Managing the financial health of a small business can often feel like a juggling act, demanding precision, attention to detail, and a clear understanding of cash flow, profits, and expenses. For many entrepreneurs, dedicated accounting software might seem like an unnecessary expense or an overly complex solution, especially in the early stages. This is where the practicality and affordability of spreadsheet programs like Microsoft Excel truly shine, offering a robust yet flexible platform for financial tracking. The right Excel Templates For Small Business Accounting can transform daunting bookkeeping tasks into manageable processes, providing structure and clarity without a significant learning curve or monetary investment.

Excel’s ubiquity and versatility make it an ideal tool for small businesses looking to establish organized financial records. Unlike proprietary software, Excel offers unparalleled customization, allowing business owners to tailor their accounting systems precisely to their unique operational needs. From tracking daily expenditures to generating comprehensive financial statements, a well-designed template can streamline virtually every aspect of a company’s financial management. This accessibility empowers business owners to take a hands-on approach to their finances, fostering a deeper understanding of their economic performance.

Moreover, the learning curve for basic Excel functions is relatively gentle, making it a viable option even for those without extensive accounting backgrounds. Numerous free and paid templates are readily available, designed by experts to guide users through the complexities of bookkeeping. These pre-formatted sheets minimize the risk of common accounting errors and ensure that essential financial data is captured consistently. By leveraging these resources, small businesses can maintain professional-grade financial records, crucial for both internal decision-making and external reporting to stakeholders or tax authorities.

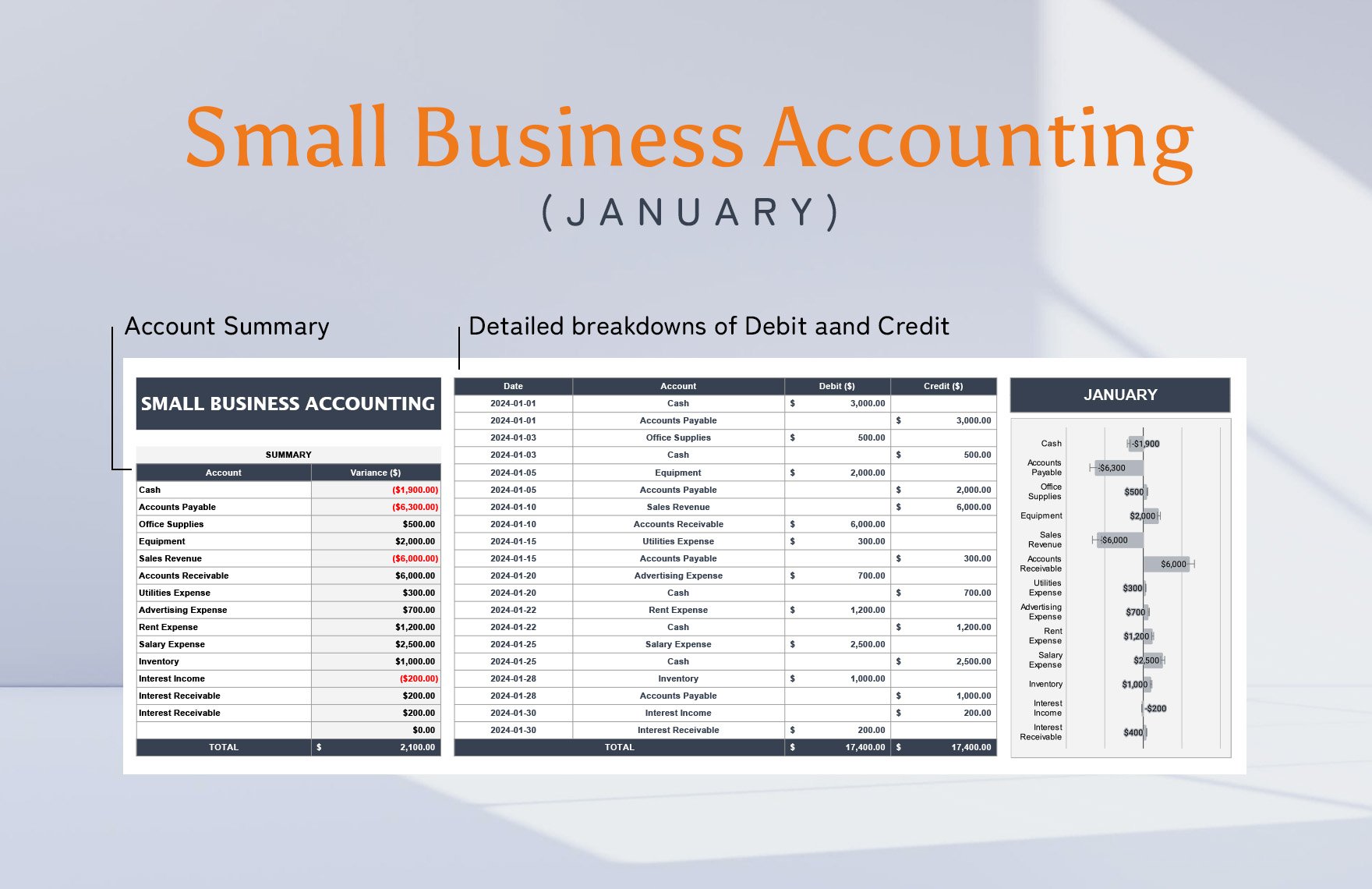

The ability to easily manipulate data, perform quick calculations, and visualize financial trends through charts and graphs are just a few reasons why Excel continues to be a go-to choice for small business accounting. It provides the necessary tools to monitor financial performance closely, identify areas for improvement, and make informed strategic decisions. This article will delve into the various types of Excel templates available, their benefits, and best practices for implementing them effectively in your small business.

Why Excel Templates Are a Game-Changer for Small Business Accounting

For many small businesses, budget constraints and a preference for simplicity often lead them away from expensive, complex accounting software. This is precisely where Excel templates for small business accounting step in as a powerful, cost-effective alternative. Excel offers a familiar interface and immense flexibility, allowing business owners to build and manage their financial systems from the ground up, or adapt existing templates to their specific requirements. The open-ended nature of Excel means that as your business evolves, your accounting system can evolve with it, without being locked into a rigid software framework.

One of the most significant advantages is cost-effectiveness. Excel is often already bundled with office software suites, meaning there’s no additional subscription fee for dedicated accounting software. This immediate saving can be crucial for startups and micro-businesses operating on tight budgets. Furthermore, the sheer volume of free templates available online means businesses can get started with sophisticated financial tracking without any upfront investment.

