Lending money to a friend, family member, or business associate can be a generous act, but it often walks a fine line between a helping hand and a financial minefield. To protect both your relationship and your finances, it’s essential to have a clear, written record of the transaction. This is where finding a reliable Private Loan Agreement Template Free of charge becomes an invaluable first step, providing a structured framework that formalizes the loan and sets clear expectations for everyone involved. Without a formal document, misunderstandings about repayment terms, interest, and deadlines can quickly strain or even sever personal bonds.

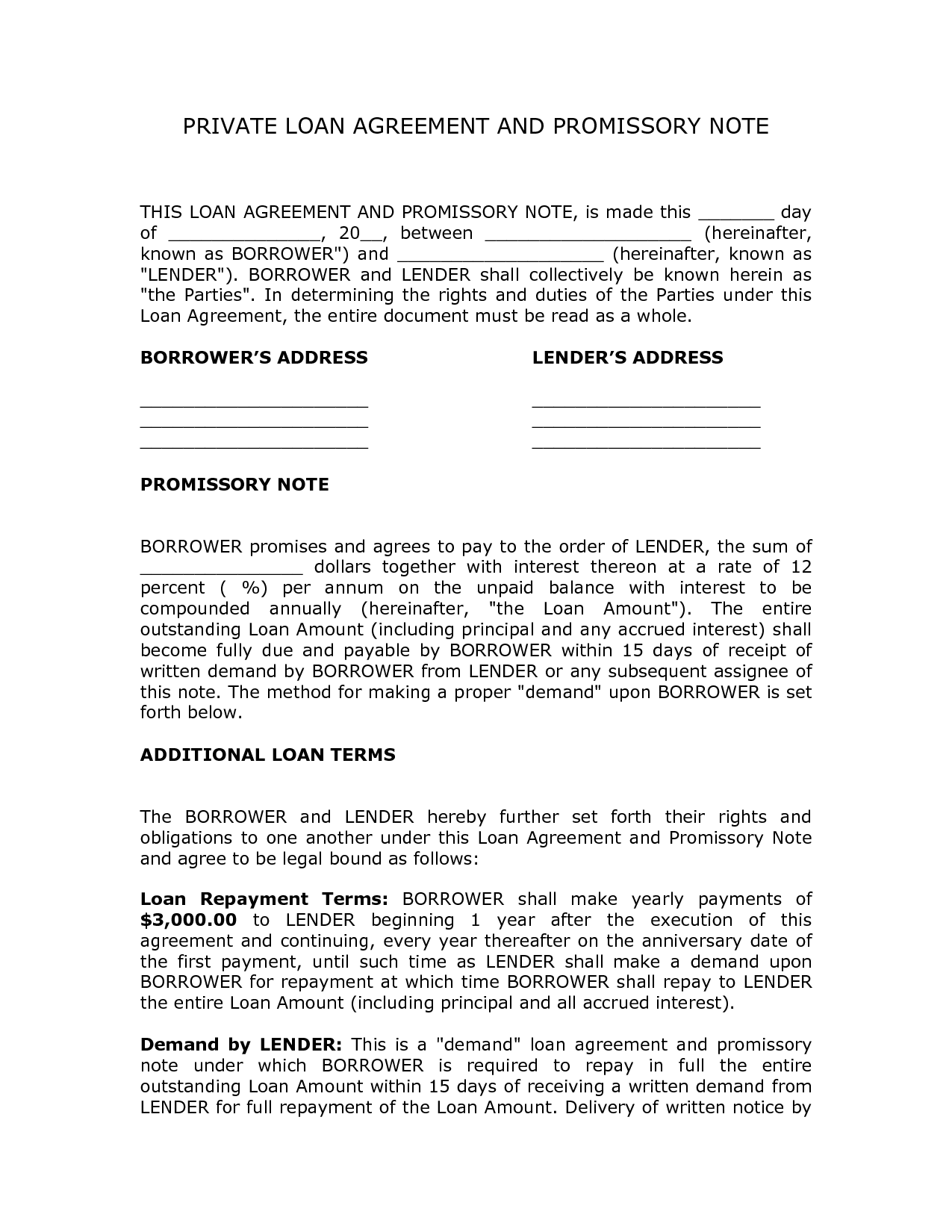

A private loan agreement, also known as a personal loan agreement or a promissory note, is a legally binding contract between two parties—the lender and the borrower. It meticulously outlines the terms and conditions of the loan, including the amount of money being borrowed, the interest rate, the repayment schedule, and the consequences of a default. This document transforms an informal handshake deal into a clear, enforceable arrangement. It isn’t a sign of mistrust; rather, it’s a mark of respect and responsibility, ensuring that both parties are on the same page and understand their obligations from the outset.

