Transforming a brilliant business idea into a tangible, fundable venture requires a roadmap, and at the core of that map are the numbers. For many entrepreneurs, the task of forecasting revenue, expenses, and cash flow can be the most intimidating part of writing a business plan. This is where finding a high-quality Business Plan Financial Projections Template Free of charge becomes an absolute game-changer, providing the structure needed to translate your vision into a language that investors, lenders, and you yourself can understand and trust.

These financial projections are far more than just a mandatory section in your business plan; they are the financial heartbeat of your company. They serve as a critical tool for strategic planning, allowing you to anticipate challenges, manage resources effectively, and set realistic goals for growth. Without a solid financial forecast, you are essentially navigating the treacherous waters of business without a compass. A well-constructed projection demonstrates to potential stakeholders that you have a deep understanding of your market, your operational costs, and your path to profitability.

The process forces you to think critically about every aspect of your business operations. How much will it cost to acquire a customer? What are your fixed monthly expenses? When will your business reach the break-even point? Answering these questions with data-backed assumptions is fundamental to building a sustainable enterprise. A good template simplifies this complex process, guiding you through the necessary calculations and ensuring you don’t overlook crucial financial components.

This comprehensive guide will walk you through everything you need to know about creating powerful financial projections for your business plan. We will break down the essential components, explain how to use a template effectively, and highlight common pitfalls to avoid. By the end, you’ll be equipped to build a financial story that not only supports your business plan but also empowers you to make smarter, more confident decisions for your company’s future.

Why Financial Projections Are the Heart of Your Business Plan

Financial projections are the quantitative expression of your business strategy. While the rest of your business plan describes your mission, market analysis, and operational plan in words, the financial section translates those ideas into concrete numbers. This part of your plan proves the viability of your business concept, making it arguably the most scrutinized section by anyone evaluating your venture.

Securing Funding from Investors and Lenders

For investors and lenders, your financial projections are the main event. They want to see a clear and credible path to profitability and a return on their investment. Your forecasts for revenue, expenses, and cash flow provide a detailed picture of your company’s potential financial health. Lenders, such as banks, will analyze your projections to assess your ability to repay a loan, focusing heavily on your projected cash flow. Venture capitalists and angel investors, on the other hand, will look for significant growth potential and a high return, examining your revenue forecasts and profit margins to gauge the scalability of your business.

Guiding Strategic Decision-Making

Beyond securing funding, financial projections are an invaluable internal tool. They act as a guide for your strategic decisions. For instance, if your projections show a potential cash flow crunch in six months, you can proactively seek a line of credit or adjust your spending now to avoid it. These forecasts help you determine when to hire new employees, when to invest in new equipment, or how to price your products and services. By modeling different scenarios, you can understand the financial impact of various strategic choices before you commit to them, reducing risk and improving your chances of success.

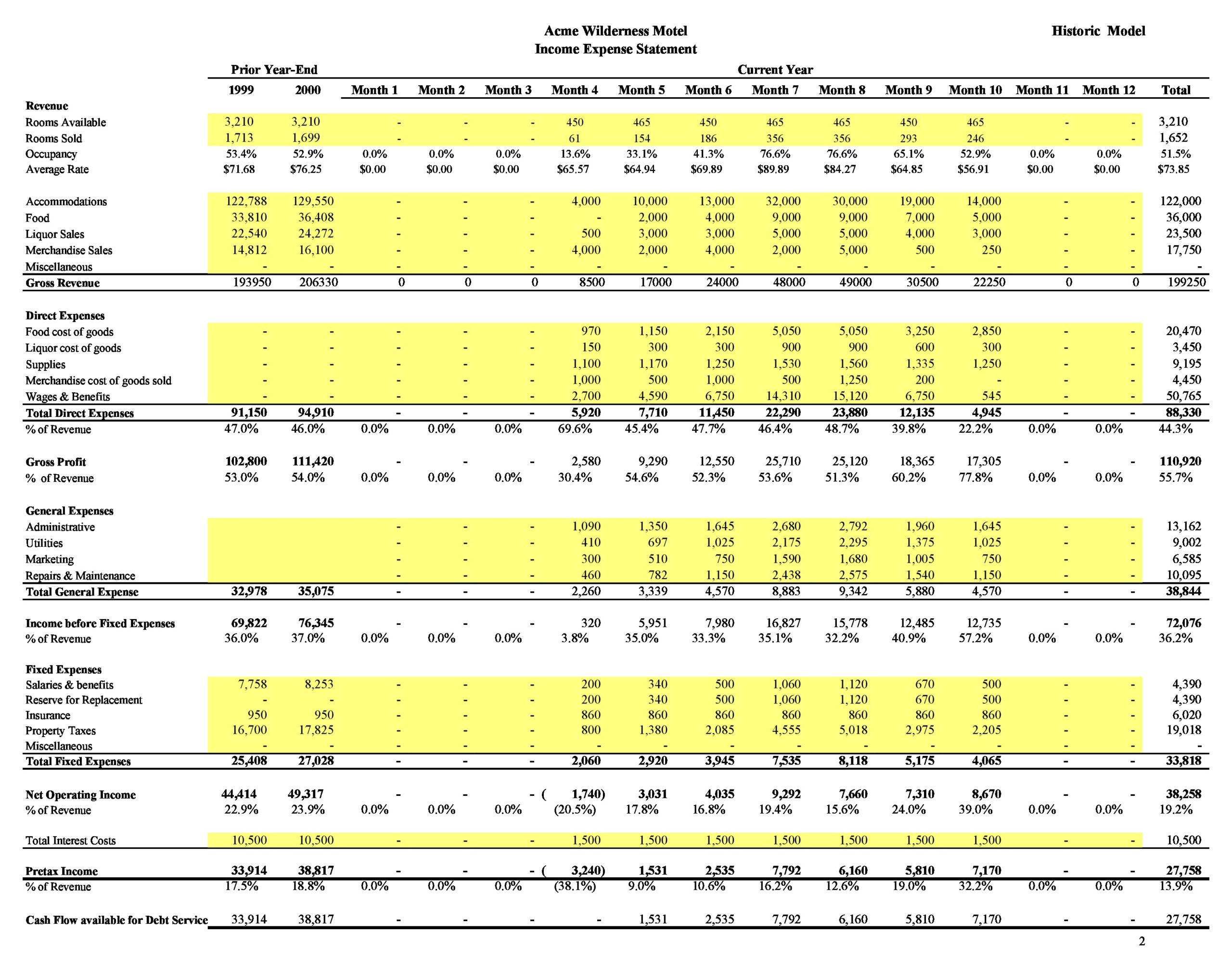

Measuring Performance and Setting Benchmarks

Once your business is up and running, your initial financial projections become the benchmark against which you measure your actual performance. By comparing your actual results to your projected figures—a process known as variance analysis—you can identify what’s working and what isn’t. Are your sales lower than expected? Perhaps your marketing strategy needs a rethink. Are your costs higher than projected? It might be time to renegotiate with suppliers or find operational efficiencies. These projections provide the targets that keep your team aligned and focused on key financial goals.

