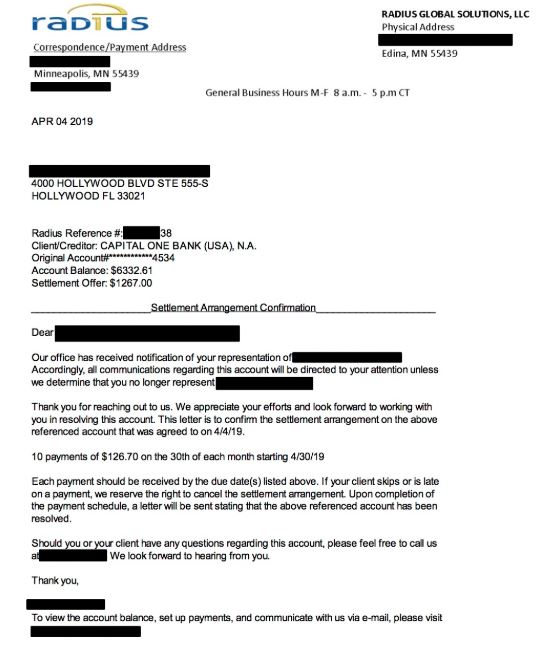

Debt Negotiation Letter Template. Others may be restricted when it comes to other options and are more prepared to take the danger. Nevertheless, it might be difficult to know the best steps to comply with when writing a debt settlement letter by yourself. Keep this written confirmation protected too in case there’s any dispute in the future, so you’ll be able to provide this as proof of the settlement. When I obtain it, I will send the complete quantity of AMOUNT to you within 5 working days.

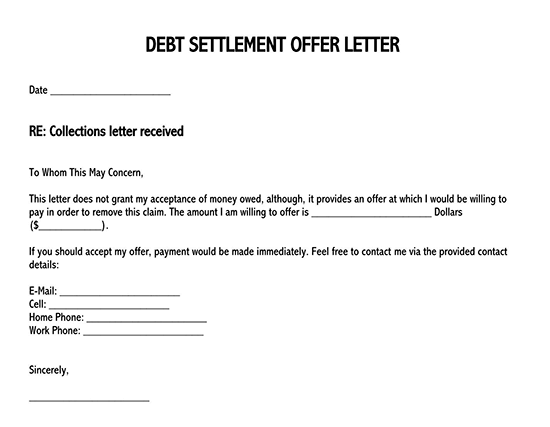

Even when you negotiate decrease month-to-month funds, you will not profit a lot if you cannot regularly make these payments. A debt settlement letter contains a proposal offer that will hopefully open the door to negotiate a good and reasonable debt settlement. There are even samples for negotiation letters, thank you letters ….

As mentioned, if you efficiently dispute a debt, your debt collector normally won’t respond. If the debt collector fails to reply or present proper proof, you may find a way to dispute the validity of the debt letter. 2 Note that there’s nothing a debt settlement firm can do for you that you just can’t do your self. It’s a lot easier to stop than to get the money returned. This means that things you say in a genuine try and resolve the dispute out of court docket cannot later be used against you in court docket.

