Embarking on a new business venture with co-founders is an exciting time, filled with optimism and a shared vision. In this initial “honeymoon phase,” it’s easy to overlook the legal nuts and bolts, but a solid Founders Shareholder Agreement Template is one of the most critical documents you can create to ensure the long-term health and stability of your company. It acts as a prenuptial agreement for your business, laying out the rules of engagement, rights, and responsibilities before any potential conflicts arise.

While discussions about equity, departure, and potential disagreements can feel awkward at the beginning, they are infinitely easier to have when everyone is aligned and motivated. Neglecting this crucial step is a common and often fatal mistake for early-stage startups. A verbal agreement or a simple handshake might seem sufficient among friends, but the pressures of running a business can strain even the strongest relationships. A well-drafted agreement provides a clear roadmap for navigating future challenges, protecting each founder’s investment of time, money, and intellectual property.

This comprehensive guide will explore the essential components of a founders’ agreement, explain why it’s a non-negotiable document for any multi-founder company, and provide insights into how to customize a template for your specific needs. By understanding and implementing this legal framework from day one, you are not just mitigating risk; you are building a strong, resilient foundation upon which your business can grow and thrive. This document will serve as your single source of truth, ensuring clarity and fairness for all parties involved as you journey from a fledgling idea to a successful enterprise.

What is a Founders Shareholder Agreement?

A Founders Shareholder Agreement, often simply called a founders’ agreement, is a legal contract between the co-founders of a company. Its primary purpose is to govern the relationship between the founders and to define their respective rights, responsibilities, ownership stakes, and obligations to each other and to the company itself. It is one of the first and most important legal documents a startup should put in place.

This agreement is distinct from other foundational corporate documents. While your Articles of Incorporation officially create the company as a legal entity and the bylaws outline the basic operating rules for the corporation (like how to hold board meetings), the founders’ agreement deals specifically with the founder-level issues that can make or break a young company. It’s the “what if” document.

It answers critical questions like: What percentage of the company does each founder own? What happens if a founder wants to leave the company after six months? Who owns the intellectual property created before the company was even incorporated? How will major business decisions be made? Without clear, written answers to these questions, you leave the door open to disputes that can derail your progress and even lead to litigation.

Why Every Startup Needs a Founders Agreement

Putting a founders’ agreement in place isn’t about a lack of trust; it’s about professional foresight. The process of creating the agreement forces co-founders to have critical, and sometimes difficult, conversations early on. This alignment is invaluable and prevents misunderstandings down the road.

Aligning Expectations and Defining Roles

One of the most immediate benefits is clarifying each founder’s role and responsibilities. The agreement should explicitly state each person’s title, duties, and expected time commitment. This ensures that everyone is on the same page about who is responsible for what, preventing overlap, gaps in responsibility, and resentment over perceived imbalances in workload.

Protecting the Company from Founder Departures

People’s circumstances change. A founder might get a lucrative job offer, face a personal or family crisis, or simply lose passion for the project. A founders’ agreement protects the company by implementing a vesting schedule. Vesting means that founders earn their equity over a period of time, typically four years with a one-year “cliff.” If a founder leaves before their shares are fully vested, the company has the right to repurchase the unvested shares, usually for a nominal price. This prevents a departing co-founder from walking away with a large chunk of the company after contributing very little.

Establishing a Framework for Decision-Making

Disagreements are inevitable in any business partnership. A solid agreement outlines the process for making key decisions. It specifies which decisions require a simple majority vote versus those that require unanimous consent (e.g., selling the company, taking on significant debt). It also can include a deadlock provision, which dictates how to resolve a situation where founders are split 50/50 on a critical issue.

Attracting Future Investors

Sophisticated angel investors and venture capitalists will almost always ask to see your founders’ agreement during their due diligence process. The absence of one is a major red flag. Investors need to know that the founding team is stable, that equity is clearly defined and subject to vesting, and that the company’s intellectual property is properly protected. A well-structured agreement signals that you are a serious, professional team that has thought through potential risks.

