Gaining control over your company’s finances is the cornerstone of sustainable growth and long-term success. For many entrepreneurs and small business owners, the task of creating a comprehensive financial plan from scratch can feel overwhelming, often leading to procrastination or incomplete efforts. This is where a well-structured framework becomes invaluable, and using Business Budgets Templates provides the perfect starting point to demystify the process, organize your numbers, and create a clear roadmap for your financial future. These templates act as pre-built blueprints, guiding you through the essential components of a budget without requiring an advanced degree in accounting.

A business budget is far more than just a list of expenses and income; it is a strategic tool that translates your company’s goals into a quantifiable plan. It allows you to anticipate challenges, allocate resources effectively, and make informed decisions with confidence. Whether you’re planning a major marketing campaign, considering hiring new staff, or simply trying to improve your profit margins, your budget serves as the primary reference point. Without this financial guide, a business is essentially navigating blind, vulnerable to unexpected costs, cash flow shortages, and missed opportunities.

By leveraging a template, you can bypass the initial hurdle of figuring out what to include and how to structure it. Instead, you can focus your energy on the numbers themselves—gathering historical data, forecasting future sales, and analyzing your spending patterns. This article will explore the critical role of budgeting, highlight the advantages of using templates, and break down the different types available for various business needs. We will also cover what to look for in a quality template and how to customize it to perfectly fit your unique business operations, ultimately empowering you to take command of your financial destiny.

Why Every Business Needs a Budget

A budget is the financial heartbeat of any organization, regardless of its size or industry. It provides the clarity and structure necessary to operate efficiently and plan for the future. Many businesses that fail do so not because of a bad product, but because of poor financial management. Implementing a robust budget is the first and most critical step in avoiding that fate.

Financial Control and Visibility

At its core, a budget offers a transparent view of your company’s financial health. It forces you to track every dollar that comes in and every dollar that goes out. This process illuminates where your money is actually going, often revealing surprising or wasteful spending habits that can be corrected. This financial visibility is crucial for maintaining positive cash flow, preventing debt accumulation, and ensuring you have enough capital to cover operational costs. It moves you from a reactive state of paying bills as they arrive to a proactive state of planning for them in advance.

Strategic Planning and Goal Setting

Your business goals, whether they involve launching a new product line, expanding to a new location, or increasing market share, are directly tied to your financial resources. A budget serves as the bridge between your ambitions and reality. It allows you to set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. For example, if you want to increase revenue by 20% next year, your budget will help you determine the marketing spend, staffing, and inventory levels required to support that growth. It becomes a performance benchmark, allowing you to track your progress against your goals on a monthly or quarterly basis.

Securing Funding

If you ever plan to seek external funding from investors, apply for a bank loan, or attract partners, a detailed and realistic budget is non-negotiable. Lenders and investors need to see that you have a firm grasp of your company’s finances and a viable plan for profitability. A well-prepared budget, along with financial projections, demonstrates fiscal responsibility and a strategic approach to business management. It shows that you have done your homework and that their potential investment will be managed wisely.

Improved Decision-Making

Every day, business owners make decisions that have financial implications. Should you hire a new employee? Is it time to invest in new equipment? Can you afford to offer a discount to attract new customers? A budget provides the data needed to answer these questions intelligently. By comparing the potential cost of a decision against your projected income and available cash, you can evaluate its affordability and potential return on investment (ROI). This data-driven approach minimizes guesswork and reduces the risk of making costly mistakes.

The Power of Using Business Budgets Templates

While you can create a budget from a blank spreadsheet, starting with a template offers a significant advantage. It provides a structured, professional framework that streamlines the entire process, making it more accessible and less prone to errors, especially for those who aren’t financial experts.

Save Time and Effort

The most immediate benefit of using a template is the immense amount of time saved. Designing a comprehensive budget spreadsheet from scratch involves creating categories, setting up rows and columns, and programming formulas to perform calculations. Business Budgets Templates come with all this foundational work already done. The structure is in place, the expense and income categories are suggested, and the formulas for totals, variances, and percentages are often pre-built. This allows you to dive straight into inputting your numbers and analyzing the results, rather than getting bogged down in the mechanics of spreadsheet design.