Beyond cost, Excel provides unparalleled control and transparency. Every formula, every data point, and every calculation is visible and auditable by the user. This level of transparency fosters a deeper understanding of financial data, which is invaluable for making strategic decisions. It also simplifies the process of reviewing and verifying financial records, reducing the chances of errors going unnoticed. For a small business owner who needs to be intimately familiar with every aspect of their operation, this hands-on approach to accounting is incredibly beneficial.

Core Benefits of Leveraging Excel Templates for Small Business Financial Management

Adopting Excel Templates For Small Business Accounting brings a multitude of benefits that directly impact the efficiency and accuracy of financial operations. These advantages extend beyond mere cost savings, contributing significantly to a business’s long-term financial health and strategic planning.

Firstly, simplicity and ease of use stand out. Most individuals have some familiarity with Excel, making the learning curve less steep compared to specialized accounting software. Templates come pre-structured, guiding users on where to input data, reducing confusion and the likelihood of errors. This allows business owners to focus on their core operations rather than spending excessive time learning complex software.

Secondly, the improvement in organization and accuracy is remarkable. Instead of relying on scattered paper receipts or disparate digital files, an Excel template provides a centralized, organized system for all financial transactions. Consistent data entry into structured fields ensures accuracy, and built-in formulas can automatically calculate totals, profits, and balances, minimizing manual calculation errors. This organized approach is invaluable during tax season or when preparing for audits.

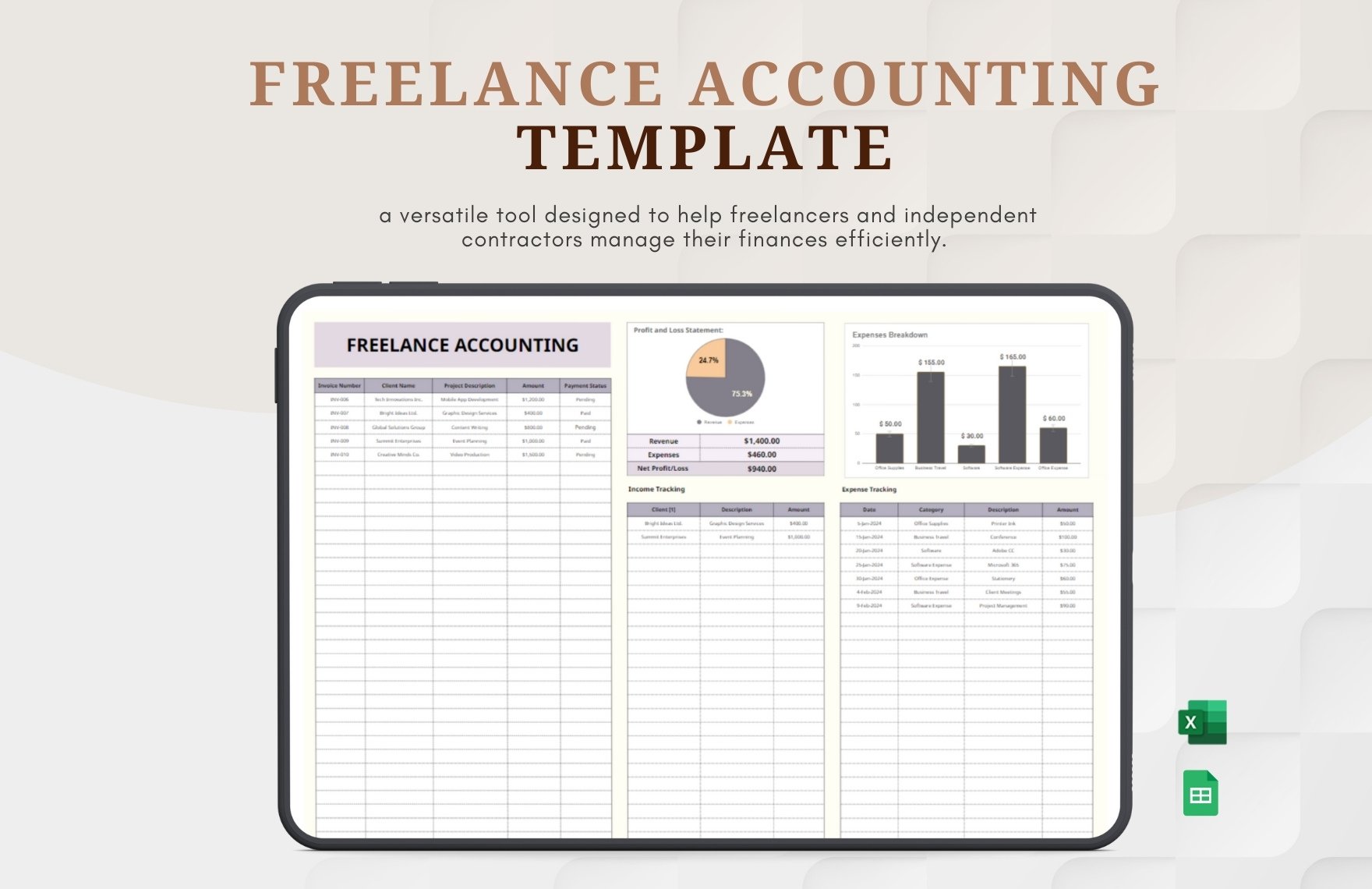

Thirdly, Excel facilitates better financial insights and decision-making. With organized data, it becomes easier to generate various reports – from cash flow statements to profit and loss reports. Visualizing this data through charts and graphs within Excel can help business owners identify trends, understand spending patterns, assess profitability, and project future performance. These insights are critical for strategic planning, budgeting, and making informed decisions about investments or cost reductions.

Finally, scalability and flexibility are key. As a small business grows, its financial needs may evolve. Excel templates can be easily customized or expanded to accommodate new categories, additional sheets, or more complex calculations. Unlike some rigid software, Excel adapts to the business, not the other way around. This flexibility ensures that the accounting system remains relevant and effective as the business expands.