Key Components of a Comprehensive Financial Projection

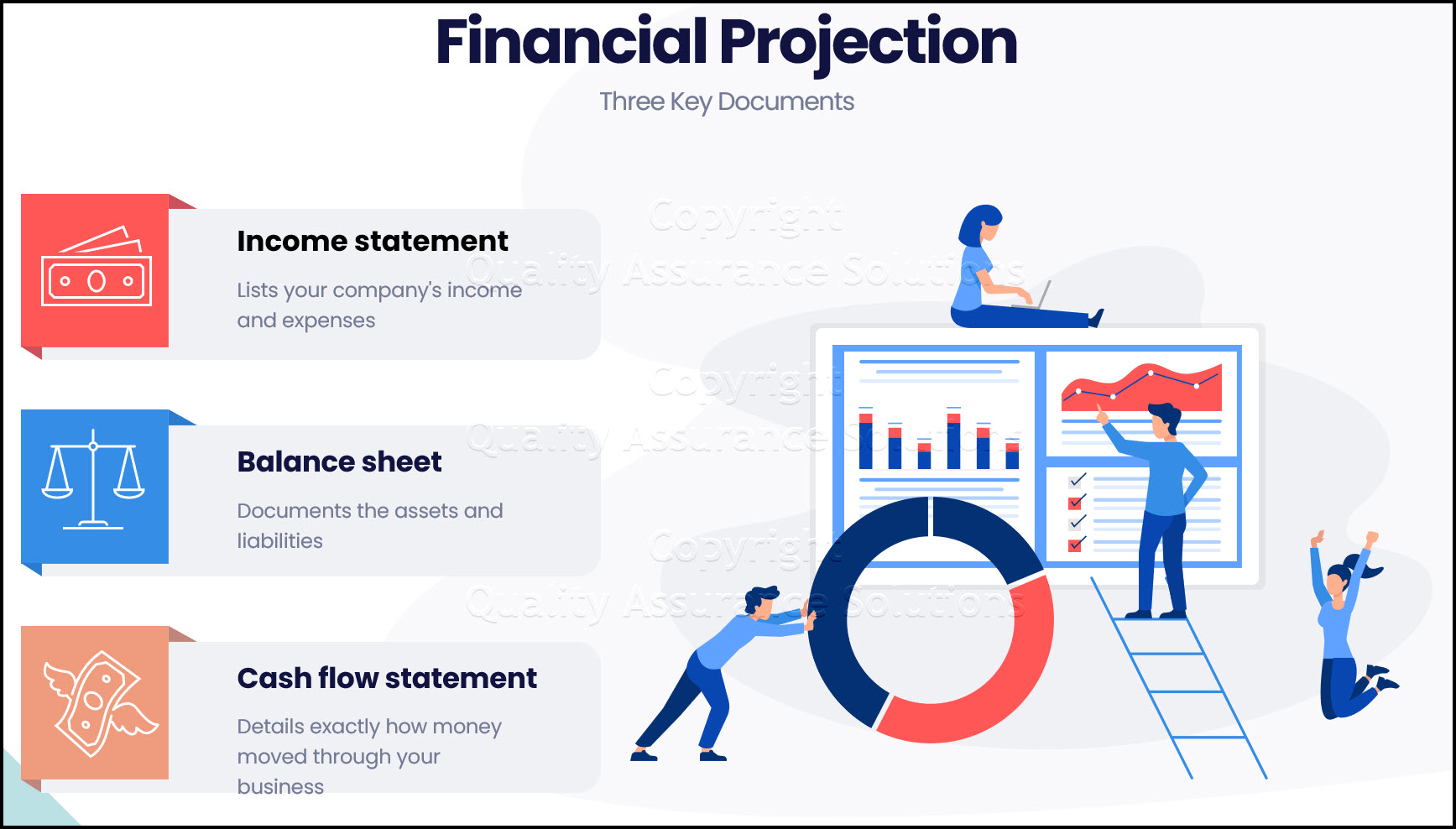

A thorough financial projection is built upon three core financial statements, each providing a different but interconnected view of your business’s financial health. A good template will integrate these statements, so an input in one area automatically updates the relevant figures in others.

