Mortgage Note Template. People select to prepay in order that they’ll repay their mortgage early or make decrease interest funds. In case of a secured observe, the borrower might be required to provide a collateral similar to property, goods, services, and so on., within the occasion that they fail to repay the borrowed amount. If you might have any questions concerning the mortgage course of, please don’t hesitate to get in contact. Security– Items such as automobiles or a 2nd mortgage on a house is supplied if the borrowed money isn’t paid back by the borrower.

An project of a mortgage refers to an task of the note and task of the mortgage settlement. Investors will need the conversion shares to be issued in the most senior class at this time of conversion. Investors and companies within the secondary mortgage notice industry can buy personal mortgage notes from those trying to sell.

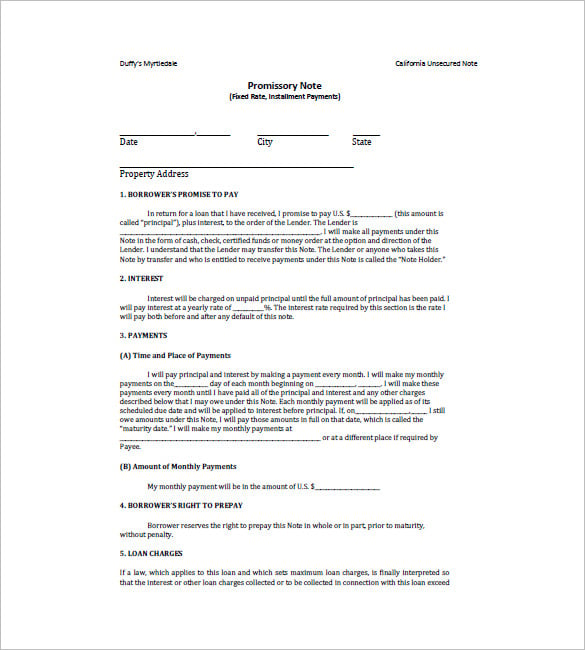

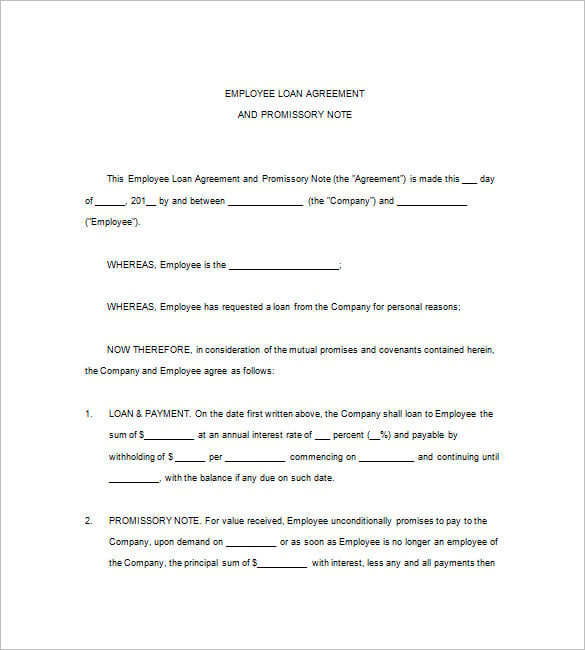

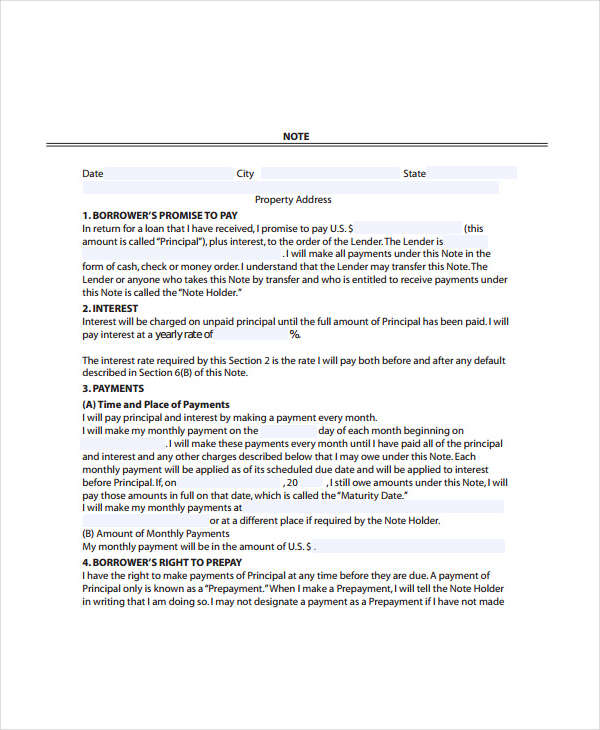

A promissory notice isn’t a contract, however you’ll likely have to sign one earlier than you take out a mortgage. Sign Lease settlement for house electronically Sign Lease agreement for house electronically in a few … It is standard apply for notices to be written and to be delivered both in particular person or by licensed mail with copies and receipts. In most circumstances, a handwritten Promissory Note signed by both events will rise up in court. Please bear in mind that our agents are not licensed attorneys and cannot address legal questions.