Essential Excel Templates For Small Business Accounting You Can’t Do Without

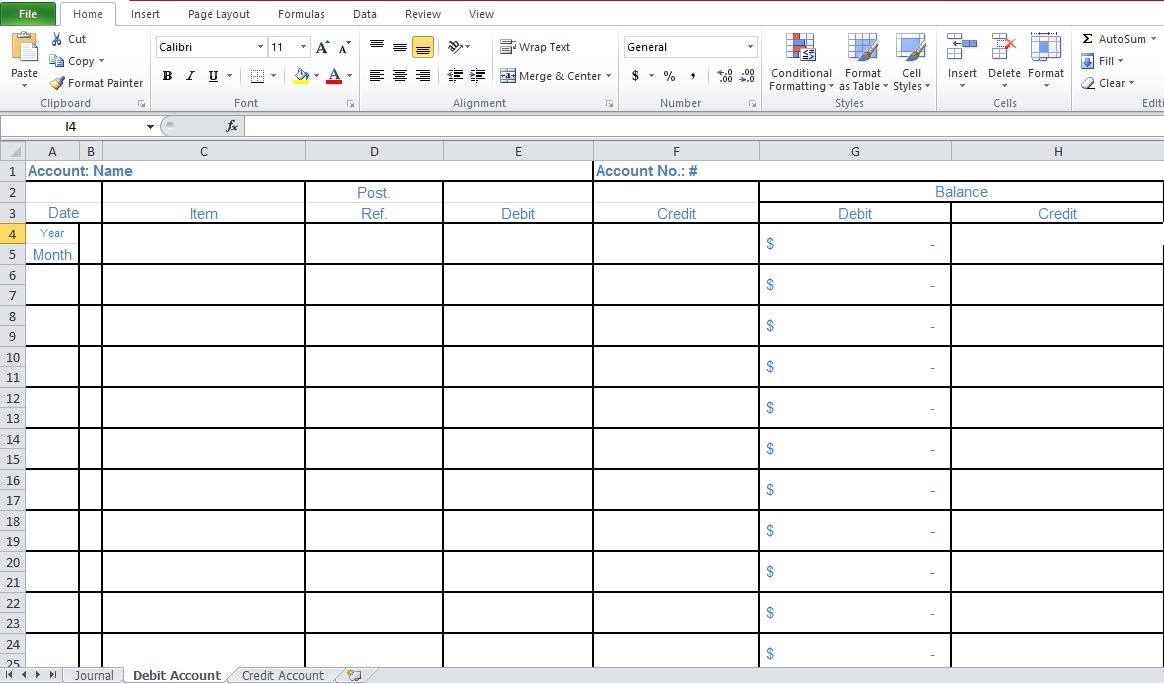

To effectively manage a small business’s finances, certain foundational accounting templates are indispensable. These templates provide a structured framework for tracking income, expenses, assets, and liabilities, offering critical insights into financial performance. Here are some of the most essential Excel templates for small business accounting:

