Unanimous Shareholder Agreement Template

Navigating the complexities of business ownership requires a robust framework to govern the relationship between shareholders, especially in closely held companies. A well-drafted Unanimous Shareholder Agreement Template serves as the cornerstone for ensuring clarity, preventing disputes, and protecting the interests of all parties involved. This legal document outlines the rights, responsibilities, and obligations of each shareholder, providing a clear roadmap for how the company will be managed and how shareholder relationships will be handled during both normal operations and unforeseen circumstances. Understanding the components and importance of such an agreement is paramount for the smooth and sustainable growth of any enterprise.

The absence of a formal, legally binding agreement can lead to significant misunderstandings and conflicts down the line. These disputes can range from disagreements over company strategy and management decisions to issues concerning the sale or transfer of shares. A unanimous shareholder agreement addresses these potential friction points proactively, establishing clear rules for decision-making, dividend distribution, and the exit of shareholders. It is designed to reflect the specific needs and agreements of the founding members and subsequent investors, ensuring that everyone is on the same page regarding the company’s future.

Moreover, a comprehensive Unanimous Shareholder Agreement Template can safeguard minority shareholders by providing them with certain rights and protections that might not otherwise be available under standard corporate law. It can dictate buy-sell provisions, valuation methods for shares, and mechanisms for resolving deadlocks. For founders, it establishes a clear understanding of their roles and the value of their contributions, while for investors, it offers assurance regarding their investment and potential returns. The flexibility of a template allows for customization to fit the unique circumstances of each business, making it an indispensable tool for corporate governance.

Why a Unanimous Shareholder Agreement is Essential

The core purpose of a unanimous shareholder agreement is to provide a clear and comprehensive set of rules governing the ownership and management of a corporation. Unlike the default rules found in corporate statutes, which are often insufficient for closely held businesses, a shareholder agreement allows the owners to tailor the governance structure to their specific needs and desires. This is particularly critical in companies where all shareholders agree on the direction and operation of the business, hence the “unanimous” aspect.

Protecting Shareholder Interests

A key benefit of having a unanimous shareholder agreement in place is the protection of all shareholder interests, including those of minority shareholders. Without such an agreement, a majority shareholder could potentially make decisions that are detrimental to the minority. The agreement can stipulate that certain significant decisions require the unanimous consent of all shareholders, thereby preventing oppressive conduct and ensuring fair treatment. This includes matters like selling major assets, issuing new shares, or amending the company’s articles of incorporation.