By establishing these ground rules in writing, you create a definitive reference point that can be consulted if any questions or disputes arise later. It protects the lender by providing legal recourse if the borrower fails to repay the loan, and it protects the borrower by preventing any misunderstandings about the total amount owed or the payment terms. This guide will walk you through the essential components of a robust private loan agreement, explain how to properly utilize a template, and discuss the legal considerations you should keep in mind to ensure a smooth lending process for everyone.

Understanding the Basics of a Private Loan Agreement

Before diving into the specifics of a template, it’s crucial to grasp the fundamental concepts behind a private loan agreement. Unlike a loan from a bank or a credit union, a private loan is a transfer of money between individuals, such as friends, family members, or colleagues. While these loans are often based on trust, that trust alone is not enough to guarantee a smooth transaction. A formal agreement is the bedrock of a successful private lending experience.

A well-drafted agreement serves several key purposes. First and foremost, it acts as proof of the loan. In the unfortunate event of a dispute, this document is your primary evidence that the transaction was a loan and not a gift. Second, it clarifies all terms, leaving no room for ambiguity. Both the lender, who provides the funds, and the borrower, who receives them, will have a clear understanding of their respective rights and responsibilities. This clarity helps prevent future disagreements that can arise from faulty memory or miscommunication.

Legally, a signed private loan agreement is an enforceable contract. If the borrower defaults on the loan, the lender can use the agreement to pursue legal action, such as filing a lawsuit in small claims court, to recover the outstanding balance. Without this written contract, proving the terms of the original loan—or even that it was a loan at all—can be incredibly difficult, if not impossible. Therefore, taking the time to create a formal document is a critical step in safeguarding your financial interests.

Key Components of a Comprehensive Loan Agreement

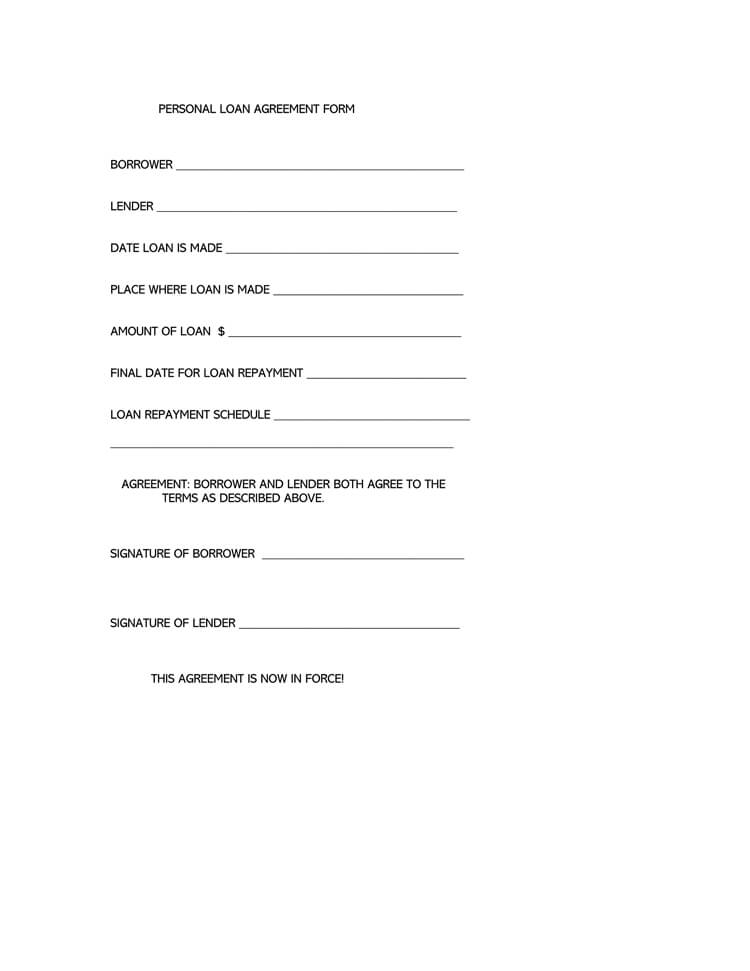

A simple “IOU” is not sufficient. A comprehensive loan agreement must contain specific clauses to be effective and enforceable. When you select a template or draft your own document, ensure it includes the following essential elements.