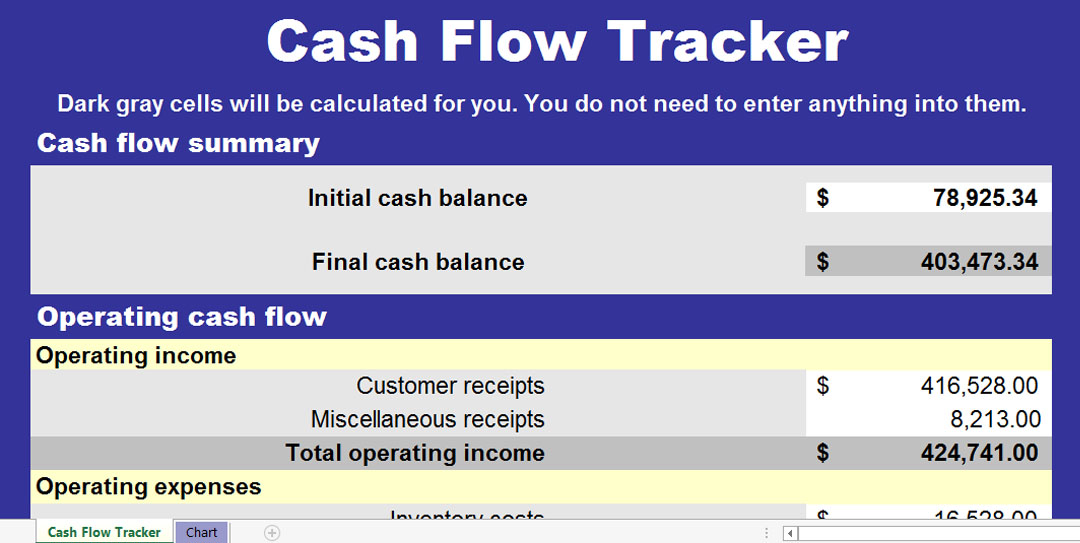

Cash Flow Statement Template

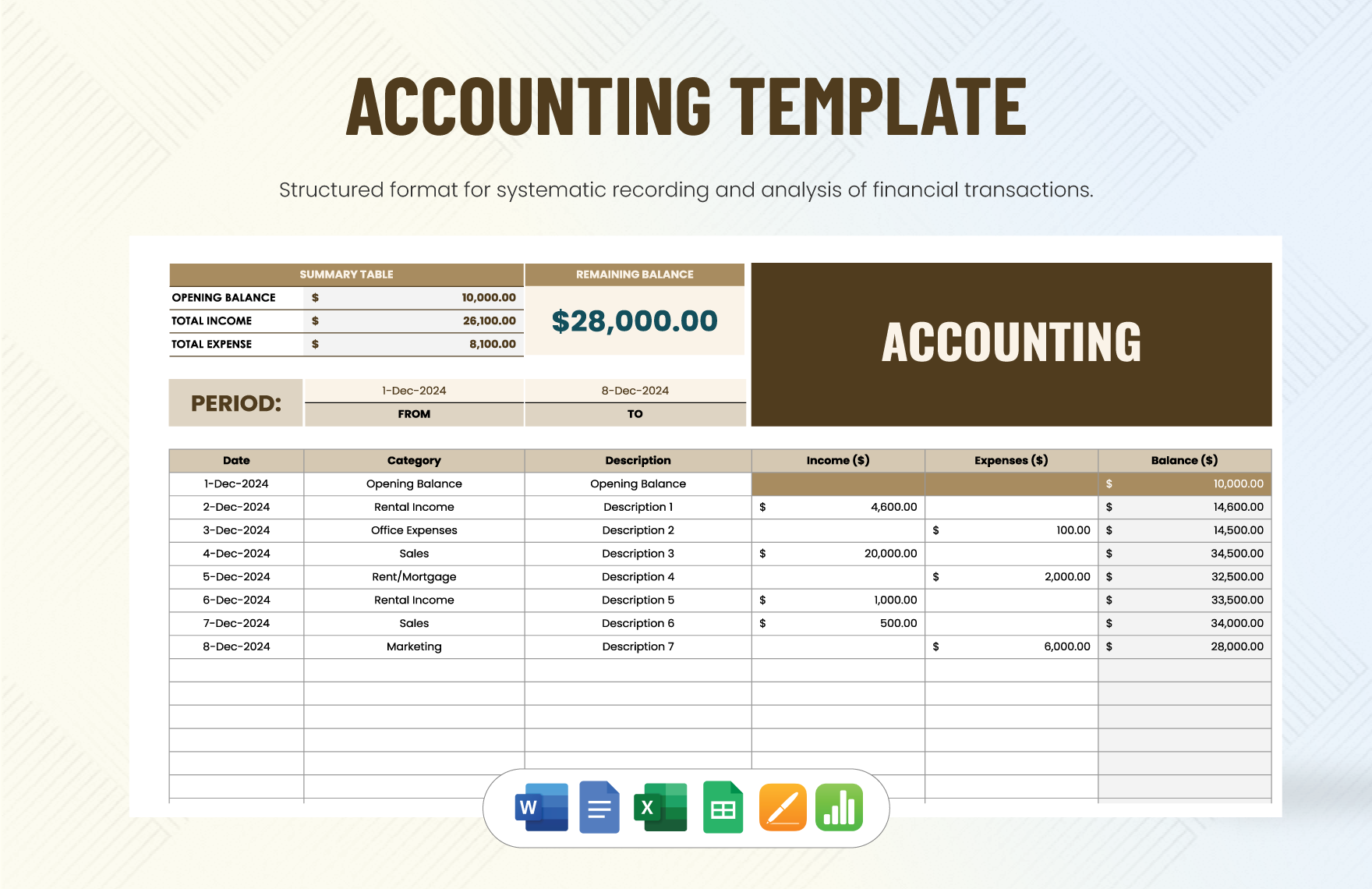

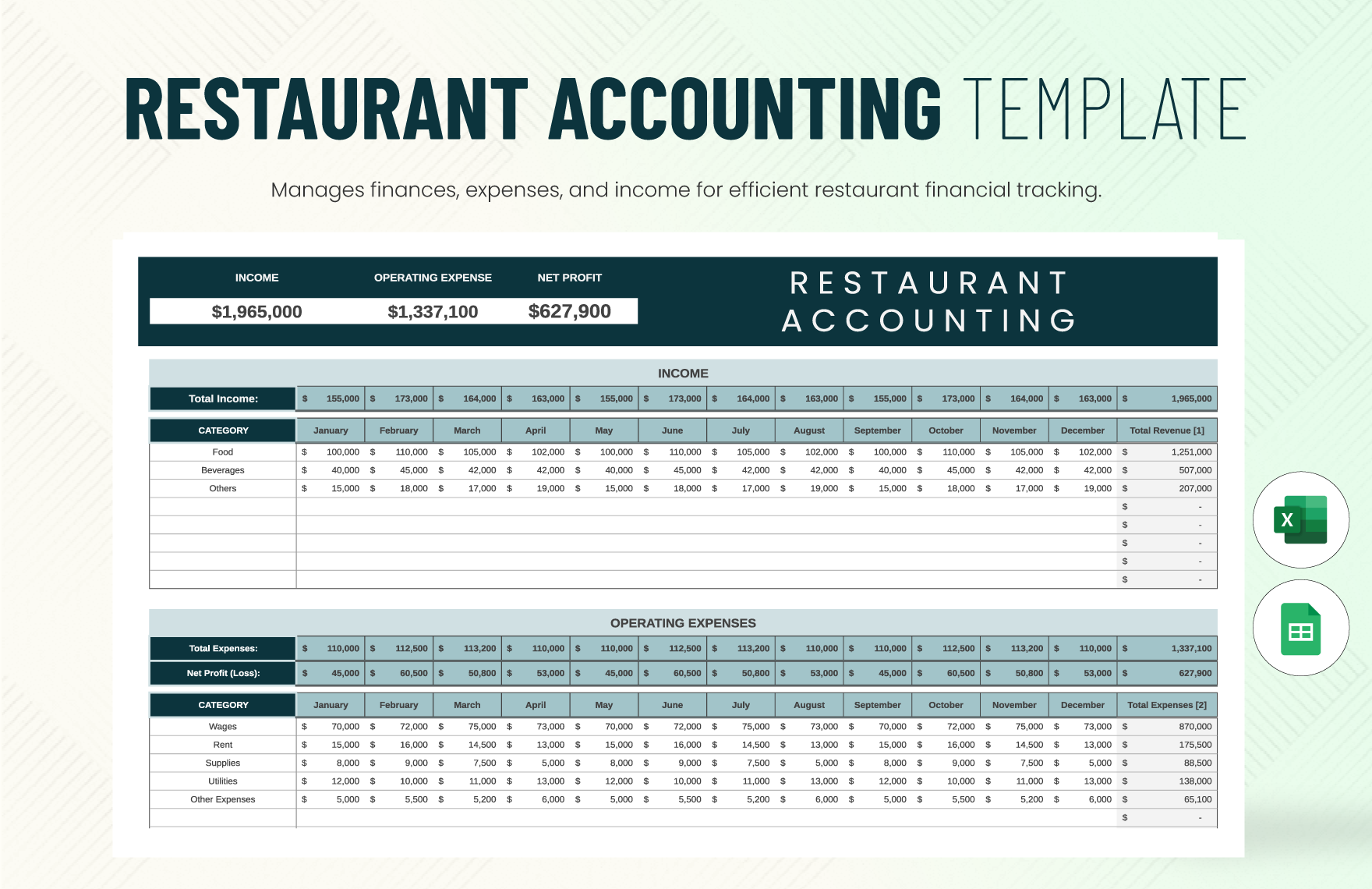

A cash flow statement template is vital for understanding the movement of money in and out of your business. It tracks cash generated from operations, investments, and financing activities. By using this template, small business owners can identify periods of cash surplus or deficit, which is crucial for managing liquidity and ensuring the business has enough cash to meet its short-term obligations. It helps answer the fundamental question: “Where is my money coming from, and where is it going?”

