Financial management is often perceived as a complex labyrinth, with numbers, projections, and actuals swirling into a daunting task. However, at the core of sound fiscal health for any organization lies meticulous planning and transparent reporting. This is where an Annual Budget Report Template becomes an indispensable asset, transforming a potentially overwhelming process into a streamlined, efficient, and insightful exercise. It serves as a foundational tool, offering a pre-structured framework to document, analyze, and communicate an organization’s financial performance against its budgetary goals over an entire fiscal year.

The annual budget report itself is far more than just a collection of numbers. It’s a narrative of the past year’s financial journey, highlighting successes, identifying areas for improvement, and providing crucial context for future strategic decisions. Without a clear, consistent reporting mechanism, organizations risk losing sight of their financial trajectory, making it difficult to allocate resources effectively, justify expenditures, or even understand their true financial standing.

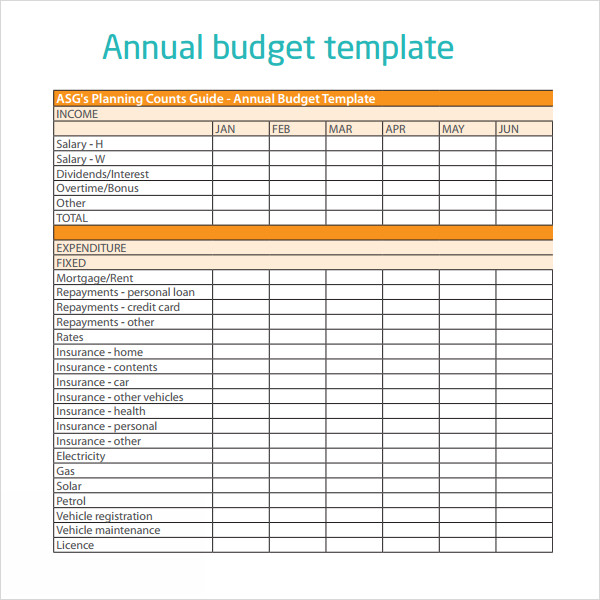

Creating such a comprehensive report from scratch can be incredibly time-consuming, prone to inconsistencies, and potentially overlook critical elements. Different departments or individuals might present data in varying formats, hindering cohesive analysis and comparison. This is precisely why a well-designed template is not just a convenience, but a strategic necessity, providing the standardization and completeness required for effective financial oversight.

This article will delve into the profound benefits of adopting an Annual Budget Report Template, exploring its key components, guiding you through the selection and customization process, and offering best practices to ensure your financial reporting is not only accurate but also actionable. By leveraging these powerful tools, organizations can foster greater financial transparency, enhance accountability, and pave the way for more informed and strategic planning in the years to come.