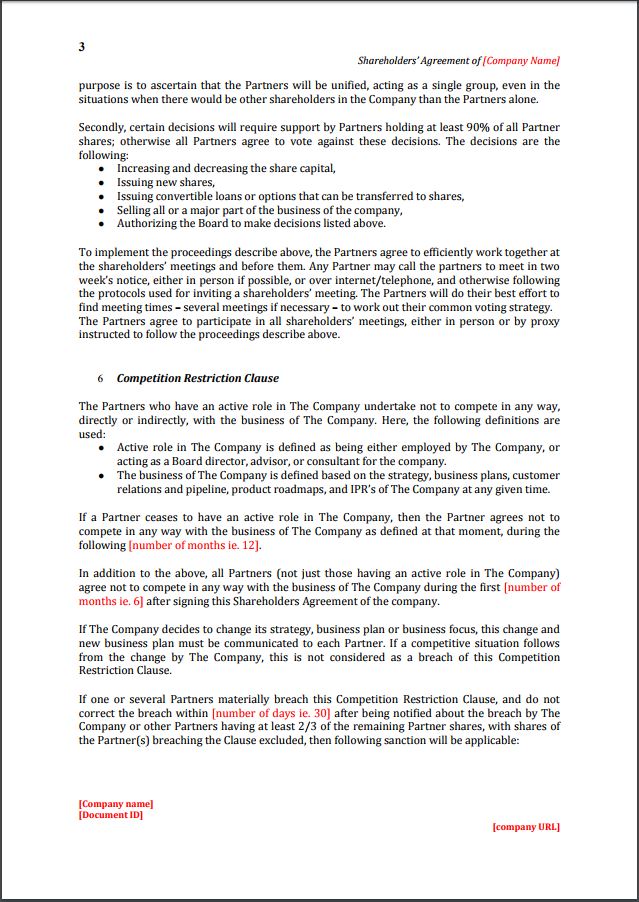

Key Clauses to Include in Your Founders Shareholder Agreement Template

While every agreement should be tailored to the company’s unique situation, a robust template will include several essential clauses. When you sit down with your co-founders, these are the key areas you must discuss and formalize in writing.

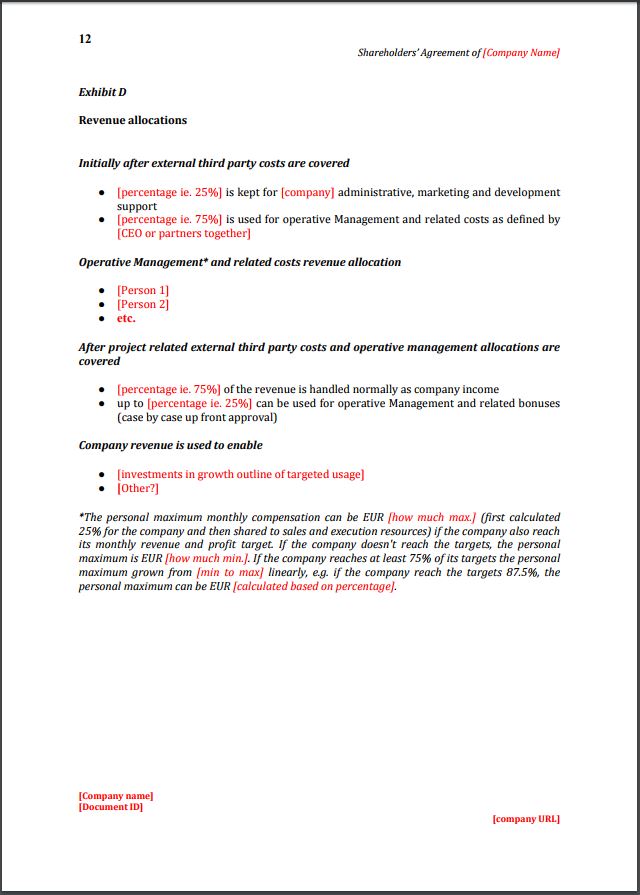

Equity Ownership and Vesting

This is often the most discussed section. It clearly states the percentage of equity each founder owns. The split doesn’t have to be equal, but it should be explicitly agreed upon and reflect the perceived value of each founder’s contribution (e.g., initial capital, expertise, time commitment). Crucially, this section must detail the vesting schedule. A standard schedule is a 4-year vesting period with a 1-year cliff. This means no shares are owned until the one-year anniversary, at which point 25% of the shares vest. The remaining shares then typically vest on a monthly or quarterly basis over the next three years.

Roles and Responsibilities

Don’t assume everyone knows their job. This clause should define each founder’s title (e.g., CEO, CTO, CMO) and outline their primary responsibilities and expected time commitment (full-time or part-time). Being explicit here helps manage expectations and provides a basis for holding each other accountable.