Establishing Clear Governance and Management

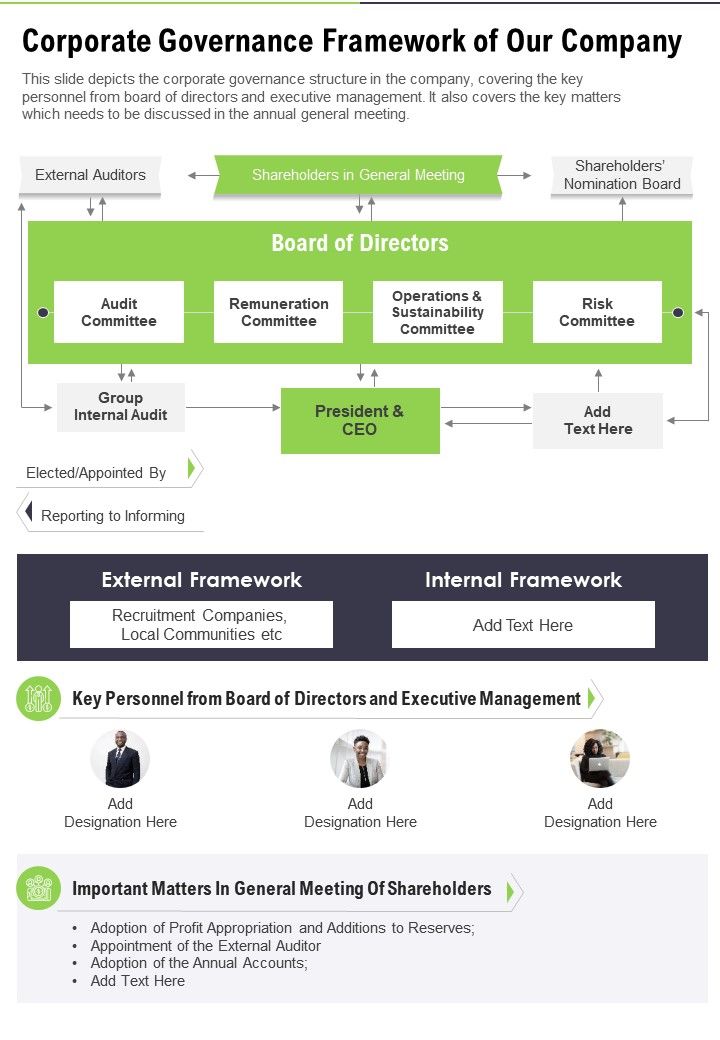

This type of agreement clearly defines how the company will be managed, who will be on the board of directors, and what powers the directors and officers will have. It can outline specific procedures for board meetings, voting requirements, and the appointment of key management personnel. By setting these parameters in advance, the agreement helps to prevent internal power struggles and ensures that the company is run efficiently and in accordance with the shareholders’ collective vision.

Preventing and Resolving Disputes

Disagreements are almost inevitable in any business partnership. A unanimous shareholder agreement provides a structured framework for resolving these disputes before they escalate. It can include provisions for mediation, arbitration, or other dispute resolution mechanisms, as well as pre-agreed methods for valuing shares in the event of a shareholder’s departure or death. This proactive approach can save considerable time, money, and emotional distress.

Defining Share Transfer Restrictions

One of the most critical aspects addressed in a shareholder agreement concerns the transfer of shares. Without restrictions, a shareholder could sell their shares to anyone, potentially introducing an undesirable partner into the business. The agreement can impose restrictions such as pre-emptive rights (giving existing shareholders the first option to buy shares being sold), rights of first refusal, or even outright prohibitions on certain types of transfers. This ensures that ownership remains with those who are aligned with the company’s goals.

Key Components of a Unanimous Shareholder Agreement Template

A robust Unanimous Shareholder Agreement Template will typically cover a range of essential areas to provide comprehensive protection and guidance for the business and its owners. While the specifics will vary depending on the company and its shareholders, several core components are almost always included.

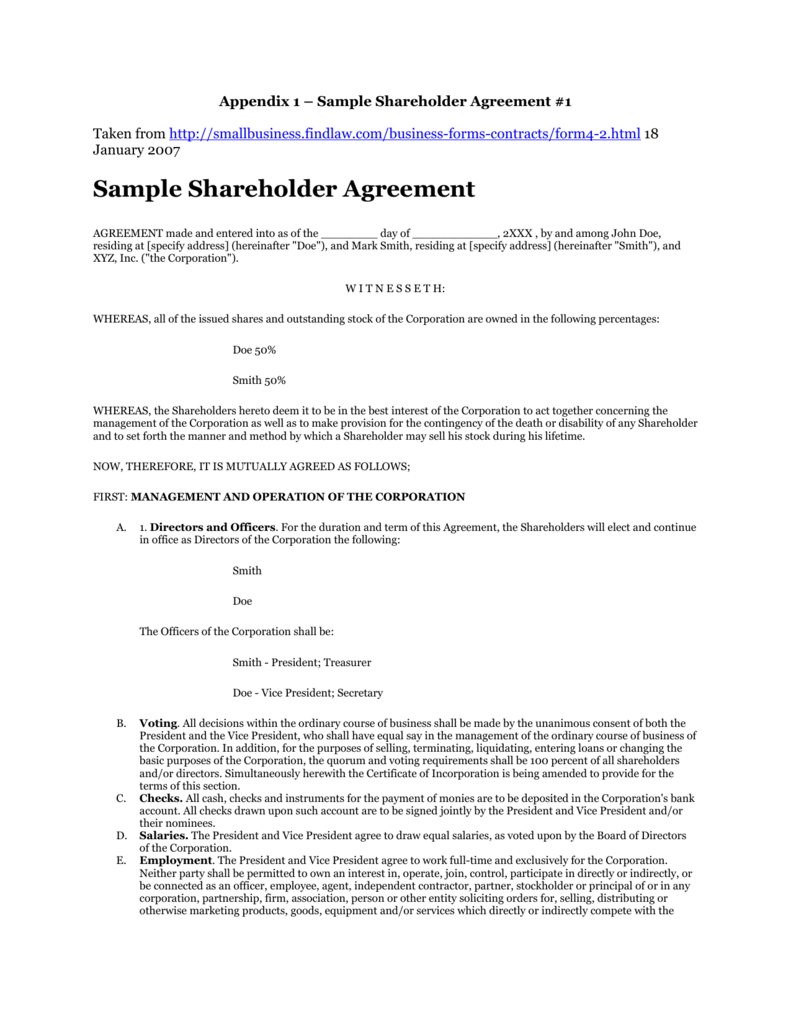

Identification of Parties and Company Information

The agreement should clearly identify all the parties involved – the company and each individual shareholder, including their respective addresses and the number of shares they own. This forms the foundational basis of the document.