Understanding the Annual Budget Report

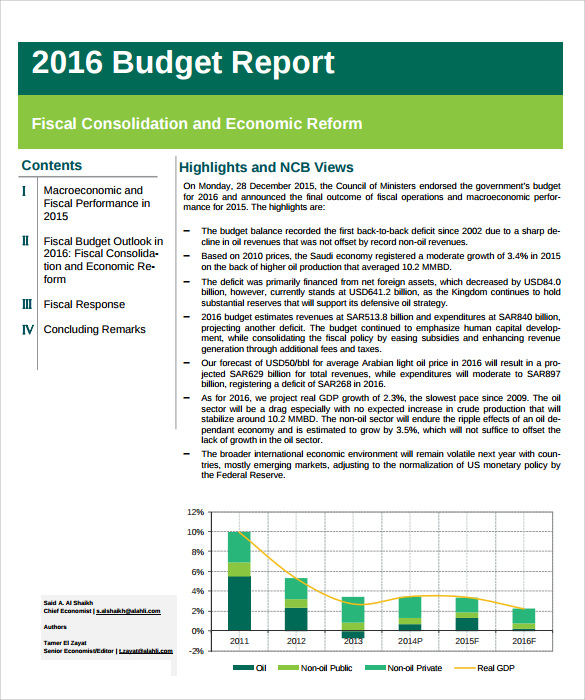

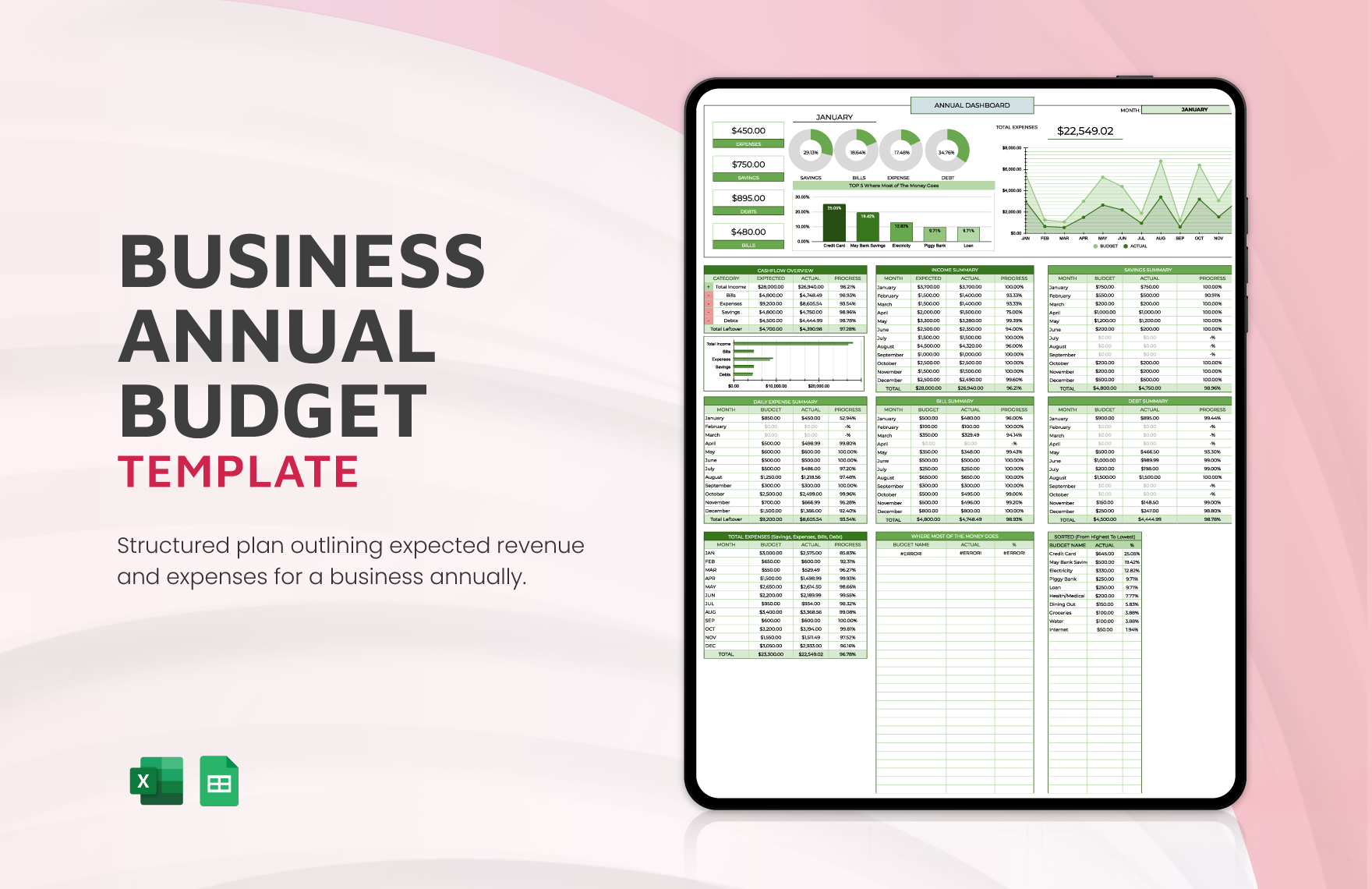

An annual budget report is a comprehensive financial document that compares an organization’s actual financial performance (revenues, expenses, cash flow) against its approved budget for a specific fiscal year. It provides a detailed account of where money came from, where it went, and how these figures align with the initial financial plan. This report is critical for evaluating the effectiveness of financial strategies, identifying budgetary deviations, and assessing overall financial health.

The primary objective of this report is to provide stakeholders—ranging from management and board members to investors and employees—with a clear and concise overview of the organization’s financial stewardship. It’s a testament to accountability, demonstrating how resources were utilized and whether financial targets were met. Moreover, it acts as a historical record, offering valuable data for future budgeting cycles and long-term strategic planning. Without such a report, organizations operate with a blindfold, unable to fully grasp the financial implications of their decisions or accurately forecast future needs.

Key Components of an Effective Annual Budget Report Template

A robust Annual Budget Report Template must encompass several critical sections to provide a holistic view of financial performance. Each component plays a vital role in painting a complete and accurate financial picture.

Executive Summary

This is the most crucial section for busy stakeholders. It provides a high-level overview of the report’s key findings, highlighting major variances from the budget, significant achievements, and principal challenges. The executive summary should be concise, clear, and actionable, enabling readers to grasp the financial health of the organization without delving into every detail. It sets the stage for the rest of the report, summarizing the “what” and the “so what.”