Intellectual Property (IP) Assignment

This is a critically important clause. It ensures that any intellectual property—code, designs, business plans, inventions—created by the founders related to the business is legally owned by the company, not the individual founder. This “assignment” of IP is vital for the company’s valuation and protects it in case a founder leaves and tries to claim ownership of a core piece of technology or a key business concept.

Decision-Making and Control

How will you run the company day-to-day versus making major strategic shifts? This section defines the voting power of each founder, often in proportion to their equity. It should specify which decisions can be made by a single manager (like the CEO) and which require a vote of the board of directors or shareholders. Examples of major decisions often requiring a supermajority or unanimous vote include selling the company, issuing new shares, or taking on significant debt.

Founder Departure and Buy-Sell Provisions

This section details what happens when a founder leaves, whether voluntarily, involuntarily (termination for cause), or due to death or disability. It works in conjunction with the vesting schedule. It should also include buy-sell provisions that govern the transfer of shares. Key terms to include are:

– Right of First Refusal (ROFR): If a founder wants to sell their vested shares to a third party, the company and/or the other founders have the right to buy those shares first on the same terms.

– Buyback Rights: The agreement should specify the price at which the company can buy back a departing founder’s vested shares (e.g., fair market value).

Confidentiality and Non-Compete

To protect the business’s sensitive information, a confidentiality clause (or non-disclosure agreement, NDA) is essential. It prevents founders from sharing trade secrets or proprietary information with outsiders. A non-compete clause restricts a departing founder from starting a similar, competing business for a specific period and within a certain geographic area. Note that the enforceability of non-compete clauses varies significantly by jurisdiction, so legal advice is recommended here.

Dispute Resolution

Even with the best intentions, disputes can arise. This clause outlines the process for resolving them without immediately resorting to expensive litigation. It typically specifies a multi-step process, such as informal negotiation, followed by formal mediation, and then, as a last resort, binding arbitration.

How to Use and Customize a Template

Using a Founders Shareholder Agreement Template is an excellent and cost-effective way to start the process, but it should never be the final step. Think of a template as a detailed checklist for your conversation, not a one-size-fits-all legal document.