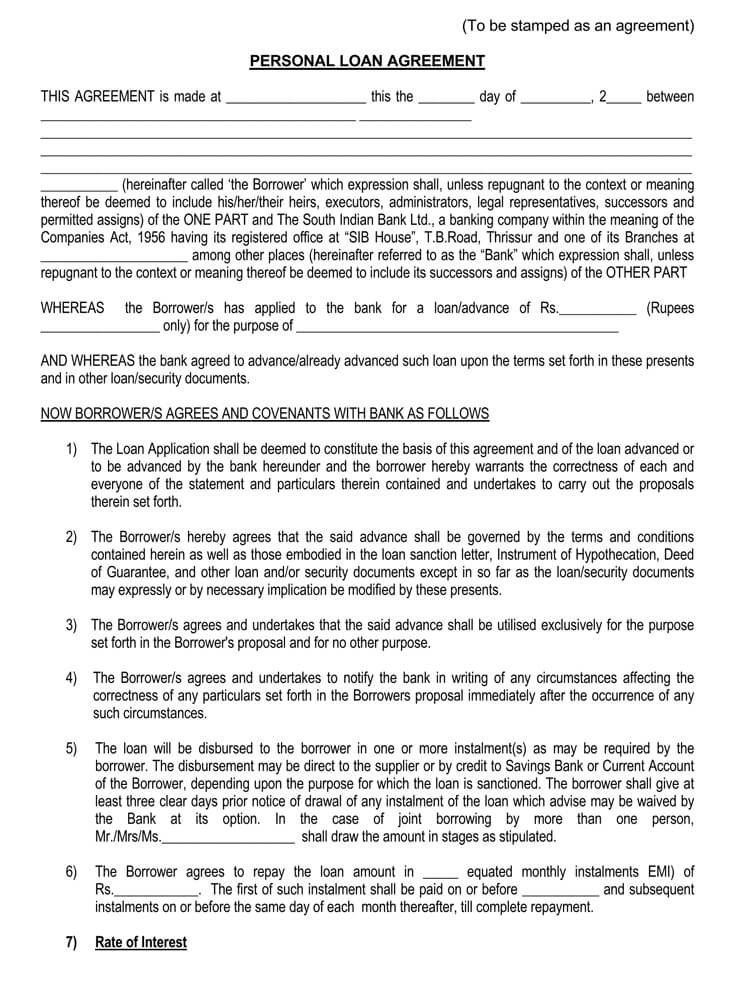

Contact Information of Both Parties

The agreement must clearly identify the lender and the borrower. This section should include their full legal names, mailing addresses, and phone numbers. Accurate identification is fundamental for the contract’s validity, as it establishes exactly who is bound by the terms.

The Principal Loan Amount and Loan Date

State the exact amount of money being loaned in both numbers and words to prevent any confusion (e.g., “$5,000 (five thousand dollars)”). This is known as the principal amount. The agreement should also clearly state the date the funds were or will be disbursed to the borrower.

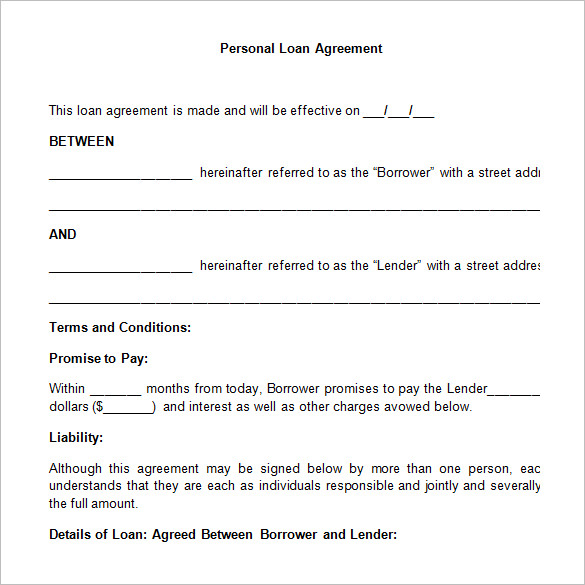

Interest Rate and APR

If the loan will accrue interest, this section is critical. You must specify the interest rate (e.g., 5% per annum). It’s also wise to mention whether the interest is simple or compounded. Be aware of your state’s usury laws, which set a maximum legal interest rate that can be charged. Charging an illegally high rate can render the agreement unenforceable. The Annual Percentage Rate (APR) should also be stated, which includes the interest rate plus any other fees associated with the loan. For most simple private loans, the interest rate and APR will be the same.