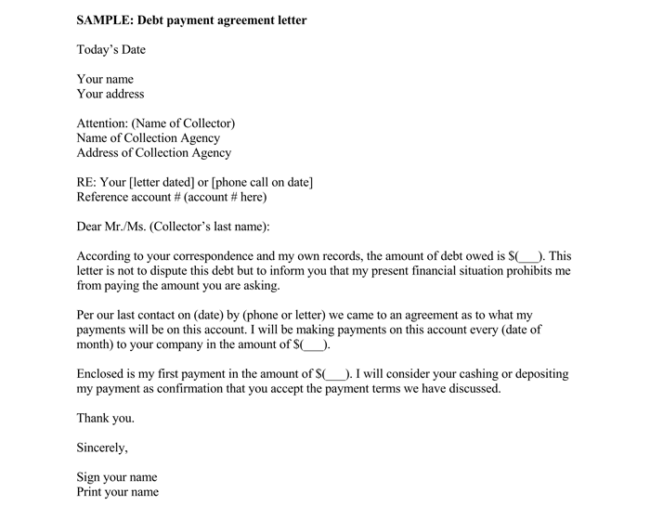

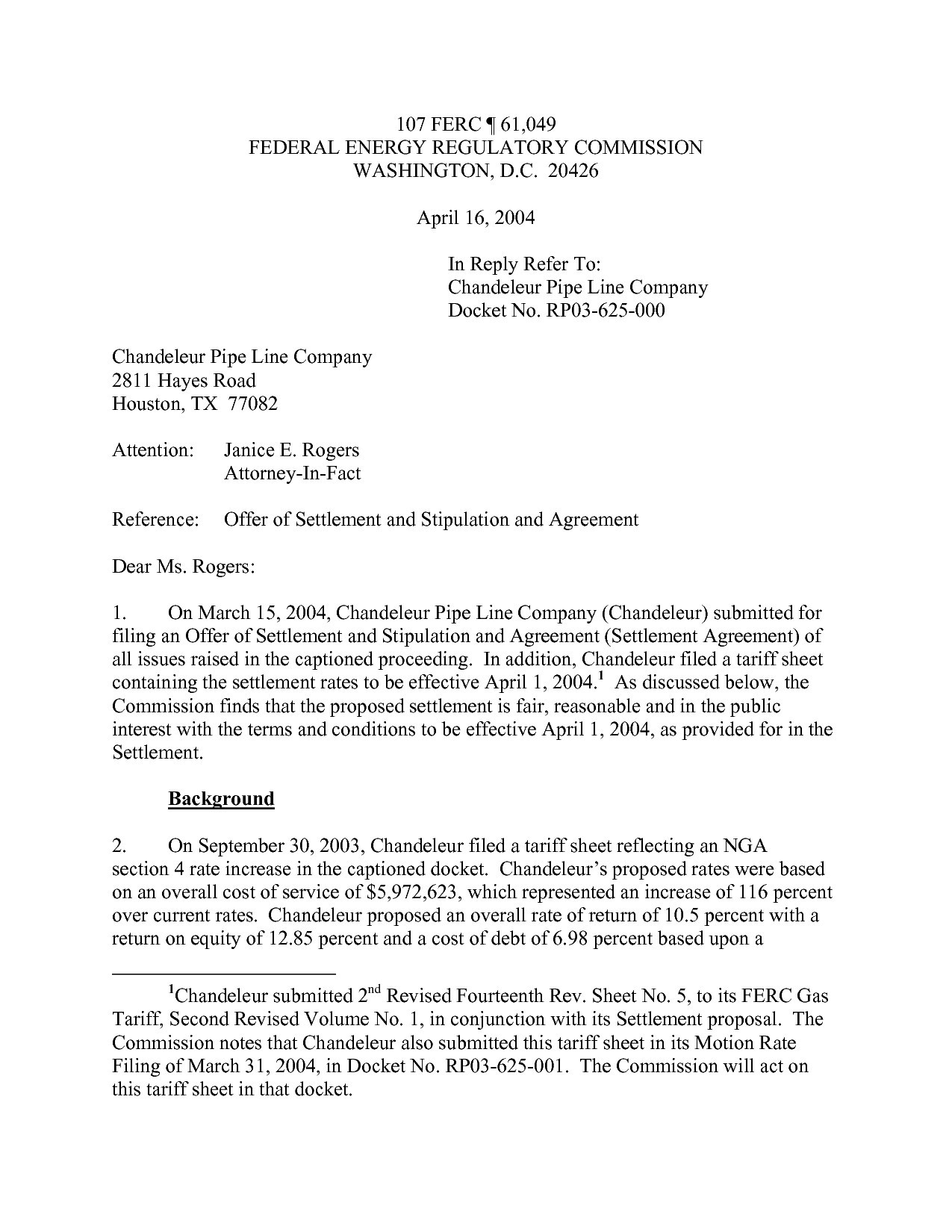

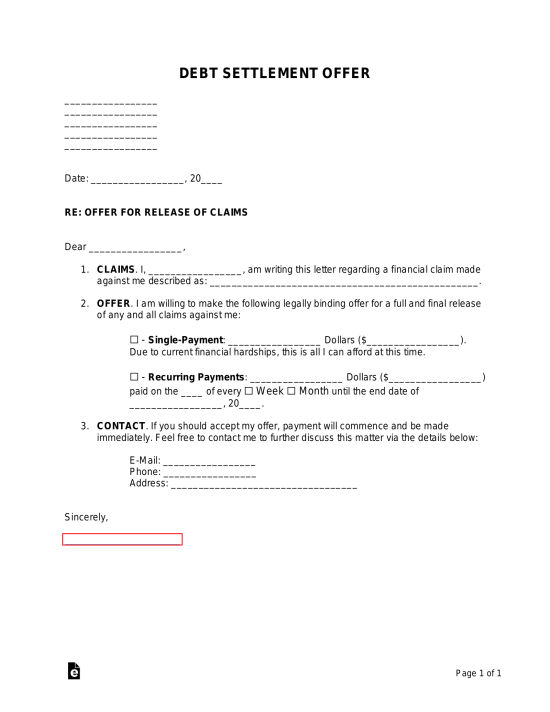

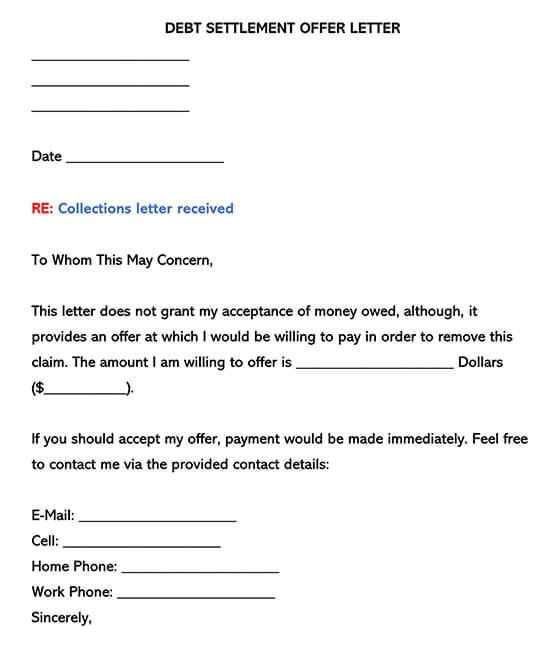

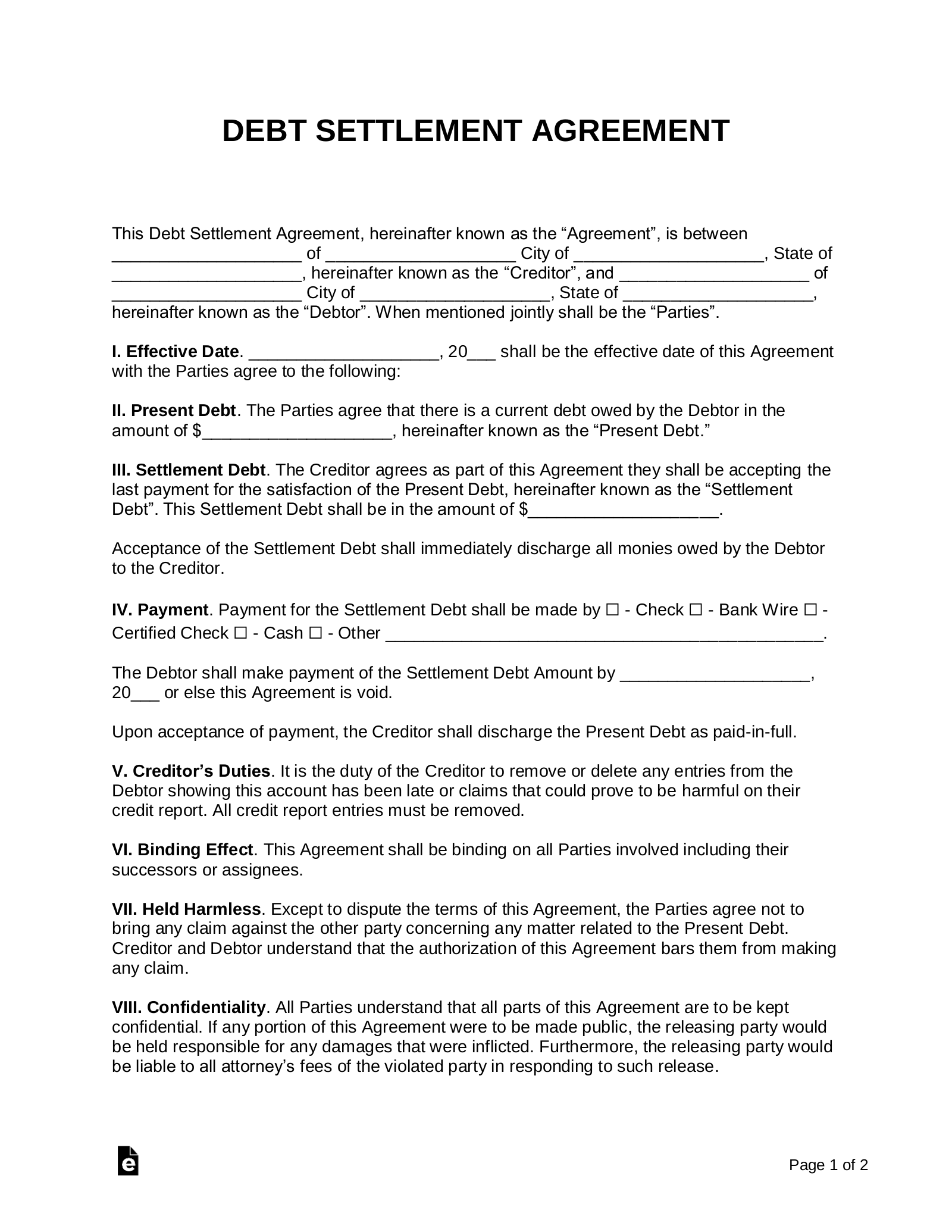

It’s necessary that your debt settlement letter incorporates certain details without providing the debt collector with info it could use towards you in a lawsuit. The proposal in your debt settlement is a legal contract provide. A template just like the one on this article can help you place your proposal into phrases.

Some debts cross via a number of assortment companies once they go away the original creditor. During that time, mix-ups can happen or money owed can turn into so old they’re previous the statute of limitations and legally uncollectible.

The Method To Write A Debt Validation Letter

If you’re unable or not sure about negotiating a debt settlement over the phone, negotiating by letter is a reasonable possibility. It’s not a lot totally different negotiating together with your creditor by phone, however it may take longer. There are a number of methods to organize a settlement letter, together with hiring an attorney to write down it for you or going surfing to obtain a template to use as a place to begin.