Share Ownership and Capitalization

This section details the current shareholding structure, including the classes of shares, the number of shares held by each shareholder, and the total issued capital. It may also include provisions related to future capital requirements and how additional funding will be raised, such as through new share issuances or debt financing.

Management and Governance Structure

This is a critical part of the agreement. It defines how the company will be managed, including:

* Board of Directors: How directors are appointed, their terms, and their powers. In many closely held companies, shareholders may also be directors.

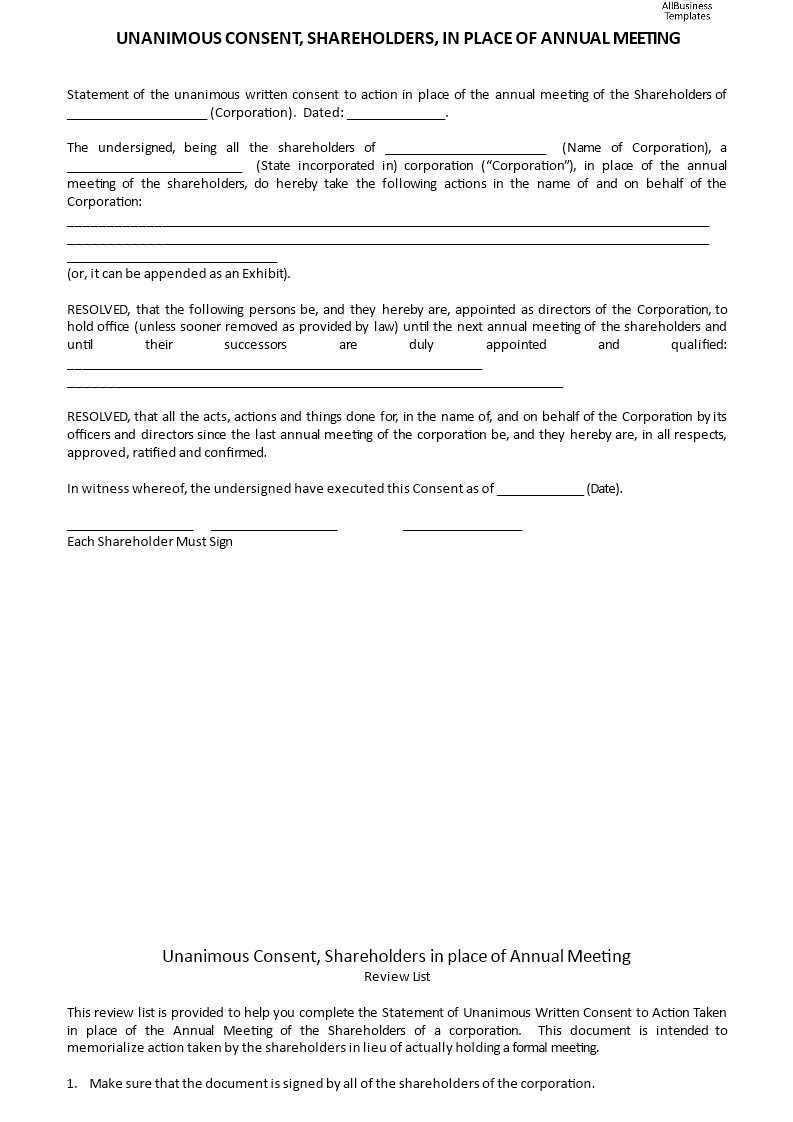

* Shareholder Meetings: Rules for calling and conducting shareholder meetings, quorum requirements, and voting procedures.

* Key Decisions: Specifying which decisions require unanimous shareholder consent, such as changing the nature of the business, taking on significant debt, or approving the sale of substantial assets.

Dividend Policy

While companies are generally allowed to declare dividends, a shareholder agreement can establish a clear policy on how and when dividends will be distributed. This might include a commitment to distribute a certain percentage of profits or to reinvest profits for growth, providing shareholders with predictability regarding their returns.

Restrictions on Share Transfers

As mentioned earlier, this is a vital section. It outlines the conditions under which shares can be sold, gifted, or otherwise transferred. Common provisions include:

* Right of First Refusal (ROFR): If a shareholder wishes to sell, they must first offer their shares to the existing shareholders at the same terms offered by a third party.

* Permitted Transfers: Often, transfers to immediate family members or trusts for their benefit are allowed without triggering ROFR, but with notification.

* Drag-Along Rights: Allows a majority shareholder to “drag” minority shareholders into a sale of the company to a third party, ensuring that a complete sale isn’t blocked by a small minority.