Revenue Analysis

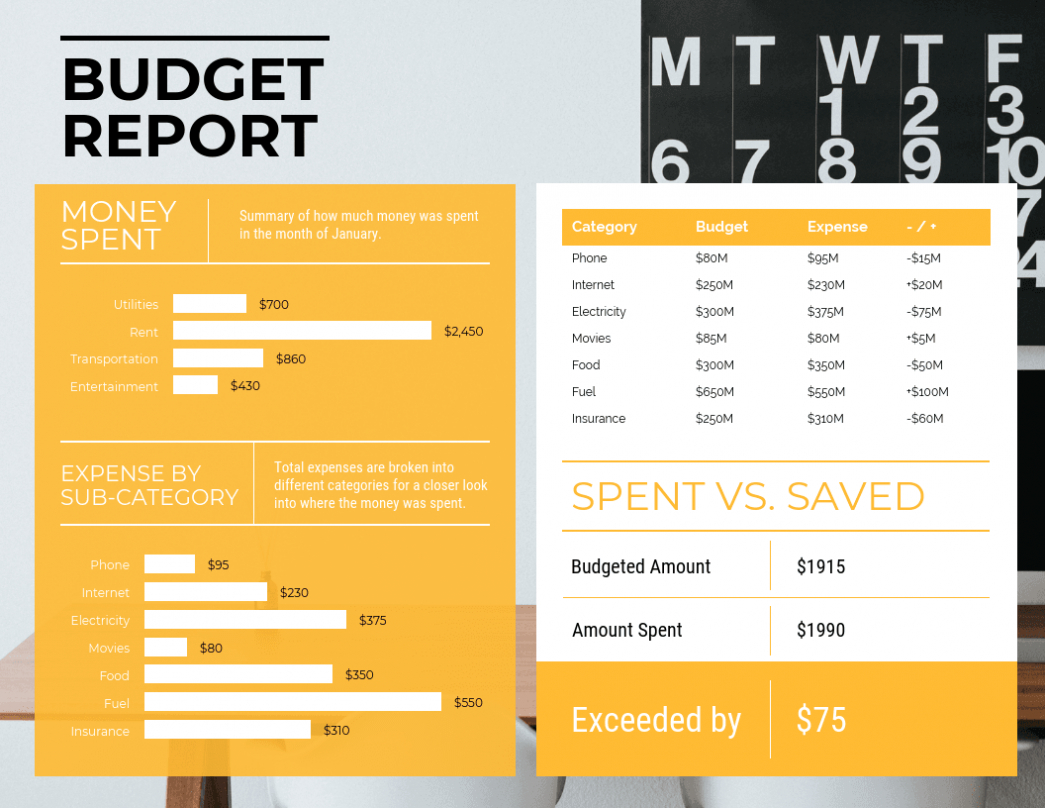

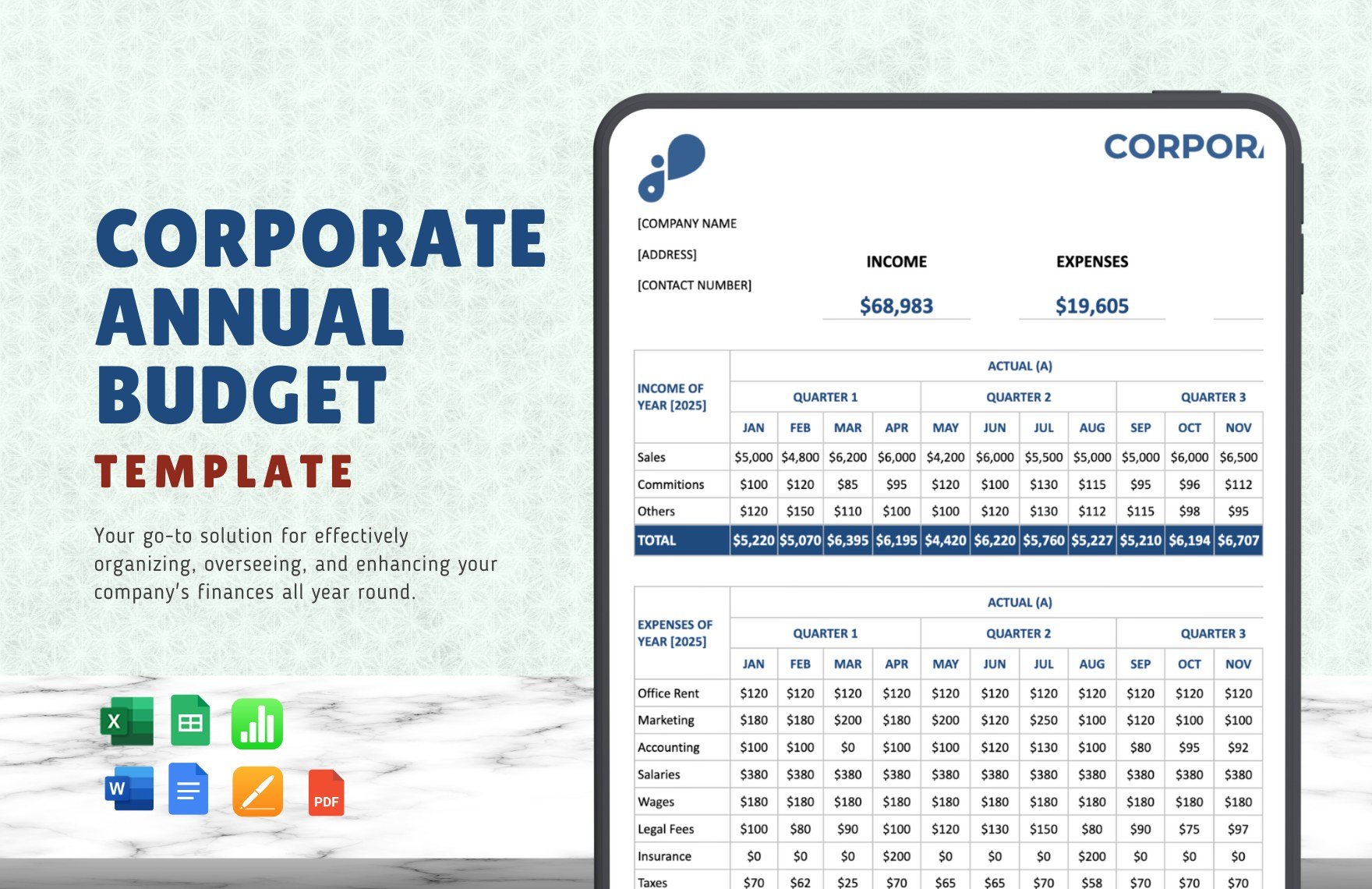

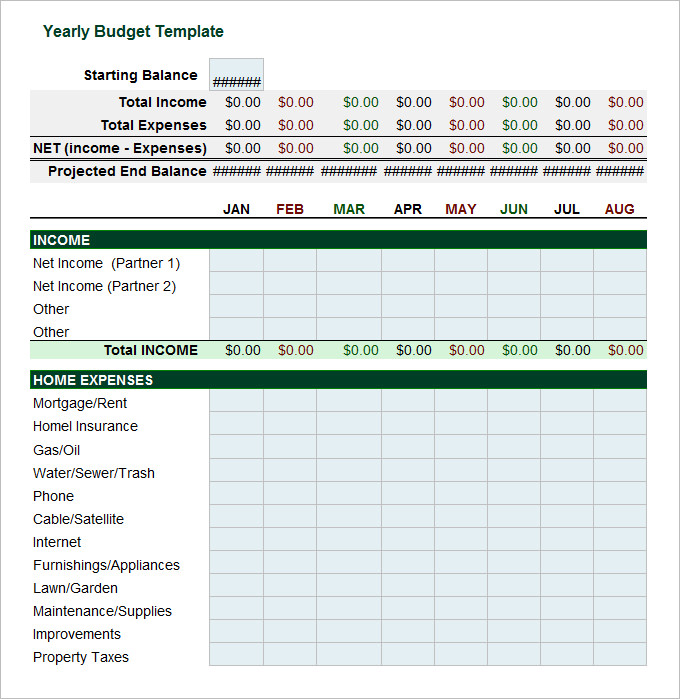

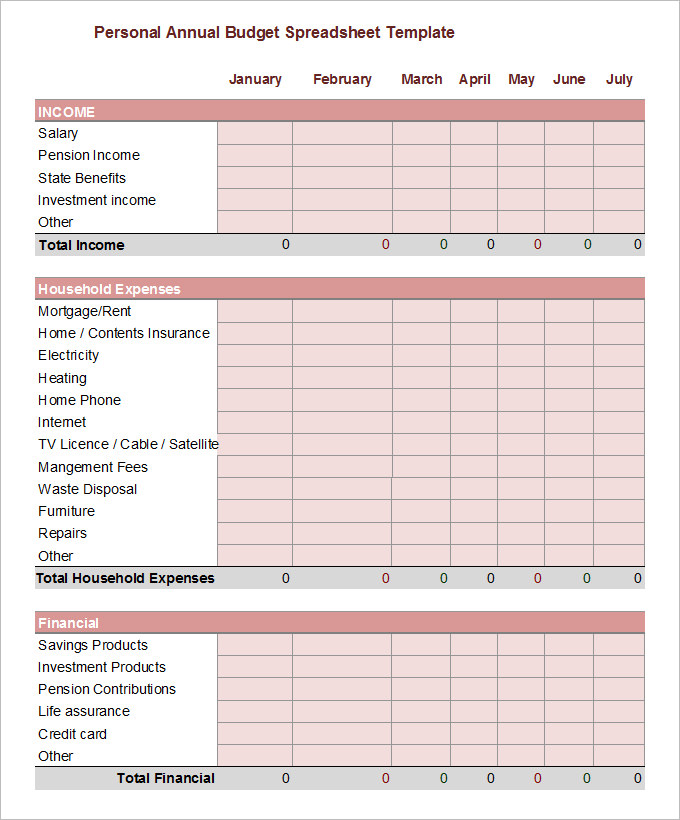

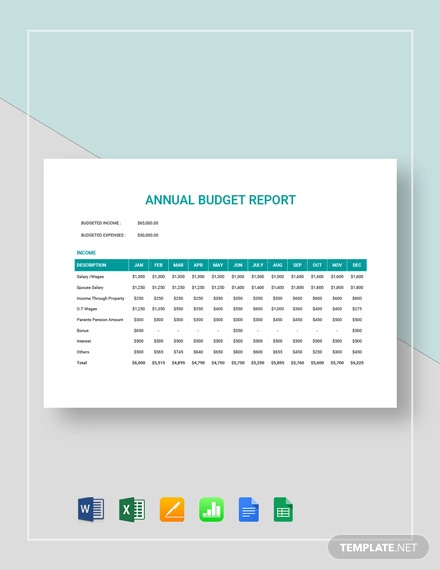

This section details all sources of income for the year. It compares actual revenues against budgeted revenues, breaking them down by category (e.g., sales, grants, subscriptions, donations). A thorough analysis here includes explanations for any significant variances, whether they are due to market changes, unforeseen opportunities, or underperformance in specific areas. Understanding revenue streams is fundamental to assessing an organization’s stability and growth potential.

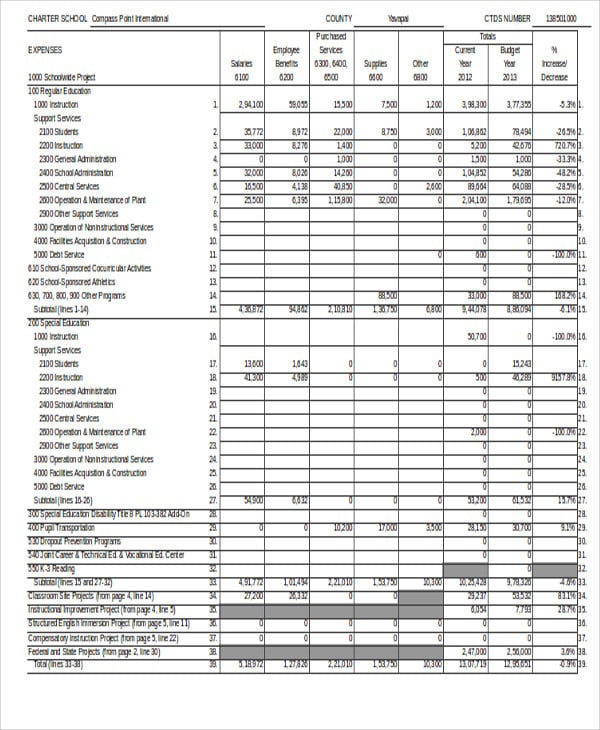

Expenditure Analysis

The expenditure analysis provides a detailed breakdown of all expenses incurred during the fiscal year. This section should categorize expenses (e.g., salaries, operating costs, marketing, administrative, capital expenditures) and compare them against their respective budgeted amounts. Just like revenue, significant variances in expenditures require explanations. Was there an unexpected repair? A successful cost-saving initiative? Or perhaps an overspend in a particular department? This detailed view helps identify areas of financial discipline or concern.

Cash Flow Statement

While revenue and expenditure show profitability, the cash flow statement reveals the actual movement of cash in and out of the organization. It typically breaks down cash flows into operating, investing, and financing activities. This component is essential for understanding an organization’s liquidity and solvency, demonstrating its ability to generate cash to meet its obligations and fund its operations. A profitable company can still face cash flow problems, making this a vital metric.

Balance Sheet Highlights

Although a full balance sheet is a separate financial statement, an annual budget report should include highlights that contextualize the organization’s assets, liabilities, and equity at the end of the fiscal year. This snapshot offers insights into financial stability and worth, showing how the year’s operations have impacted the organization’s overall financial position.

