Receiving a record of a transaction is a fundamental part of commerce, offering reassurance to both the buyer and the seller. For businesses, efficiently documenting sales is not just good practice; it’s a necessity for accounting, customer service, and legal compliance. This is where a well-designed credit card receipt template becomes an invaluable asset, streamlining the process of providing proof of purchase for card-based payments.

Credit card transactions, in particular, demand clear and detailed documentation. Unlike cash transactions, which often have less stringent record-keeping requirements for individual sales, credit card payments involve third-party processors and banks, necessitating precise information for reconciliation and dispute resolution. A standardized template ensures that all critical data points are consistently captured, minimizing errors and saving precious time.

Beyond the operational efficiencies, a professional receipt template reinforces your brand’s credibility. It communicates attention to detail and a commitment to transparency, enhancing the customer experience. Whether you operate a brick-and-mortar store, an e-commerce platform, or provide services on the go, the ability to generate a clear, accurate receipt instantly is a mark of professionalism.

This article will delve into the critical aspects of credit card receipt templates, exploring why they are indispensable for modern businesses, what essential elements they must contain, and how to choose or create the perfect template to meet your specific needs. Understanding these components will empower you to manage your financial records more effectively and bolster customer trust.

Why Are Credit Card Receipts Indispensable for Businesses?

Credit card receipts serve multiple crucial functions that extend far beyond simply confirming a payment. They are foundational documents for financial management, customer relations, and legal adherence. Ignoring their importance can lead to significant operational hurdles and potential legal issues.

For Businesses: Financial Tracking and Reconciliation

Every credit card transaction recorded on a receipt is a data point vital for accurate bookkeeping. Receipts enable businesses to reconcile sales figures with bank statements, track revenue streams, and monitor expenses. They provide a clear audit trail for every dollar earned, making month-end and year-end financial closing processes significantly smoother. Without proper receipts, identifying discrepancies, managing refunds, or even understanding true profitability becomes a challenging, if not impossible, task.

For Customers: Proof of Purchase and Consumer Rights

From the customer’s perspective, a credit card receipt is their official proof of purchase. This document is essential for various reasons: returning an item, claiming a warranty, disputing a charge with their bank, or simply for their own personal expense tracking. A clear receipt empowers customers to exercise their consumer rights and provides them with the necessary information should they need to contact the business regarding their transaction.