* Tag-Along Rights (Co-Sale Rights): Protects minority shareholders by allowing them to participate in a sale initiated by a majority shareholder, ensuring they can sell their shares on the same terms.

Buy-Sell Provisions and Valuation Methods

This section addresses what happens when a shareholder wishes to exit the company or is forced to exit due to certain events.

* Triggering Events: These can include death, disability, bankruptcy, termination of employment (if the shareholder is also an employee), or simply a desire to sell.

* Purchase Obligation/Option: The agreement can obligate the company or the remaining shareholders to buy the exiting shareholder’s shares, or it can grant them an option to do so.

* Valuation Methods: Crucially, it defines how the value of the shares will be determined. Common methods include a fixed price, a formula based on financial performance (e.g., a multiple of earnings), or an independent appraisal. Agreeing on this in advance avoids contentious valuation disputes.

Confidentiality and Non-Competition

These clauses protect the company’s proprietary information and prevent departing shareholders from competing with the business.

* Confidentiality: Shareholders agree not to disclose sensitive company information to third parties.

* Non-Competition: If a shareholder leaves the company, especially an executive, they may be restricted from engaging in a similar business within a specified geographic area and for a specified period.

Dispute Resolution

A detailed dispute resolution clause outlines the process for handling disagreements. This typically starts with negotiation, moves to mediation, and then potentially to binding arbitration rather than litigation, which can be faster and less expensive.

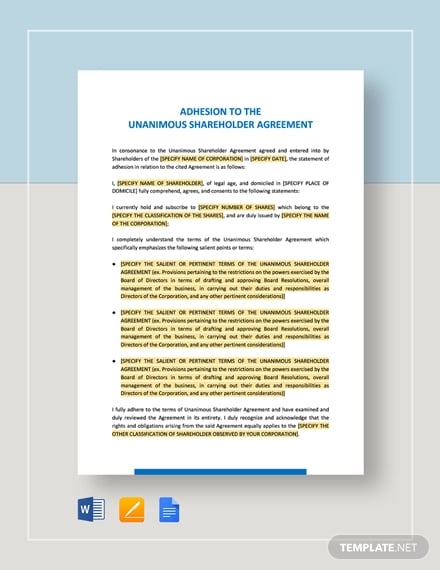

Amendments

The agreement should specify how it can be amended, typically requiring the written consent of all shareholders.

Tailoring Your Unanimous Shareholder Agreement Template

While a Unanimous Shareholder Agreement Template provides a solid foundation, it is crucial to recognize that no two businesses are identical. Therefore, customization is not just recommended; it’s essential for creating a document that truly serves the unique needs of your company and its shareholders.

Understanding Your Specific Business Needs

Before even looking at a template, take the time to discuss and agree upon the fundamental principles of your business relationship with your co-shareholders. Consider:

* What are your long-term goals for the company?

* How do you envision the management structure evolving?

* What level of control does each shareholder expect?

* What are the financial expectations for dividends versus reinvestment?

* What are the potential exit strategies for each shareholder?

Incorporating Specific Share Transfer Scenarios

For instance, if one of the shareholders is also a key employee, the buy-sell provisions might need to be intricately linked to their employment status. What happens if they are terminated for cause? What if they resign voluntarily? These scenarios require detailed clauses that consider the employment aspect alongside the shareholding. Similarly, if there are plans for future funding rounds that might dilute existing shareholdings, the agreement should address pre-emptive rights in that context.

Addressing Minority Shareholder Protections

If there are significant disparities in share ownership, ensuring adequate protections for minority shareholders is paramount. This could involve granting them veto rights over specific types of decisions that could significantly impact their investment, even if they don’t hold a majority of the voting power. The agreement can elevate their rights beyond what corporate law might automatically grant.

Dispute Resolution Mechanisms Tailored to Your Culture

The choice of dispute resolution mechanism should align with the shareholders’ preferences and the nature of potential conflicts. For a group that highly values preserving relationships, a more collaborative approach like mediation might be prioritized. For those focused on efficiency and certainty, binding arbitration with a pre-selected arbitration body might be preferred.

Legal Review and Professional Advice

Even with a well-structured template, it is highly advisable to have the agreement reviewed by legal counsel experienced in corporate law. A lawyer can help identify potential loopholes, ensure compliance with local laws and regulations, and advise on clauses that might be overly restrictive or legally unenforceable. They can also help draft specific clauses that precisely reflect your agreements.

The Legal Framework and Compliance

A Unanimous Shareholder Agreement operates within the broader legal framework governing corporations. Understanding this framework is essential to ensure that the agreement is both effective and legally sound.