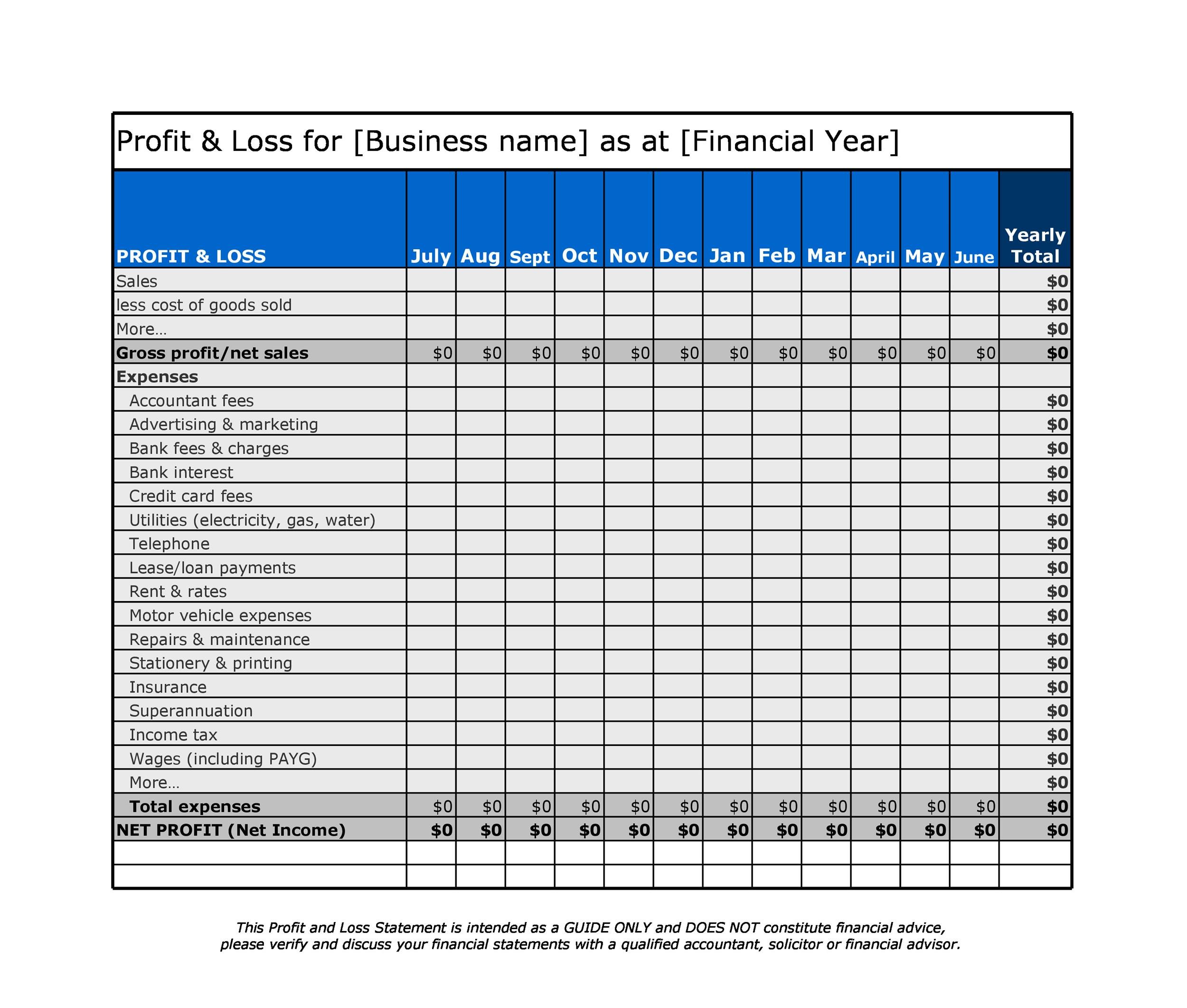

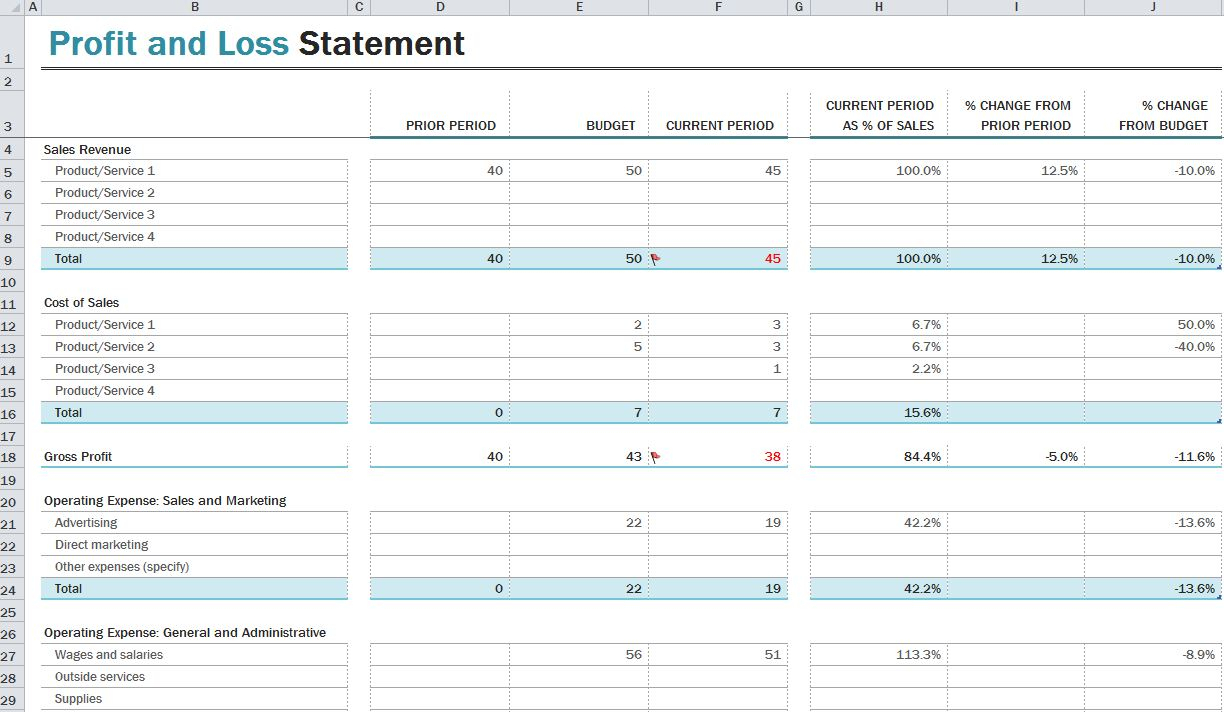

Profit and Loss (P&L) Statement Template

Also known as an income statement, a profit and loss statement template summarizes revenues, costs, and expenses incurred during a specific period. This template clearly shows whether your business is making a profit or a loss. It’s instrumental for assessing your company’s profitability, understanding your revenue streams, and identifying areas where costs can be reduced. A well-maintained P&L helps in evaluating business performance over time.