Legal and Tax Compliance

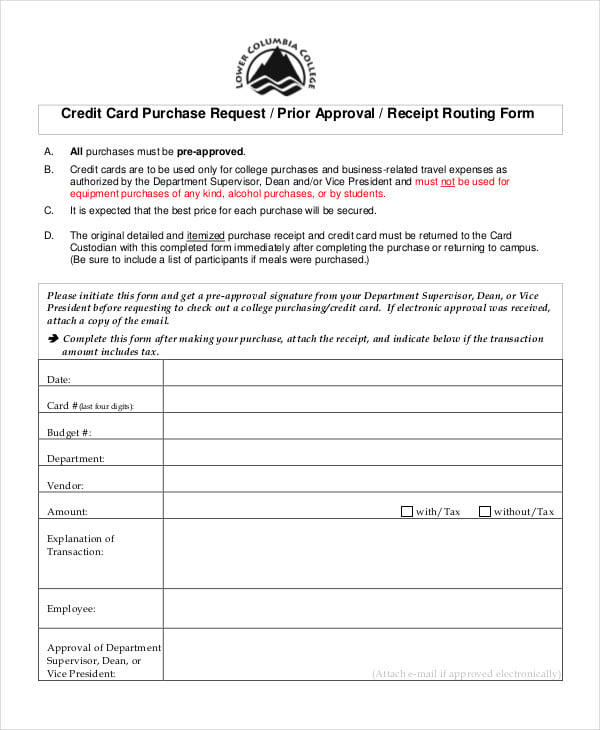

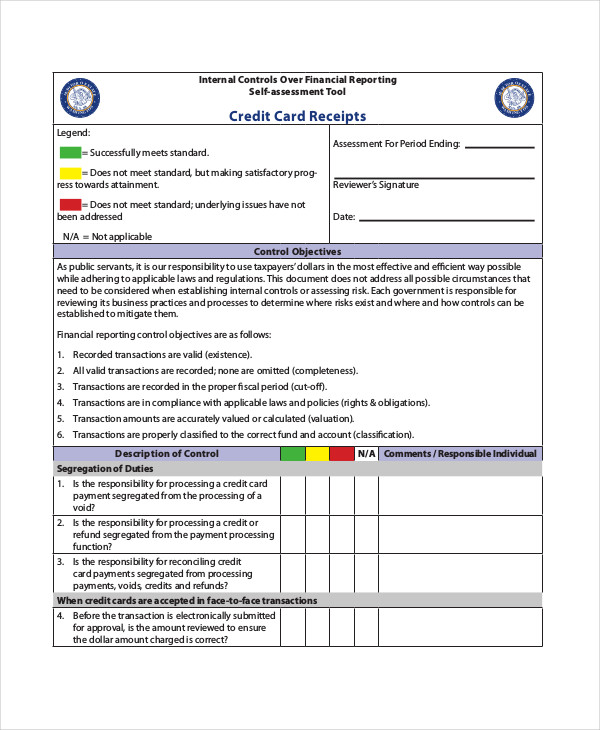

Governments and tax authorities worldwide require businesses to maintain meticulous financial records. Credit card receipts are fundamental to demonstrating compliance during tax audits. They serve as evidence of income and can be used to justify deductions, such as business expenses. Furthermore, in the event of a chargeback dispute from a customer, a detailed receipt is often the primary piece of evidence a business can present to the credit card company to validate the transaction, potentially preventing financial loss.

