Navigating the future of your business can often feel like steering a ship in a thick fog. To make sound decisions and chart a successful course, you need reliable instruments that can help you see what lies ahead. For countless entrepreneurs, startups, and established companies, the most accessible and powerful of these instruments is a well-structured Business Forecast Spreadsheet Template. It serves as a financial compass, translating your strategic plans, market assumptions, and historical data into a clear and actionable projection of your company’s future performance.

A business forecast is more than just a guess about future sales; it’s a comprehensive financial model that predicts revenue, expenses, and profits over a specific period, typically one to three years. This predictive process is fundamental to strategic planning. It helps you set realistic goals, manage your resources effectively, allocate budgets wisely, and identify potential cash flow shortages before they become critical problems. Whether you’re pitching to investors, applying for a loan, or simply planning for sustainable growth, a solid forecast provides the data-driven foundation needed to build confidence and guide your strategy.

While sophisticated financial modeling software exists, many businesses find that the simplicity, flexibility, and cost-effectiveness of a spreadsheet template are ideal. Spreadsheets like Microsoft Excel or Google Sheets are universally available and highly customizable, allowing you to tailor the forecast to the unique variables of your industry and business model. You don’t need to be a financial wizard to get started. A good template provides the framework, formulas, and essential components, empowering you to focus on the assumptions and data that drive your business forward.

This article will serve as your comprehensive guide to understanding, utilizing, and mastering the business forecast. We will break down the essential components of a robust template, walk you through the process of creating your own forecast, and explore common pitfalls to avoid. By the end, you’ll have the knowledge and confidence to build a financial forecast that illuminates your path to success and transforms your business planning from guesswork into a strategic advantage.

What is a Business Forecast?

At its core, a business forecast is a projection of your company’s financial future. It uses historical data and informed assumptions to estimate key financial metrics like revenue, expenses, and cash flow. Think of it as a detailed financial story of where your business is headed. The primary purpose of this forecast is to facilitate informed decision-making. It’s a critical tool for everything from managing daily operations to crafting long-term strategy.

Business forecasting helps answer vital questions: Can we afford to hire new staff next quarter? Do we have enough cash to survive a seasonal downturn? Is our new product line projected to be profitable? By providing a glimpse into the future, it allows business owners and managers to be proactive rather than reactive. It’s essential for securing funding, as investors and lenders will almost always require a detailed financial forecast to assess the viability and potential return on investment of your venture.

It’s important to distinguish between a forecast and a budget. While they are related, they serve different purposes. A budget is a plan or a goal for what you want to happen—it outlines how you intend to allocate resources to achieve specific targets. A forecast, on the other hand, is a prediction of what you expect to happen based on data, trends, and assumptions. Your forecast informs your budget. For example, if your forecast predicts a 20% increase in sales, you might create a budget that allocates more funds to marketing and production to support that growth.

Key Components of a Comprehensive Business Forecast Spreadsheet Template

A powerful and effective business forecast isn’t just a single sheet of numbers. It’s an interconnected model composed of several key financial statements that work together to provide a holistic view of your business’s health. A well-designed template will include separate, linked tabs for each of these components.