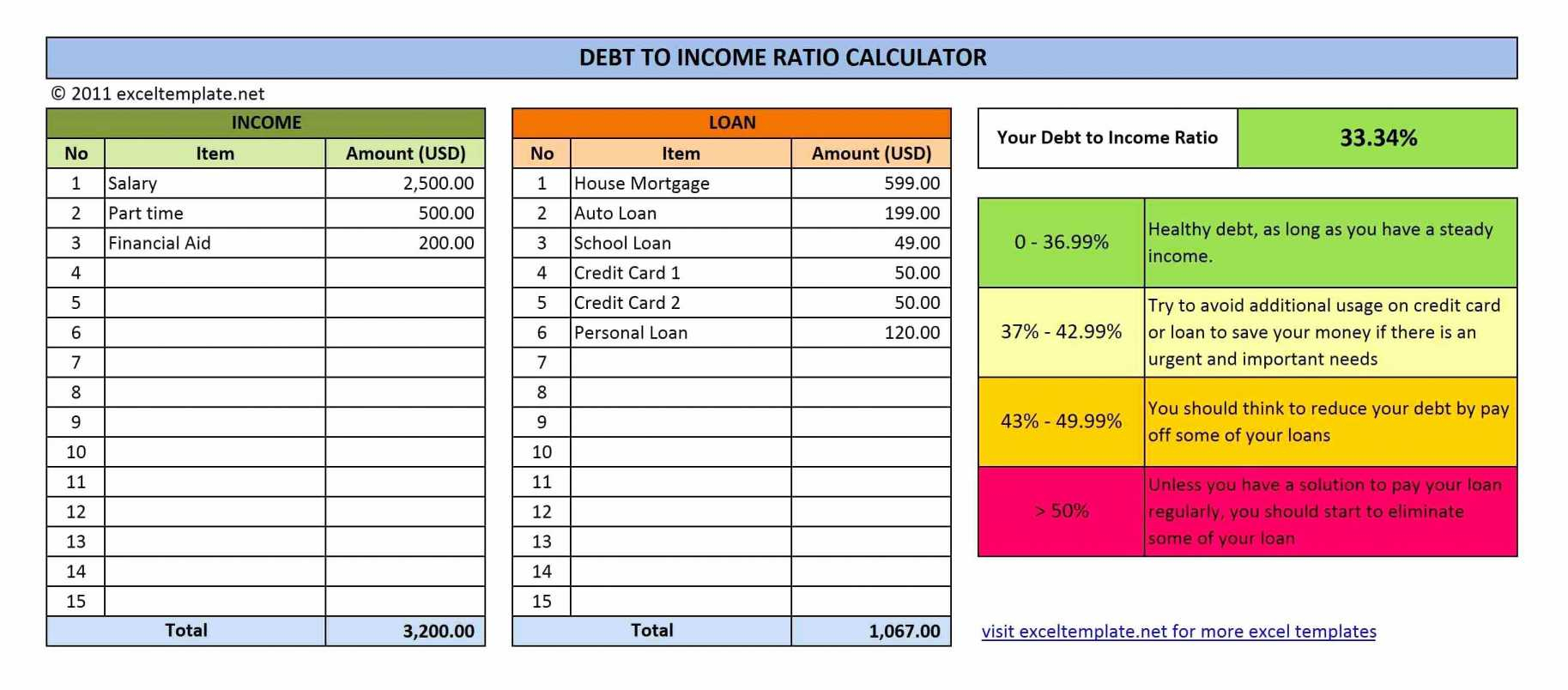

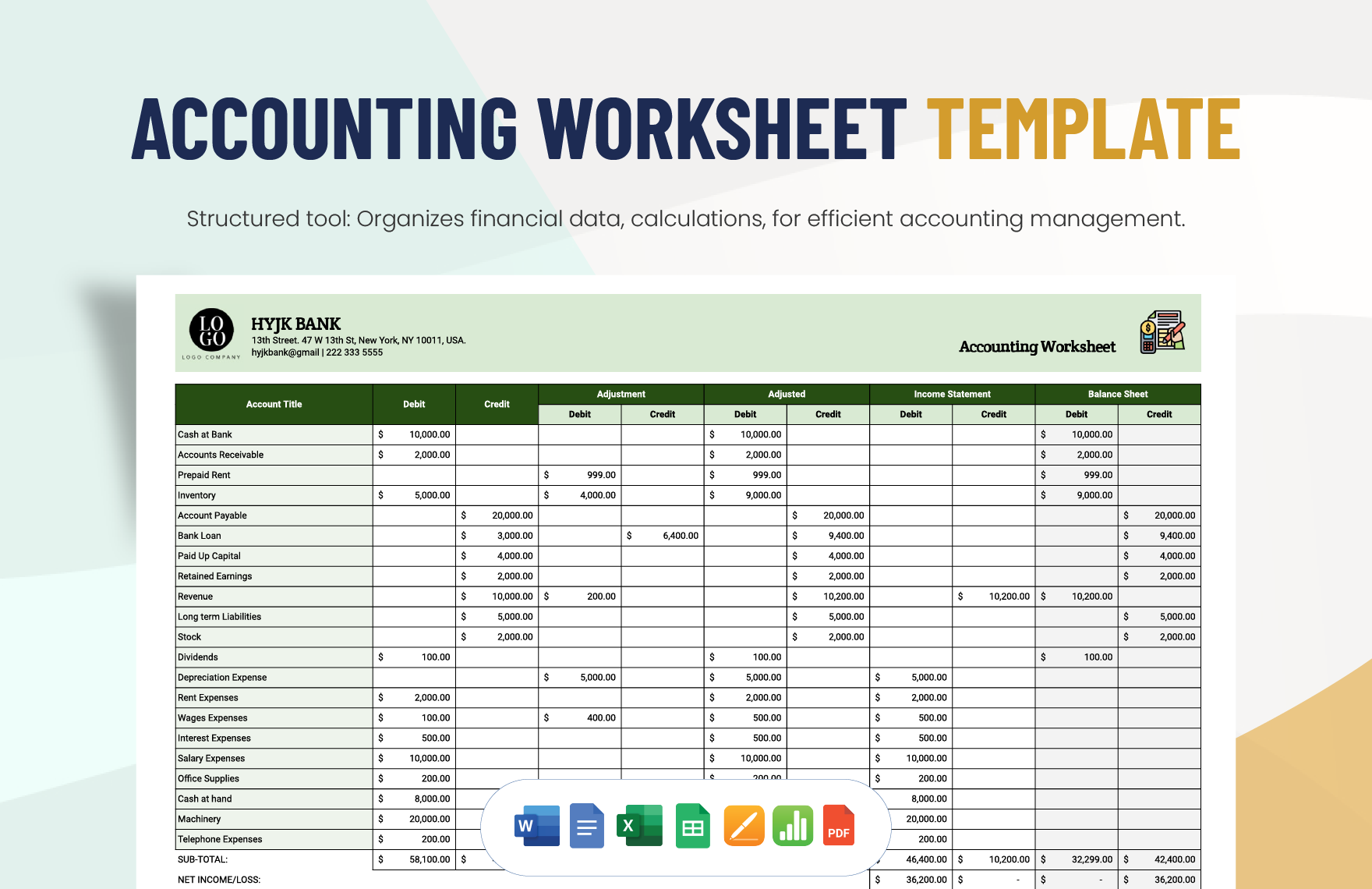

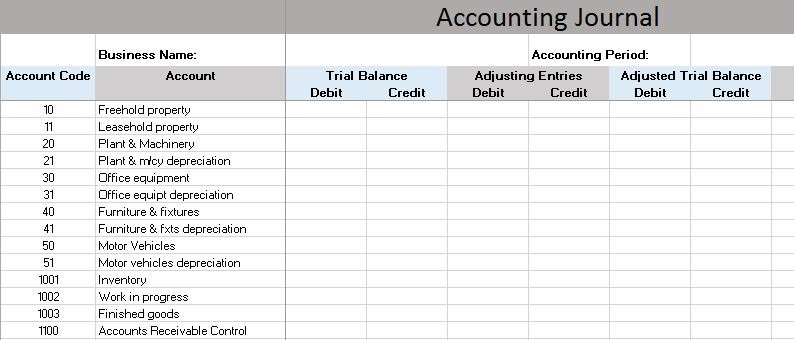

Balance Sheet Template

The balance sheet template provides a snapshot of your business’s financial health at a specific point in time. It details your assets (what your business owns), liabilities (what your business owes), and owner’s equity (the owner’s investment in the business). The fundamental accounting equation, Assets = Liabilities + Equity, must always hold true. This template is crucial for understanding your business’s overall financial position, including its solvency and liquidity.

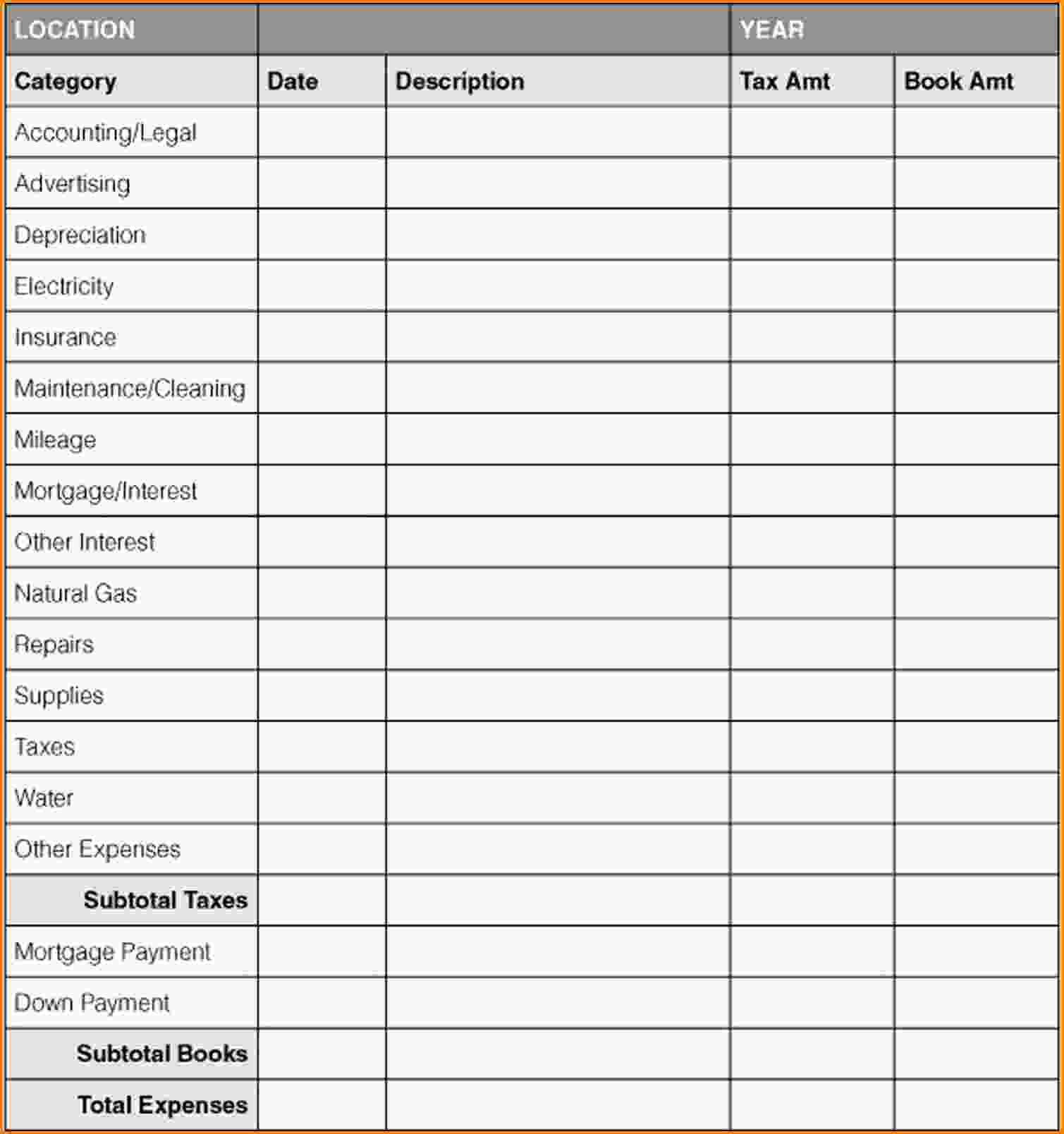

Expense Tracker Template

A detailed expense tracker template is fundamental for monitoring and categorizing all business expenditures. From office supplies and utility bills to marketing costs and travel expenses, accurately tracking expenses is critical for budgeting, tax preparation, and identifying opportunities for cost savings. This template often includes fields for date, vendor, description, category, and amount, making it easy to see where money is being spent.

Invoice Template

Professional and clear invoicing is essential for timely payments. An invoice template allows small businesses to generate standardized, professional-looking invoices that include all necessary details like client information, service/product descriptions, quantities, rates, totals, and payment terms. Using a template ensures consistency, reduces errors, and helps in tracking outstanding payments.

Budget Template

A budget template is a cornerstone of financial planning. It helps small businesses project future income and expenses over a specific period, typically monthly or annually. By comparing actual financial performance against budgeted figures, businesses can identify variances, make necessary adjustments, and ensure they stay on track to meet their financial goals. It’s a proactive tool for financial control.

Payroll Template

For businesses with employees, a payroll template can simplify the calculation of wages, deductions (like taxes or benefits), and net pay. While not suitable for complex payroll needs, a basic template can help track employee hours, calculate gross pay, and apply standard deductions for a small number of employees, ensuring accurate and timely compensation.

Inventory Management Template

Businesses that sell products need an inventory management template to track stock levels, product costs, and sales. This template helps in monitoring what’s in stock, what needs to be reordered, and the cost of goods sold. Effective inventory management prevents stockouts, reduces carrying costs, and improves cash flow.

Mastering Your Finances: Tips for Using Excel Templates For Small Business Accounting Effectively

Simply having Excel templates for small business accounting is not enough; their effective utilization is key to unlocking their full potential. Implementing these best practices will help ensure accuracy, provide valuable insights, and streamline your financial management processes.