Ensure Accuracy and Reduce Errors

Manual data entry and formula creation in a complex spreadsheet can easily lead to errors. A simple mistake, like a misplaced decimal or an incorrect cell reference in a formula, can have a cascading effect that distorts your entire financial picture. Professionally designed templates are typically tested and vetted to ensure their formulas are accurate. By using a reliable template, you significantly reduce the risk of calculation errors, leading to a more trustworthy and dependable budget.

Provide a Professional Structure

Templates are built based on established accounting principles and best practices. They provide a standardized layout that is logical, easy to read, and comprehensive. This professional structure is not only beneficial for your internal analysis but is also ideal for sharing with external stakeholders. When presenting your financial plan to a bank, investor, or board member, a clean, well-organized budget created from a proven template conveys a sense of professionalism and competence.

Scalability and Customization

A common misconception is that templates are rigid and one-size-fits-all. In reality, the best templates are designed to be both scalable and highly customizable. As your business grows, your budgeting needs will become more complex. A good template can be easily adapted by adding new income streams, expense categories, or even entire departments. You can tailor it to match your specific industry and business model, ensuring it remains a relevant and useful tool as your company evolves.

Key Types of Business Budgets Templates to Consider

Businesses have different needs at different stages, and a variety of budget templates are available to address these specific requirements. Choosing the right type of template is the first step toward creating a meaningful financial plan.

Startup Budget Template

For new businesses, the financial landscape is focused on initial setup costs and surviving the early months. A startup budget template is specifically designed for this phase. It includes sections for one-time startup expenses like business registration fees, legal costs, equipment purchases, and security deposits. It also helps you forecast your initial operating expenses (like rent and marketing) and estimate your revenue before you have any historical data to rely on. This template is essential for determining how much seed capital you need to launch and sustain the business until it becomes profitable.