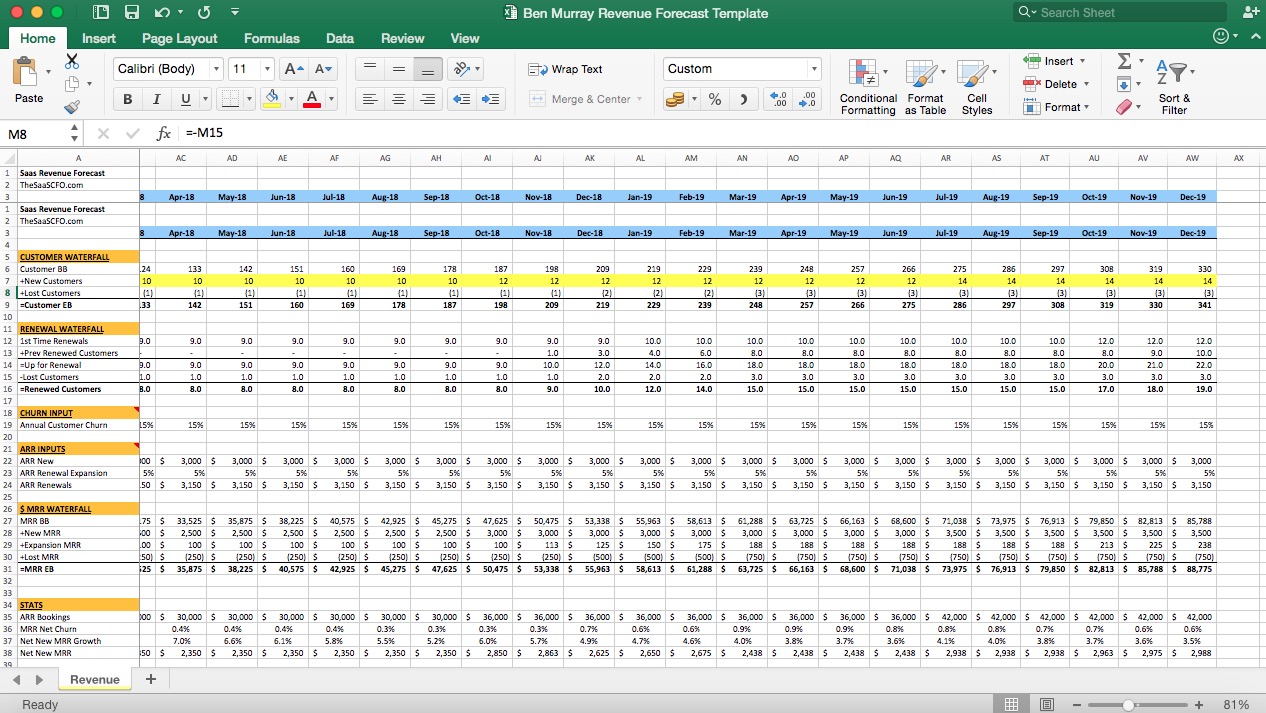

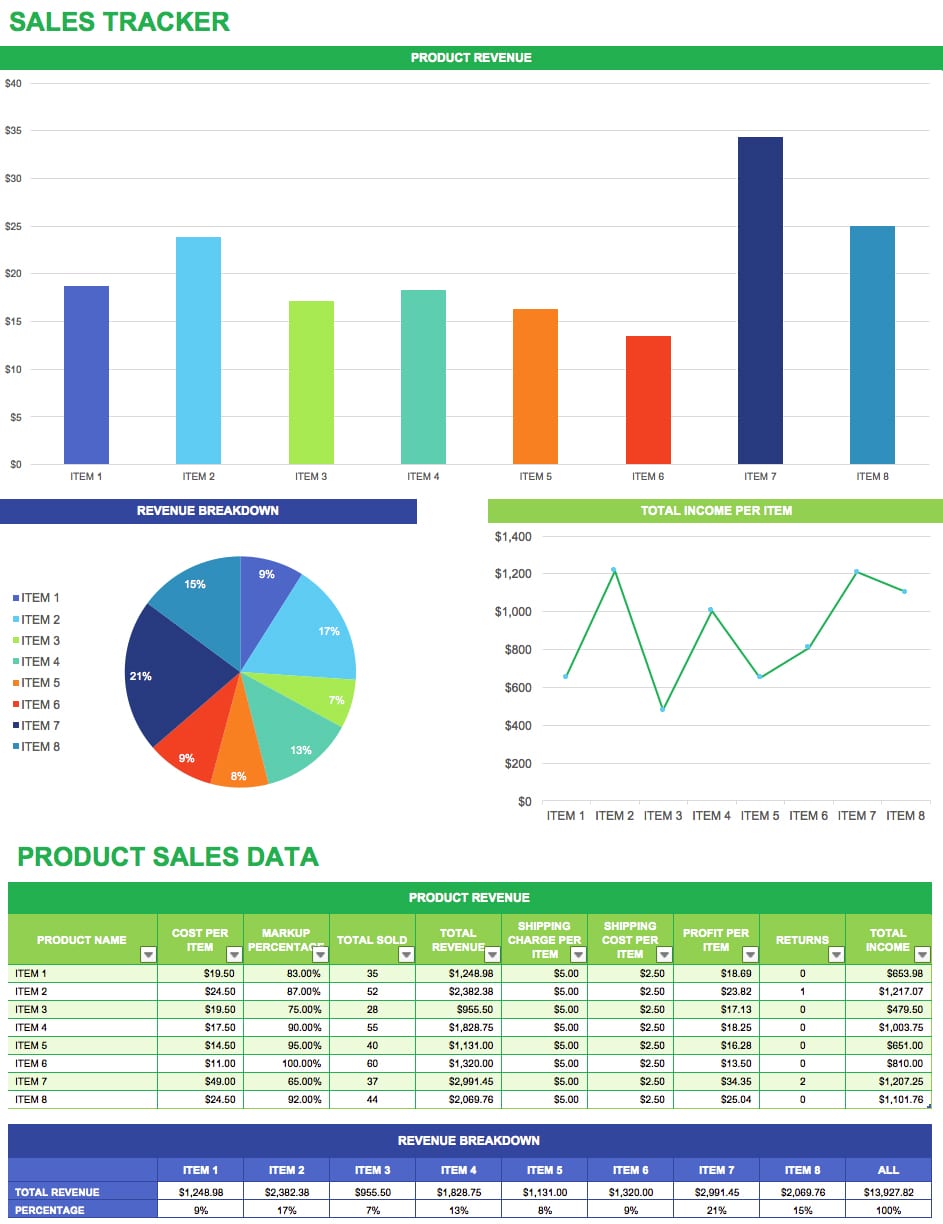

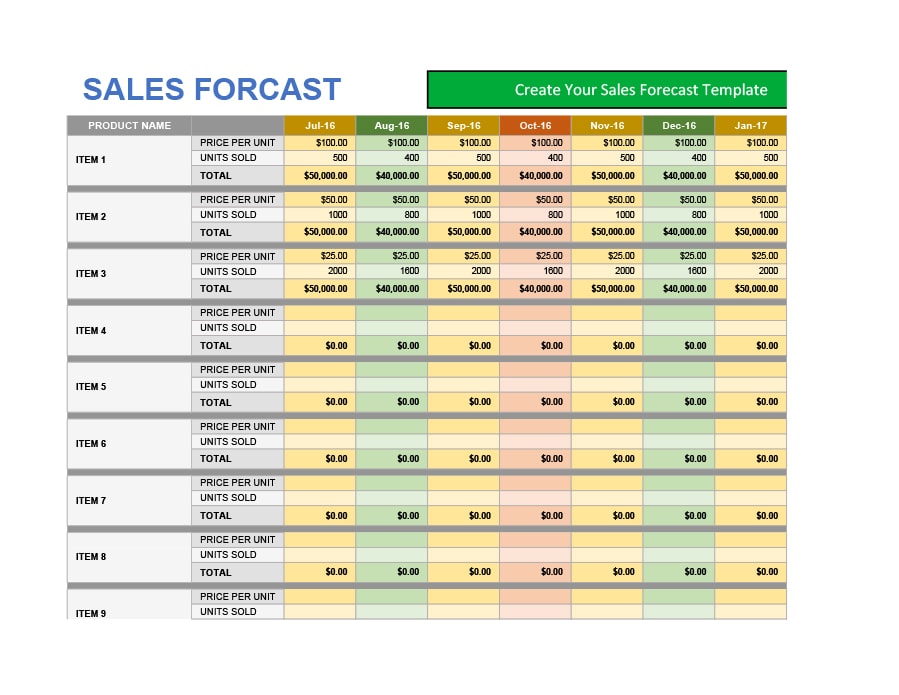

Sales Forecast

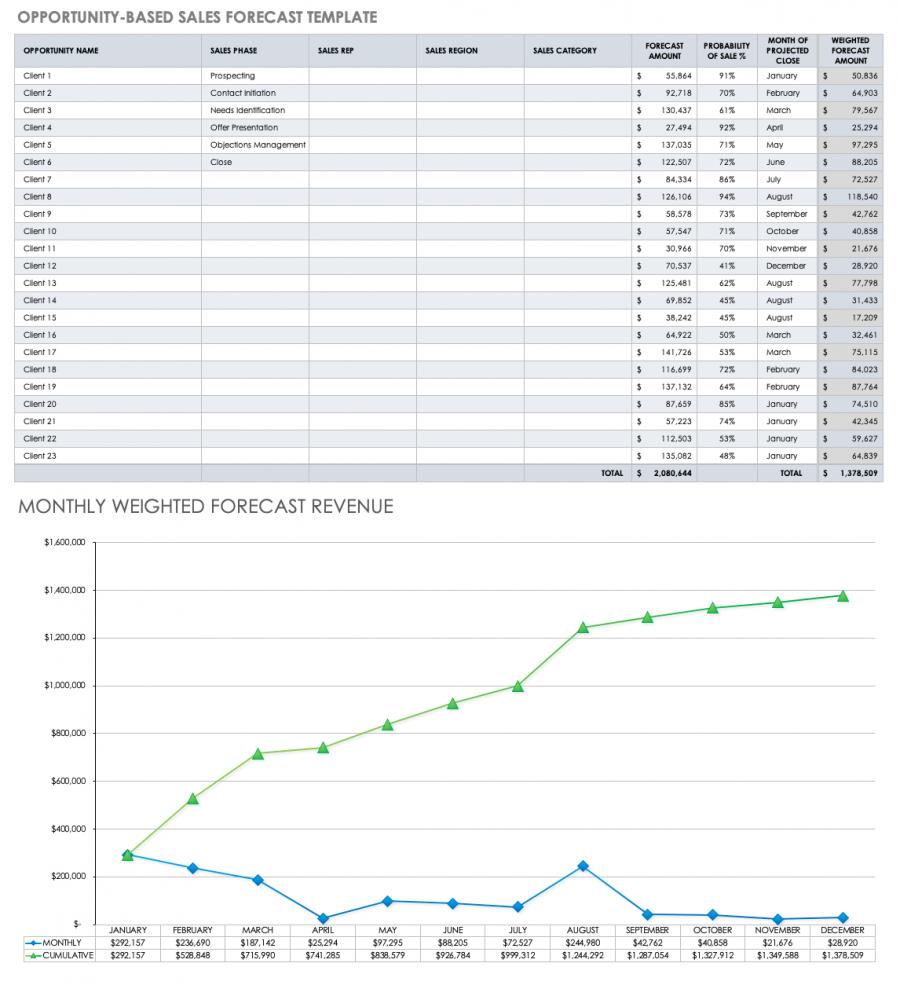

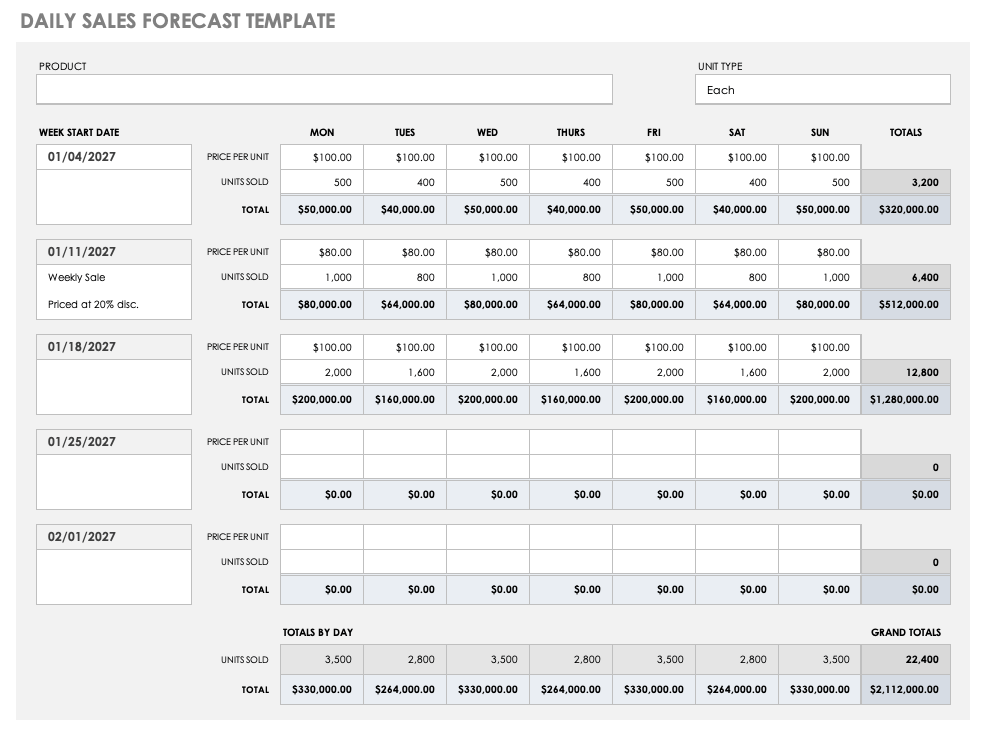

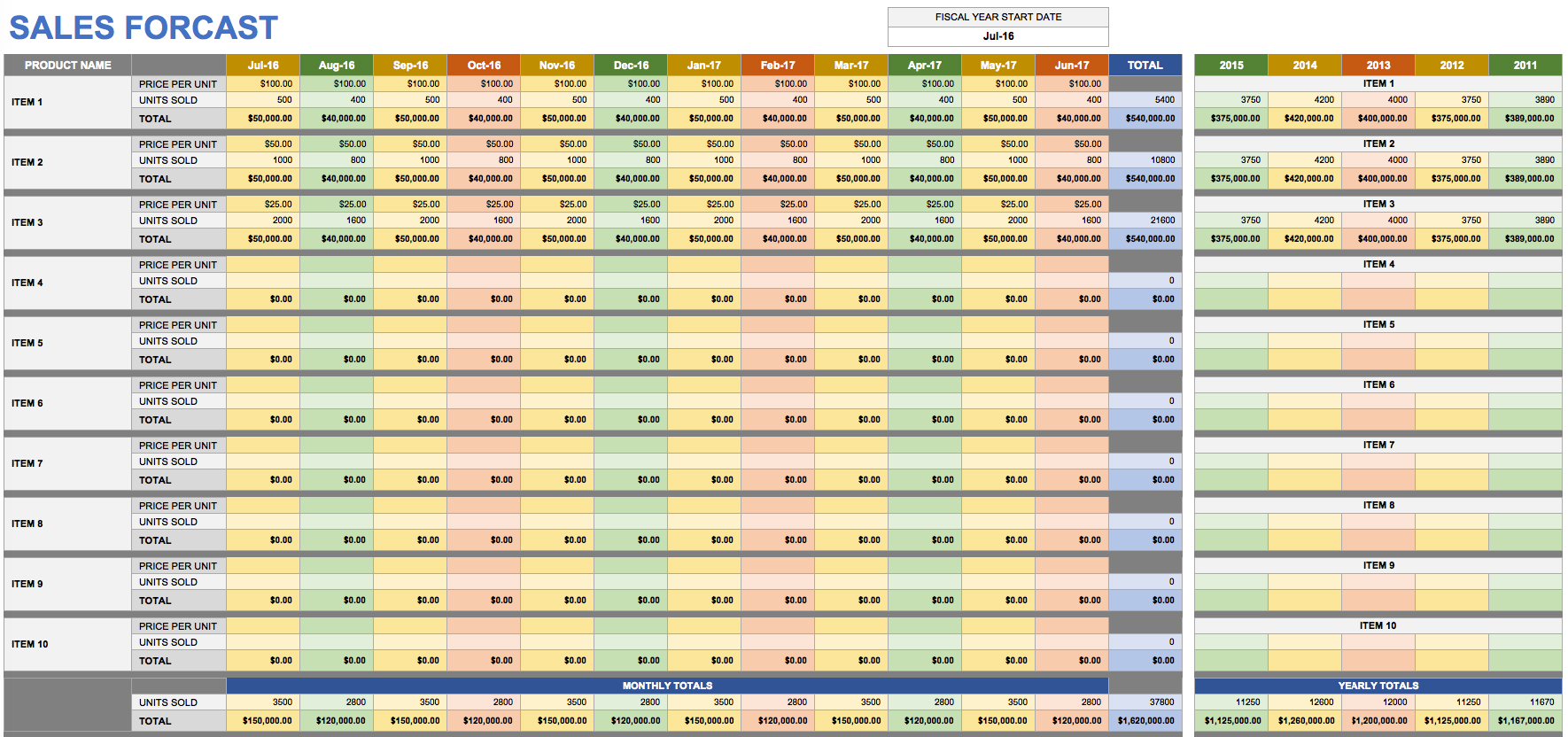

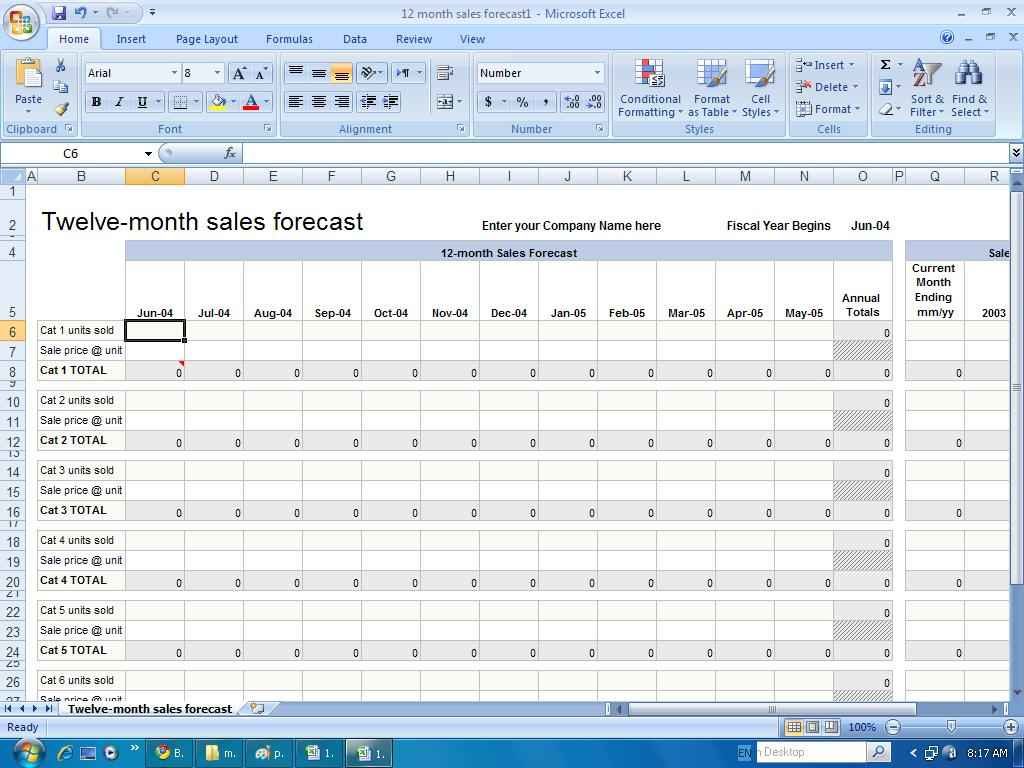

The sales forecast is the engine of your entire financial model. Almost every other projection, from expenses to cash flow, is driven by how much revenue you expect to generate. This section projects your sales over a defined period (e.g., monthly for the first year, then quarterly or annually).

To build this forecast, you’ll need to make assumptions based on factors like:

* Historical Sales Data: Your past performance is often the best indicator of future results.

* Market Trends: Is your industry growing or shrinking?

* Pricing Strategy: Are you planning to increase or decrease prices?

* Sales and Marketing Efforts: How will new campaigns or a larger sales team impact revenue?

* Seasonality: Do your sales fluctuate at certain times of the year?

Your template should allow you to input variables like the number of units sold, price per unit, or number of customers to calculate total revenue.