We select pages with information associated to Assignment Of Note And Mortgage. These will embody the official login link and all the knowledge, notes, and necessities about the login.

You get entry to all previously downloaded forms inside the My Forms tab of your profile. This form is a pattern letter in Word format overlaying the topic matter of the title of the form. Download and print 1000’s of document layouts whereas utilizing US Legal Forms website, that gives crucial assortment of authorized sorts.

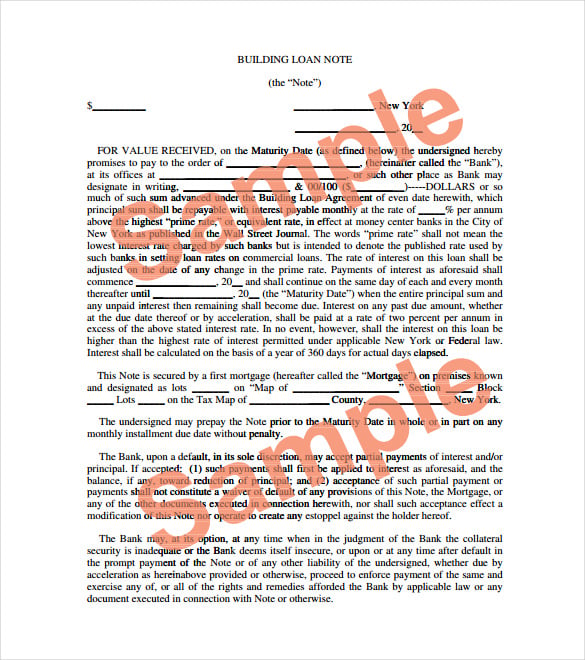

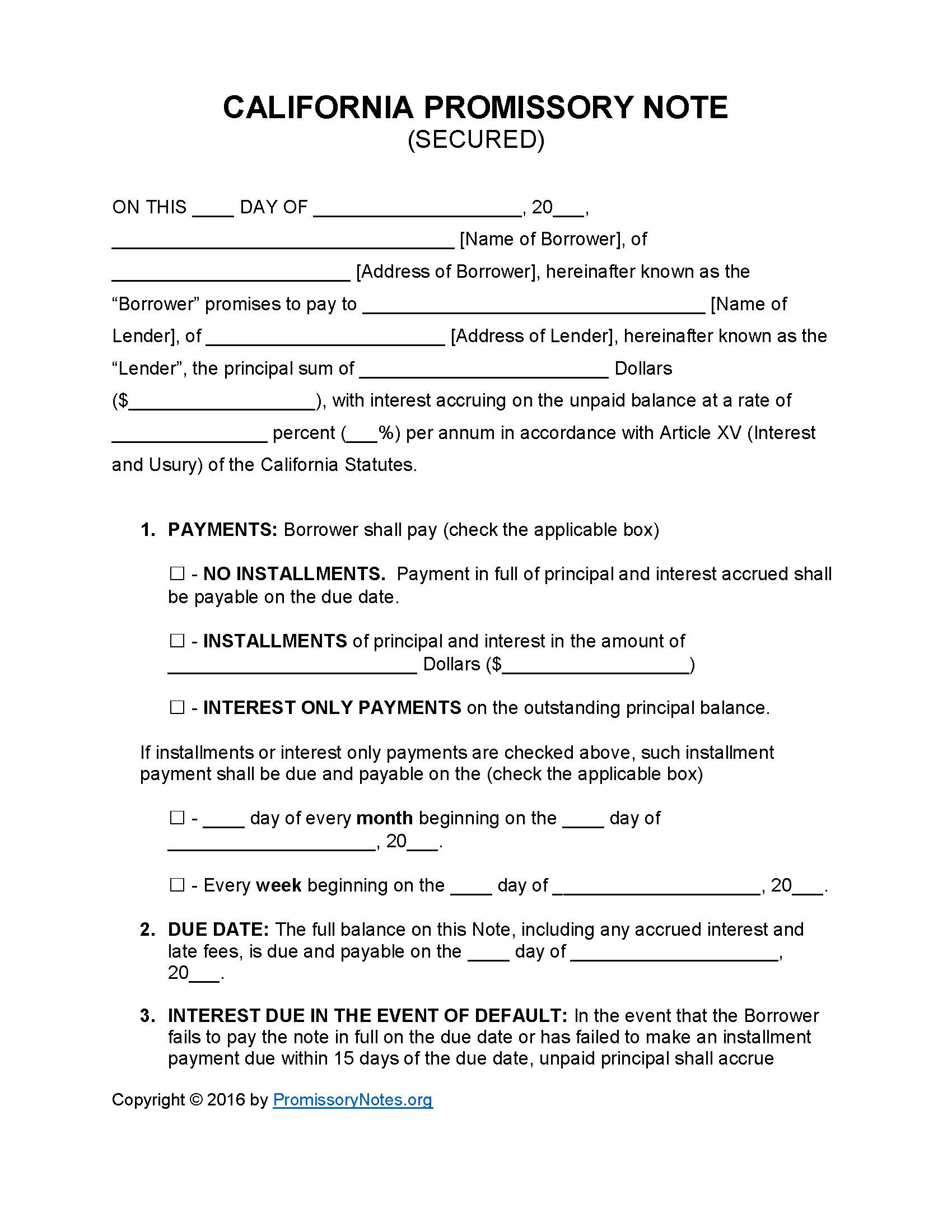

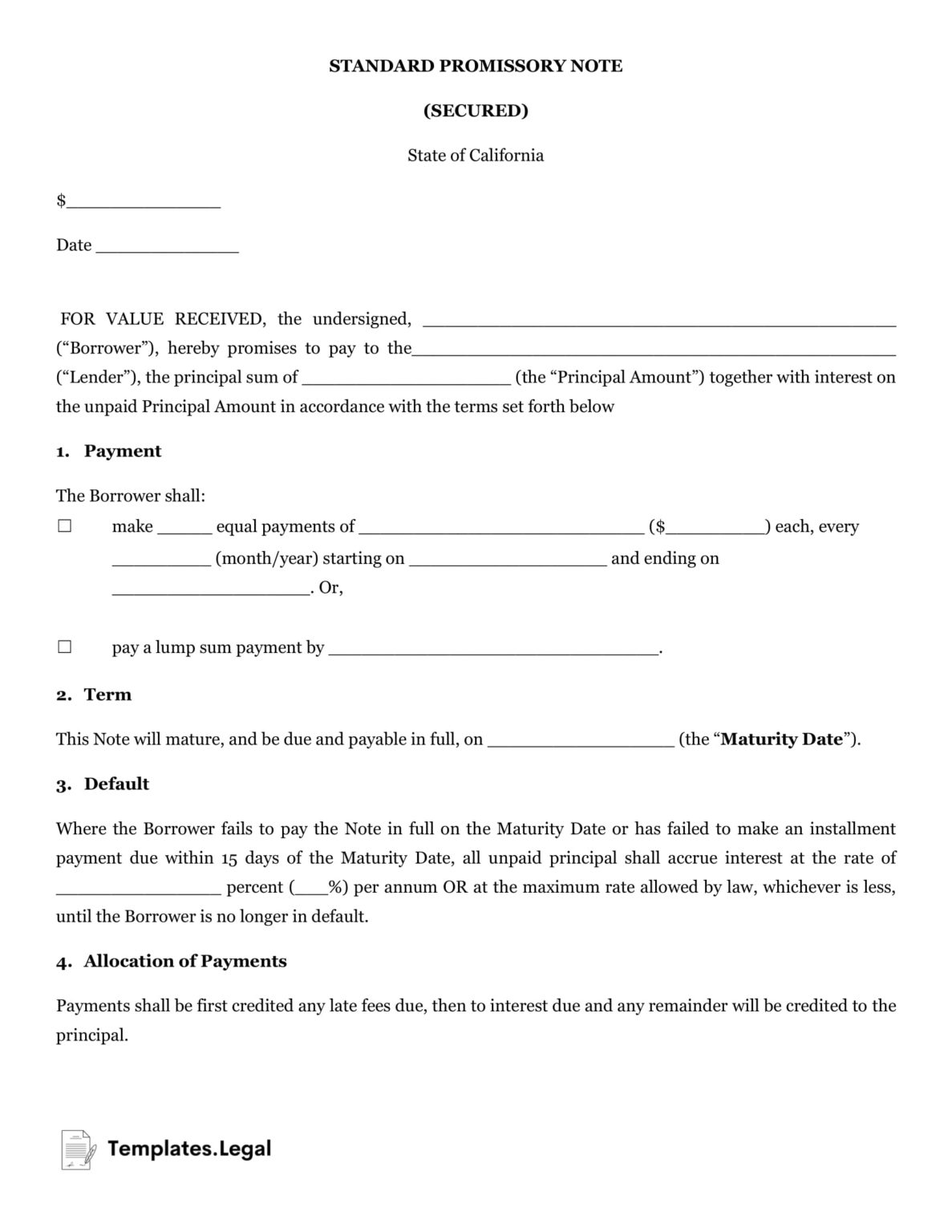

This is to supply assurance to the lender that their money shall be paid-back both in money or assets. Secured Promissory Note – For the borrowing of cash with an asset of value “securing” the amount loaned corresponding to a automobile or a house. If the borrower does not pay back the quantity inside the timeframe advised the lender may have the best to acquire the property of the borrower.