Repayment Plan and Schedule

This clause details how the loan will be repaid. It should specify:

* Payment Method: Will payments be in regular installments or a single lump sum?

* Payment Amount: If using installments, state the exact amount of each payment.

* Payment Frequency: Specify whether payments are due weekly, monthly, or on another schedule.

* Due Date: Note the specific day each payment is due (e.g., “the 1st day of each month”).

* Loan Term: Mention the date of the first payment and the date of the final payment.

Late Fees and Penalties

To encourage timely payments, you can include a clause for late fees. This section should define what constitutes a “late” payment (e.g., more than 5 days past the due date) and specify the penalty. This could be a flat fee (e.g., “$25 for each late payment”) or a percentage of the overdue installment.

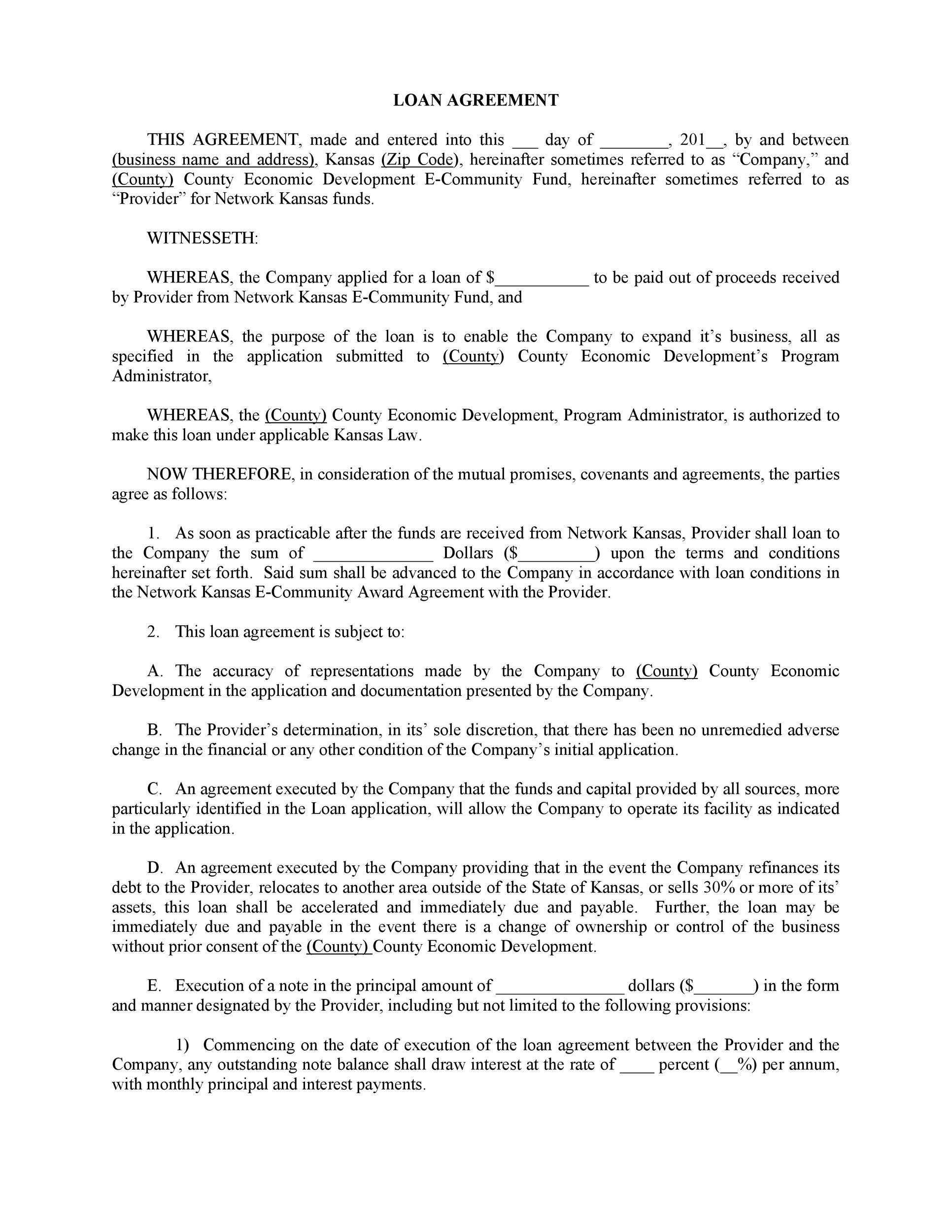

Default Clause

This is one of the most important protective clauses for the lender. It explicitly defines what actions constitute a default on the loan, such as missing a certain number of payments or filing for bankruptcy. The clause should also outline the lender’s rights in the event of a default. This often includes an acceleration clause, which allows the lender to demand that the entire remaining loan balance, including accrued interest, become immediately due and payable.

Collateral (If Applicable)

For larger loan amounts, a lender may require the borrower to pledge an asset as collateral. Collateral is property (such as a car, jewelry, or real estate) that the lender can seize and sell if the borrower defaults on the loan. If collateral is involved, the agreement must describe the item in detail, including its location, condition, and identifying marks like a serial number or Vehicle Identification Number (VIN).

Governing Law

This clause specifies which state’s laws will be used to interpret and enforce the agreement. This is typically the state where the lender resides or where the agreement is signed. It’s a crucial component for resolving any potential legal disputes.