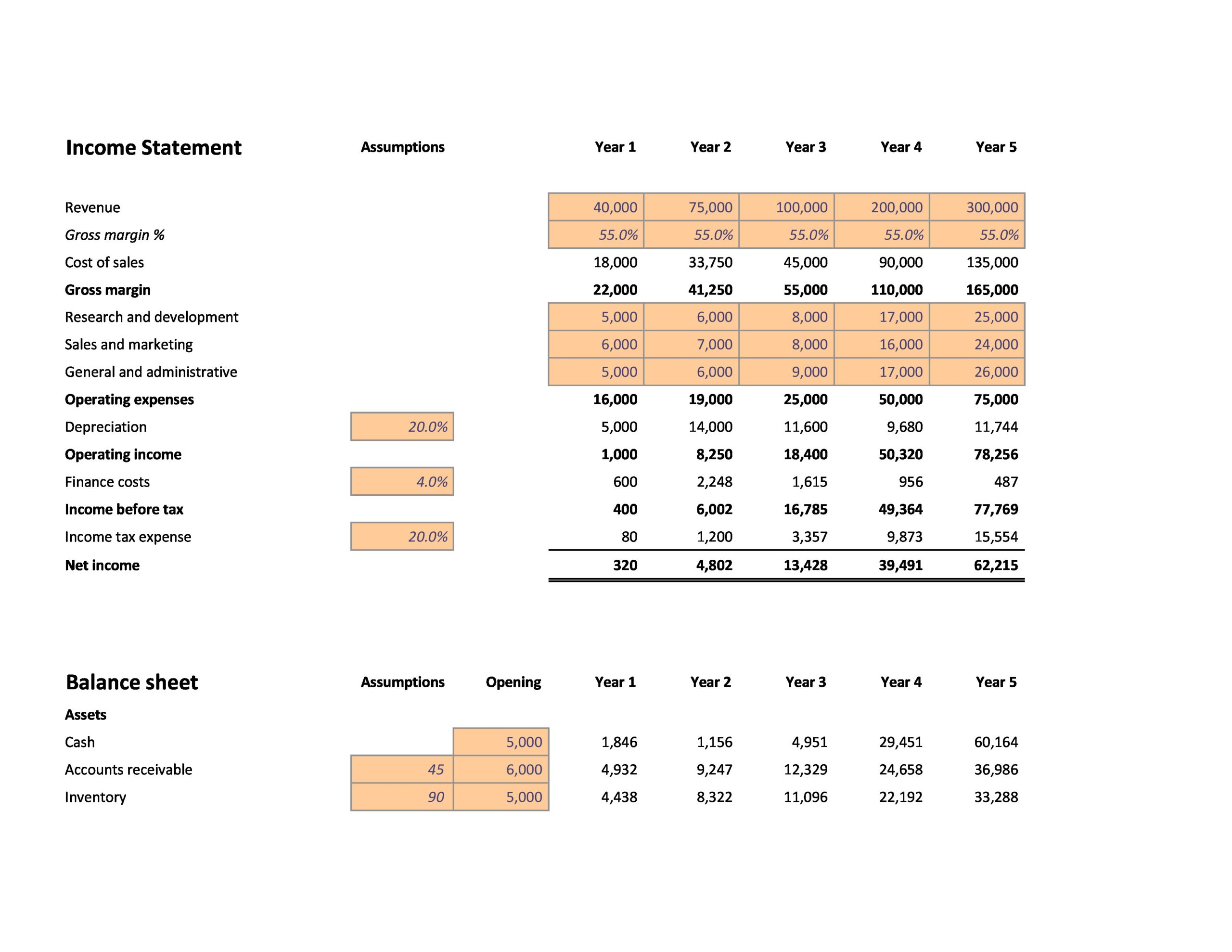

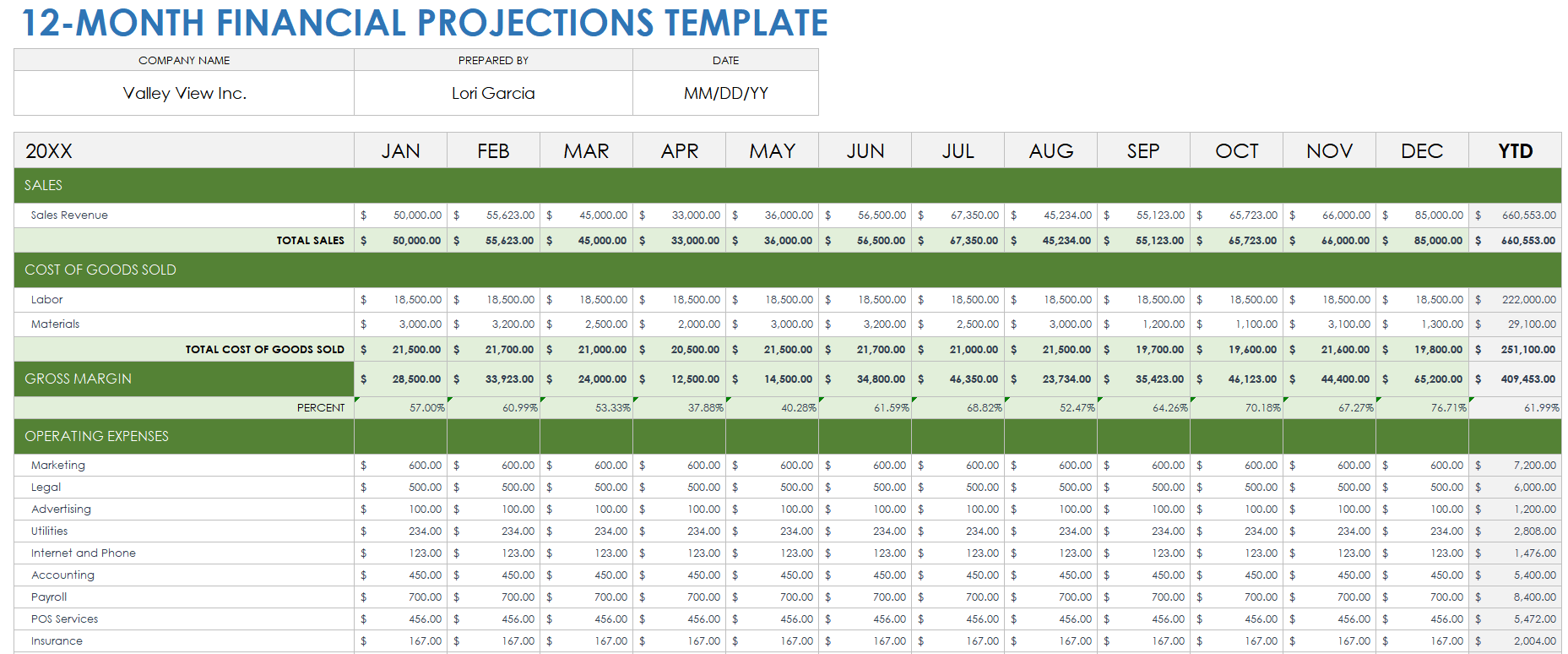

The Income Statement (Profit and Loss)

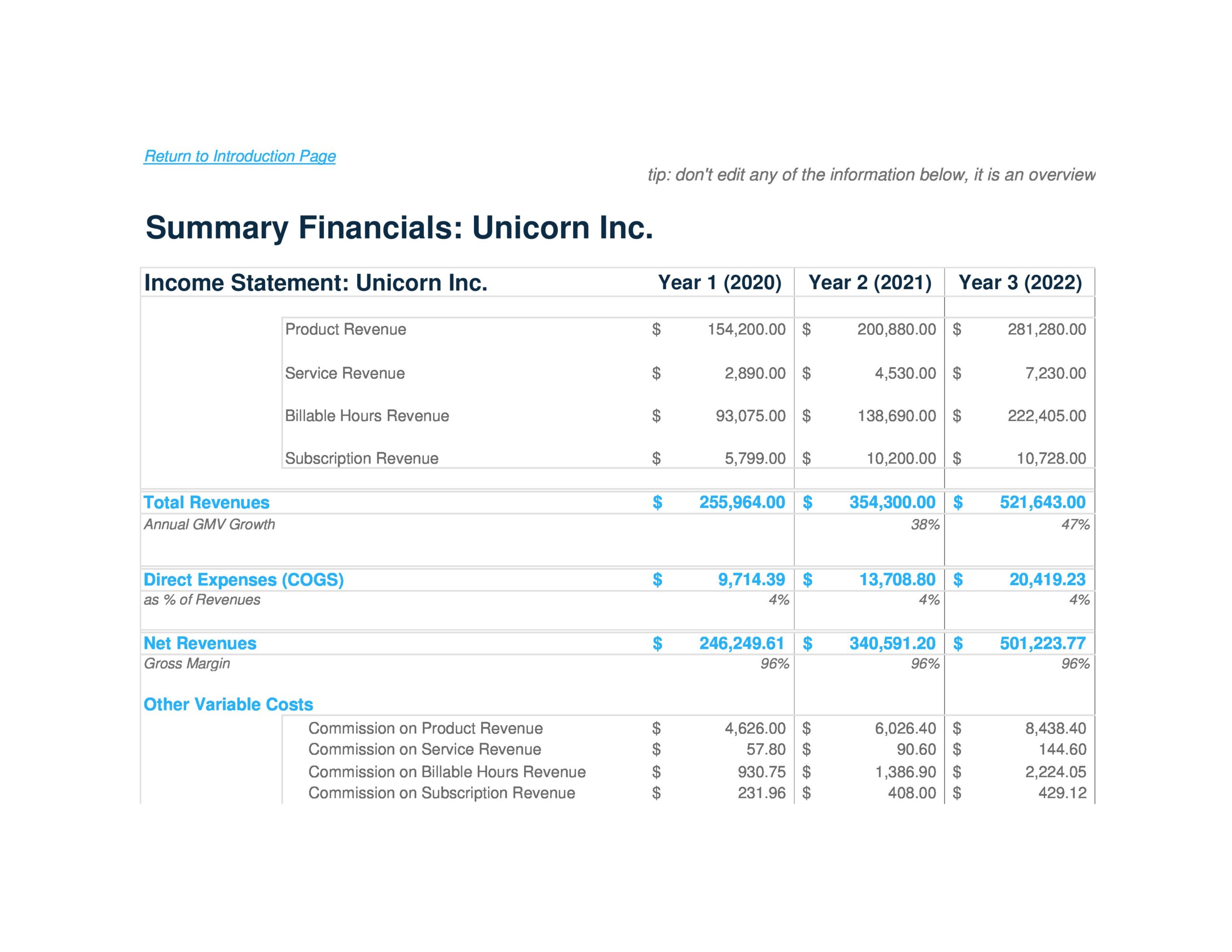

The Income Statement, often called the Profit and Loss (P&L) statement, summarizes your revenues, costs, and expenses over a specific period, such as a month, quarter, or year. It ultimately shows your company’s net income or net loss for that period. Key elements include:

* Revenue (or Sales): The total amount of money generated from selling your products or services.

* Cost of Goods Sold (COGS): The direct costs associated with producing your goods or services.

* Gross Profit: Calculated as Revenue minus COGS, this shows how much profit you make on your products before accounting for operating expenses.

* Operating Expenses: Costs not directly related to production, such as marketing, salaries, rent, and utilities.

* Net Income (Profit): The final number after all expenses, including taxes and interest, are subtracted from revenue.