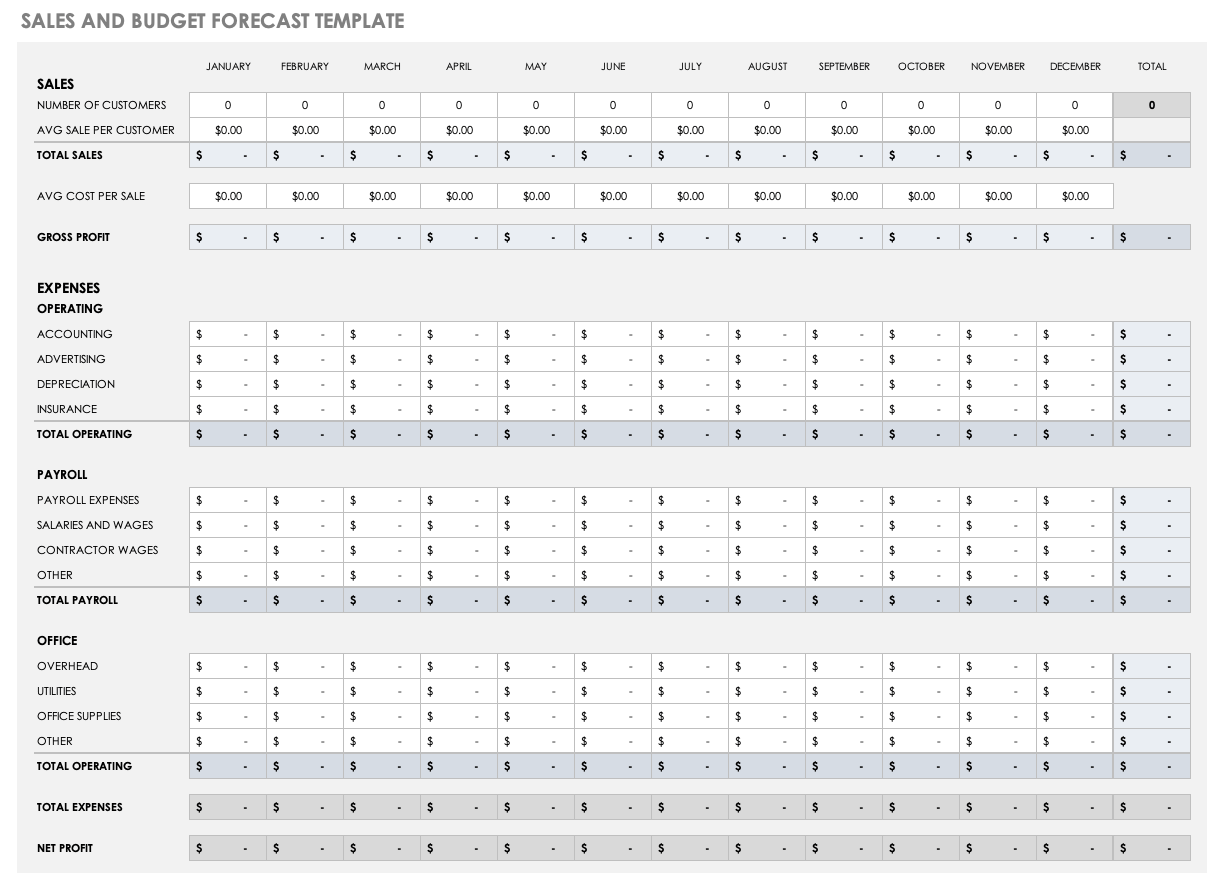

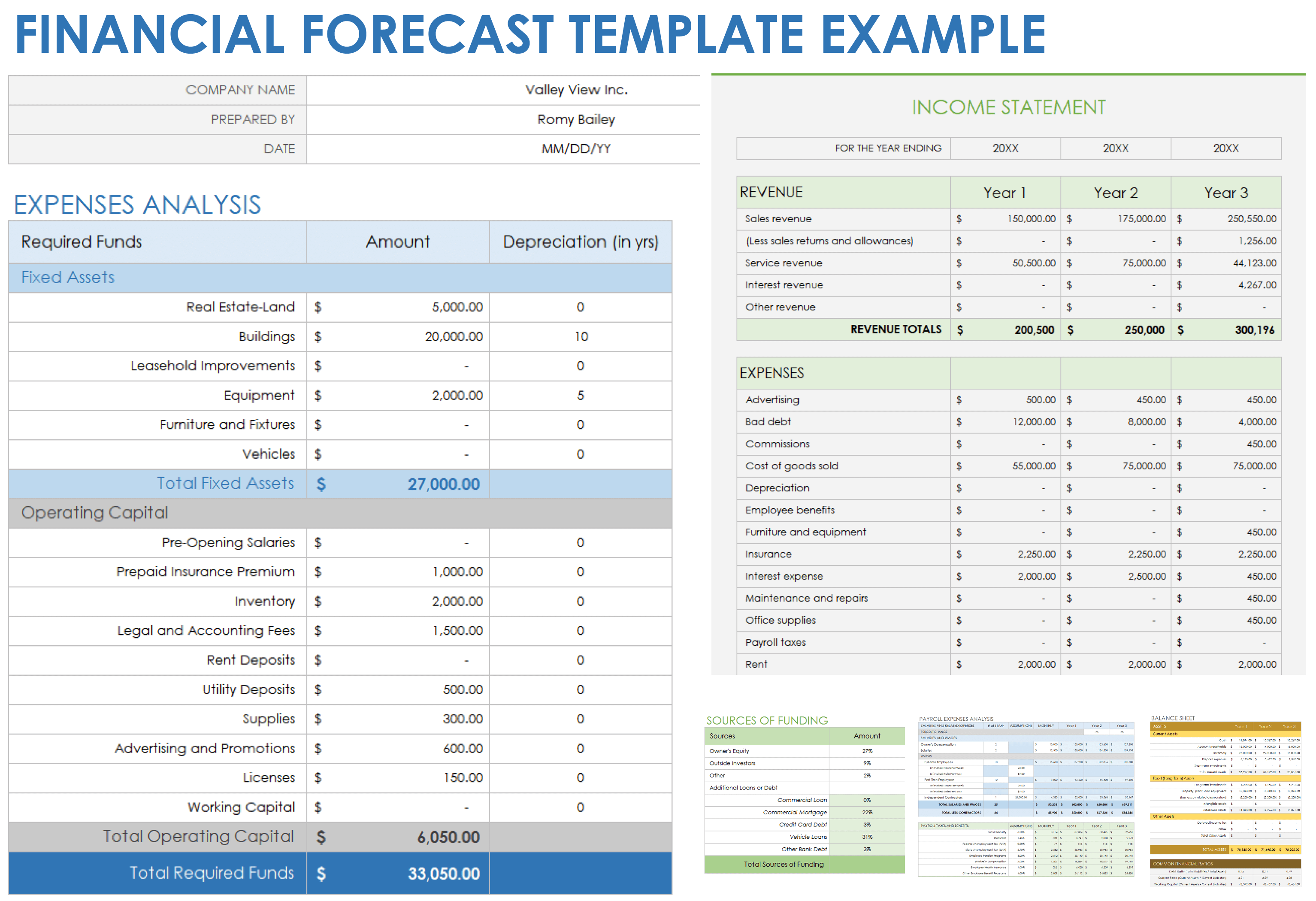

Expense Forecast (Cost of Goods Sold & Operating Expenses)

Once you’ve projected your revenue, you need to forecast the costs associated with generating it. Expenses are typically broken down into two main categories.

- Cost of Goods Sold (COGS): These are the direct costs of producing your goods or delivering your services. For a product-based business, this includes raw materials and direct labor. For a service business, it might be the salaries of front-line staff. COGS are variable costs, meaning they typically increase as your sales increase.

- Operating Expenses (OpEx): These are the indirect costs required to run the business, regardless of sales volume. Examples include rent, salaries for administrative staff, marketing, utilities, and software subscriptions. OpEx can include both fixed costs (like rent) and variable costs (like advertising spend).