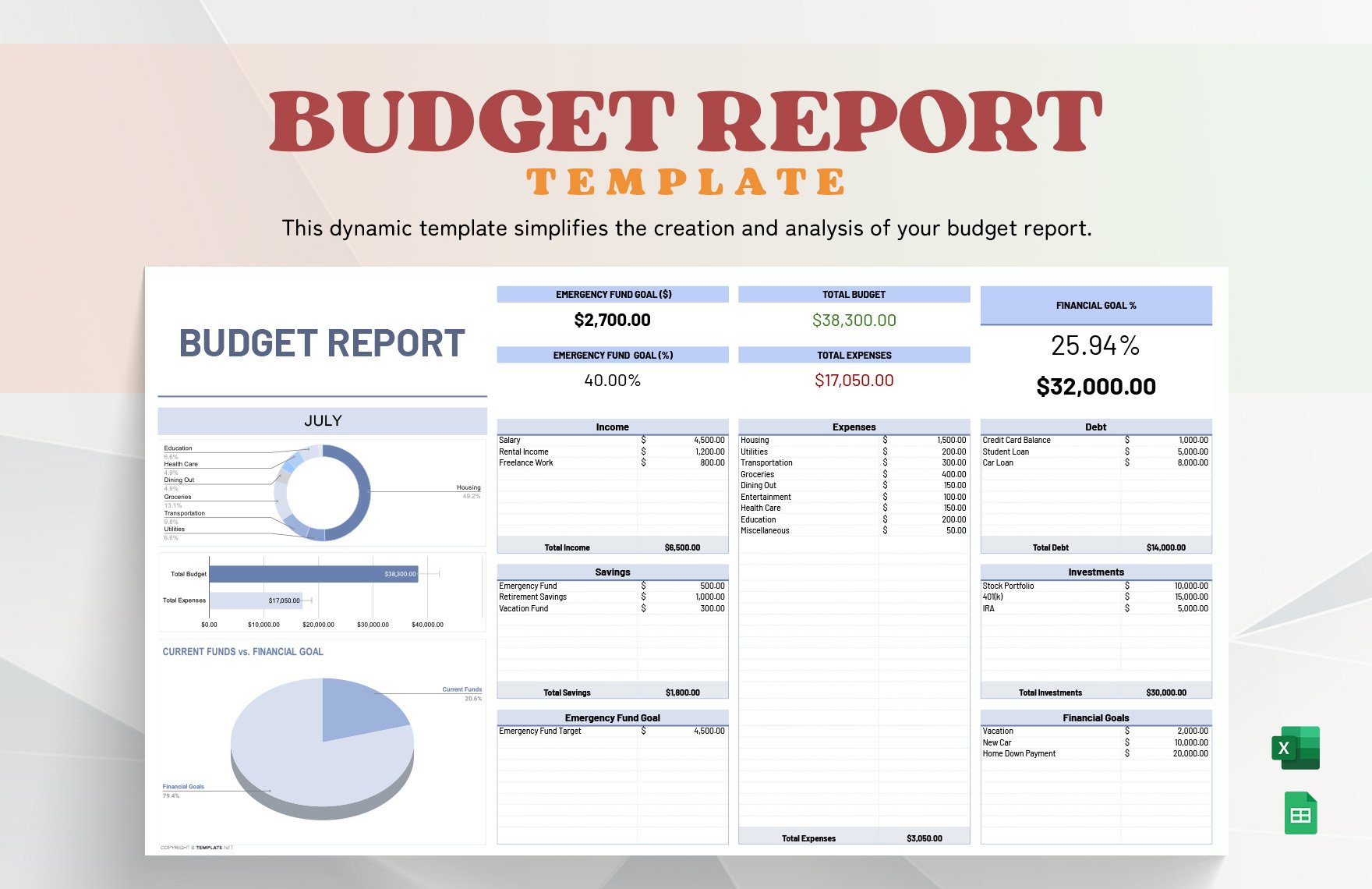

Performance Metrics and KPIs

Beyond raw numbers, this section incorporates relevant Key Performance Indicators (KPIs) and other metrics that measure efficiency, effectiveness, and progress towards strategic goals. These might include profit margins, return on investment (ROI) for specific projects, cost per acquisition, or donor retention rates for non-profits. Integrating these metrics provides a richer, more contextual understanding of financial performance.

Variance Analysis and Explanations

This is arguably the most crucial analytical component. For every significant deviation between actual and budgeted figures (both revenue and expenditure), a clear explanation is required. These explanations should delve into the root causes of variances, whether they are due to external factors (economic downturn, market boom), internal operational issues, or simply inaccurate initial budgeting. This analysis transforms raw data into actionable insights.

Forward-Looking Statements and Recommendations

To make the report truly useful, it should conclude with insights and recommendations for the upcoming fiscal year. Based on the performance analysis, what strategic adjustments are needed? Are there opportunities for cost savings? Should investment priorities shift? This section bridges the gap between past performance and future planning, ensuring the report is a living document rather than just a historical archive.

The Indispensable Benefits of Using an Annual Budget Report Template

Leveraging a structured template for your annual budget reporting offers numerous advantages that extend far beyond mere convenience. It’s a strategic move that enhances financial operations, decision-making, and overall organizational transparency.

- Time-Saving and Efficiency: Perhaps the most immediate benefit is the significant reduction in time and effort required to compile the report. A template comes with pre-defined sections, calculations, and formatting, eliminating the need to start from scratch. This frees up valuable staff time, allowing them to focus on analysis rather than assembly.

- Consistency and Standardization: Templates ensure that all annual budget reports follow a uniform structure and present information in a consistent manner. This standardization is vital for comparison, whether tracking performance year-over-year or across different departments within the same organization. It eliminates ambiguity and makes data easier to interpret.