First and foremost, regular and consistent data entry is paramount. Treat your Excel accounting system with the same discipline as a dedicated software. Schedule specific times each week or month to update all income and expense records. Delayed or sporadic data entry can lead to errors, missing information, and a skewed financial picture, rendering the templates less effective.

Always back up your Excel files regularly. Financial data is critical, and losing it due to a computer crash or accidental deletion can be devastating. Store copies on an external hard drive, cloud storage (like Google Drive or OneDrive), or both. Implement a routine backup schedule to protect your valuable information.

Invest a little time in learning basic Excel functions and formulas. Understanding functions like SUM, AVERAGE, IF, and conditional formatting can significantly enhance the utility of your templates. You might also explore pivot tables for powerful data analysis, allowing you to quickly summarize and analyze large datasets from your expense trackers or sales logs. Even a rudimentary understanding can help you customize templates and extract deeper insights.

Customize templates to fit your specific business needs. While pre-made templates are a great starting point, your business is unique. Don’t hesitate to add new categories for income or expenses, modify formulas, or create new sheets to track specific metrics relevant to your operations. The flexibility of Excel is one of its greatest strengths; leverage it.

Regularly review your financial reports and data. Don’t just input data and forget about it. Set aside time to analyze your cash flow, P&L, and balance sheet statements generated from your templates. Look for trends, identify areas of overspending, pinpoint profitable product lines, and assess your financial health. This regular review is crucial for proactive decision-making.

Finally, consider implementing basic security measures. If multiple people have access to your accounting files, use password protection for your Excel worksheets or workbooks to prevent unauthorized changes. While Excel’s security isn’t foolproof, it adds a layer of protection against accidental alterations.

Customizing and Optimizing Your Excel Templates for Unique Business Needs

While off-the-shelf Excel templates for small business accounting provide an excellent foundation, truly maximizing their value often comes down to customization and optimization. Tailoring these tools to your specific operational nuances ensures they remain relevant and highly effective as your business evolves.

Start by refining your category lists. The default categories in a template might not perfectly align with your business. For instance, a graphic design firm will have different expense categories than a retail shop. Modify the expense and income categories to reflect your actual operations, making sure they are granular enough for detailed analysis but not so numerous that they become unwieldy. Think about what information you’ll need for tax purposes and internal reporting.

Next, consider creating simple dashboards. Excel’s charting capabilities are powerful. By pulling key data from different sheets (e.g., total monthly income from your P&L, cash balance from your cash flow, top 5 expenses from your expense tracker), you can create a summary dashboard on a separate sheet. This provides an “at-a-glance” overview of your financial performance, making it easier to spot trends and make quick assessments without diving into complex data.

Integrate multiple sheets within a single workbook. Instead of having separate files for your P&L, cash flow, and expense tracker, link them within one Excel workbook. This allows for cross-referencing and ensures consistency. For example, your expense tracker sheet can feed directly into your P&L statement sheet, minimizing manual data transfer and potential errors. Use simple cell references (='SheetName'!Cell) to pull data across sheets.

Explore conditional formatting to highlight critical data points automatically. For example, you can set rules to automatically turn expense figures red if they exceed a certain budget amount, or highlight invoices that are overdue. This visual cue helps you quickly identify areas that require immediate attention.

Lastly, for more advanced users, consider exploring VBA (Visual Basic for Applications) for simple automation. While this requires a bit more technical skill, even basic VBA scripts can automate repetitive tasks, such as clearing input fields after data entry, or generating simple reports with a single button click. This level of optimization can save significant time and further reduce manual effort.

When to Look Beyond Excel: Limitations and Alternatives

While Excel templates for small business accounting offer significant advantages, it’s equally important to recognize their limitations and understand when it might be time to transition to more specialized solutions. Excel, despite its versatility, is not a perfect fit for every business stage or every accounting need.

One primary limitation is scalability for complex operations. As your business grows, the volume of transactions increases exponentially. Managing hundreds or thousands of invoices, expenses, and payroll entries in Excel can become incredibly cumbersome and prone to error. Manually inputting and reconciling large datasets can consume an inordinate amount of time, diverting focus from core business activities.

Another significant drawback is the increased risk of human error. While templates help, a single incorrect formula, misplaced entry, or accidental deletion in a spreadsheet can corrupt entire financial records. Unlike dedicated accounting software that often has built-in checks and balances, Excel relies heavily on the user’s vigilance and understanding of formulas. This risk compounds when multiple users are accessing and modifying the same file.

Furthermore, Excel often lacks the automation and integration capabilities found in specialized software. Tasks like automatic bank reconciliation, recurring invoice generation, automated tax calculations, or direct integration with point-of-sale (POS) systems or e-commerce platforms are typically not feasible or are very complex to implement in Excel. This means more manual work, which can be inefficient and lead to discrepancies.

Security and audit trails are also weaker in Excel. While password protection can be applied, it’s not as robust as the security features in commercial software. Dedicated accounting platforms also maintain detailed audit trails, tracking every change made to a transaction, which is crucial for compliance and accountability.

Therefore, when your business reaches a certain size or complexity, or when the time spent on manual data entry and error-checking in Excel outweighs its cost-saving benefits, it’s time to consider dedicated accounting software. Solutions like QuickBooks, Xero, FreshBooks, or Zoho Books offer advanced features such as automated bank feeds, robust reporting, integrated payroll, multi-user access with permissions, and enhanced security. These platforms are designed specifically for financial management, providing greater automation, accuracy, and scalability to support growing businesses more effectively.

Conclusion

For many small businesses, navigating the complexities of financial management can be a daunting task. However, the judicious use of Excel templates for small business accounting offers an incredibly practical, cost-effective, and flexible solution. These templates empower entrepreneurs to take control of their financial records, providing clear insights into cash flow, profitability, and overall financial health without the immediate need for expensive, specialized software. From tracking expenses and generating invoices to preparing crucial financial statements like the P&L and balance sheet, Excel provides the foundational tools necessary for sound bookkeeping.

The core benefits of adopting Excel templates—including their ease of use, cost savings, improved organization, and the ability to foster better financial insights—make them an invaluable asset for startups and growing enterprises alike. By implementing essential templates such as cash flow statements, profit and loss reports, and expense trackers, businesses can maintain accurate records, identify trends, and make informed strategic decisions. Furthermore, customizing these templates to fit unique operational needs and adhering to best practices for data entry and review will maximize their effectiveness. While Excel has its limitations and businesses may eventually outgrow its capabilities, for a significant portion of the small business landscape, these templates serve as an indispensable cornerstone of financial management, providing a solid foundation for growth and fiscal responsibility.

]]>