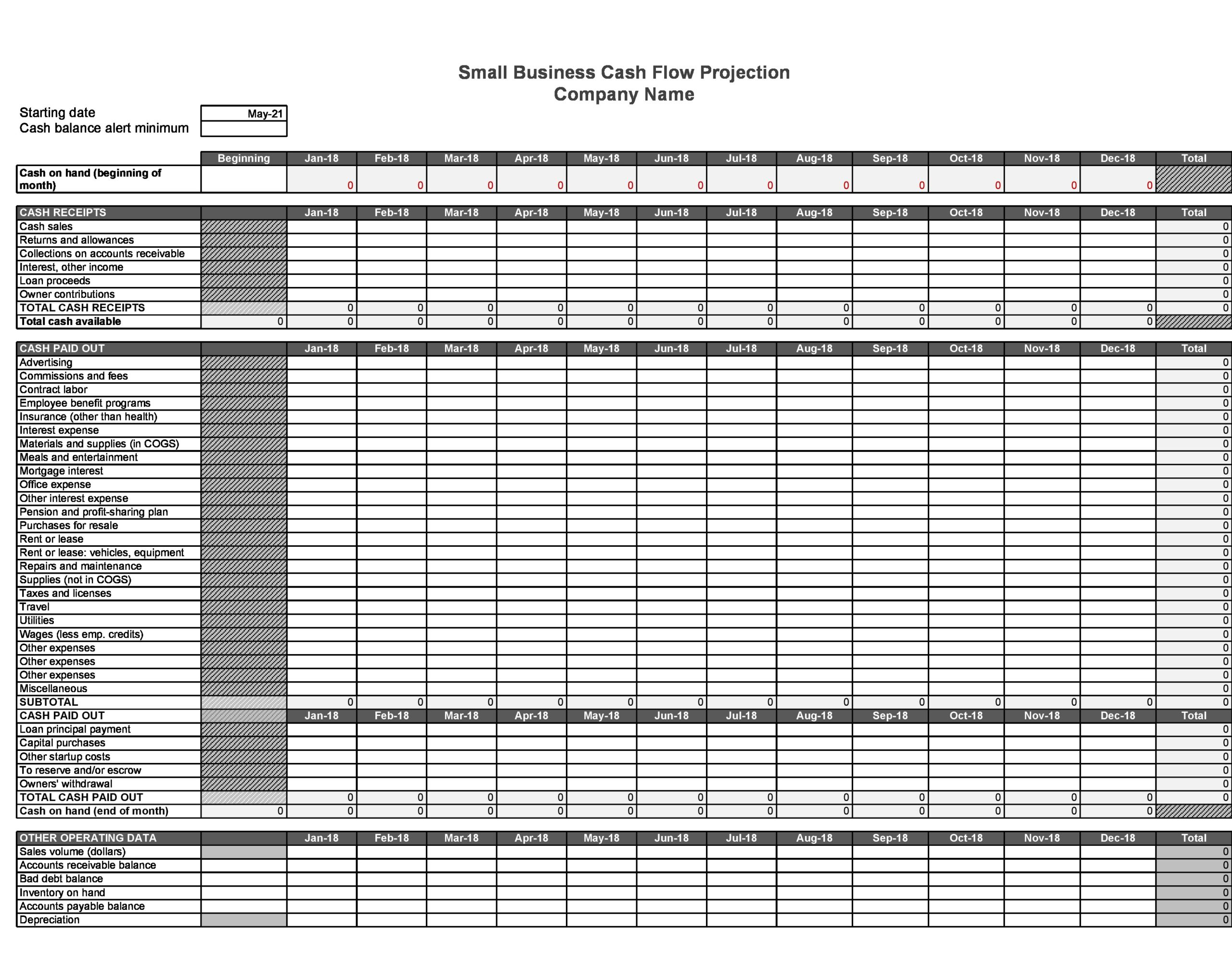

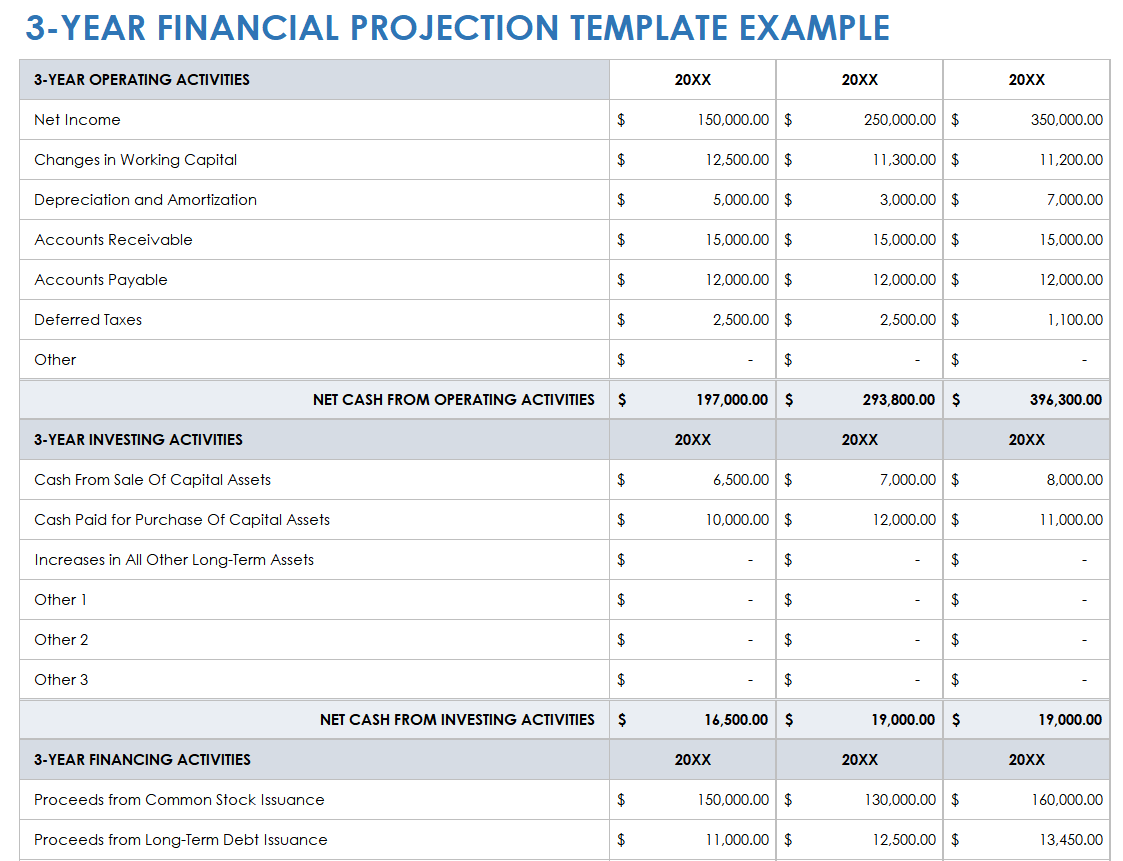

The Cash Flow Statement

The Cash Flow Statement is arguably the most critical for a new business. Profitability on paper doesn’t mean you have cash in the bank to pay your bills. This statement tracks the movement of cash into and out of your company. It is broken down into three activities:

* Operating Activities: Cash generated from your primary business operations.

* Investing Activities: Cash used for or generated from investments, such as buying equipment or property.

* Financing Activities: Cash from investors or banks, or cash paid out to them.

This statement helps you understand your company’s liquidity and solvency. A business can be profitable on its income statement but still fail due to poor cash flow management.

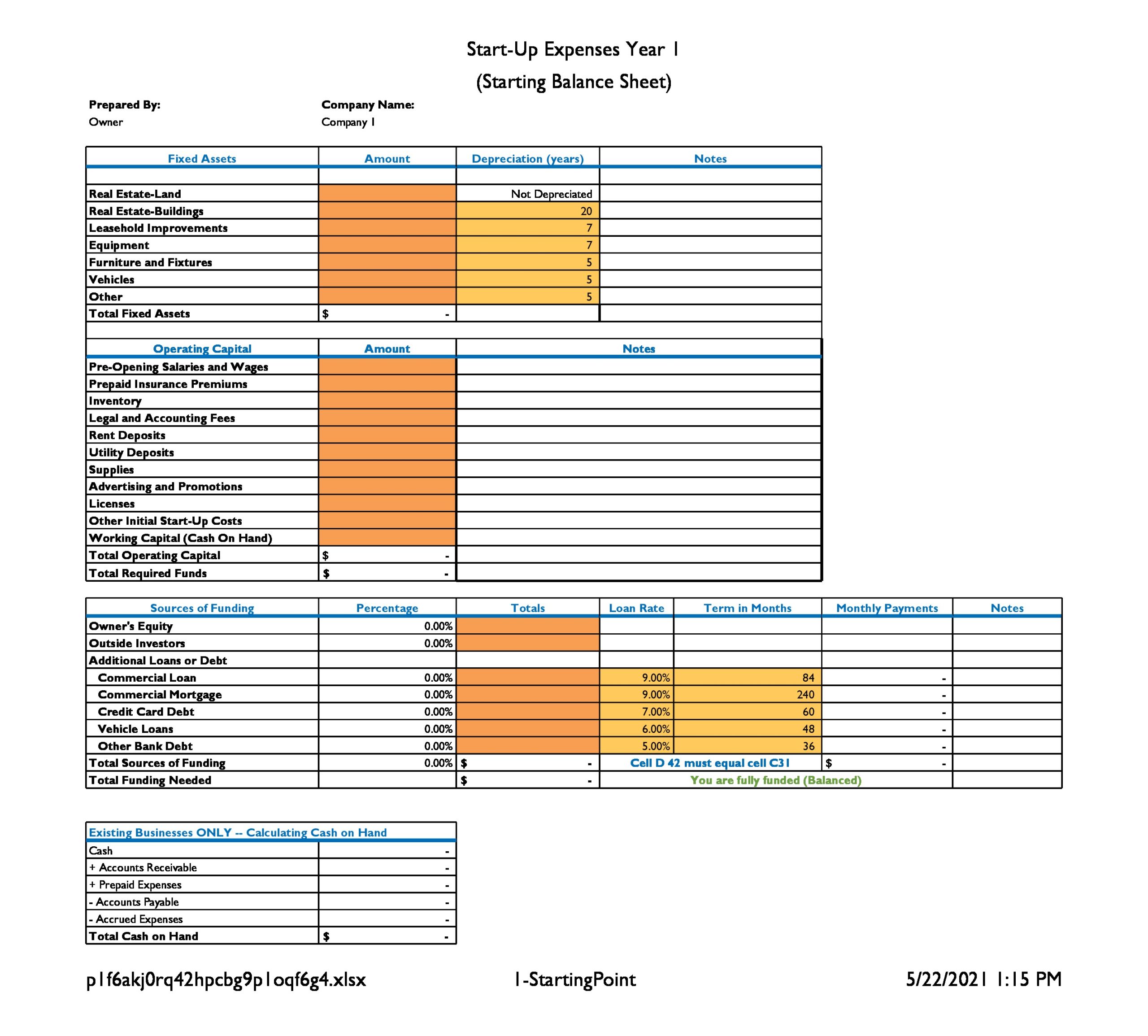

The Balance Sheet

The Balance Sheet provides a snapshot of your company’s financial position at a single point in time. It follows a simple but fundamental equation: Assets = Liabilities + Equity.