We place hyperlinks on our website to our affiliates, and if you click on these hyperlinks, our associates compensate us for it. Our relationships with our associates might affect which merchandise we characteristic on our web site and the place these products seem in our articles. Creditors sometimes provide hardship packages for purchasers who’re…

Full And Ultimate Settlement Provide Sole Name

It’s unlawful for debt collectors to report old money owed as new by… At current the creditors I even have contacted are prepared to settle at a 50% low cost on the outstanding money owed.

It won’t affect your credit report for years like a chapter will, and you’ll be ready to dig yourself out of debt in a shorter amount of time. If you might be unable or unwilling to make a call, you probably can send a debt settlement letter as an alternative.

Body – this is where you’ll explain the details of your settlement provide and what you expect from your creditor. Even in the course of the negotiation course of the creditor might continue to name and demand fee, so the debtor should keep sturdy until all negotiations are finalized. Most debt collectors have on-line portals, web forms, and e-mail addresses that will assist you communicate and ship funds online.

As you negotiate your debt settlement for money owed like a credit card, keep in mind that principal, interest, late fees, and different costs will continue to accumulate if you’re now not making regular funds. There’s no guarantee that you’ll be able to negotiate a settlement agreement together with your creditor.

I’ll pay the quantity provided within [number of days/weeks/months] supplied you send a signed settlement settlement that satisfies all of my requests. Please remember that, due to my state of affairs, I actually have many different financial obligations which will take priority if we’re unable to come back to an settlement.

If your debt’s statute of limitations has expired, you’re safe from legal motion. If you most likely did get sued, you can have the lawsuit dismissed instantly.

If you fail to send the debt validation letter within this period, the creditor doesn’t have to answer your requests for validation sooner or later. They can then proceed with the idea that the debt is legitimate. While they might be present with payments, their creditworthiness is basically poor because they can not make a fee on a new car loan.

We might obtain a commission from the referred supplier if you use their service. This is to maintain our website and the prices of operating it as a free service.

By regulation, a debt collector should ship you a notification that your debt has been offered. So, look out for any official notices that may inform you who now holds your account. This letter will clarify the debtor’s current financial scenario and reason why the account is late.