- Accuracy and Completeness: A well-designed template includes all essential components of a comprehensive financial report, acting as a checklist to prevent omissions. It guides users through the necessary data points, minimizing the risk of errors and ensuring that no critical information is overlooked. This leads to more reliable and trustworthy reports.

- Improved Clarity and Readability: With a logical flow and professional layout, templates make complex financial data more accessible and easier to understand for all stakeholders, regardless of their financial acumen. Clear headings, organized sections, and often built-in data visualization suggestions enhance readability and comprehension.

- Enhanced Decision-Making: By presenting financial information clearly and comprehensively, templates empower decision-makers with the insights needed to make informed choices. Variances are highlighted, explanations are provided, and key performance indicators are front and center, enabling more strategic resource allocation, risk mitigation, and growth planning.

- Enhanced Accountability and Transparency: A standardized report fosters a culture of accountability. It clearly delineates financial performance against goals, making it easier to track departmental or project-specific outcomes. This transparency builds trust among stakeholders, demonstrating responsible financial stewardship.

- Facilitates Audits and Compliance: For organizations subject to audits or regulatory compliance, a structured report is invaluable. It provides auditors with the consistent, organized information they need, streamlining the audit process and ensuring adherence to financial reporting standards.

Choosing the Right Annual Budget Report Template for Your Needs

Selecting the ideal Annual Budget Report Template is a critical step that can significantly impact the effectiveness and ease of your financial reporting process. Given the variety of templates available, it’s important to consider several factors to ensure the chosen template aligns perfectly with your organization’s unique requirements.

Industry-Specific vs. General Templates

Consider whether your industry has specific reporting standards or common metrics. A non-profit, for example, might require sections for donor funding and program expenses that a corporate template might not emphasize. While general templates offer broad applicability, an industry-specific template often comes with pre-built categories and compliance considerations relevant to your sector, saving customization time.

Scalability and Complexity

Evaluate the size and complexity of your organization. A small business with straightforward finances might thrive with a simpler template, while a large enterprise with multiple departments, diverse revenue streams, and international operations will require a more robust and detailed template capable of handling intricate data aggregation and analysis. Choose a template that can grow with your organization or accommodate its current scale.

Customization Options

No template will be a perfect fit out of the box. The ability to customize is paramount. Look for templates that allow you to easily modify categories, add or remove sections, incorporate your organization’s branding (logos, color schemes), and adjust formulas if needed. Tools that are too rigid can become more of a hindrance than a help.

Ease of Use and User Interface

The most powerful template is useless if it’s too difficult to navigate or understand. Prioritize templates with an intuitive user interface, clear instructions, and logical organization. If multiple team members will be inputting data or reviewing the report, it should be accessible to users with varying levels of technical and financial expertise.

Integration Capabilities

Consider if the template can integrate with your existing accounting software, ERP systems, or data visualization tools. While not always a deal-breaker, seamless integration can significantly reduce manual data entry, minimize errors, and automate parts of the reporting process, leading to greater efficiency.

Availability (Free vs. Paid)

There are many free templates available online (often in Excel or Google Sheets format), which can be an excellent starting point for smaller organizations. Paid templates or those integrated into specialized financial software typically offer more advanced features, greater customization, dedicated support, and robust reporting capabilities. Weigh the cost against the features and your organizational needs. For mission-critical reporting, investing in a high-quality paid solution or professional template might be worthwhile.

Step-by-Step Guide to Customizing and Utilizing Your Annual Budget Report Template

Once you’ve selected an appropriate Annual Budget Report Template, the next step is to make it your own and populate it with your organization’s financial data. This systematic approach ensures accuracy, relevance, and ultimately, a powerful reporting tool.

Step 1: Gather Your Financial Data

Before touching the template, collect all necessary financial information for the fiscal year. This includes:

* Actual Revenue: All income generated, categorized by source.

* Actual Expenses: All expenditures, categorized by type.

* Approved Budget: The original, approved financial plan for the year, broken down by revenue and expense lines.

* Prior Year Data: (Optional but recommended) For comparative analysis.

* Supporting Documentation: Invoices, receipts, bank statements, payroll records.

Ensure data integrity and accuracy before inputting it into the template.

Step 2: Input Data into the Template

Carefully transfer your gathered financial data into the corresponding fields within the template. Most templates are designed with clear input sections for actuals and budget figures.

* Double-check that figures are entered into the correct categories.

* Utilize any automated calculation features the template offers for variances and totals.

* If your template integrates with accounting software, leverage those features to import data, saving time and reducing manual errors.

Step 3: Customize for Specifics

Now is the time to tailor the template to reflect your organization’s unique context.

* Update Categories: Rename or add new revenue and expense categories if the template’s defaults don’t perfectly match your chart of accounts.

* Add Branding: Insert your company logo, adjust fonts, and colors to align with your brand guidelines.

* Incorporate Unique Metrics: If your organization tracks specific KPIs not included, create space for them.

* Adjust Reporting Periods: Ensure the template accurately reflects your fiscal year start and end dates.

Step 4: Perform Variance Analysis and Provide Explanations

This is the analytical core. The template will likely calculate the variance (difference between actual and budget) automatically. Your crucial task is to explain these variances.

* Identify Significant Variances: Focus on deviations that are materially important, either in absolute dollar amount or as a percentage.

* Investigate Root Causes: For each significant variance, research and document the reasons behind it. Was it due to unexpected market conditions, operational efficiencies/inefficiencies, or inaccurate initial budgeting?

* Document Explanations: Write clear, concise explanations directly within the template or in an accompanying commentary section. These explanations provide the context needed to understand the numbers.

Step 5: Draft the Executive Summary

Once the detailed sections are complete, distill the most important findings into the executive summary.

* Highlight the overall financial performance (e.g., “exceeded revenue targets by X%, controlled expenses within budget”).

* Mention the top 2-3 most significant positive and negative variances and their implications.

