Risk management is a critical component of any business, particularly in industries with inherent risks. Failing to adequately address potential threats can lead to significant financial losses, reputational damage, and legal liabilities. A robust Risk Management Agreement Template provides a clear framework for identifying, assessing, and mitigating these risks, ultimately safeguarding your organization. This article will delve into the essential elements of a comprehensive Risk Management Agreement Template, equipping you with the knowledge to create a document that protects your interests and promotes proactive risk control. Risk Management Agreement Template is more than just a legal document; it’s a strategic tool for building resilience and ensuring long-term success.

Understanding the Importance of Risk Management

The modern business landscape is characterized by increasing complexity and volatility. Companies face a myriad of potential risks, ranging from operational disruptions and cybersecurity threats to regulatory changes and market fluctuations. Without a formalized approach to risk management, these risks can escalate rapidly, impacting profitability and stability. A well-defined Risk Management Agreement Template is the cornerstone of effective risk management, enabling organizations to systematically identify, analyze, and respond to potential threats. It’s not simply about avoiding problems; it’s about proactively managing them and minimizing their impact. Ignoring risk management is akin to navigating a ship without a compass – you’re likely to drift aimlessly and face significant challenges. Investing in a robust Risk Management Agreement Template is an investment in the future of your business.

Key Elements of a Comprehensive Risk Management Agreement Template

Creating a truly effective Risk Management Agreement Template requires careful consideration of various factors. Here’s a breakdown of the essential components:

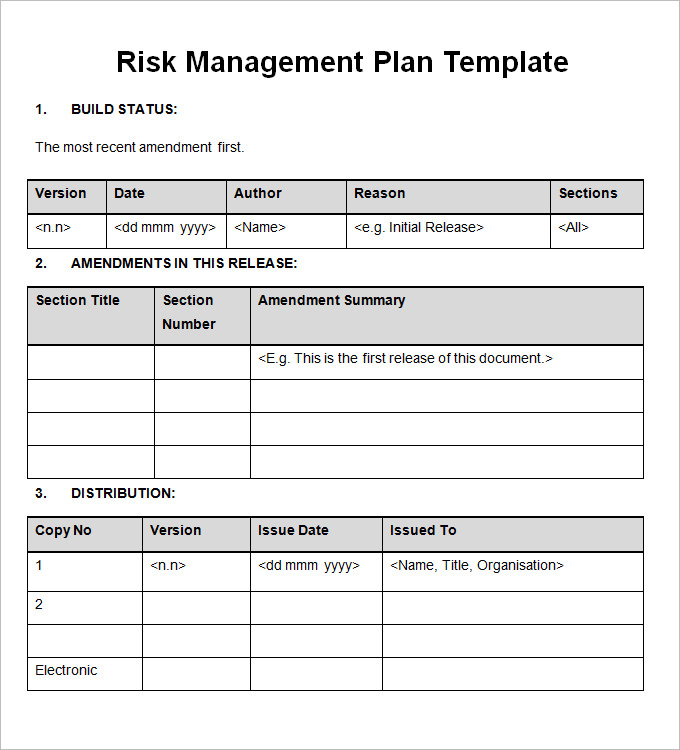

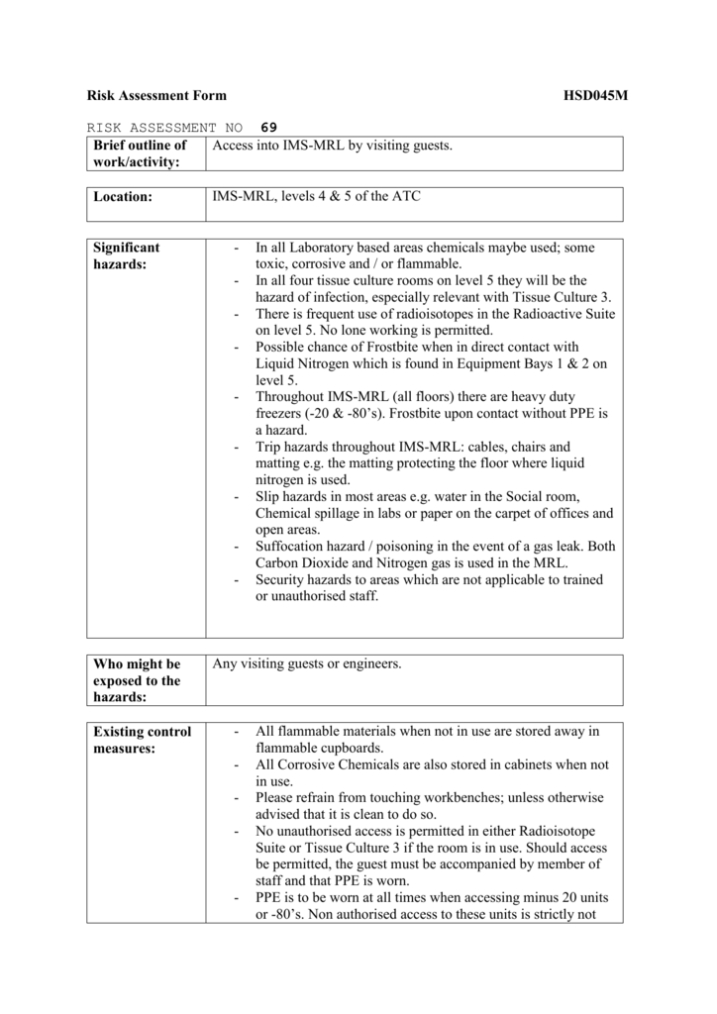

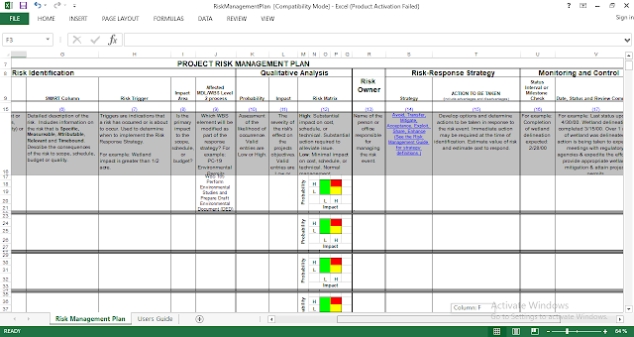

- Identification of Risks: This section should clearly outline the types of risks the agreement will address. It’s crucial to be specific – avoid vague statements. Examples include operational risks, financial risks, compliance risks, cybersecurity risks, and reputational risks. Consider using a risk matrix to visually represent the severity and likelihood of each risk.

- Risk Assessment: How will risks be assessed? This involves determining the potential impact and likelihood of each identified risk. Quantitative methods (e.g., probability and impact analysis) and qualitative assessments (e.g., expert judgment) can be employed. Documenting this process is vital for accountability.

- Risk Mitigation Strategies: This is arguably the most important section. It details the specific actions the parties will take to mitigate or reduce the identified risks. These strategies can range from implementing preventative measures to developing contingency plans. Consider including options like insurance, training, process improvements, and technology solutions.

- Responsibilities and Accountability: Clearly define the roles and responsibilities of each party involved in the Risk Management Process. Who is responsible for identifying risks, assessing their impact, implementing mitigation strategies, and monitoring their effectiveness? This avoids confusion and ensures accountability.

- Monitoring and Review: Risk Management is not a one-time activity. The agreement should outline a process for ongoing monitoring and review of risks and mitigation strategies. This includes establishing key performance indicators (KPIs) to track progress and identify emerging risks. Regular reviews should be conducted at least annually, or more frequently if significant changes occur.

- Termination Clause: Specify the conditions under which the agreement can be terminated and the consequences of termination. This protects both parties and ensures a smooth transition.

Risk Management Agreement Template – A Detailed Example

Here’s a simplified example illustrating some of the key elements:

Risk Management Agreement

Between: [Party A Name] and [Party B Name]

Date: October 26, 2023

1. Scope of Agreement

This Risk Management Agreement outlines the framework for managing risks associated with [briefly describe the business activity]. It covers all operational, financial, compliance, and cybersecurity risks relevant to [Party A’s] business operations.

2. Identified Risks

The following risks have been identified:

- Operational Risk: Potential disruptions to supply chain due to supplier failures.

- Financial Risk: Fluctuations in interest rates impacting debt servicing costs.

- Compliance Risk: Failure to comply with data privacy regulations (GDPR).

- Cybersecurity Risk: Potential data breaches leading to reputational damage and financial losses.

3. Risk Assessment & Mitigation

| Risk | Likelihood | Impact | Mitigation Strategy | Responsibility |

|---|---|---|---|---|

| Supply Chain Disruptions | Medium | High | Diversify suppliers, maintain buffer stock. | [Party A] |

| Interest Rate Fluctuations | Medium | Medium | Secure hedging strategies, monitor market trends. | [Party B] |

| Data Privacy Violations | Low | High | Implement robust data security protocols, employee training. | [Party A] |

| Cybersecurity Incident | Medium | High | Regular security audits, penetration testing, incident response plan. | [Party A] |

4. Responsibilities

- Party A: Responsible for identifying and assessing operational risks, implementing mitigation strategies, and monitoring compliance.

- Party B: Responsible for identifying and assessing financial risks, ensuring data privacy compliance, and providing support for cybersecurity measures.

5. Monitoring & Review

This agreement will be reviewed annually, or more frequently as needed, to assess the effectiveness of mitigation strategies and identify emerging risks. KPIs related to risk management (e.g., number of security incidents, compliance audit results) will be tracked.

6. Termination Clause

This agreement may be terminated by either party upon 30 days written notice, subject to legal requirements. Upon termination, [Party A] will be responsible for returning any confidential information and [Party B] will be responsible for providing a final accounting of any outstanding liabilities.

Conclusion

Risk Management Agreement Templates are indispensable tools for organizations seeking to proactively manage risks and protect their interests. By carefully considering the key elements outlined in this article and tailoring the template to your specific business needs, you can create a document that fosters resilience, promotes accountability, and ultimately contributes to long-term success. Investing in a well-crafted Risk Management Agreement Template is a strategic investment in the future of your business.

Conclusion

Ultimately, a robust Risk Management Agreement Template is a proactive measure that safeguards your organization from potential threats, minimizes financial losses, and promotes sustainable growth. It’s a commitment to responsible risk management, demonstrating a dedication to protecting your assets and achieving your strategic objectives. By consistently reviewing and updating this agreement, you ensure it remains a relevant and effective tool for navigating the complexities of the modern business environment.