Download Mortgage Loan Observe

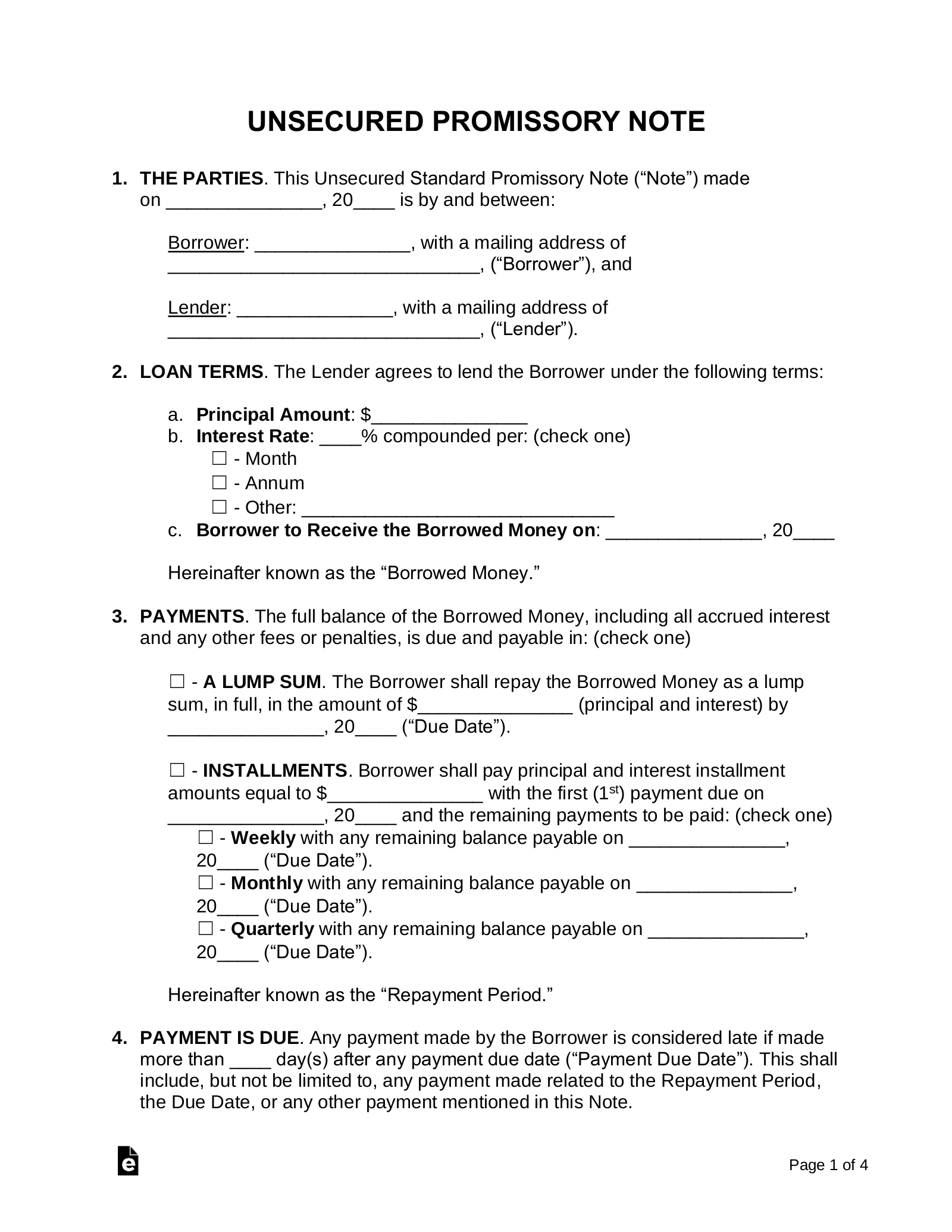

A Promissory Note may be secured or unsecured. In case of a secured observe, the borrower might be required to supply a collateral similar to property, goods, providers, and so on., in the event that they fail to repay the borrowed quantity.

Assignment Of Mortgage Template will sometimes glitch and take you a very lengthy time to try different solutions. LoginAsk is right here that will help you access Assignment Of Mortgage Template rapidly and handle every particular case you encounter.