Operating Budget Template

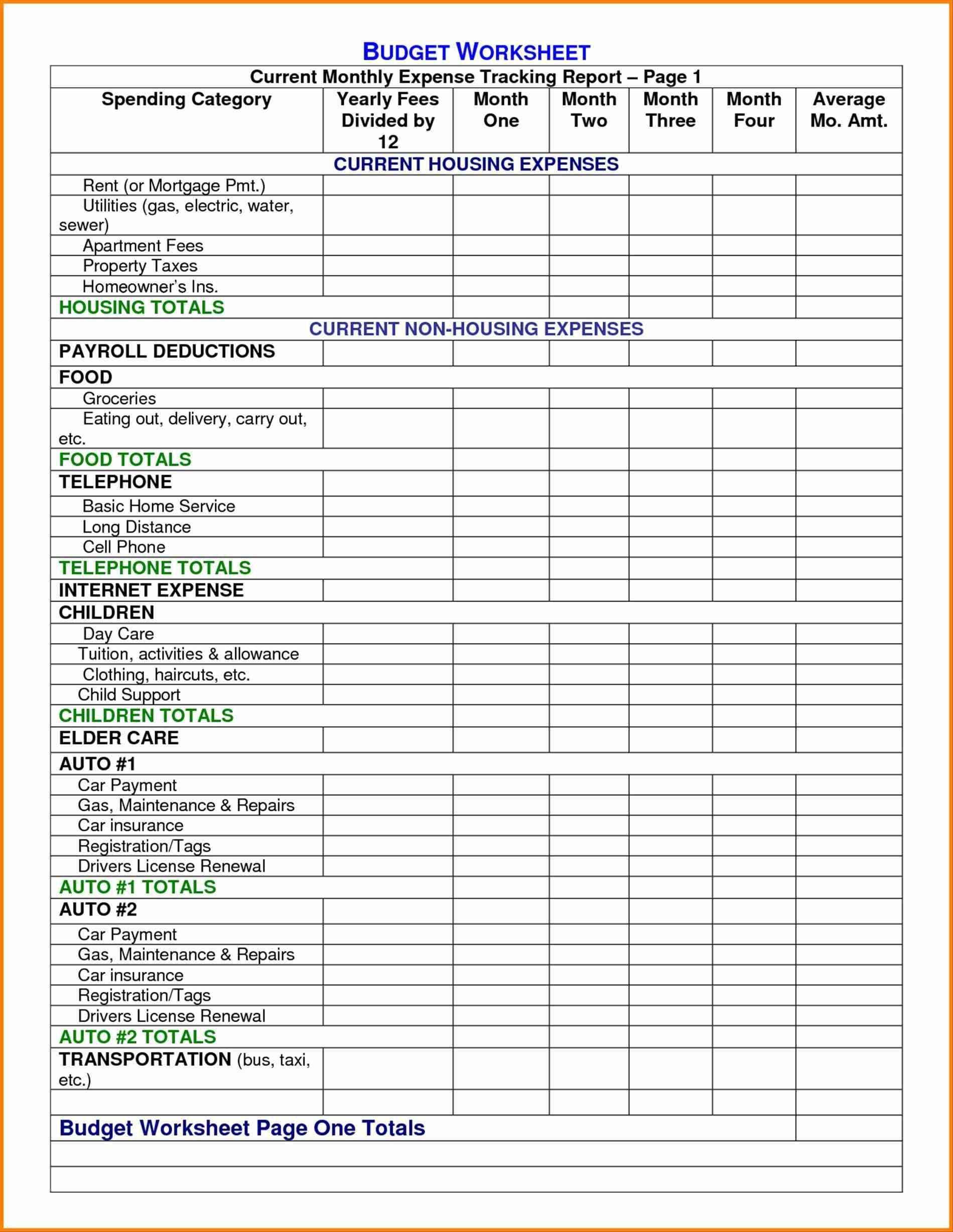

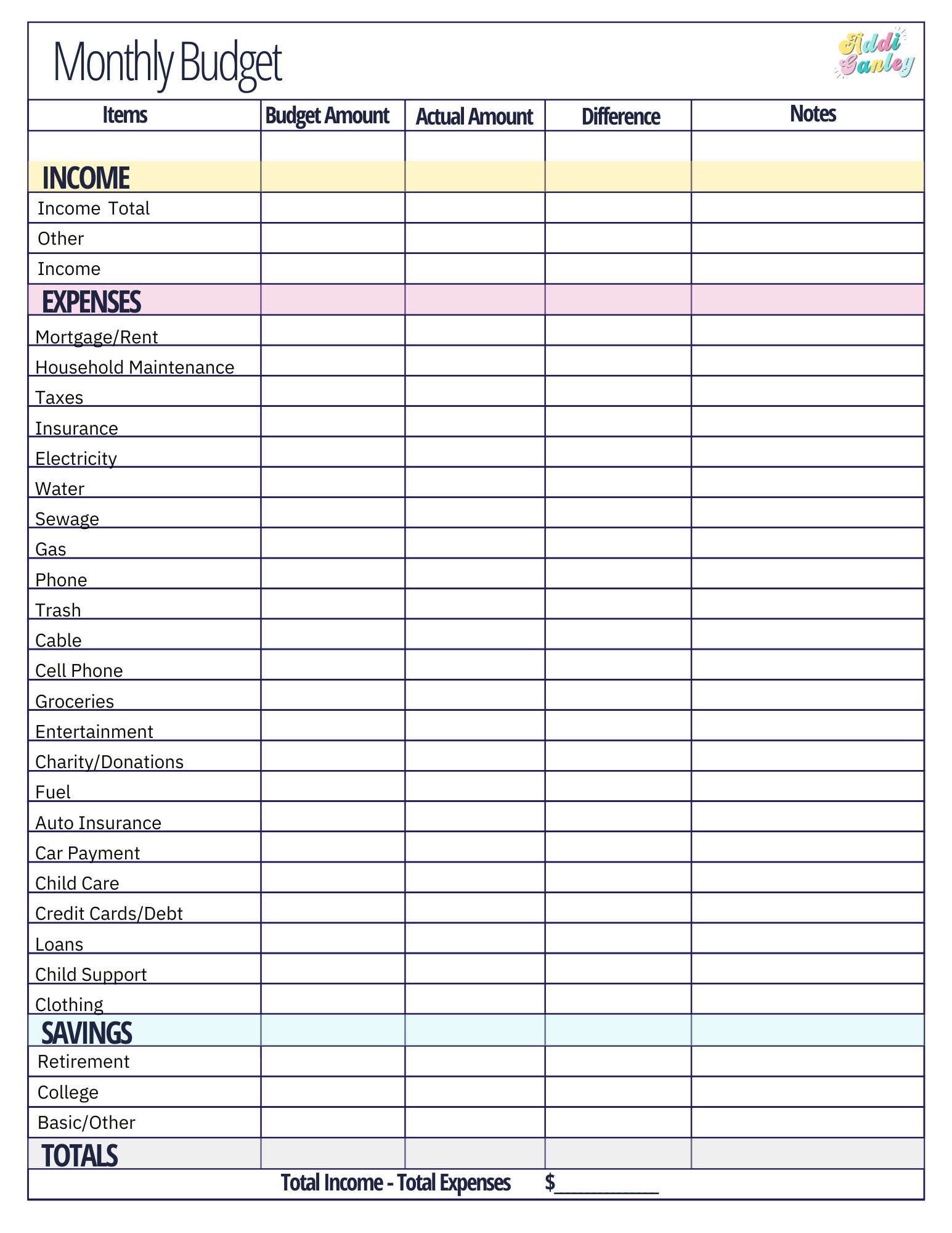

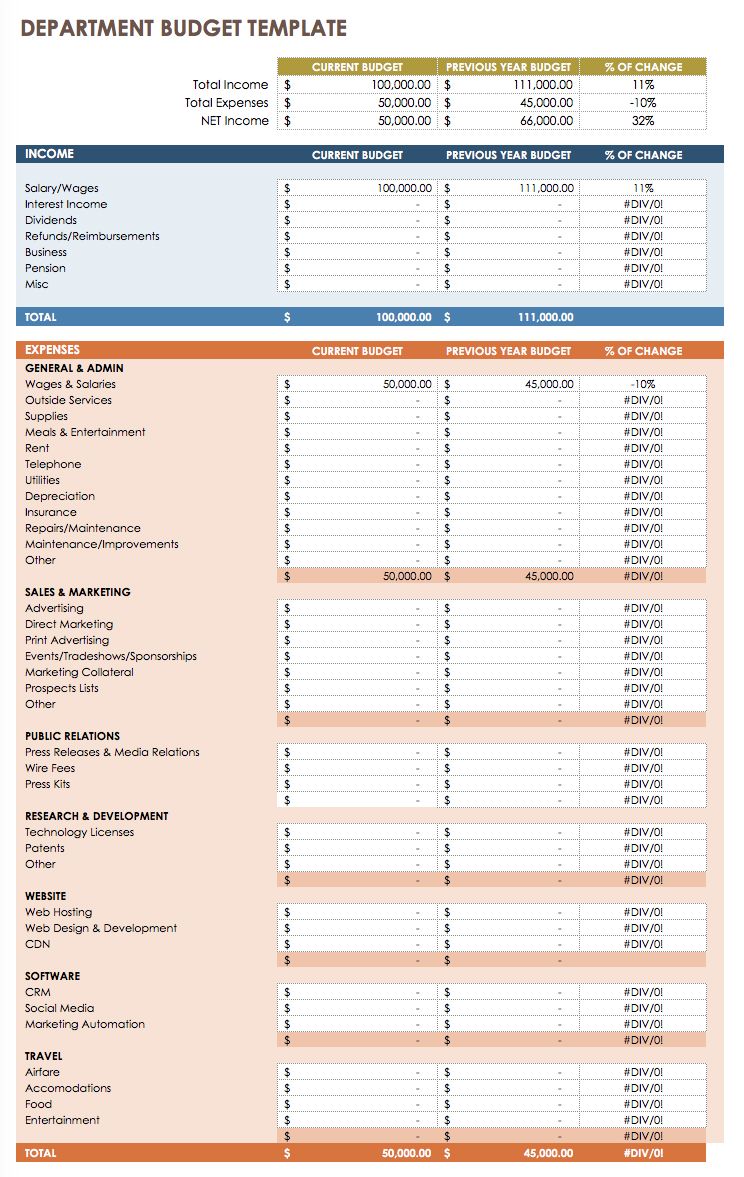

This is the most common and fundamental type of budget for any ongoing business. An operating budget template details the projected revenue and expenses over a specific period, typically a year, broken down by month or quarter. It covers all the costs associated with your day-to-day business operations, including salaries, rent, utilities, supplies, and marketing. This budget is your primary tool for managing daily finances, monitoring performance against targets, and controlling costs.