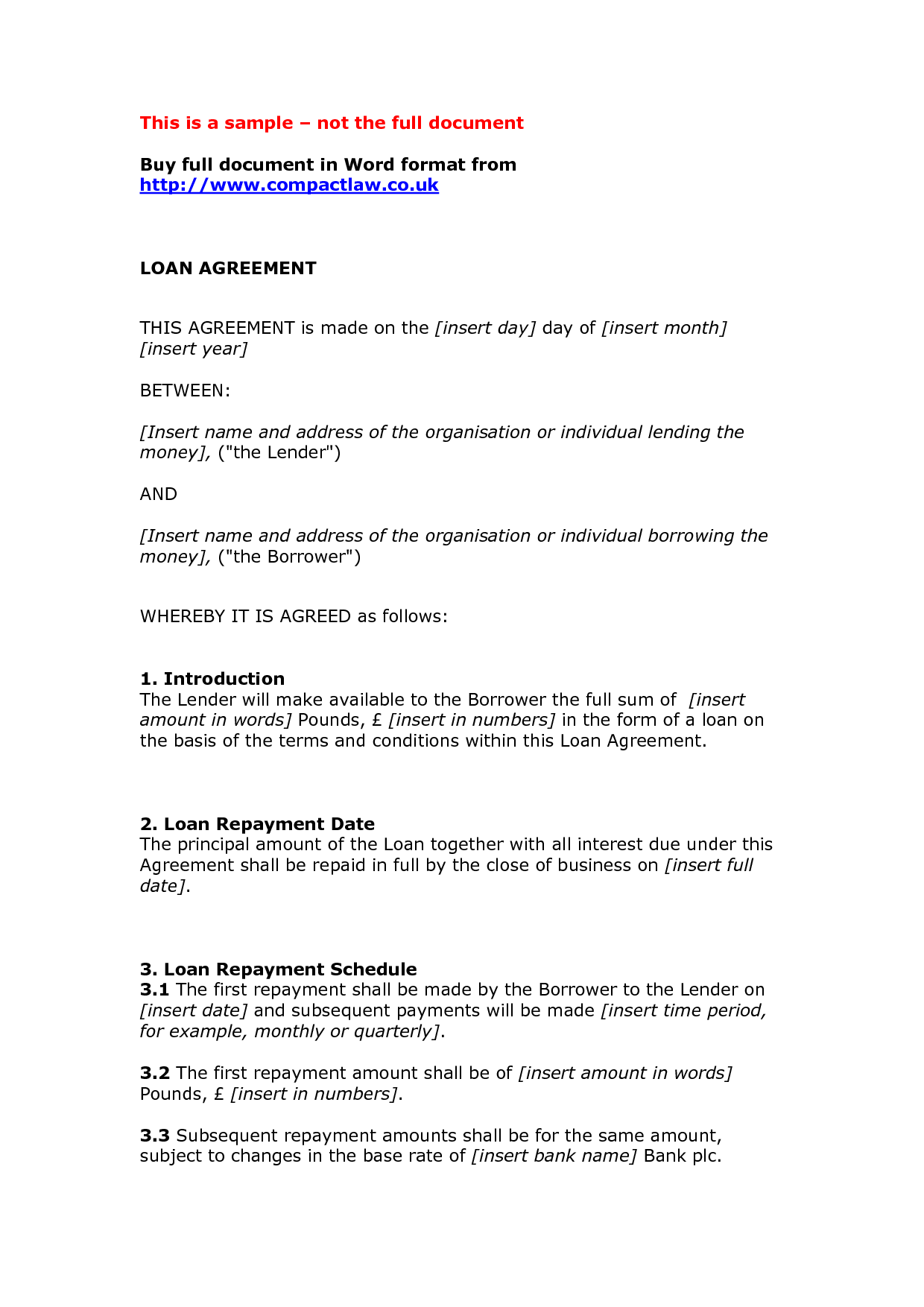

How to Use a Private Loan Agreement Template Free of Charge

Once you understand the essential components, you can confidently seek out a template to create your document. Finding a Private Loan Agreement Template Free online is relatively easy, but it’s important to approach the process with care and attention to detail.

Start by searching for templates from reputable sources that specialize in legal or financial documents. A good template will serve as a robust starting point, but it should never be used without careful review and customization. Every loan situation is unique, and a generic document may not fully address your specific needs.

After downloading a template, read through the entire document to ensure you understand every clause. Then, methodically fill in the required information for each section, including names, addresses, the loan amount, interest rate, and repayment schedule. Pay close attention to any optional clauses, such as those related to collateral or late fees, and decide whether they are relevant to your situation. Remove any clauses that do not apply to avoid confusion.

What to Look for in a Quality Template

A high-quality free template should be:

* Comprehensive: It should include all the key components discussed above, from party information to default clauses.

* Clear and Understandable: The language should be straightforward and avoid excessive legal jargon that could be misinterpreted.

* Customizable: The template should be in an editable format (like a Word document or Google Doc) that allows you to easily add, remove, or modify clauses to fit your specific agreement.

* State-Specific Considerations: While many loan principles are universal, the best templates will include notes or options related to state-specific laws, especially regarding interest rates (usury laws).

The Legal and Financial Implications to Consider

Creating a private loan agreement has important legal and financial ramifications for both the lender and the borrower. It’s essential to be aware of these before entering into the contract.

For the Lender

As a lender, the interest you earn from a loan is considered taxable income by the IRS. You must report this income on your tax return. If you lend a significant amount of money at a low or zero-interest rate, the IRS may still impute interest under the “Below-Market Interest Rules” and tax you as if you had charged a fair market rate. The primary risk is, of course, non-repayment. While the agreement gives you legal recourse, the process of recovering your money can be time-consuming and costly, and there is no guarantee of success.

For the Borrower

As a borrower, your primary obligation is to repay the loan according to the terms of the agreement. Failure to do so can have serious consequences. Even though a private loan may not appear on your credit report, a default can lead to a lawsuit. If the lender wins a judgment against you, it can be enforced through wage garnishment, bank account levies, or liens on your property. It is crucial to read every part of the agreement and ensure you can realistically meet the repayment obligations before you sign.