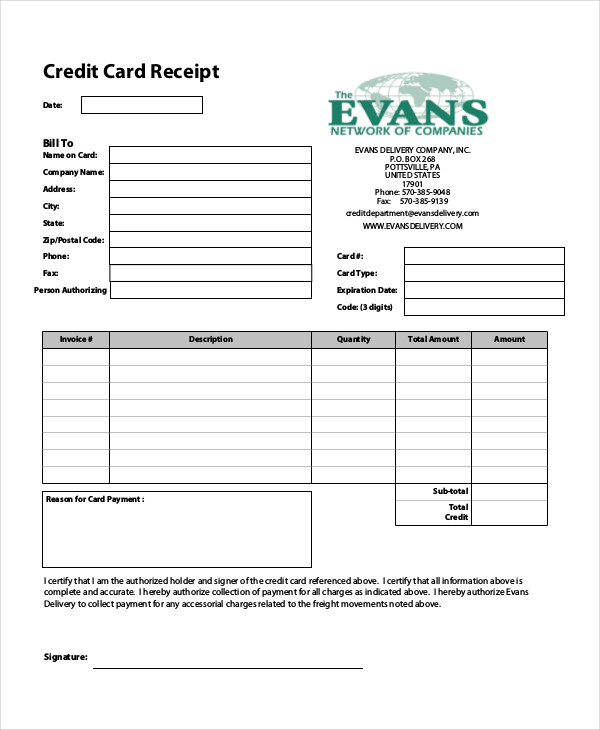

Essential Elements of a High-Quality Credit Card Receipt Template

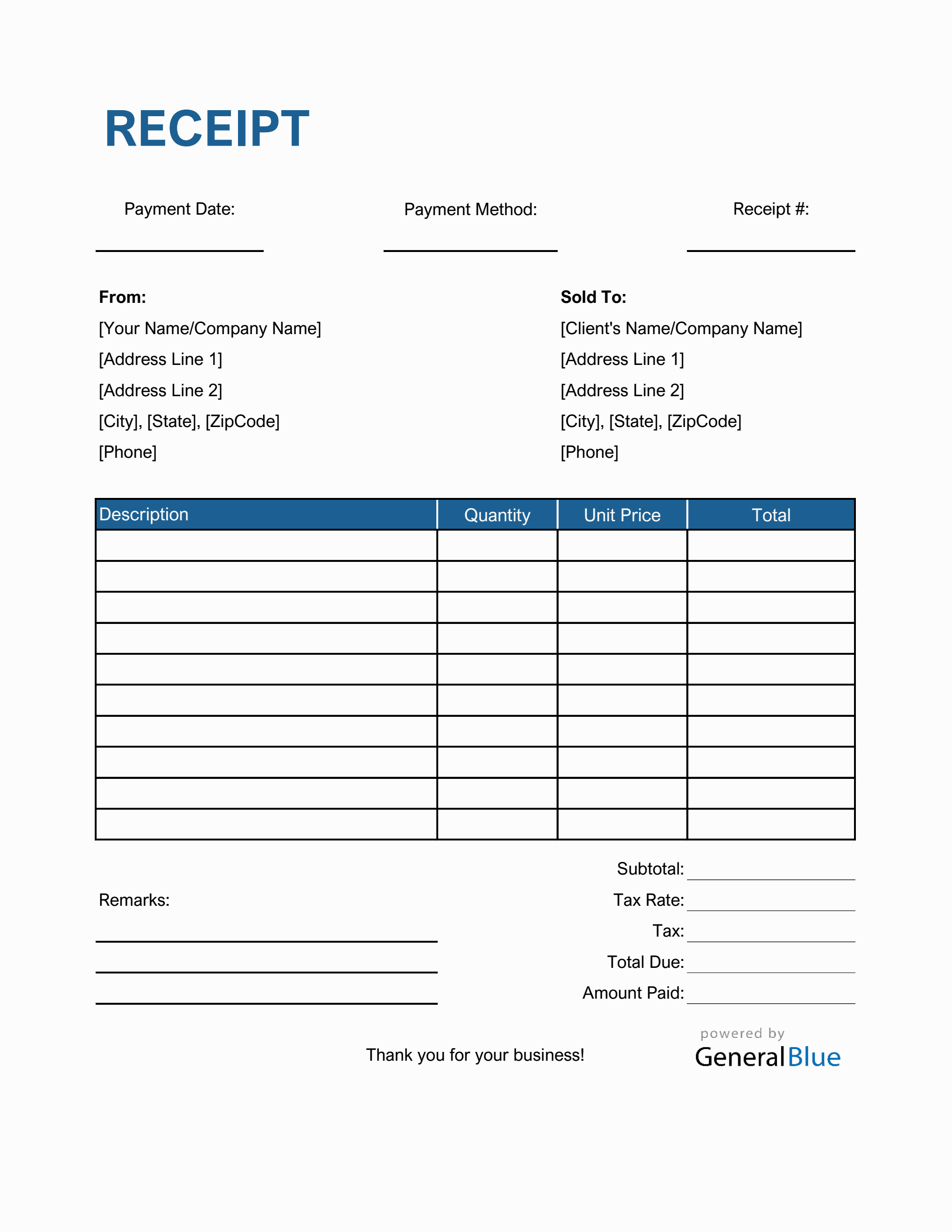

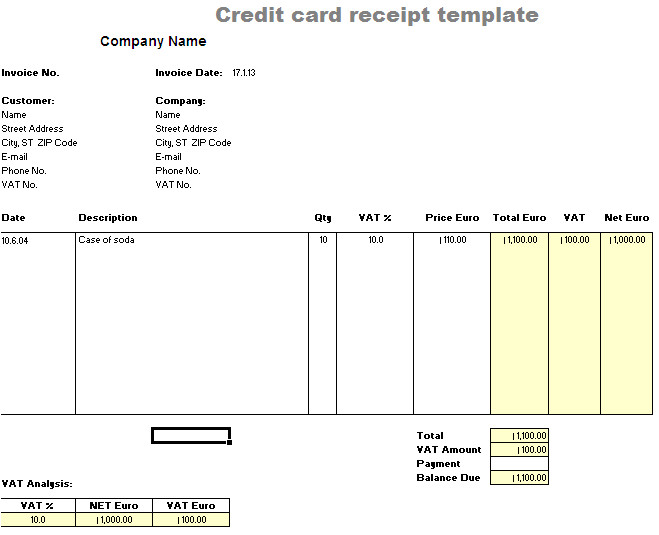

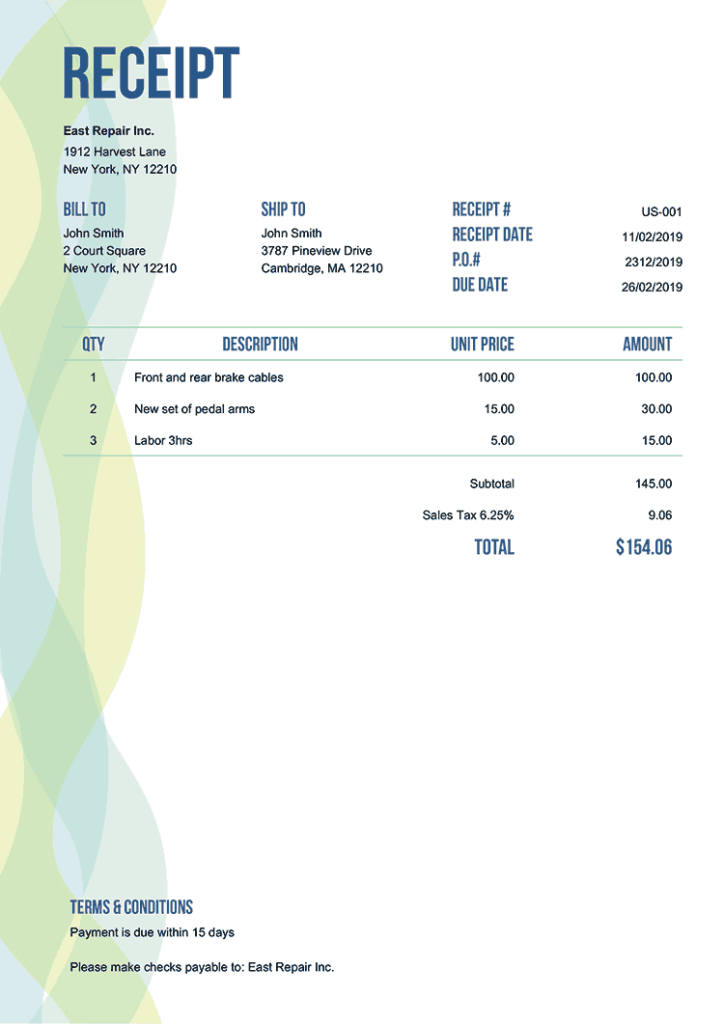

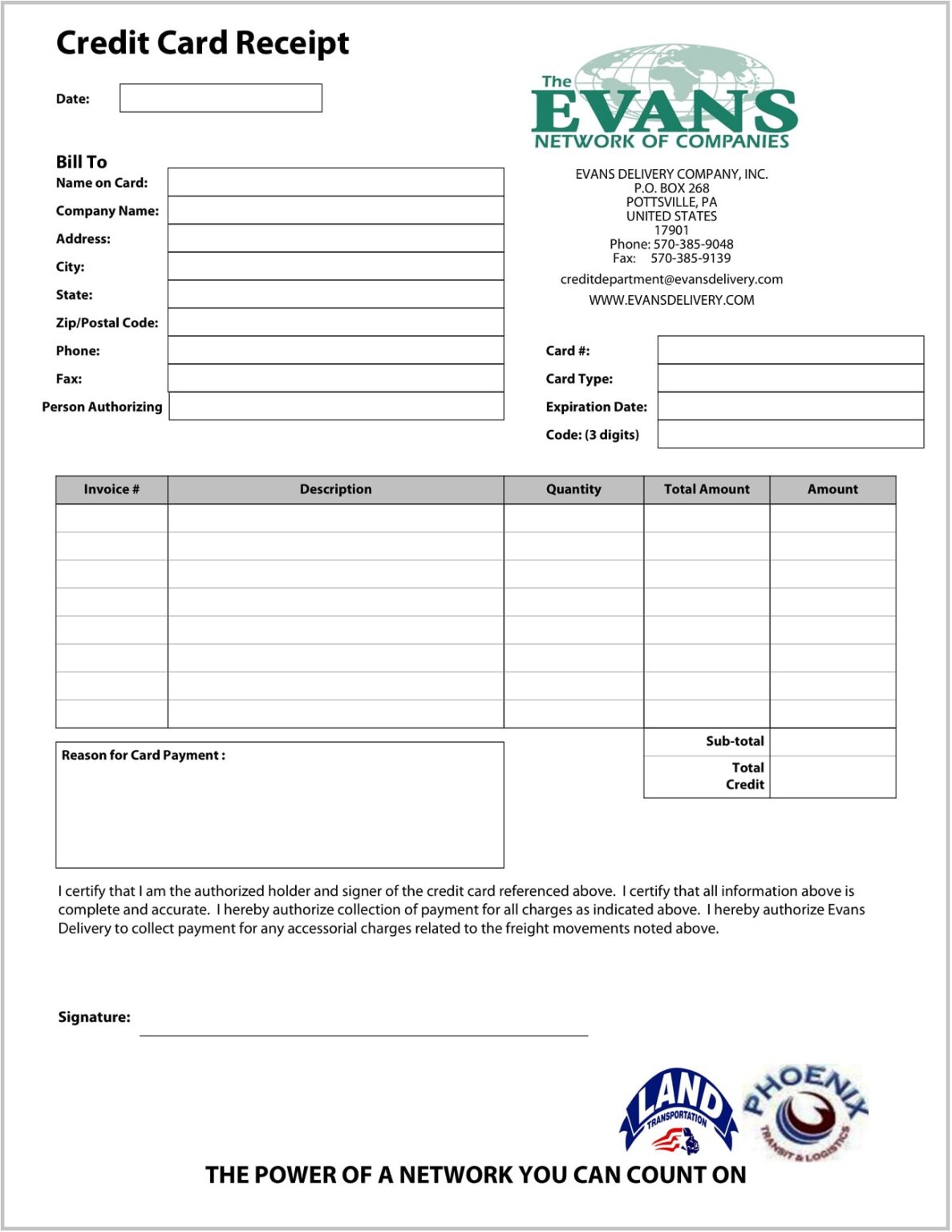

A truly effective credit card receipt template isn’t just a blank form; it’s a carefully structured document that captures all necessary information in an easily digestible format. Missing key details can render a receipt less useful, or even invalid, for accounting or legal purposes.

Business Information

The receipt must clearly identify the seller. This typically includes:

* Business Name: The legal name of your company.

* Address: Your physical business address.

* Contact Information: Phone number, email address, or website.

* Logo: Your company logo for branding and easy recognition.

Transaction Details

This section forms the core of the receipt, detailing the specifics of the purchase:

* Date and Time: When the transaction occurred.

* Receipt/Transaction Number: A unique identifier for the specific transaction, crucial for tracking.

* Items Purchased: A clear list of products or services, including quantities and individual prices.

* Subtotal: The total cost before taxes and discounts.

* Discounts/Coupons: Any reductions applied.

* Sales Tax: The amount of tax charged, often broken down by rate.