Every Little Thing You Should Find Out About Convertible Loan Notes

Word when your not obtainable to sign an important doc and also you want somebody …

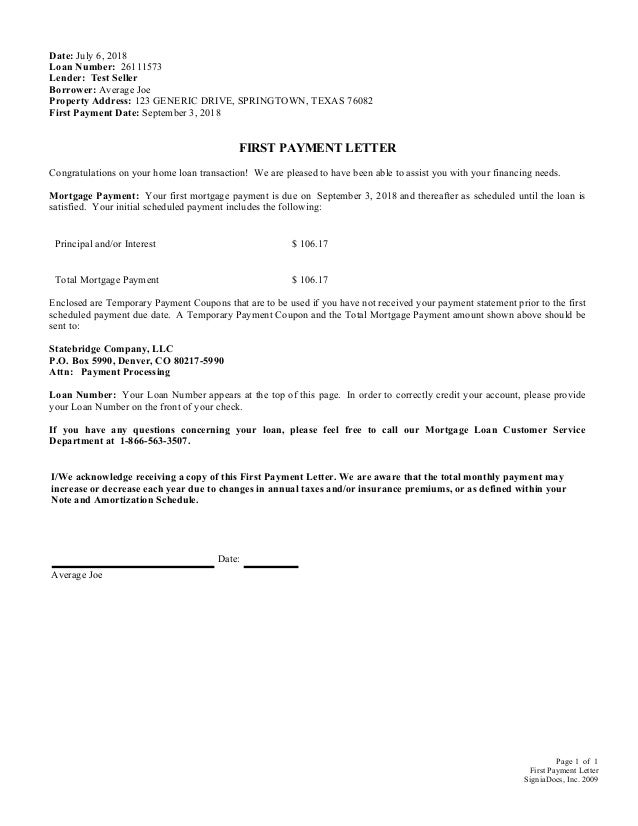

I perceive that the Lender could switch this Note. The Lender or anyone who takes this Note by transfer and who’s entitled to obtain payments underneath this Note known as the “Note Holder.” 2.