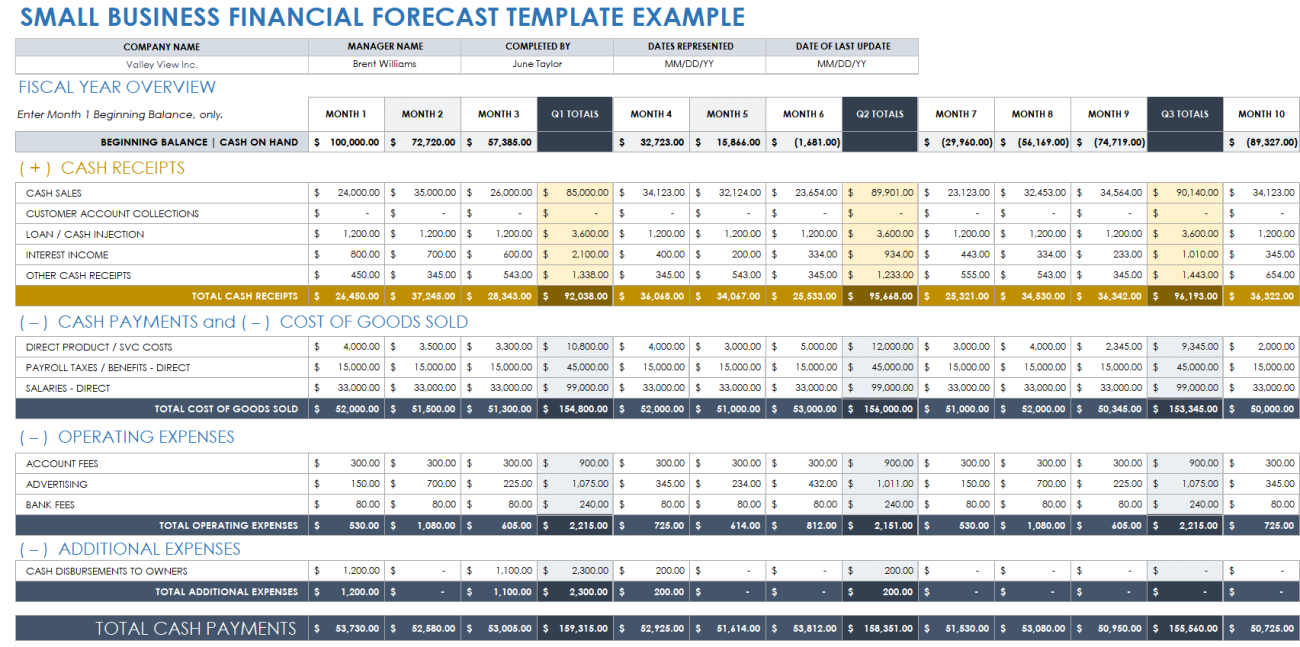

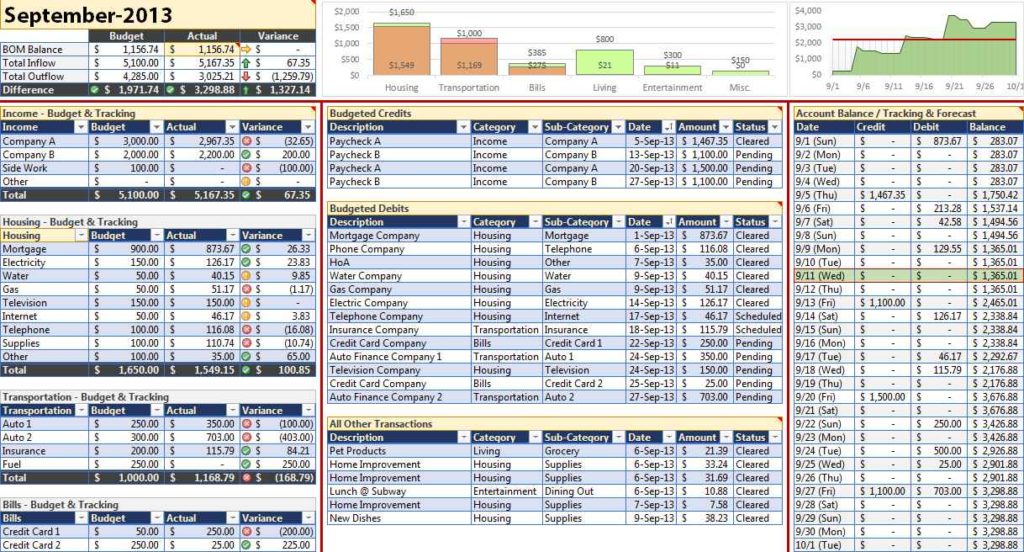

Cash Flow Forecast

Profitability doesn’t always equal liquidity. A business can be profitable on paper but fail due to a lack of cash. The cash flow forecast is arguably the most critical component for ensuring a business’s survival. It tracks the actual movement of cash into and out of your business on a monthly basis.

This forecast starts with your opening cash balance, adds all cash inflows (like cash from sales and loan proceeds), and subtracts all cash outflows (like paying for expenses, inventory, and loan repayments). The result is your closing cash balance for the period. This projection helps you anticipate cash shortages and plan accordingly, perhaps by securing a line of credit or adjusting payment terms with suppliers.

Profit and Loss (P&L) Statement

The Profit and Loss (P&L) Statement, also known as the Income Statement, summarizes your revenues, costs, and expenses over a specific period to show your company’s net profitability. The basic formula is: Revenue – COGS – Operating Expenses = Net Profit/Loss. The P&L statement provides a clear picture of whether your business model is sustainable and how efficiently you are operating. It’s a key document for internal analysis, tax purposes, and for external stakeholders like investors.

Balance Sheet Forecast

The Balance Sheet provides a snapshot of your company’s financial position at a single point in time. It follows the fundamental accounting equation: Assets = Liabilities + Equity.

* Assets: What your company owns (e.g., cash, inventory, equipment).

* Liabilities: What your company owes (e.g., loans, accounts payable).

* Equity: The net worth of the company (what’s left after subtracting liabilities from assets).

Forecasting the balance sheet is more advanced but is crucial for understanding the long-term financial structure and health of your business.

How to Use and Customize Your Spreadsheet Template

A template is just a starting point. The real value comes from tailoring it to your business and populating it with well-reasoned assumptions. Here’s a step-by-step approach to using your forecast template effectively.

Step 1: Gather Your Historical Data

If you’re an existing business, your most valuable resource is your own history. Collect at least 12-24 months of financial data, including past P&L statements, sales records by month, and lists of expenses. This data will serve as the baseline for your projections and help you identify patterns, growth rates, and seasonality. For startups with no historical data, you’ll need to rely on market research, industry benchmarks, and competitor analysis.

Step 2: Make Your Assumptions

This is the most critical and challenging part of forecasting. Your forecast is only as good as the assumptions that underpin it. Create a dedicated tab in your spreadsheet to list and explain every single assumption you make. This transparency is crucial for understanding the forecast and for easily updating it later.

Examples of key assumptions include:

* Sales growth rate (e.g., “We project a 5% month-over-month growth for the first year based on our new marketing strategy.”)