* Total Amount: The final amount the customer paid.

* Currency: The currency in which the transaction was conducted.

Payment Information Specific to Credit Cards

Since this is a credit card receipt, specific payment details are critical:

* Payment Method: Explicitly state “Credit Card” or the specific card type (e.g., Visa, Mastercard).

* Last Four Digits of Card Number: To protect customer data, only the last four digits of the credit card should be displayed.

* Authorization Code: A unique code generated by the payment processor confirming the transaction’s approval.

* Entry Method: How the card was processed (e.g., swiped, chipped, contactless, manually entered).

Customer Information (Optional, but useful)

While not always mandatory, including customer details can be beneficial for certain businesses, especially for returns, loyalty programs, or service-based businesses:

* Customer Name: If available.

* Customer ID/Loyalty Number: For repeat customers.

Return Policy or Terms and Conditions

Providing a clear outline of your return or exchange policy directly on the receipt prevents misunderstandings and reduces customer service inquiries. Even a short statement directing customers to your website for full terms is beneficial.

Thank You Message

A simple “Thank You for Your Business!” can go a long way in enhancing customer satisfaction and reinforcing a positive brand image.

Types of Credit Card Receipt Templates and Formats

The digital age has brought a variety of formats and methods for generating receipts, moving beyond simple paper slips. Businesses can choose the best option based on their operational style, customer preferences, and technological capabilities.

Physical vs. Digital Templates

Historically, receipts were always physical. Today, businesses often choose between printed credit card receipt templates or entirely digital solutions.

* Physical Receipts: Still prevalent, especially in retail. Generated via point-of-sale (POS) systems, thermal printers, or traditional receipt books.

* Digital Receipts: Sent via email, SMS, or accessible through an online portal. They are environmentally friendly, easy to store for both parties, and simplify expense tracking for customers. Many modern POS systems offer the option to provide both.

Printable Credit Card Receipt Template Options

Many businesses still prefer or require physical receipts. A printable credit card receipt template can be easily customized and printed from standard office software or dedicated receipt generators. These templates often come in formats compatible with:

* Microsoft Word/Excel: Easy to customize for basic needs, but less automated.

* Google Docs/Sheets: Cloud-based alternatives offering similar flexibility.

* PDF: Static templates that can be filled out, but offer less customization on the fly.