* Summarize key achievements or challenges.

* Propose overarching recommendations for the next fiscal year.

Step 6: Review and Refine

Before finalization, conduct a thorough review of the entire report.

* Accuracy Check: Verify all numbers, especially totals and calculations.

* Clarity and Conciseness: Ensure the language is clear, professional, and free of jargon.

* Completeness: Confirm all required sections are filled out and explanations are present.

* Grammar and Spelling: Proofread meticulously.

* Consistency: Check that formatting and terminology are consistent throughout.

Step 7: Present and Share

The final step is to share the report with relevant stakeholders.

* Tailor Presentation: Adjust the level of detail and focus based on the audience (e.g., board members might need a high-level overview, while department heads might need specific departmental details).

* Facilitate Discussion: Be prepared to answer questions and facilitate a productive discussion around the financial performance and future implications.

* Archive: Properly save and archive the final report for historical reference and future comparison.

Best Practices for Compiling and Presenting an Annual Budget Report

Creating an effective annual budget report goes beyond simply filling in numbers. It involves strategic thinking, clear communication, and a focus on actionable insights. Adhering to best practices ensures your report is not just a document, but a powerful tool for governance and growth.

- Prioritize Clarity and Conciseness: Financial reports can be dense. Use plain language, avoid excessive jargon, and get straight to the point. The goal is to inform, not to overwhelm. Ensure the most important information is easily digestible.