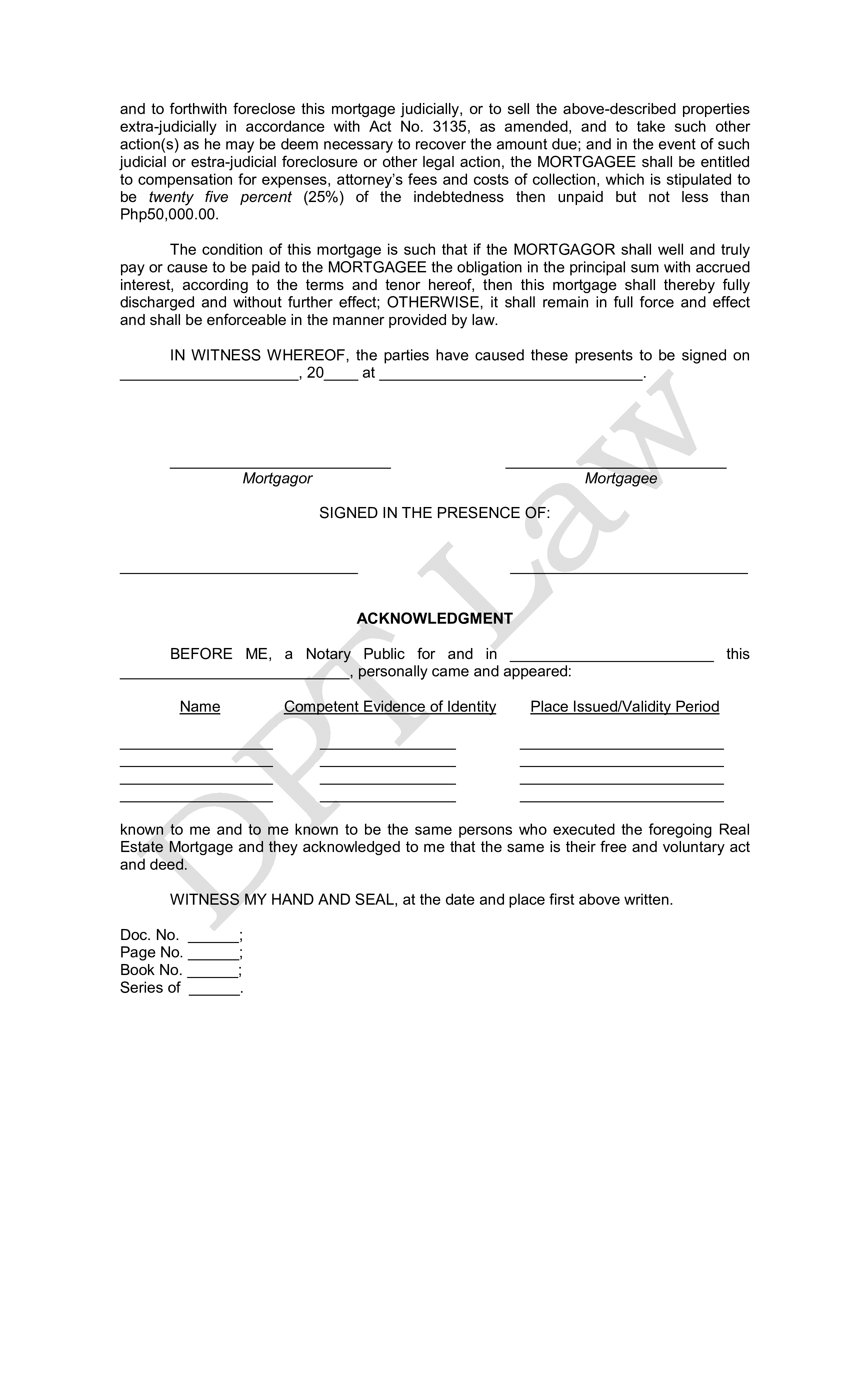

In contrast, a deed of trust normally features a “power of sale” clause, which permits the trustee to sell the property via non-judicial foreclosures. However, this agreement is only between two events – the borrower and the lender – whereas a deed of belief is between three parties – the borrower, lender, and trustee. A Quitclaim Deed and Warranty Deed are other kinds of actual property deeds that are less frequent however generally used to satisfy actual estate objectives.