I, ________________, have received info concerning a debt that’s being claimed in opposition to me. Code § 1692g, I maintain the proper to confirm the entire debt quantity, including any charges, and who the unique get together that’s making the declare. After receiving such information I will evaluation and respond throughout the 30-day period allotted to me under federal regulation.

Under the Fair Debt Collections Practices Act , I am entitled to request validation of the debt that you allege is as a result of of you. This isn’t a request to verify the debt however rather a request for you to provide full and competent proof of my contractual obligation to supply fee to you.

After that, when the preliminary inside revenue service and/or state tax obligation points are solved, they inform us precisely how they actually feel significantly better, complimentary, and able to live life once again. The satisfaction each as nicely as every individual in our group has for the Five Star Reviews is what makes us much more passionate and likewise dedicated to serving to you. By doing this, you’ll be capable of see when the letter is delivered.

You can negotiate by speaking to the other party, or by writing a letter, or each. If the other get together has a lawyer, you need to communicate to their lawyer quite than on to the opposite party. Be competitive and purchase, and print the Vermont Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties with US Legal Forms.

This will depend on your circumstances and might be mentioned at the earliest opportunity. MoneyNerd Limited is a free to make use of service, however we may obtain a fee, without charge to you, when you complete a loan.

USLegal received the following as in comparison with 9 different type websites. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Customer Service 10/10.

Once you have accepted my supply and I actually have acquired written settlement of this. “What is a debt collection validation notice?” Retrieved January 6, 2022. If a debt collector does verify your debt, the following step is to work out how old it’s.

I can be very grateful should you kindly accept my agreement letter and send me a affirmation letter as a proof of the acceptance of this letter. The first payment of amount 50 $ has been enclosed along with this letter.

Although collectors are underneath no legal obligation to accept debt settlement provides, negotiating and paying decrease quantities to settle money owed is way extra common than many people understand. Fortunately, the debt settlement experts at United Settlement may help you write an efficient debt settlement proposal letter.

When it involves debt , it’s a good idea to know the small print of the statutes of limitations in your state. Don’t worry, we’ve obtained every thing you have to know proper right here. In actuality, this approach doesn’t yield such simple outcomes — until the debt really is not yours!

The letters come together with text that will assist you perceive how you should format your writing, before you start negotiations with collectors. You’re more likely to have a company accept a settlement offer if you are ready to pay it upfront and in full. Creditors choose this technique because they’re assured to get their money and it’s a carried out deal afterwards.

The “reference” line ought to embrace the related account quantity. This have to be included so the creditor will know precisely which debt you’re proposing to settle. Writing letters won’t assist your credit score unless you observe up to make sure the letters had been received and to find out whether or not your collectors took action.

The average US resident has roughly $38,000 in private debt. According to Northwestern Mutual’s 2018 Planning & Progress Study, the debt quantity was $1,000 less on the end of 2018.

Though the tackle section might appear to be more of a formality than anything else, it consists of info important to a debt settlement proposal. Now that you’ve got a fundamental thought of what a debt settlement letter looks like, we can get into the details of each part, and why you need to convey the particular information shown.

He has a background in accounting and the mortgage industry. Since 2009, Kevin Mercadante has been sharing his journey.

After all, that is where the rubber meets the highway in Baby Step 2. A statute of limitations on debt limits a debt collector’s capacity to sue you in civil court docket for assortment of debt.

Make positive that the negotiable amount complies with each the parties else the creditor might not conform to the settlement letter. In debt fee settlement letter, make sure that on the very beginning the debtor should have a written copy of all of the cost details which may be to be made so as to keep away from any sort of controversy in future.

In most instances, simply by freeing up numerous hundred more dollars a month with a debt adjudication program, you’ll have the ability to have the peace of thoughts you need as well as get your unsafe lenders dealt with. Similar to a “bank card monetary debt forgiveness” program, for shoppers that qualify, the creditors forgive a sure quantity of financial debt that’s owed. Nobody can anticipate sure future outcomes as a end result of every occasion is distinct.

This can damage your credit, however it might ultimately help you to get back into a better monetary situation in the long run if you’ll have the ability to settle. Whatever you do although, be sure to get the settlement in writing. Debt settlement is amongst the most marketed and for good reason.