* Assets: What your company owns (e.g., cash, inventory, equipment).

* Liabilities: What your company owes (e.g., loans, accounts payable).

* Equity: The net worth of the company, representing the owners’ and investors’ stake.

The three core statements—income statement, cash flow statement, and balance sheet—must all work together and balance, providing a complete and consistent financial picture.

The Break-Even Analysis

A break-even analysis is a crucial calculation that determines the point at which your total revenue equals your total costs. In other words, it’s the level of sales you need to achieve to cover all your expenses without making a profit or a loss. This analysis is vital for setting sales goals, developing pricing strategies, and understanding the level of risk in your business venture.

How to Use a Business Plan Financial Projections Template Free of Charge

Once you’ve found a reliable Business Plan Financial Projections Template Free of charge, using it effectively comes down to the quality of the information you put into it. The template is the tool, but your research and assumptions are the fuel.

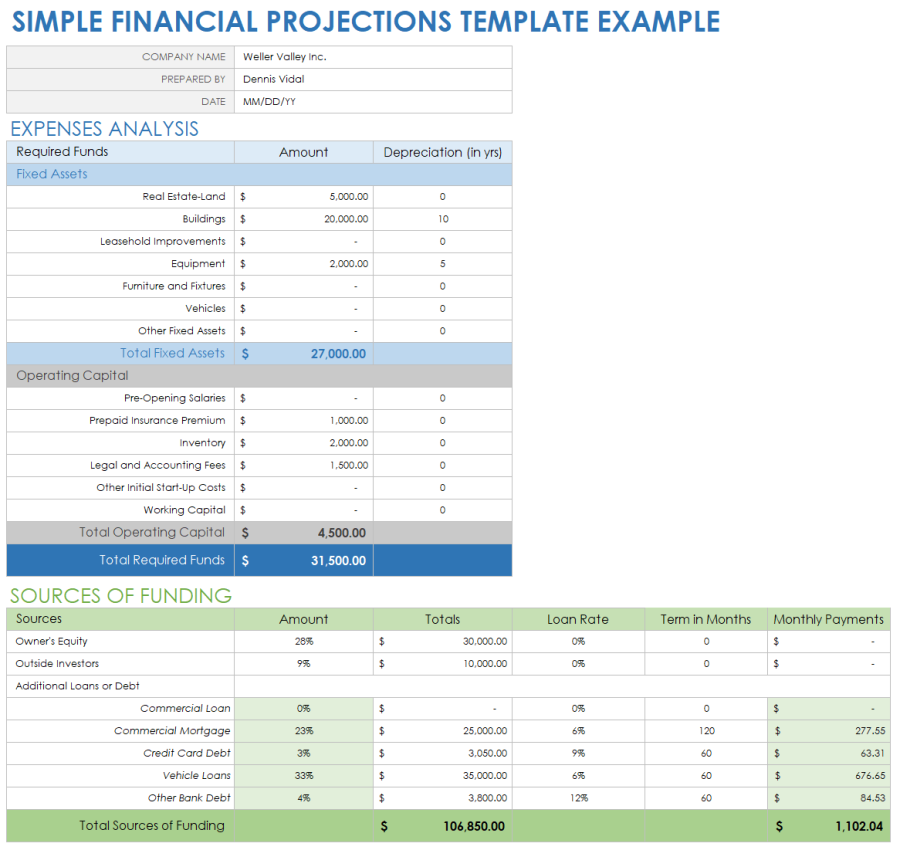

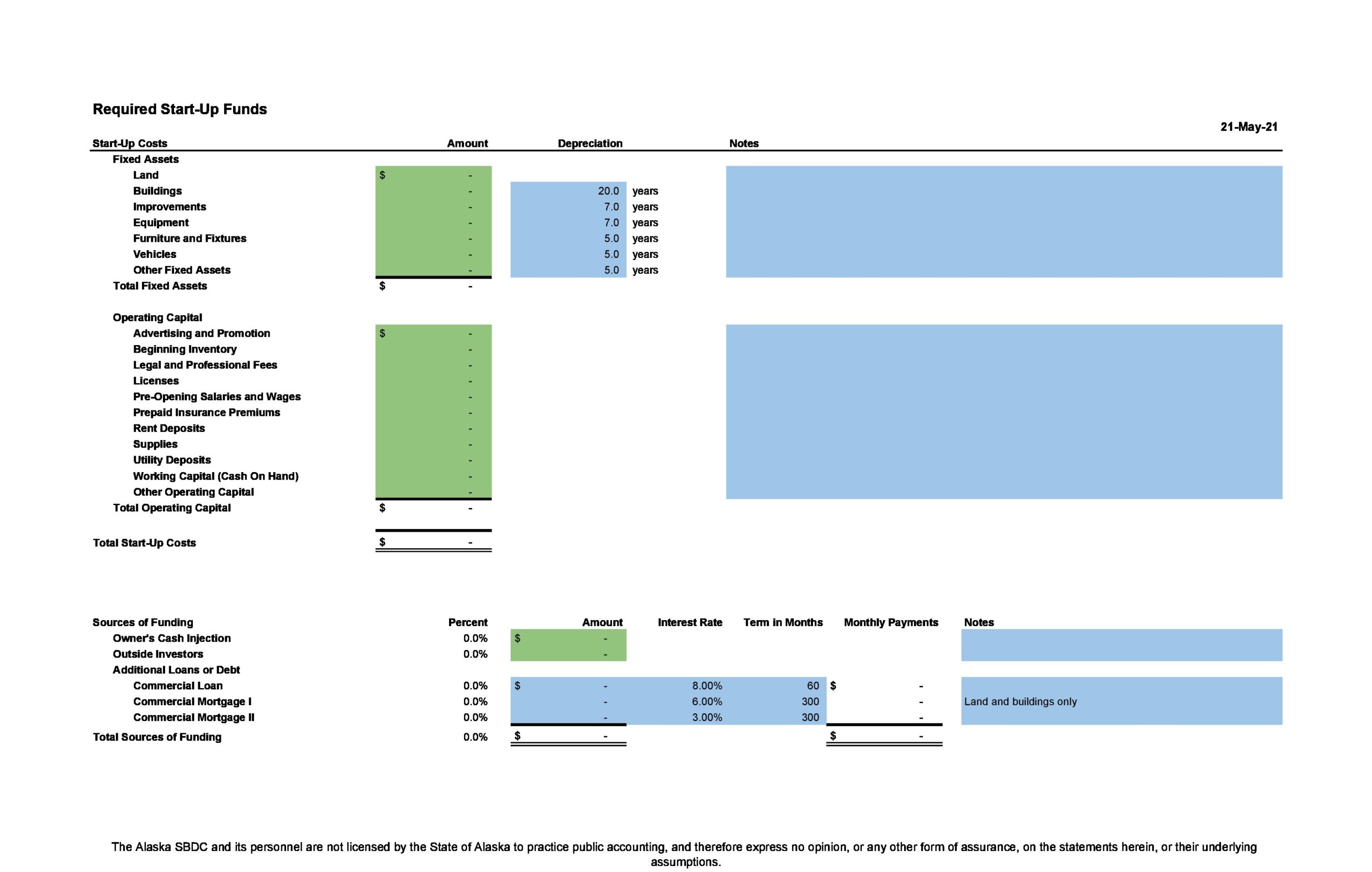

Gathering Your Data and Assumptions

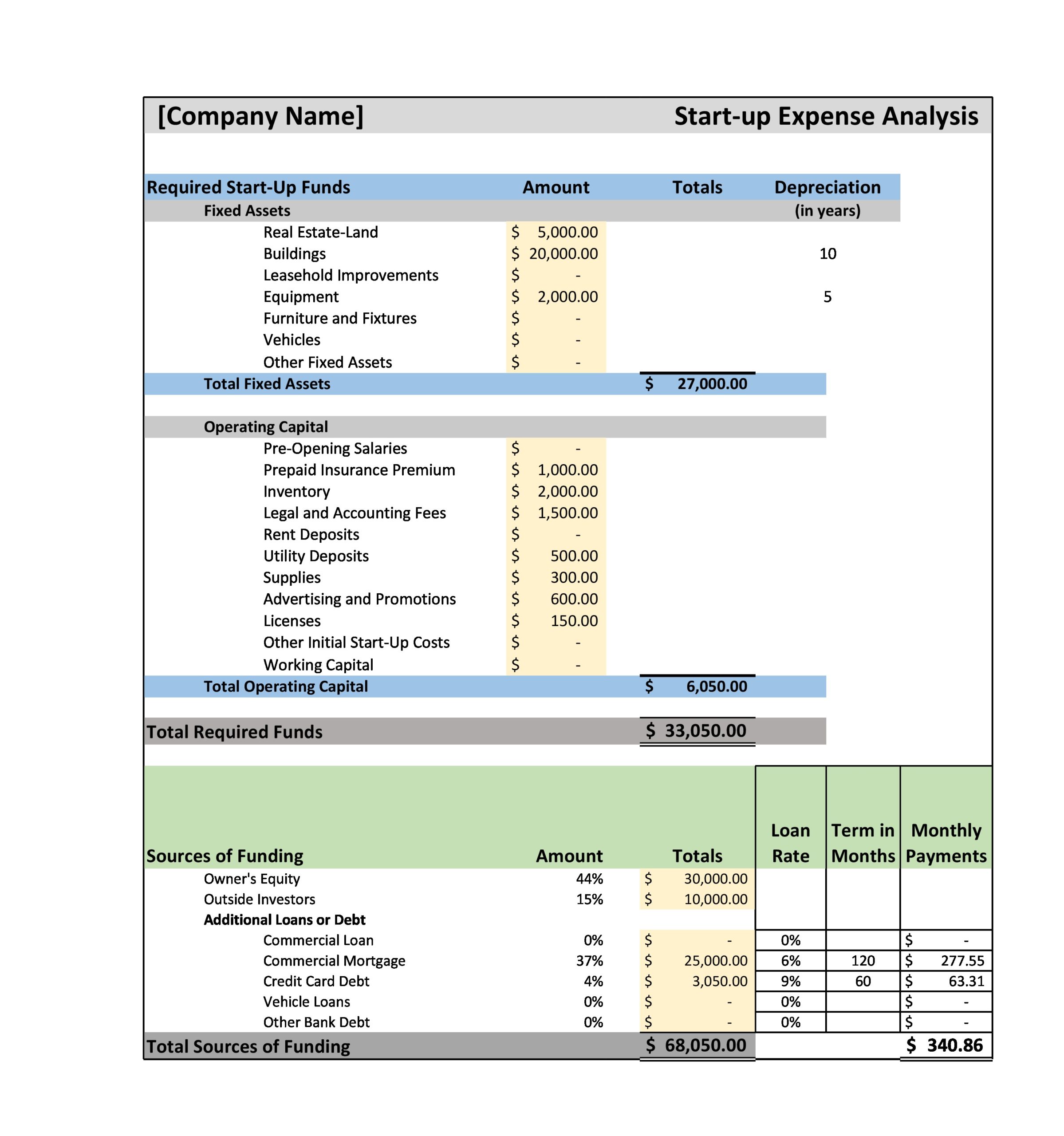

This is the most time-consuming but most important step. Your projections are only as good as the assumptions they are built on. You need to gather data for:

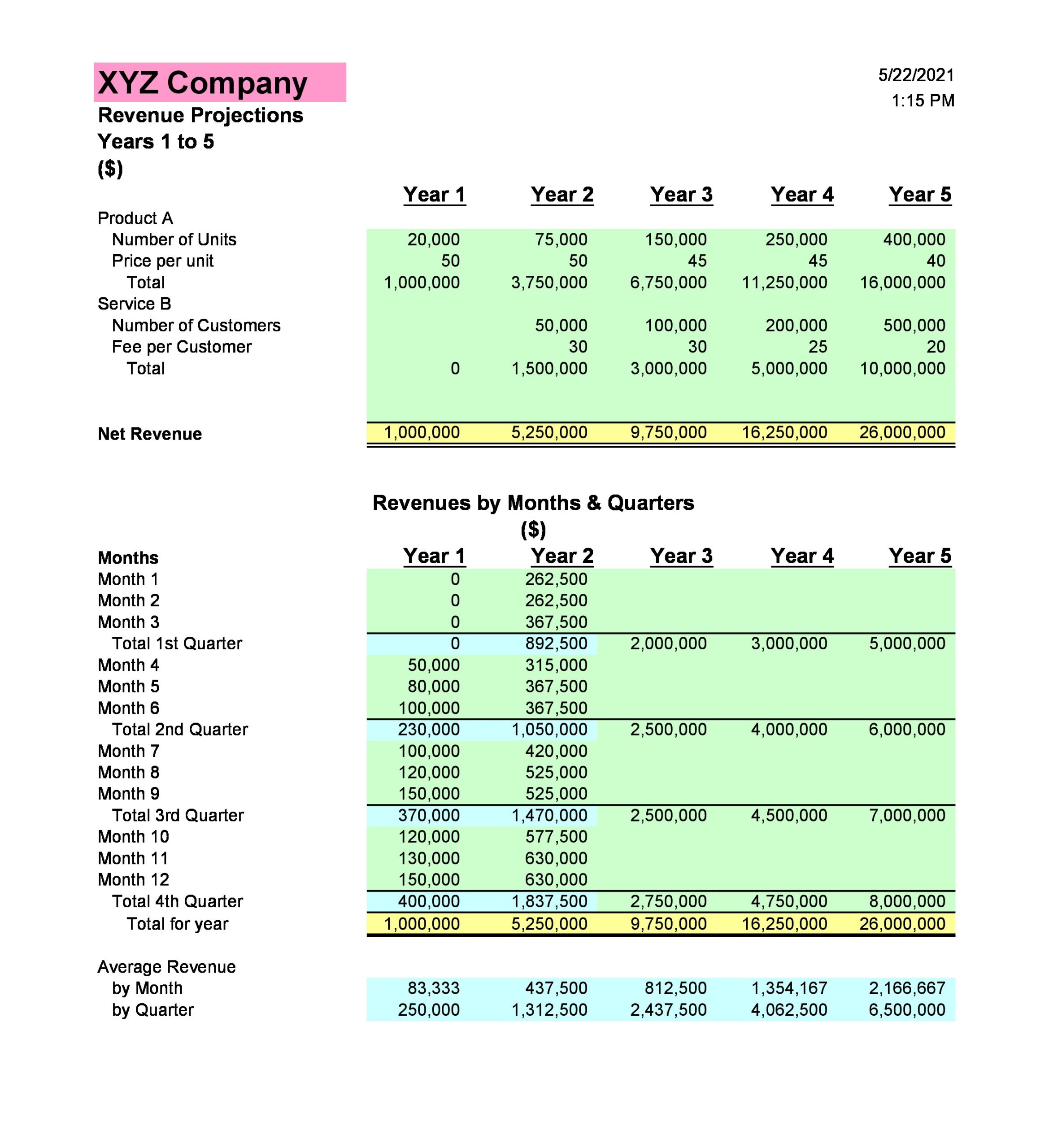

* Sales Forecast: How many units will you sell, and at what price? This should be based on market research, industry benchmarks, and your sales and marketing capacity.

