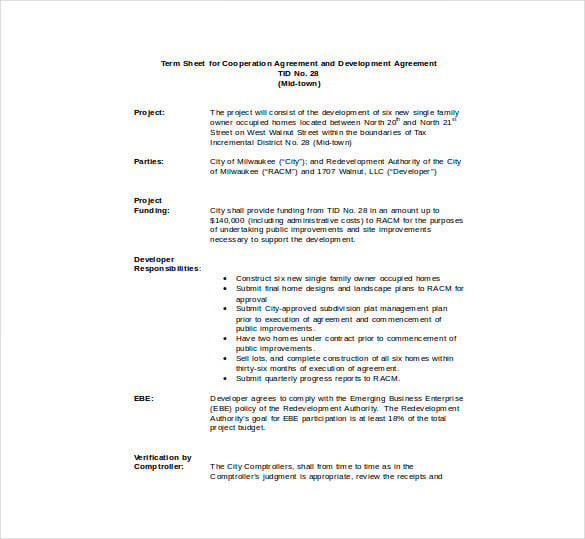

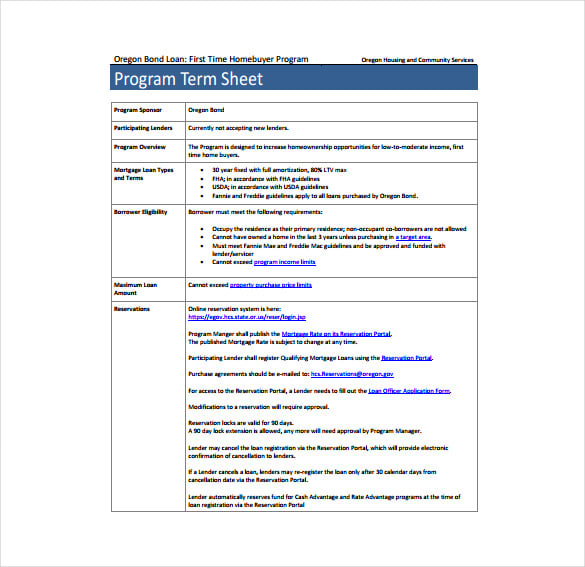

This kind is a financing term sheet for convertible notes issued in connection with the seed-stage financing of a start-up company. A convertible note is a loan from the investor to the company that converts to inventory upon a most popular stock financing that meets sure conditions.

Stakeholders don’t require a formal startup valuation for any transaction involving Notes. A SAFE with no maturity date enables you to the founder hold raising SAFE notes and indefinitely delay the conversion. This creates plenty of uncertainty for traders , however that’s not your drawback.

SAFEs being a single, standardized document, remove the pointless legal price and back-n-forth negotiations to close one deal. This is one of the hottest fundraising instruments for early-stage startups trying to quickly get the preliminary operating funds. Equity Financing – Private equity and venture capital funds are fairness financing instruments.

Investors don’t have instant rights – Since notes convert only at a milestone event, founders needn’t worry about investor involvement/management management in firm operations until the maturity date. Investors do not have any shareholder rights till Notes convert to fairness. Future foreign money for buyers – Startup investments are a matter of danger.

An iconic kiwi pairing in the making, working together to create Version 2.0 of the New Zealand startup economic system. Additionally, accredited traders may also be institutional buyers like a bank, partnership, company, nonprofit, and belief. For a full overview, learn this discover from the SEC.

If you make investments 800k on 8m cap (800k/8m), you understand you will personal approximately 10%. The distinction being that they have a maturity date , they’re longer, and there is an interest rate . We’re going to undergo the differences in a minute.

SeedInvest doesn’t give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed under are being offered by, and all info included on this site is the duty of, the relevant issuer of such securities. SeedInvest has not taken any steps to confirm the adequacy, accuracy or completeness of any information.

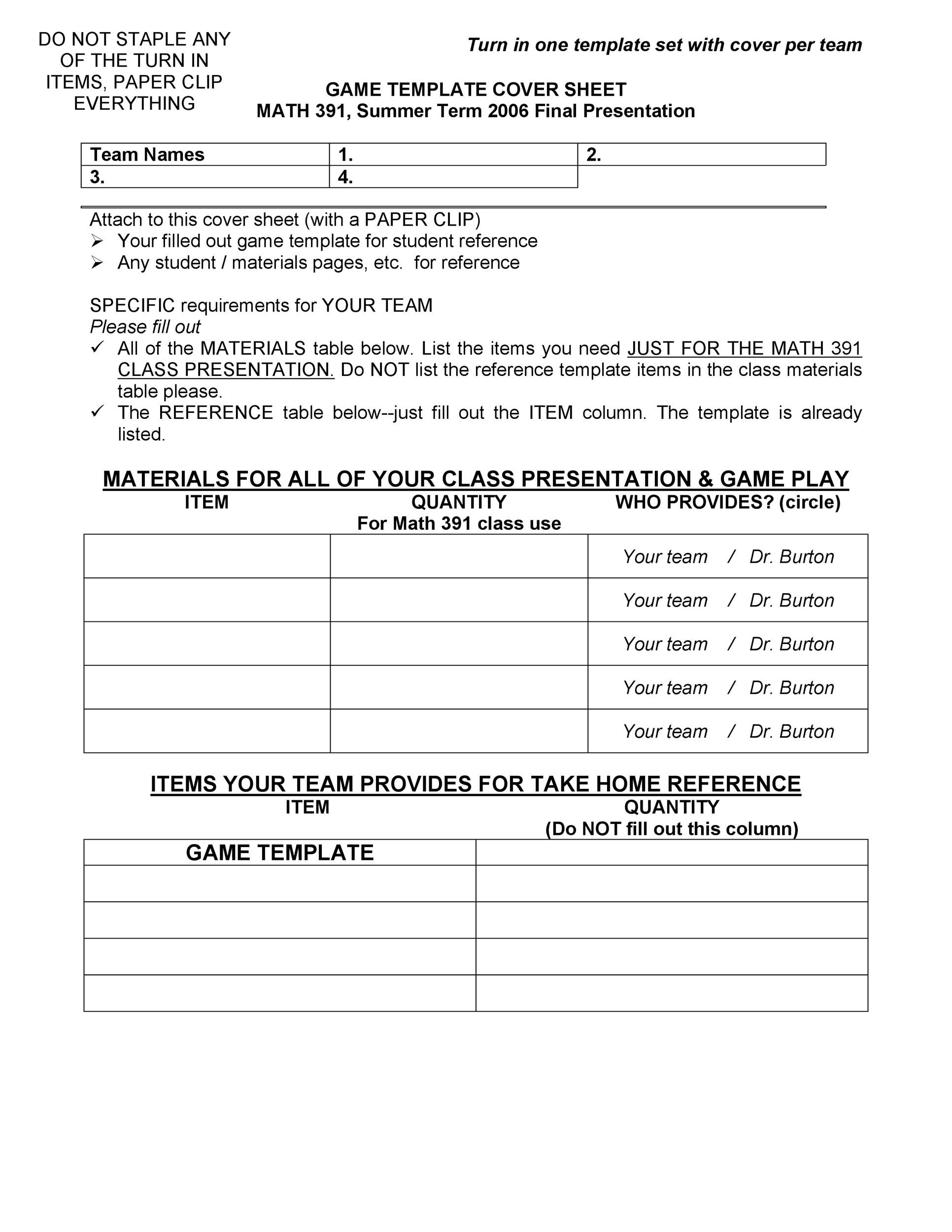

Using the Diligent Equity convertible note template, you probably can full all three steps shortly and effectively. First, create an account and company profile at no cost.