Statutory Provisions vs. Shareholder Agreements

Corporate statutes provide a baseline for how companies are run and how shareholders’ rights are protected. However, these statutes are often general and may not adequately address the specific dynamics of closely held companies. A shareholder agreement allows shareholders to contractually override or supplement these statutory provisions, provided they do not violate public policy or mandatory legal requirements. For example, while corporate law might allow for majority rule on most decisions, a shareholder agreement can mandate unanimous consent for certain critical actions.

Enforceability of Shareholder Agreements

The enforceability of a shareholder agreement is generally high, especially when it is signed by all shareholders. Courts typically uphold agreements that reflect the genuine intentions of the parties. However, certain clauses might be challenged if they are deemed unreasonable or oppressive. For instance, a non-competition clause that is excessively broad in scope, duration, or geographic reach might be struck down. Similarly, any provision that attempts to unlawfully shield shareholders from their statutory liabilities or bypass mandatory legal procedures would likely be unenforceable.

Compliance with Corporate Law

It is crucial that the shareholder agreement does not contradict fundamental principles of corporate law or create an illegal structure. For instance, while shareholders can agree on management structures, they cannot agree to operate the company in a way that is illegal or fraudulent. The agreement should also be reviewed to ensure it aligns with any specific corporate legislation in the relevant jurisdiction, particularly concerning reporting requirements, director duties, and shareholder rights.

Duty of Good Faith and Fair Dealing

Even with a comprehensive agreement, all parties are typically bound by an implied duty of good faith and fair dealing in their interactions concerning the corporation. This means that shareholders cannot use the agreement as a tool to deliberately harm or take unfair advantage of other shareholders, even if the actions technically comply with the letter of the agreement.

Common Pitfalls to Avoid When Using a Template

While a Unanimous Shareholder Agreement Template is a valuable starting point, blindly adopting one without careful consideration can lead to significant problems. Avoiding common pitfalls is crucial for creating a document that truly serves its purpose.

Not Customizing to Specific Needs

This is arguably the most significant mistake. A generic template will not account for the unique relationships, goals, and potential issues within your specific company. Failing to tailor clauses related to share valuation, buy-sell triggers, or management responsibilities can lead to disputes that the template was meant to prevent.

Overly Restrictive or Vague Clauses

Clauses that are too restrictive can stifle business growth or make it impossible for shareholders to exit the company under reasonable circumstances. Conversely, clauses that are too vague create ambiguity, which is the breeding ground for future disagreements. Precision in language is key.

Failing to Address Future Scenarios

Business is dynamic. A template that only considers the current state of affairs may quickly become outdated. Consider how the agreement might need to adapt if new investors join, if the company expands internationally, or if management roles change significantly.

Inadequate Dispute Resolution Mechanisms

Not all dispute resolution clauses are created equal. A poorly defined process, or one that doesn’t align with the shareholders’ tolerance for conflict and cost, can exacerbate problems rather than solve them. Ensure the chosen methods are practical and agreeable.

Neglecting Legal Review

Relying solely on a template without professional legal advice is a high-risk strategy. Corporate lawyers can identify potential legal conflicts, ensure compliance with local laws, and provide insights into common issues that you might not have considered.

Ignoring the “Unanimous” Aspect

The “unanimous” nature means every shareholder must agree. Failing to get buy-in from all parties on every critical clause can undermine the agreement’s authority and create division from the outset. The process should be collaborative.

Not Regularly Reviewing and Updating the Agreement

As the company evolves, so too should the shareholder agreement. Schedules, market conditions, and shareholder relationships can change. Periodically reviewing and updating the agreement to reflect these changes is essential to maintain its relevance and effectiveness.

Conclusion

A Unanimous Shareholder Agreement Template is an indispensable tool for any closely held corporation. It serves as a vital legal document that outlines the rights, responsibilities, and expectations of all shareholders, thereby fostering a clear, predictable, and cooperative business environment. By meticulously detailing governance structures, share transfer restrictions, dividend policies, and dispute resolution mechanisms, such an agreement proactively addresses potential conflicts and safeguards the long-term interests of every stakeholder.

The process of creating or adapting a Unanimous Shareholder Agreement template should be approached with diligence and collaboration. Understanding the core components, tailoring them to the specific nuances of the business, and crucially, seeking professional legal advice are paramount steps. Avoiding common pitfalls like overly generic clauses or neglecting future scenarios will ensure the agreement remains a robust and effective framework for years to come. Ultimately, a well-crafted agreement is not just a legal formality; it is an investment in the stability, growth, and harmonious operation of the company.

]]>