The world of business can be complex, and securing funding is often a critical step towards growth. One of the most common and vital financial instruments for businesses is the Revolving Credit Facility Agreement. This agreement allows businesses to borrow funds as needed, providing flexibility and stability during periods of fluctuating revenue or economic uncertainty. Understanding the nuances of these agreements is crucial for both lenders and borrowers. This article will delve into the key components of a Revolving Credit Facility Agreement Template, offering a comprehensive overview for businesses considering this important financial arrangement. Revolving Credit Facility Agreement Template – a cornerstone of modern business finance.

What is a Revolving Credit Facility?

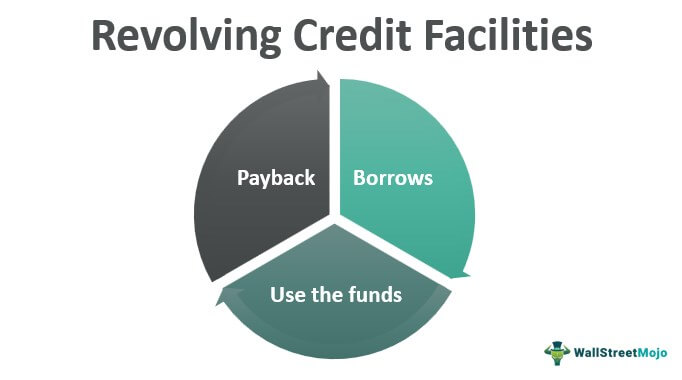

A Revolving Credit Facility (RCF) is a type of loan that provides businesses with access to a stream of funds, typically repaid over a period of time, based on a pre-defined credit limit. Unlike a traditional loan, which has a fixed repayment schedule, a RCF allows businesses to draw down funds as needed, up to the agreed-upon limit. This flexibility is particularly beneficial for businesses experiencing seasonal fluctuations in sales or those requiring short-term working capital. The “revolving” aspect means that the credit limit can be increased or decreased as the business’s needs change. It’s a powerful tool for managing cash flow and responding to market conditions.

Key Components of a Revolving Credit Facility Agreement

A well-drafted Revolving Credit Facility Agreement is more than just a simple loan agreement. It’s a legally binding contract outlining the terms and conditions of the facility. Here’s a breakdown of the essential components:

1. Parties Involved

The agreement clearly identifies the parties involved – the borrower (the business) and the lender (the financial institution). It’s vital to specify the full legal names and addresses of both parties. Understanding the roles and responsibilities of each party is paramount to a successful agreement. For example, the borrower is responsible for demonstrating sufficient creditworthiness and adhering to the terms of the agreement.

2. Facility Details

This section details the specific terms of the credit facility, including:

- Credit Limit: The maximum amount of funds the borrower can borrow.

- Interest Rate: The annual percentage rate charged on the outstanding balance.

- Fees: Any associated fees, such as origination fees, prepayment penalties, or late payment fees.

- Repayment Schedule: The frequency and amount of payments, typically monthly or quarterly.

- Collateral: Whether any collateral is required to secure the facility.

3. Usage Restrictions

The agreement often includes clauses restricting how the funds can be used. This is crucial to prevent misuse of the credit. Common restrictions include limitations on spending in specific categories (e.g., marketing, inventory) or prohibiting the use of funds for non-business-related expenses. Clearly defined usage guidelines are essential for maintaining the integrity of the facility.

4. Default Provisions

This section outlines the consequences if the borrower fails to meet their obligations under the agreement. It typically includes provisions for acceleration of the debt, legal action, and potential damages. Understanding the remedies available to the lender is critical for protecting their interests.

Benefits of a Revolving Credit Facility

The advantages of a Revolving Credit Facility are numerous and can significantly benefit businesses:

- Flexibility: The ability to draw down funds as needed allows businesses to respond quickly to changing market conditions.

- Working Capital Management: Provides a readily available source of funds to manage day-to-day operations and cover short-term expenses.

- Growth Opportunities: Allows businesses to invest in expansion, new product development, or other strategic initiatives.

- Reduced Cash Flow Stress: Provides a buffer against unexpected revenue declines or economic downturns.

Navigating the Agreement: Important Considerations

While a Revolving Credit Facility Agreement is a complex document, it’s important to understand key aspects to ensure a successful relationship with your lender. Here are some crucial considerations:

1. Due Diligence

Thorough due diligence is essential before signing the agreement. This involves reviewing the borrower’s financial statements, credit history, and business plan. A strong track record demonstrates a commitment to responsible borrowing.

2. Legal Counsel

It’s highly recommended to engage experienced legal counsel to review the agreement and advise you on its terms. A lawyer can help you understand your rights and obligations and identify potential risks.

3. Creditworthiness Assessment

Lenders will assess your creditworthiness before approving a RCF. Factors considered include your financial history, industry performance, and overall business stability. Maintaining a strong credit profile is key to securing favorable terms.

4. Communication and Transparency

Maintain open and honest communication with your lender throughout the agreement’s duration. Provide regular updates on your business performance and any significant changes to your operations.

Beyond the Basics: Advanced Considerations

For businesses seeking to optimize their Revolving Credit Facility, several advanced considerations warrant attention:

1. Guarantees

Depending on the risk profile of the borrower, a personal guarantee may be required. This means the borrower personally guarantees the debt, making them liable for repayment if the business defaults.

2. Collateral Enhancement

Consider adding collateral to the agreement to mitigate the lender’s risk. This could include assets like inventory, accounts receivable, or equipment.

3. Performance Metrics

Establish clear performance metrics to track the borrower’s progress and ensure they are meeting their obligations. Regular reporting and review of these metrics are essential.

Conclusion

The Revolving Credit Facility Agreement Template is a powerful tool for businesses seeking to access capital and manage their financial resources. By understanding the key components, benefits, and considerations involved, businesses can navigate this agreement effectively and establish a strong, mutually beneficial relationship with their lenders. A well-structured agreement, coupled with diligent due diligence and proactive communication, significantly increases the likelihood of a successful and sustainable financing arrangement. Revolving Credit Facility Agreement Template – a vital tool for modern business growth.