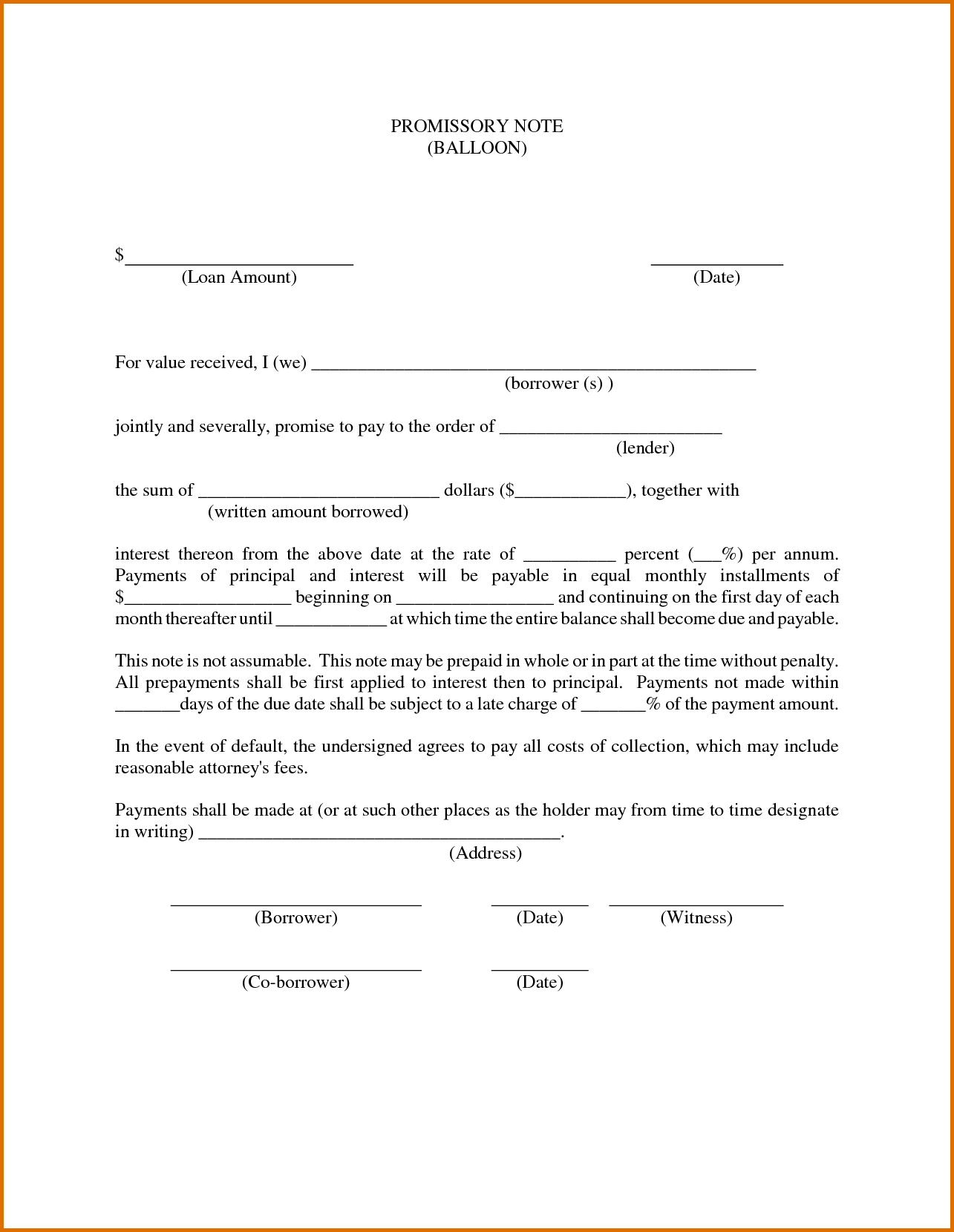

It might not make financial sense to make early funds or prepay your mortgage. This is a half of the authorized course of and helps the borrower to know what their accountability is in paying back a loan. Once they’ve paid off the entire thing of the loan, they’ll obtain the deed to their residence.

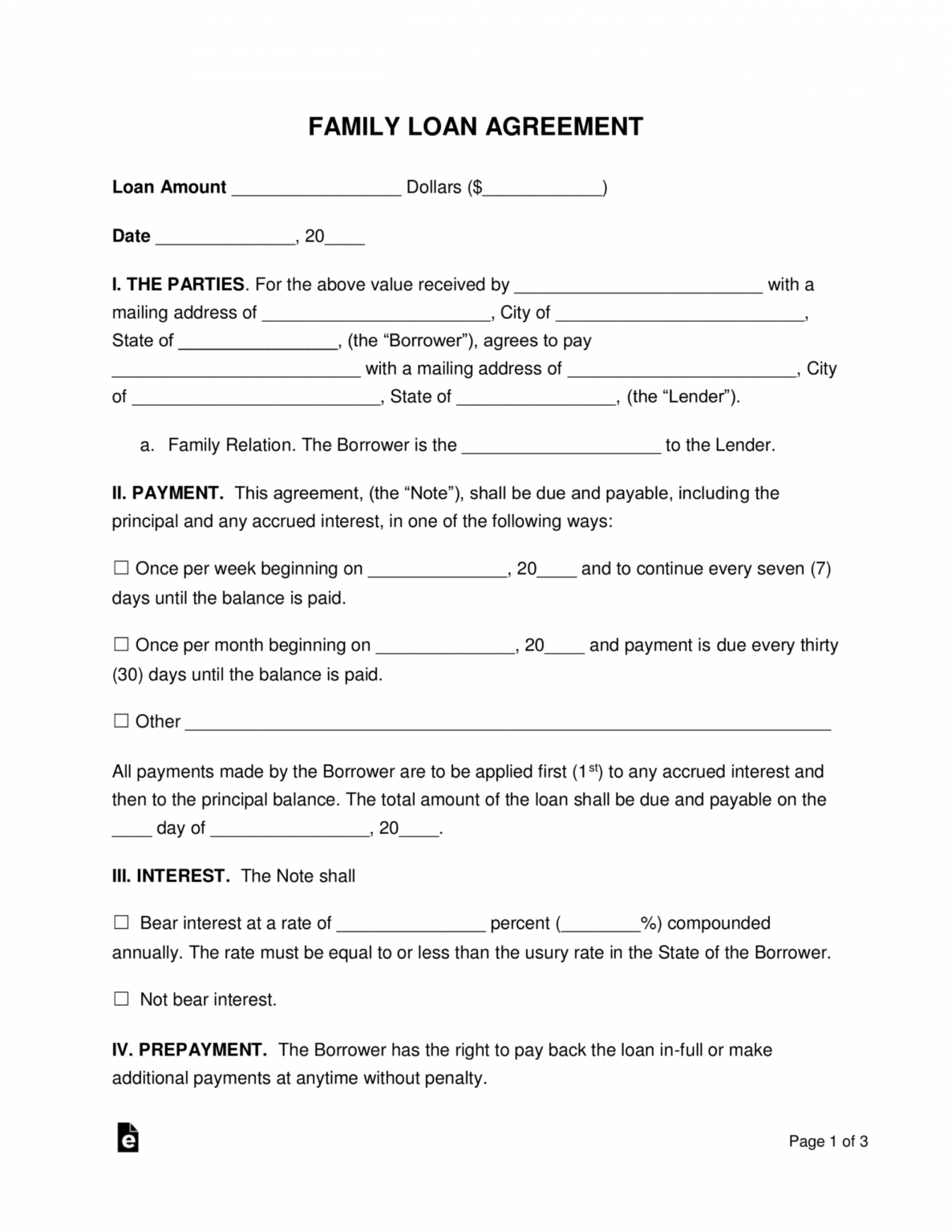

However, you could get the note notarized should you choose to . If there may be a couple of lender or borrower, all lenders or debtors ought to embody their names on the note. In some situations, you may want to document whether the cash you’re lending is a present or a mortgage for tax functions.