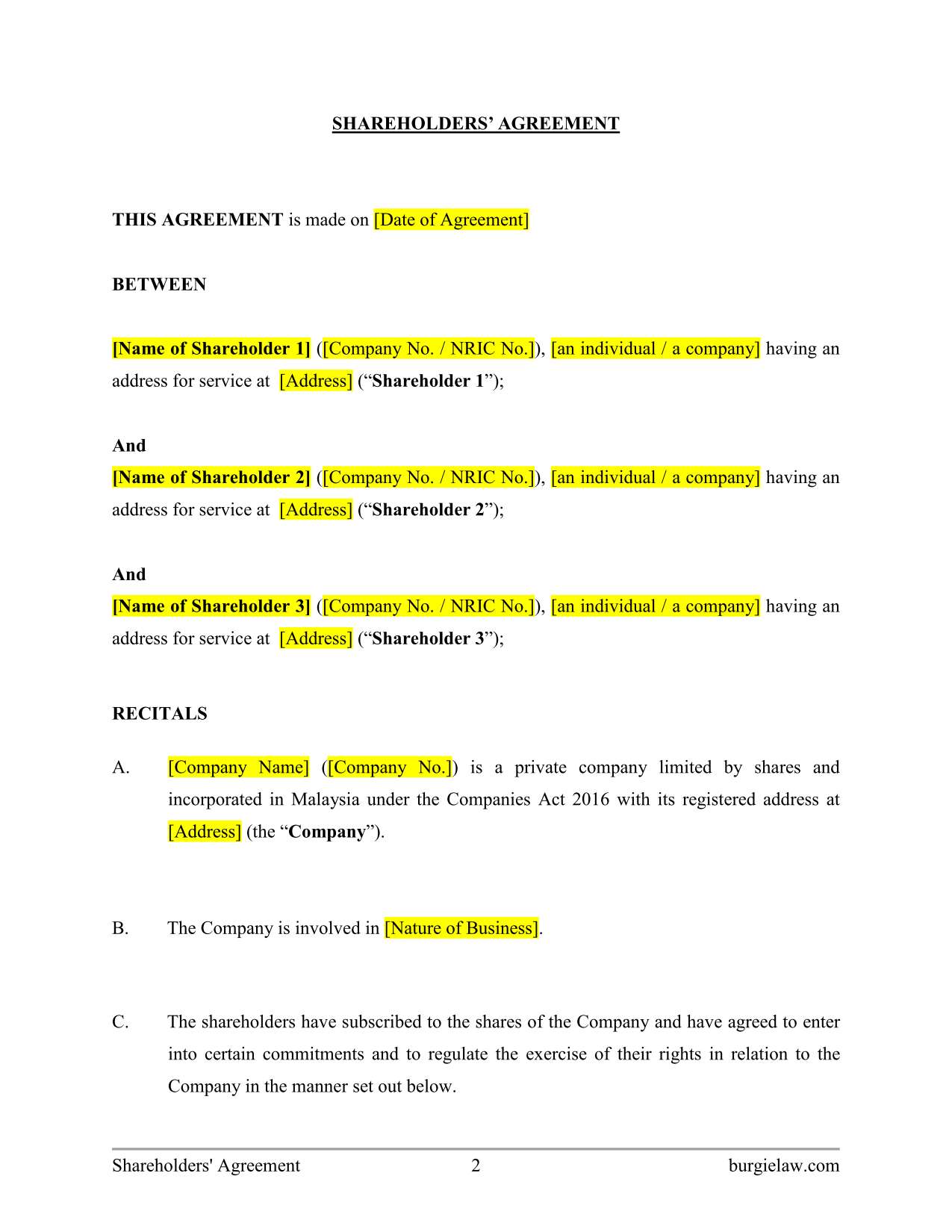

Step 1: Find a Reputable Template

Start by finding a well-regarded template from a reliable source. Many law firms, startup accelerators, and legal tech companies offer free or low-cost templates that cover the essential clauses discussed above.

Step 2: Discuss Every Clause with Your Co-founders

Set aside dedicated time to go through the template line by line with your co-founders. This is the moment to have open and honest conversations about equity splits, roles, and the “what-if” scenarios. It’s better to discover a fundamental disagreement now than two years into the business. Use the template to guide your discussion and ensure you don’t miss any critical topics.

Step 3: Customize the Details

Fill in the specifics for your company. This includes names, equity percentages, vesting schedules, and definitions of roles. Be as detailed and clear as possible. Ambiguity is the enemy of a good contract. If there are unique circumstances in your partnership, make sure the agreement reflects them.

Step 4: Seek Professional Legal Review

This is the most important step. Once you and your co-founders have reached an agreement on all the key points and have a draft, you must have it reviewed by a qualified corporate or startup lawyer. An attorney can spot potential issues, ensure the language is legally sound, check for compliance with state laws, and advise you on terms you may not have considered. The cost of a legal review is a tiny investment compared to the potential cost of a founder dispute down the line.

Common Mistakes to Avoid

In the rush to build a product and find customers, many founders make predictable and avoidable mistakes when it comes to their agreement.

- Waiting Too Long: The best time to create a founders’ agreement is right at the beginning, before the company is incorporated or shortly thereafter. The longer you wait, the more complicated it becomes.

- Failing to Include Vesting: This is arguably the biggest mistake. Without vesting, a founder can leave after a few weeks and still retain their entire equity stake, which can be devastating for the company.

- Being Vague About Roles: Not clearly defining roles and responsibilities is a recipe for conflict. Assumptions lead to misunderstandings and resentment.

- Ignoring the “What Ifs”: Avoiding the tough conversations about founder departure, death, or disability is a common error. The entire purpose of the agreement is to plan for these contingencies.

- Using a Generic Template Without Legal Counsel: A template is a great starting point, but it doesn’t know your business or your local laws. Skipping a legal review to save a few hundred dollars is a risk that is not worth taking.

Conclusion

A Founders Shareholder Agreement is not just another piece of legal paperwork; it is the constitutional document for your founding team. It codifies your shared understanding, aligns your expectations, and provides a clear, mutually agreed-upon framework for navigating the inevitable challenges of building a company. The process of creating the agreement is as valuable as the document itself, as it forces the critical conversations that build a foundation of trust and transparency.

By taking the time to carefully consider and formalize your roles, equity, IP ownership, and contingency plans, you are making a profound investment in the future of your business. It protects the company, the individual founders, and the vision you are all working so hard to achieve. Don’t let a preventable dispute derail your startup journey. Use a template as your guide, have the tough talks, and get a solid agreement in place from day one. It is one of the smartest and most important decisions you will make as a founder.

]]>

/3c0ca09f-fdba-48d9-8a86-41f941ccd985.png)