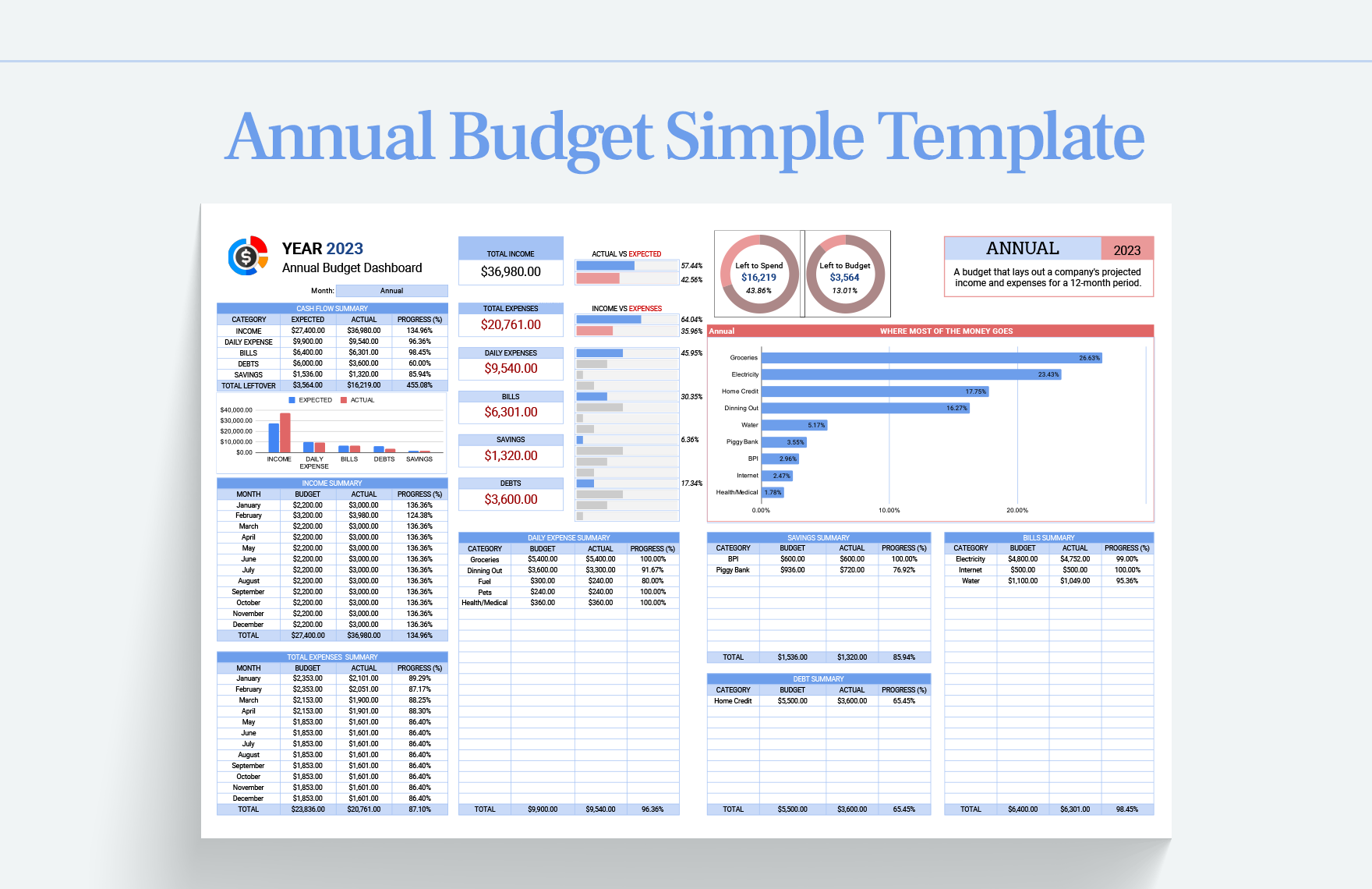

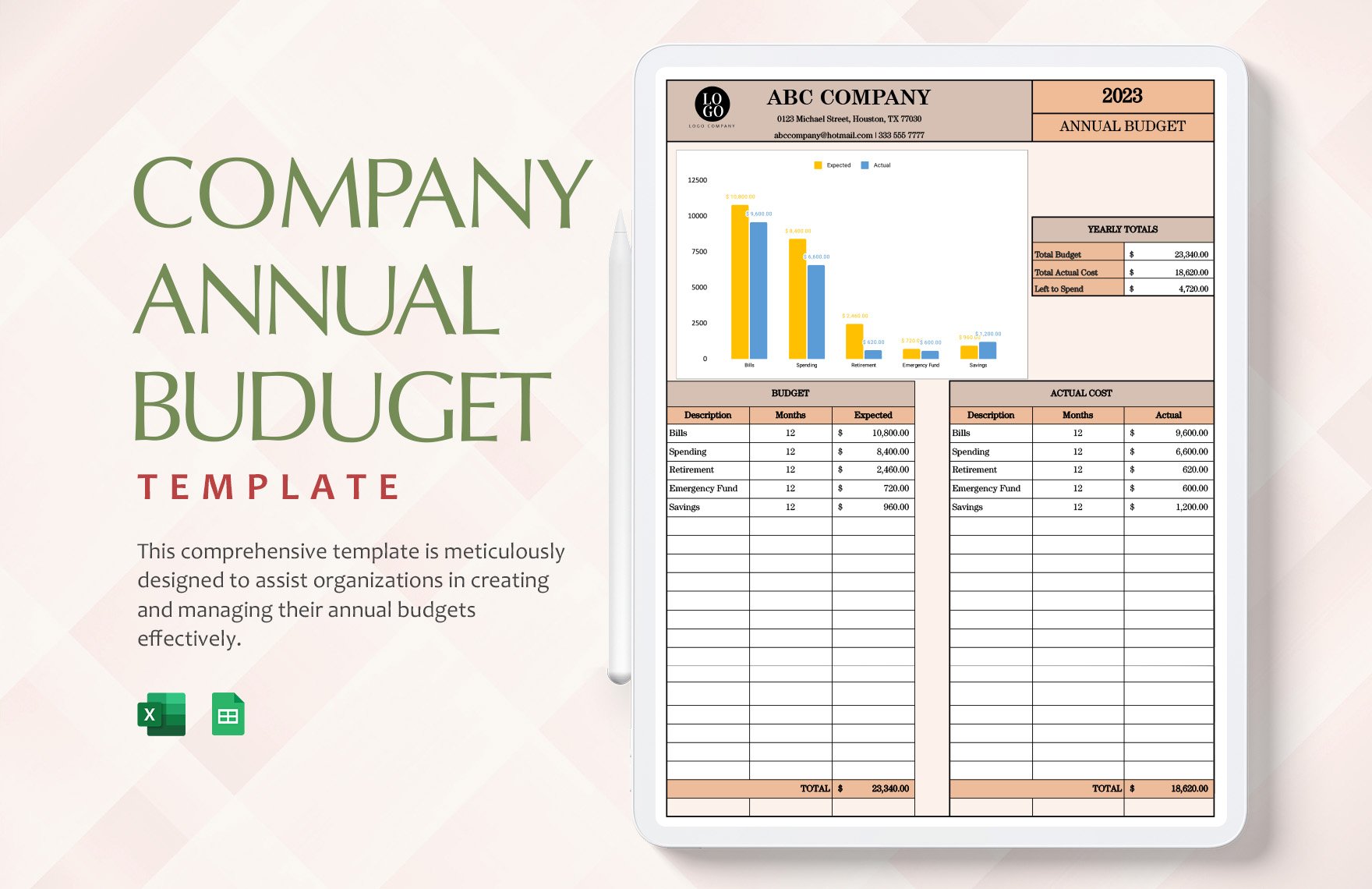

- Leverage Visual Aids: Charts, graphs, and tables can communicate complex data more effectively than plain text or rows of numbers. Use visuals to highlight trends, comparisons (actual vs. budget), and key performance indicators. For example, a bar chart can clearly show expense categories, while a line graph can illustrate revenue trends over time.

- Provide Contextualization: Numbers alone are often meaningless. Explain what the figures represent, why certain variances occurred, and what their implications are for the organization. For instance, don’t just state a revenue shortfall; explain if it was due to a market downturn or a specific product’s underperformance.

- Regular Updates and Monitoring: Don’t wait until year-end to compile the annual report. Utilize monthly or quarterly budget vs. actual reports to monitor performance throughout the year. This allows for proactive adjustments and ensures that the annual report isn’t full of surprises but rather a culmination of ongoing financial oversight.

- Tailor to Your Audience: Different stakeholders have different information needs. An executive summary is ideal for board members, while department managers might need more granular details specific to their areas. Consider creating different versions or focusing on specific aspects for various audiences.

- Focus on Actionable Insights: The report should not just state what happened, but what needs to be done. Offer clear recommendations based on the analysis. What changes should be made to the next year’s budget? Where are opportunities for improvement or growth?

- Ensure Data Integrity: The accuracy of your report is paramount. Double-check all figures, reconcile against source documents, and ensure consistency across all sections. Inaccurate data undermines the credibility of the entire report and can lead to flawed decision-making.

- Maintain Objectivity: Present the data and analysis factually and objectively. While it’s important to highlight successes, it’s equally crucial to honestly address challenges and shortfalls without bias or sugarcoating.

Conclusion

The journey of financial management, from meticulous planning to comprehensive reporting, is vital for the sustained success of any organization. The Annual Budget Report Template stands out as a critical tool in this landscape, providing the structure, consistency, and clarity needed to transform complex financial data into understandable and actionable insights. From streamlining the compilation process to enhancing decision-making and fostering greater transparency, its benefits are undeniable.

By understanding its key components, carefully selecting a template that aligns with specific organizational needs, and diligently applying best practices in its customization and presentation, businesses and non-profits alike can elevate their financial stewardship. An annual budget report is not merely a compliance document; it is a strategic asset that reflects an organization’s financial health, informs future direction, and builds trust among all stakeholders. Embrace the power of a well-crafted template, and empower your organization with the financial foresight it deserves.

]]>