The borrower and lender ought to sign the agreement earlier than two witnesses, and a notary should confirm and authenticate the signatures. The mortgage deed ought to name the particular person receiving the cash and the individual with the lien on the property . Family members ought to cost you, at a minimal, the month-to-month price published by the IRS.

Selling your mortgage note could be a method to keep away from the risk of a borrower defaulting, or it can simply be a approach to shortly liquidate an asset into usable capital. Those who hold mortgage notes have the choice to sell them to mitigate those dangers.

If you should share the mortgage type pdf with other events, you’ll find a way to easily send it by e mail. With signNow, it’s potential to eSign as many papers per day as you want at an affordable cost. Start automating your signature workflows at present.

Use specialist and express-certain templates to handle your small enterprise or individual requires. An assignment of mortgage is a doc which signifies that a mortgage has been transferred from the unique lender or borrower to a third get together.

Only can your promissory note be amended if both the lender and borrower sign a written agreement. If there are red flags that appear on the credit score report the lender could need to have the borrower add Security or a Co-Signer to the observe. Common forms of security include motor automobiles, real property , or any type of priceless asset.

For instance, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there’s no cost schedule involved. Mortgage Note Sample – 8+ Examples in Word, PDF – A mortgage notice holder can promote the mortgage notice if they’re nervous in regards to the dangers of being a lender.

If there is a have to divide property of the owner or if they are getting a divorce and property needs to be divided. In this case the holder sells their mortgage notice.

A promissory observe is created when a borrower accepts money that’s to be repaid to a lender with curiosity. You’ll be requested to submit a pile of documentation through the mortgage mortgage course of, including bank statements, tax returns, pay stubs, and extra. An assignment transfers all of the unique mortgagee’s interest underneath the mortgage or deed of trust to the new financial institution.

Promissory notes and loan agreements may be effective, legal ways of establishing an association between a borrower and a lender. In common, you should use promissory notes for easy loans with primary reimbursement buildings and select a loan agreement for extra complicated mortgage wants.

A mortgage deed allows them to take possession and sell the property if the borrower stops making loan payments. It also allows buyers to borrow massive sums of cash and offers an incentive to make payments on the mortgage or danger dropping their property. A mortgage deed and a deed of belief create a lien on a property to secure compensation of a mortgage.

The mortgage deed is separate from the mortgage settlement or promissory observe that creates the precise loan, and it units out the terms and circumstances of the mortgage. Because a mortgage observe is a security instrument, it can be purchased and offered on the secondary mortgage market. Therefore, mortgage lenders generally sell mortgage notes to actual estate investors who’re attracted to those comparatively risk-free investments and the potential to earn passive earnings.

The designed file might be connected to the draft e mail generated by signNow’s eSignature device. Decide on what sort of eSignature to create.

However, if the borrower finally ends up prevailing in court, no matter the problem, the lender must then pay for all court-related prices. After the primary terms of the note have been agreed upon the lender and borrower should come collectively to authorize the formal agreement.

However, every state has its own rules, notice durations, and procedures for judicial and non-judicial foreclosures, so timelines could differ. Lenders should strictly observe these guidelines to avoid any challenges to the foreclosures sale.

Also, present the date of the mortgage settlement or note. Without a secured mortgage, a lender is left with few choices if the borrower goes bankrupt, gets sued unexpectedly, dies, or decides to stop making funds. The lender must go through a prolonged court docket course of and stand consistent with different collectors.

All these compliance documents might be available to obtain instantly… Those with less-than-perfect credit score and these who are self-employed can flip to personal mortgages when they could not qualify for traditional financial institution options. During the recession, many homes were left abandoned and fell into disrepair, making getting conventional mortgages next to inconceivable.

Then, decide the pricing plan you want and provide your accreditations to sign up to have an account. If you have to full, down load, or printing reliable report web templates, use US Legal Forms, the most important selection of reliable varieties, which could be found on-line.

A revolving line of credit refers to a sort of loan offered by a financial establishment. Borrowers pay the debt as they’d any other. However, with a revolving line of credit score, as quickly as the debt is repaid, the person can borrow up to her credit limit again without going through one other loan approval course of.

Initial, guarantee that you have selected the correct doc format in your county/area of your liking. Look at the develop outline to ensure you have chosen the right develop.

A promissory note is a contract and is legally enforceable. Knowing what to include in a promissory notice is necessary as it ensures the doc is legitimate and might maintain up in court. Use our Promissory Note template to element the phrases of mortgage reimbursement.