Customizable Templates and Receipt Generators

For businesses needing more dynamism, customizable credit card receipt templates are essential.

* Online Receipt Generators: Numerous websites offer free or paid services to create and download custom receipts. These often allow you to input details and brand elements, then generate a PDF or image file.

* Accounting Software Integration: Many modern accounting platforms (e.g., QuickBooks, Xero) and POS systems (e.g., Square, Shopify POS) include built-in receipt generation features. These are highly automated, drawing transaction data directly from sales records and applying a standardized, often customizable, template.

How to Choose the Right Credit Card Receipt Template for Your Business

Selecting the ideal credit card receipt template involves evaluating your business size, transaction volume, industry-specific requirements, and existing technological infrastructure. A well-chosen template will not only fulfill a basic function but also contribute to overall operational efficiency and branding.

Consider Your Industry and Business Model

Different industries have different needs.

* Retail: High volume of transactions, often requiring quick physical or email receipts. Integration with POS systems is key.

* Service-Based Businesses: May need more detailed descriptions of services rendered and potentially client signatures. Digital receipts are often preferred.

* E-commerce: Exclusively digital receipts, often integrated with order confirmation emails.

* Freelancers/Small Businesses: May use simpler, manually populated templates from Word/Excel or online generators for lower transaction volumes.

Scalability and Transaction Volume

If you anticipate growth or already handle a large number of transactions, a manual template will quickly become inefficient. Look for solutions that scale easily:

* Low Volume: Manual templates, basic online generators.

* Medium Volume: Accounting software integration, advanced online generators.

* High Volume: Integrated POS systems with automated receipt generation.

Integration with Existing Systems

The best receipt solutions integrate seamlessly with your current accounting, inventory, and POS systems. This automation minimizes manual data entry, reduces errors, and ensures consistency across all your financial records. If your current system has a receipt generation feature, explore its customization options before seeking external solutions.