Cash Flow Budget Template

Profitability and cash flow are not the same thing. A business can be profitable on paper but fail if it runs out of cash to pay its bills. A cash flow budget template is designed to track the actual movement of cash into and out of your business. It focuses on when revenue is actually collected and when expenses are actually paid. This is particularly crucial for businesses with seasonal sales cycles or those that deal with long payment terms from clients. This template helps you anticipate cash shortages and surpluses, ensuring you always have the liquidity to meet your obligations.

Marketing Budget Template

Marketing is a critical driver of growth, but its costs can quickly spiral out of control without a clear plan. A marketing budget template helps you allocate funds across various marketing channels and activities, such as digital advertising, content creation, social media management, SEO, and events. By tracking your spending in each area and comparing it to the results (leads, conversions, sales), this template enables you to calculate the ROI of your marketing efforts and make smarter decisions about where to invest your marketing dollars.

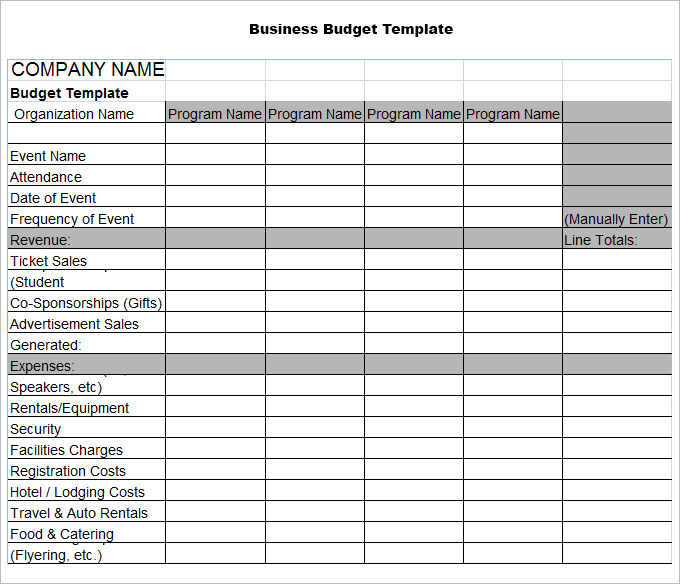

Project Budget Template

When your business takes on a specific, time-bound project, such as developing a new software application, building a website, or executing a construction job, a project budget template is essential. It isolates all the revenue and costs associated with that single project. This includes labor, materials, subcontractor fees, and other direct costs. Using a project budget helps you ensure the project remains profitable and is completed within its financial constraints.

What to Look for in a High-Quality Template

With countless templates available online, it’s important to know how to select one that is truly effective and user-friendly. A great template should do more than just hold numbers; it should help you gain insights from them.

Clarity and Simplicity

The primary goal of a budget is to provide clarity, so the template itself should be clear and simple. Look for a layout that is intuitive and easy to navigate. The labels should be self-explanatory, and the overall structure should be logical. You shouldn’t need an accounting degree to understand how to use it. A complicated or cluttered template can create more confusion than it solves.