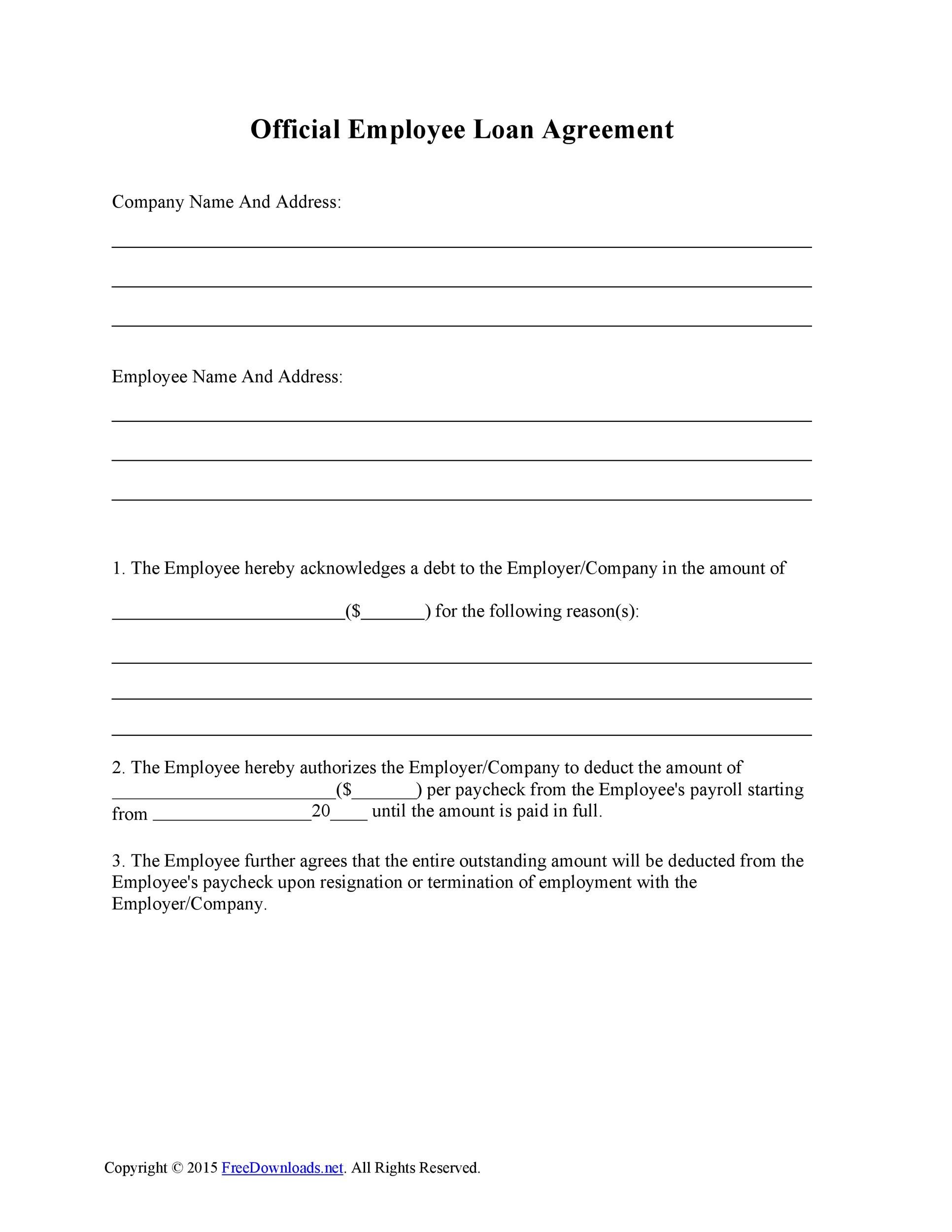

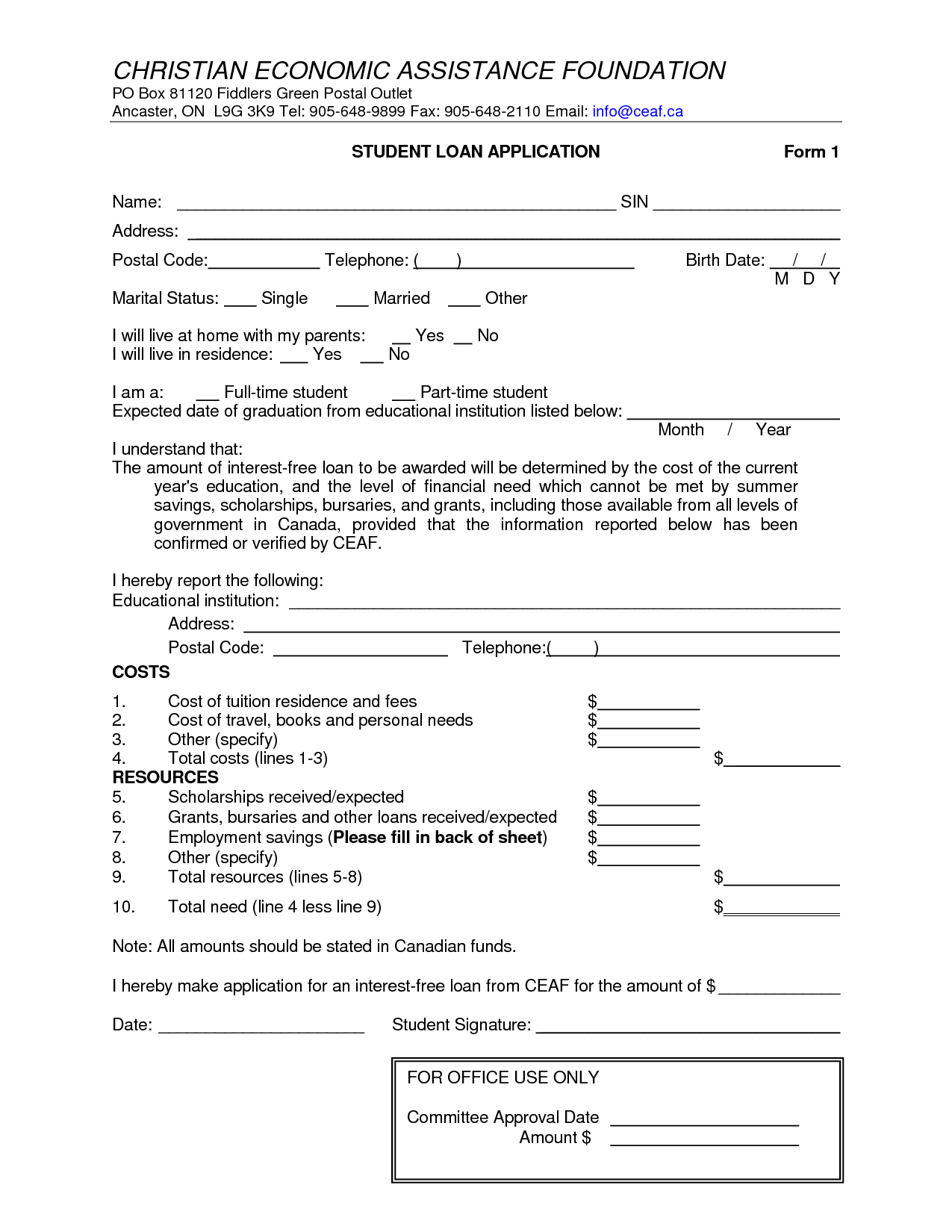

Common Scenarios for Using a Private Loan Agreement

Private loan agreements are versatile documents that can be used in a wide variety of personal and business situations. Some common scenarios include:

* Family Loans: Parents lending their child money for a down payment on a house, a car purchase, or to cover educational expenses.

* Business Startups: Providing seed money to a friend or relative who is starting a new business venture.

* Debt Consolidation: Loaning funds to someone so they can pay off high-interest credit card debt.

* Personal Emergencies: Helping a loved one cover unexpected medical bills, home repairs, or other urgent expenses.

In each of these cases, a formal agreement helps manage expectations and preserves the personal relationship by treating the transaction with the seriousness it deserves.

Notarization and Witnesses: Are They Necessary?

A common question is whether a private loan agreement needs to be notarized or signed by witnesses to be legally valid. In most states, neither is strictly required for the contract to be enforceable. A valid contract generally only requires an offer, acceptance, consideration (the loan amount), and the signatures of the involved parties.

However, having the agreement notarized is highly recommended, especially for larger loan amounts. A notary public is an impartial third party who verifies the identity of the signers and confirms they are signing the document willingly. This adds a powerful layer of authenticity to the agreement and makes it much more difficult for a party to later claim their signature was forged or they were coerced into signing.

Similarly, having one or two witnesses sign the agreement can also bolster its credibility. The witnesses are attesting that they saw both the lender and the borrower sign the document. While not always a legal necessity, these extra steps provide valuable evidence of the agreement’s legitimacy should it ever be challenged in court.

Conclusion

Lending or borrowing money within personal circles requires a delicate balance of trust and prudence. A private loan agreement is the single most important tool for achieving that balance. It transforms a potentially ambiguous verbal promise into a clear, tangible, and legally enforceable contract that protects both the lender’s investment and the borrower’s integrity. By using a Private Loan Agreement Template Free of charge as your foundation, you can easily customize a document that outlines every critical detail, from the principal amount and interest rate to the repayment schedule and consequences of default.

Remember that a template is just the beginning. The real value lies in carefully tailoring it to your unique situation and ensuring both parties fully understand and agree to its terms before signing. Adding the formality of witnesses or a notary seal further strengthens the document’s authority. Ultimately, treating a personal loan with professional diligence is the best way to ensure the transaction is successful and, most importantly, to preserve the valuable relationship at its heart.

]]>