* Average price per product or customer.

* COGS as a percentage of revenue.

* Monthly fixed costs (rent, salaries).

* Customer churn rate.

* Inflation rate for expenses.

Step 3: Input Data into the Template

Begin by entering your assumptions into the designated cells. A good template will use these assumption cells to drive calculations throughout the model. This means if you want to change your projected growth rate, you only need to update it in one place, and the entire forecast will adjust automatically. Proceed to fill in the sales forecast, followed by the expense forecast. The P&L, cash flow, and balance sheet sections should populate automatically based on the data and formulas from the previous sheets.

Step 4: Analyze the Results and Perform Scenario Analysis

Once your forecast is complete, it’s time for analysis. Does the projected profit meet your goals? Is there a point where cash flow dips into negative territory? The initial numbers are your “base case” or “most likely” scenario.

The real power of a spreadsheet model is the ability to perform scenario analysis. Easily create and compare different versions of your forecast:

* Best-Case Scenario: What if your marketing campaign is a runaway success and sales grow 50% faster than expected?

* Worst-Case Scenario: What if a new competitor enters the market and your sales decline by 20%?

* Most-Likely Scenario: Your realistic projection based on the most probable assumptions.

By modeling these different outcomes, you can better understand your business’s risks and opportunities and develop contingency plans.

Types of Business Forecasting Models

Forecasting isn’t a one-size-fits-all process. The method you choose will depend on your business stage, the data you have available, and the nature of your industry. These models can be implemented within your spreadsheet.

Qualitative Forecasting

This approach is subjective and relies on expert opinion and judgment rather than hard numbers. It’s often used when historical data is scarce or irrelevant, such as for a startup launching a completely new product. Techniques include market research, customer surveys, and the Delphi method, which involves gathering and refining forecasts from a panel of experts.

Quantitative Forecasting

This approach uses historical numerical data to predict the future. It assumes that past patterns will continue. This is the most common method for established businesses. Quantitative models can range from simple to complex:

* Time Series Analysis: This method looks at your past data to identify trends and patterns. Simple techniques include using a moving average to smooth out fluctuations or calculating a straight-line growth rate.

* Causal Modeling: This more advanced method attempts to identify cause-and-effect relationships between variables. For example, regression analysis could be used to determine how much your advertising spend (the cause) impacts your sales (the effect).

Choosing the Right Model

Most businesses benefit from a hybrid approach. You might use a quantitative model based on historical sales data as your baseline, then apply qualitative judgment to adjust the forecast for an upcoming product launch or a planned marketing push. The key is to choose a method that is appropriate for your situation and that you can clearly explain and justify.

Benefits of Using a Pre-Built Template

While you could build a forecast from a blank spreadsheet, using a pre-built template offers significant advantages, especially for those who aren’t financial modeling experts.

- Time and Cost Efficiency: Building a linked, three-statement financial model from scratch is complex and time-consuming. A template provides a professionally designed structure instantly, saving you dozens of hours and the potential cost of hiring a consultant.

- Structure and Best Practices: A quality template is built following accounting principles and best practices. It ensures you don’t miss any crucial components, like the cash flow statement, and that all the financial statements correctly link together.

- Customization and Flexibility: Good templates are designed to be flexible. You can easily add or remove line items, adjust timeframes, and tailor the assumptions to perfectly match your business model.

- Improved Decision-Making: By presenting your financial future in a clear, organized format, a template helps you spot trends, identify risks, and make strategic decisions with greater confidence.

Common Pitfalls to Avoid When Forecasting

Creating a forecast is both an art and a science. Avoiding these common mistakes will make your projections more reliable and useful.

- Overly Optimistic Projections: It’s easy to fall in love with a “hockey stick” growth curve, but investors and lenders are wary of unrealistic forecasts. Be realistic and base your projections on justifiable assumptions. It’s better to be conservative and exceed your forecast than to be wildly optimistic and miss it.

- Ignoring Seasonality and Market Trends: Many businesses have seasonal peaks and valleys. Failing to account for these can lead to serious cash flow miscalculations. Similarly, ignoring broader economic or industry trends can render your forecast irrelevant.

- Forgetting to Track Cash Flow: Focusing solely on the P&L statement is a classic mistake. Profit does not equal cash in the bank. Always build and monitor a detailed monthly cash flow forecast to manage your liquidity.

- “Set It and Forget It” Mentality: A business forecast is not a static document. It is a living tool that should be reviewed and updated regularly—at least monthly or quarterly. As you get actual results, compare them to your forecast (a process called variance analysis) and adjust your future projections accordingly.

- Poor Assumption Management: The most common point of failure is not clearly documenting the “why” behind your numbers. Without a clear list of assumptions, your forecast is just a collection of meaningless figures that cannot be easily updated or defended.

Conclusion

In the dynamic and often uncertain world of business, a financial forecast is an indispensable tool for navigation. It provides the clarity needed to set strategic direction, allocate resources effectively, and anticipate challenges before they arise. By translating your vision into a concrete financial plan, a forecast moves your business from a position of hope to one of deliberate, data-informed action.

Using a well-structured Business Forecast Spreadsheet Template demystifies this process, making it accessible to any business owner, regardless of their financial background. It provides the framework to systematically think through your revenue drivers, cost structure, and cash needs. The real power of the exercise lies not just in the final numbers, but in the strategic thinking it forces you to undertake.

Remember that a forecast is a living document. Embrace the process of building, analyzing, and regularly updating it. By doing so, you will not only gain a deeper understanding of the financial mechanics of your business but also build the confidence to make the bold, strategic decisions necessary to achieve sustainable growth and long-term success.

]]>