Comprehensive Categories

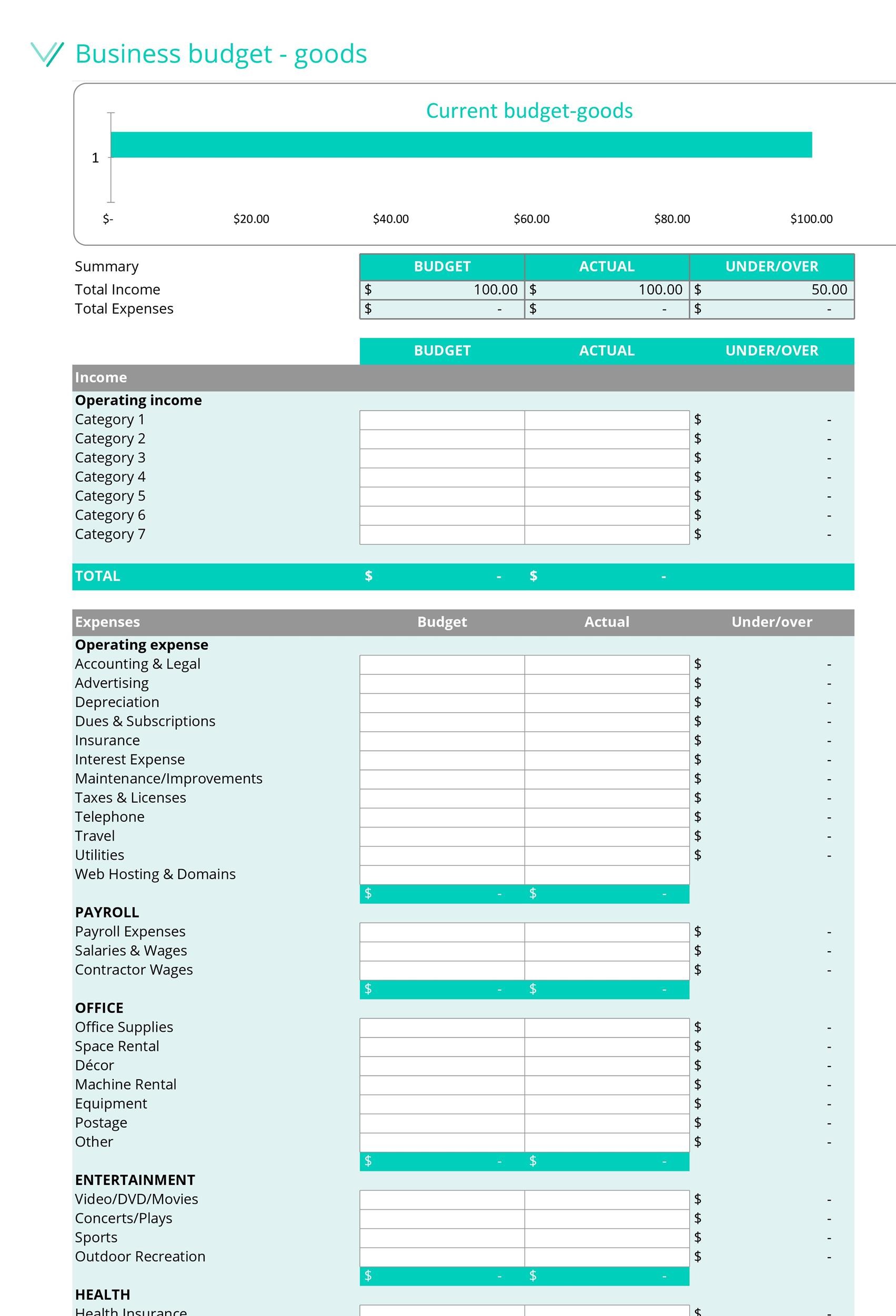

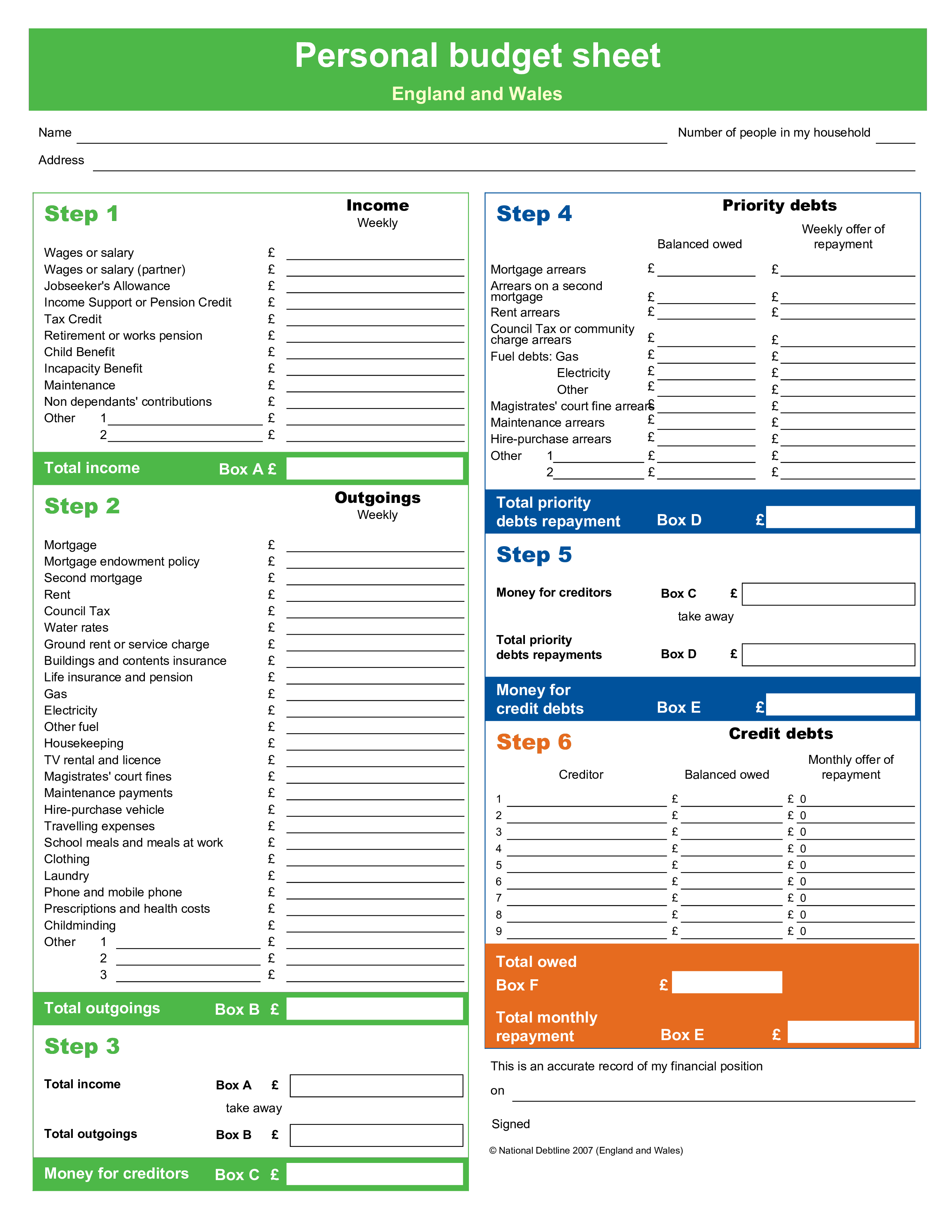

A good template will come with a comprehensive list of potential income and expense categories relevant to most businesses. It should differentiate between key financial concepts, such as fixed costs (e.g., rent, insurance, salaries) that remain constant each month, and variable costs (e.g., raw materials, shipping, sales commissions) that fluctuate with your level of business activity. Most importantly, the template should be easily customizable, allowing you to add, remove, or rename categories to perfectly match your business model.

Automation and Formulas

The real power of a spreadsheet template lies in its ability to automate calculations. A high-quality template should have pre-built formulas that automatically sum up your totals, calculate the difference (variance) between your budgeted and actual figures, and express these variances as percentages. This automation not only saves time but also prevents manual calculation errors, ensuring your data is reliable.

Visual Elements

Numbers in a spreadsheet can be hard to interpret at a glance. Templates that include visual elements like charts and graphs are incredibly valuable. A pie chart can show your expense breakdown, while a bar chart can compare budgeted vs. actual revenue over time. These visualizations make it much easier to spot trends, identify outliers, and present your financial story to others in a compelling and easily digestible format.

Compatibility

Finally, ensure the template is compatible with the software you use. The most common formats are for Microsoft Excel and Google Sheets. A Google Sheets template offers the advantage of being cloud-based, making it easy to access from anywhere and collaborate on with team members. An Excel template might be preferable if you need more advanced features or prefer to work offline. Check the file format before you download to ensure it will work for you.

How to Customize and Use Your Budget Template Effectively

Once you’ve selected a template, the next step is to make it your own and integrate it into your regular business operations. A budget is not a one-time task but a continuous process of planning, tracking, and adjusting.