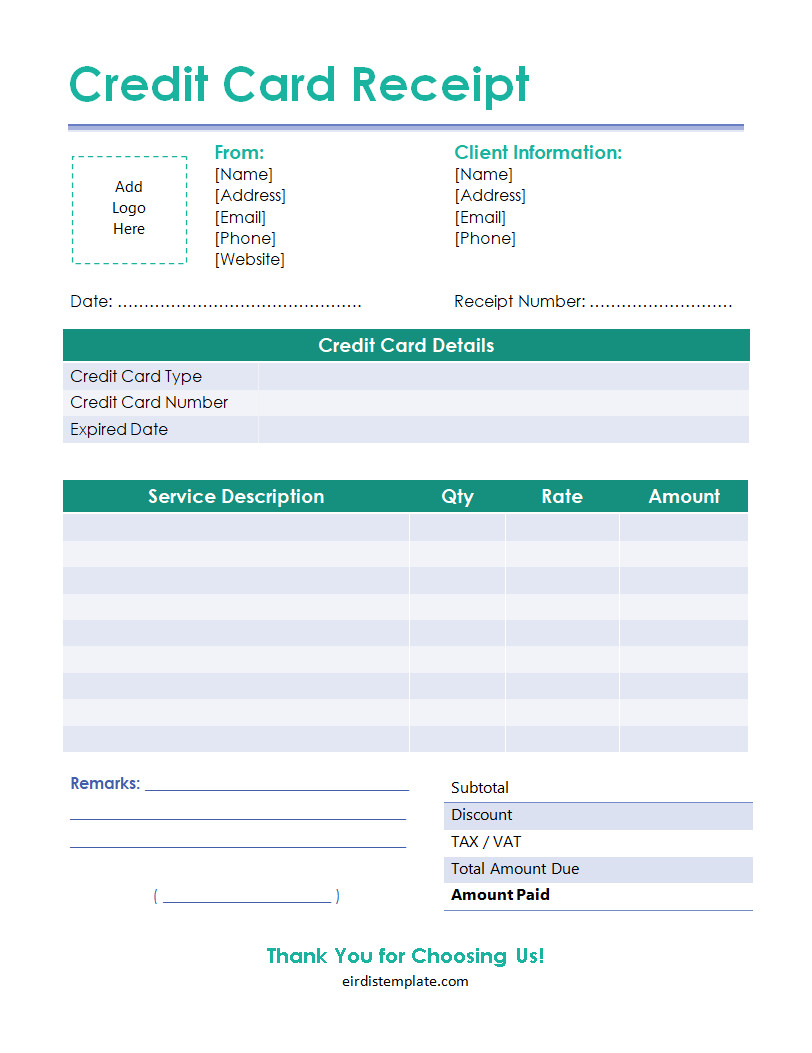

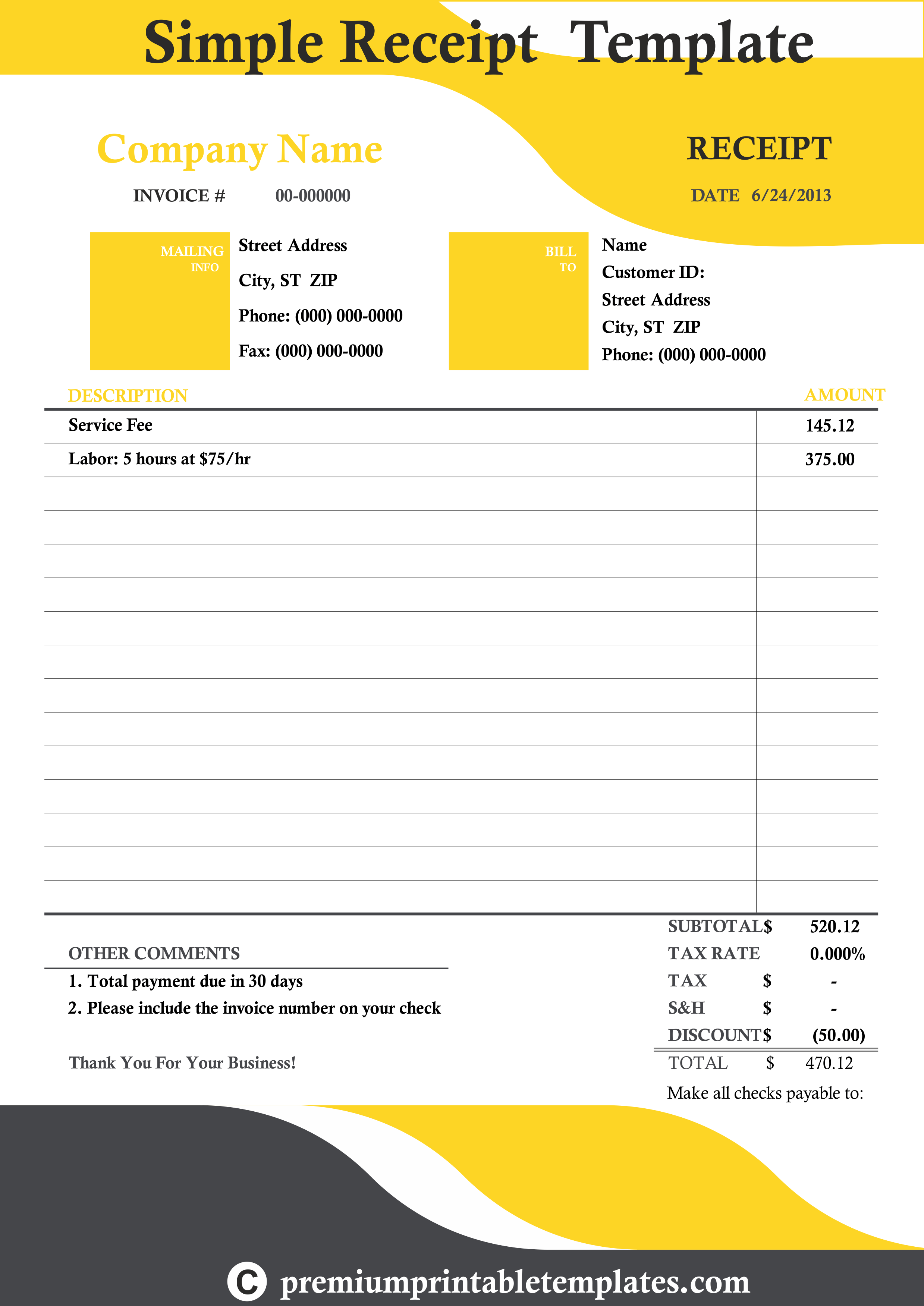

Customization Needs and Branding

Your receipt is a touchpoint with your customer. Can the template be customized to reflect your brand’s identity?

* Logo and Colors: Ability to add your company logo and use brand-consistent colors.

* Custom Messages: Space for thank-you notes, promotional messages, or important disclaimers.

* Layout: Flexibility to arrange information in a clear and intuitive manner.

Cost and Accessibility

Evaluate the financial implications and ease of access.

* Free Templates: Great for startups or very small businesses, often found in Word/Excel format or basic online generators. May offer limited features.

* Paid Subscriptions: Often come with accounting software or advanced receipt generators, offering more features, better integration, and professional support.

* Hardware Costs: Consider the cost of receipt printers if you opt for physical receipts.

Benefits of Using a Standardized Credit Card Receipt Template

Adopting a consistent and professional credit card receipt template across all your transactions offers a multitude of benefits, enhancing both your internal operations and external customer relations.

Professionalism and Branding

A well-designed receipt, featuring your company logo and consistent branding, projects an image of professionalism and attention to detail. It’s a small but significant detail that reinforces your brand identity and leaves a positive impression on customers, contributing to trust and recognition. Generic or handwritten receipts, by contrast, can suggest a lack of organization.

Error Reduction

Standardized templates minimize the risk of human error. By providing predefined fields for all essential information, they guide the user to include everything necessary, preventing omissions of crucial details like transaction numbers, dates, or payment methods. This consistency is invaluable for accurate record-keeping and avoiding discrepancies during reconciliation.

Streamlined Record-Keeping and Accounting

When every receipt follows the same format, it drastically simplifies internal accounting processes. Financial data can be quickly located and processed, whether manually or through automated systems. This leads to faster month-end closings, easier audits, and a clearer overall picture of your business’s financial health. It also aids in rapid retrieval of information during customer inquiries or chargeback disputes.

Enhanced Customer Trust and Satisfaction

Customers appreciate clarity and efficiency. A clear, accurate receipt that promptly confirms their payment instills confidence and peace of mind. Should they need to reference the transaction later for returns, warranties, or expense tracking, a comprehensive receipt makes the process straightforward, further enhancing their satisfaction and fostering loyalty to your business.

Creating and Customizing Your Credit Card Receipt Template

While many ready-made solutions exist, understanding how to create and customize your own credit card receipt template allows for maximum control and alignment with your specific business needs.

Using Online Generators

Many online tools specialize in generating receipts. These platforms typically offer a user-friendly interface where you can input your business details, transaction specifics, and even upload your logo. They then generate a PDF or image file of your receipt that you can print or email. This is an excellent option for businesses that need professional-looking receipts without investing in complex software. Be sure to check for features like currency options, tax calculations, and the ability to save templates for future use.

DIY with Word or Excel

For those comfortable with basic office software, Microsoft Word or Excel (or their Google equivalents) can be powerful tools for creating a custom receipt template.

* Word: Offers excellent control over layout and design. You can insert tables, text boxes, and images (your logo) to build a visually appealing receipt.

* Excel: Ideal for receipts that involve calculations (e.g., multiple items, taxes, discounts). You can set up formulas to automatically calculate subtotals and totals, minimizing manual errors.

While more time-consuming initially, this method provides complete flexibility and zero recurring costs.

Leveraging Accounting and POS Software

The most integrated and automated approach is to use the receipt generation features built into modern accounting software (e.g., QuickBooks, Xero) or Point of Sale (POS) systems (e.g., Square, Shopify POS). These systems automatically pull transaction data, apply your pre-set branding, and generate receipts with minimal manual input. They can often be configured to email digital receipts directly to customers or print physical copies. This method is highly recommended for businesses with higher transaction volumes due to its efficiency and reduced risk of errors.

Conclusion

The humble credit card receipt, often overlooked, is a cornerstone of robust business operations and strong customer relationships. A well-designed credit card receipt template is not merely a piece of paper or a digital file; it’s a critical tool for financial record-keeping, legal compliance, and effective branding. By ensuring every transaction is clearly documented, businesses protect their interests, streamline their accounting processes, and build trust with their clientele.

Whether you opt for a customizable digital solution, leverage your existing accounting software, or design a template from scratch, the investment in a high-quality receipt system will pay dividends. It simplifies audits, resolves disputes efficiently, and reinforces your commitment to professionalism. In today’s competitive landscape, providing clear, accurate, and professional transaction records is not just good practice—it’s an essential element of success.

]]>