Step 1: Gather Your Financial Data

Before you can fill in the template, you need to collect all the necessary financial information. This includes historical data, which is the best predictor of future performance. Gather your past income statements, bank statements, sales records, payroll reports, and receipts for major expenses. If you’re a new business, you’ll need to rely on market research and quotes from suppliers to estimate your costs.

Step 2: Estimate Your Revenue

Forecasting revenue is often the most challenging part of budgeting. Be realistic and use a combination of methods. Analyze past sales data to identify trends or seasonal patterns. Look at your current sales pipeline and consider any new contracts or clients. Research industry trends and your market position. It’s often wise to create three scenarios: a conservative (worst-case) forecast, a realistic (most likely) forecast, and an optimistic (best-case) forecast.

Step 3: List Your Fixed and Variable Costs

Go through your financial records and list all of your anticipated expenses, categorizing them as either fixed or variable. Fixed costs are expenses that do not change regardless of your sales volume, such as rent, insurance premiums, software subscriptions, and salaried employee wages. Variable costs are directly tied to your sales volume, such as the cost of goods sold (COGS), shipping fees, and sales commissions. Accurately identifying and categorizing these costs is fundamental to understanding your break-even point and profitability.

Step 4: Review and Revise Regularly

A budget is a living document, not a static one that you create in January and forget about until December. The most critical step in effective budgeting is to conduct regular reviews. At the end of each month or quarter, sit down and enter your actual income and expense figures into the template alongside your budgeted figures. Analyze the variances. Did you spend more on marketing than planned? Was your revenue lower than forecasted? Understanding why these differences occurred allows you to make timely adjustments to your strategy and update your forecast for the coming months.

Common Budgeting Pitfalls and How to Avoid Them

Creating a budget is a powerful step, but several common mistakes can undermine its effectiveness. Being aware of these pitfalls can help you create a more realistic and useful financial tool.

Being Too Optimistic

It’s natural for entrepreneurs to be optimistic, but letting that optimism cloud your financial projections is a recipe for disaster. Overestimating revenue and underestimating expenses can lead to a severe cash crunch. To avoid this, base your forecasts on solid data and be conservative in your estimates. It’s also wise to build a contingency fund into your budget—typically 5-10% of your total expenses—to cover unexpected costs or revenue shortfalls.

Setting It and Forgetting It

The “set it and forget it” approach renders a budget useless. The real value comes from the ongoing process of comparing your actual results to your plan. If you don’t regularly monitor your performance, you won’t be able to identify problems early or capitalize on opportunities. Schedule a recurring time in your calendar each month dedicated to reviewing and updating your budget.

Not Involving Your Team

If you have employees or department heads, involving them in the budgeting process can lead to a more accurate and effective plan. Your department managers have a ground-level view of their team’s needs and potential expenses. Getting their input not only improves the accuracy of the budget but also fosters a sense of ownership and accountability, encouraging them to manage their own departmental spending responsibly.

Confusing Cash Flow with Profit

One of the most dangerous financial misunderstandings is the difference between profit and cash flow. Your income statement might show a healthy profit, but if your clients take 90 days to pay their invoices, you could run out of cash to pay your rent and employees. Always use a cash flow budget alongside your operating budget to ensure you are managing your liquid assets effectively. This provides a true picture of the cash available to run your business day-to-day.

Conclusion

Mastering your business’s finances is not an optional task; it is an essential discipline for survival and growth. A budget is your most powerful tool in this endeavor, providing the clarity, control, and foresight needed to navigate the complexities of the market. It transforms abstract goals into an actionable financial plan, guiding your decisions and keeping your company on a path to stability and prosperity.

The perceived difficulty of creating a budget from scratch should never be a barrier to financial planning. By utilizing Business Budgets Templates, you can dramatically simplify the process, save valuable time, and reduce the likelihood of costly errors. These templates provide a professional, structured foundation that you can customize to fit the unique contours of your business. Whether you are a startup mapping out initial costs, an established company managing operating expenses, or a project manager overseeing a specific initiative, there is a template designed to meet your needs. Take the first step today by finding the right template, gathering your financial data, and building the financial roadmap that will guide your business to a more profitable and secure future.

]]>