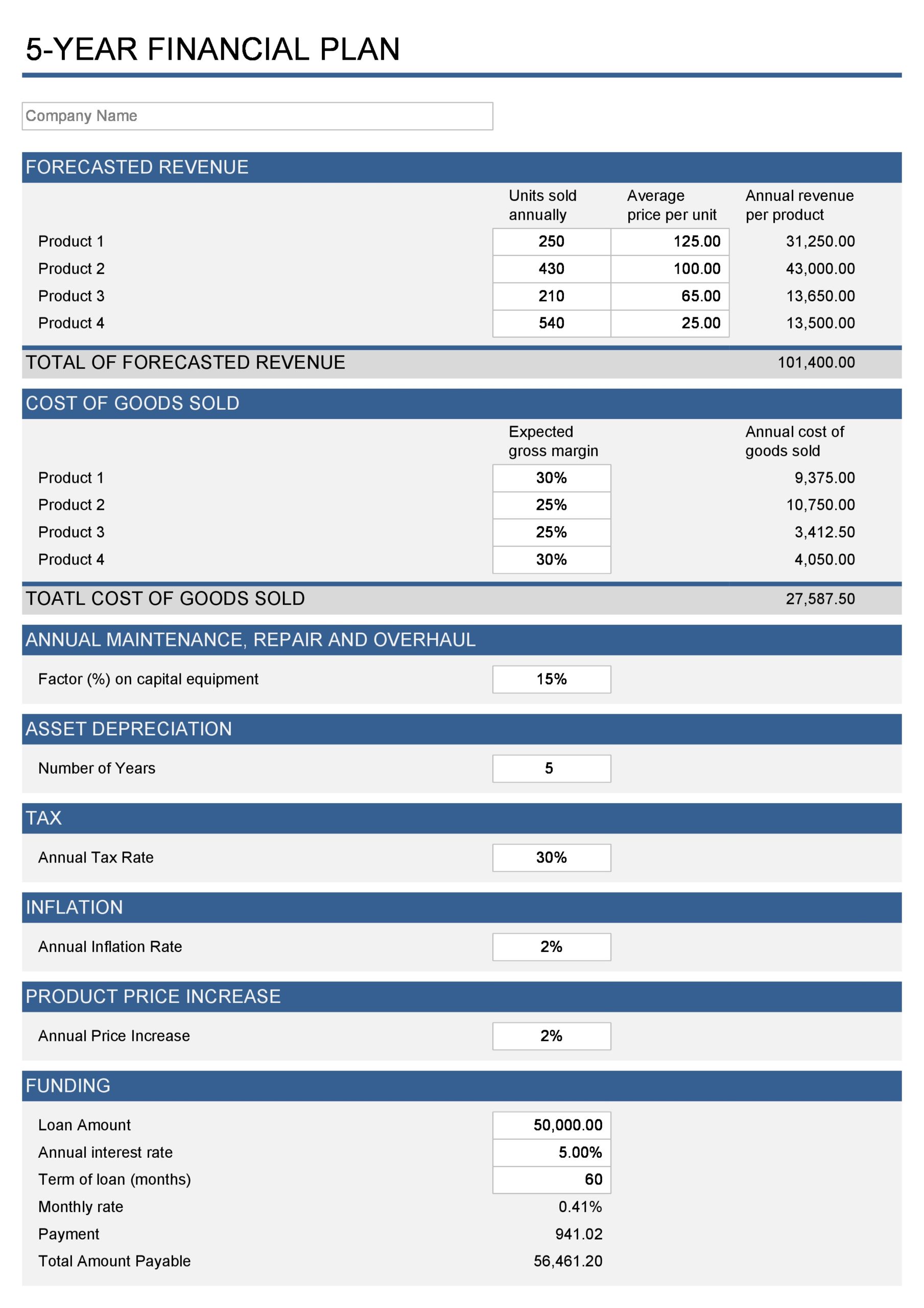

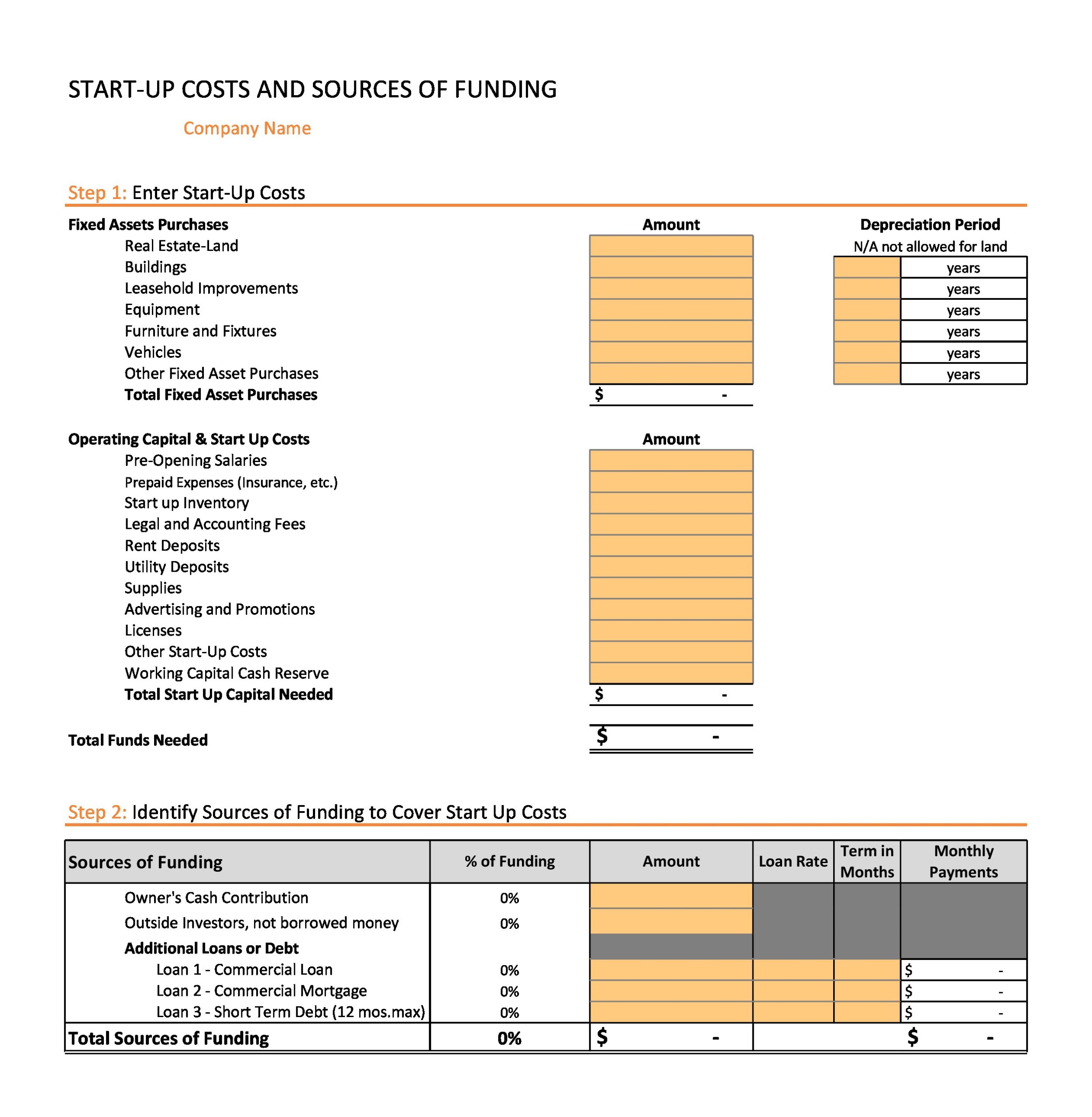

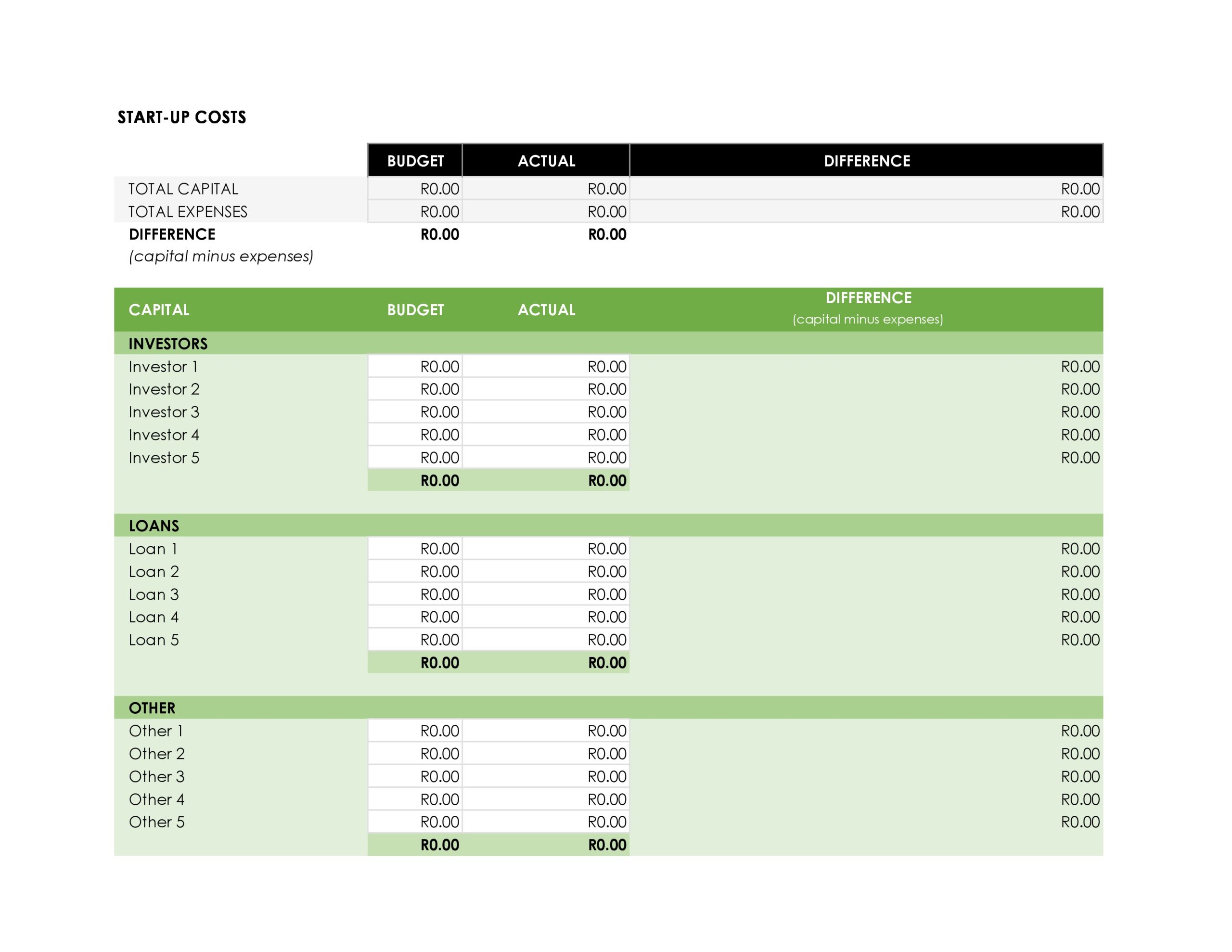

* Startup Costs: A one-time list of all expenses required to get your business off the ground, including legal fees, equipment purchases, and initial inventory.

* Cost of Goods Sold (COGS): The direct cost per unit of your product or service.

* Operating Expenses: Your recurring monthly costs, such as rent, salaries, marketing budgets, software subscriptions, and utilities. It’s helpful to separate these into fixed costs (like rent) and variable costs (like marketing spend).

Inputting Your Numbers into the Template

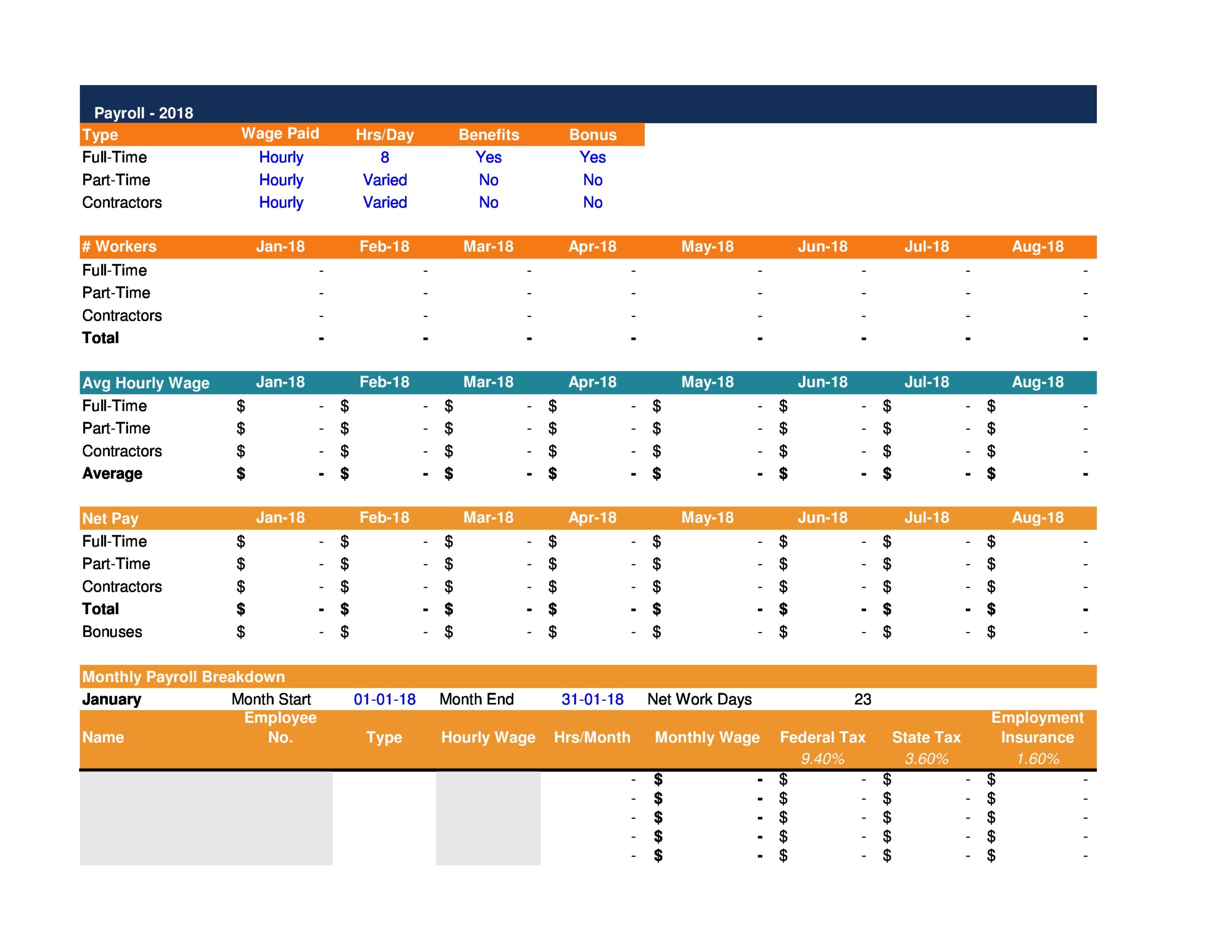

Most templates, typically built in Excel or Google Sheets, are designed for ease of use. They will usually have a dedicated “Assumptions” or “Inputs” tab where you enter all your researched data. You will input your sales forecast, pricing, expense figures, and startup funding information into designated cells. A well-designed template will then use these inputs to automatically populate the income statement, cash flow statement, and balance sheet for a period of three to five years.

Analyzing the Output and Refining Your Projections

After entering your data, it’s time to analyze the results. Look at the key outputs. Is your business projected to be profitable? If so, when? Is your cash flow positive throughout the projection period? If you see months with negative cash flow, you have a problem to solve. This is an iterative process. You may need to go back to your assumptions and adjust them. Perhaps your pricing is too low, or your marketing budget is too high. Tweak the inputs until you arrive at a projection that is both ambitious and realistic.

Common Pitfalls to Avoid When Creating Your Financials

Creating financial projections can be tricky, and several common mistakes can undermine your credibility with investors and lead to poor business decisions.

Overly Optimistic Sales Forecasts

The most common error is an overly optimistic, “hockey stick” sales forecast that shows slow initial growth followed by a sudden, exponential explosion. While exciting, investors have seen this a thousand times and are highly skeptical. Your sales projections should be grounded in reality. Back them up with a bottom-up analysis (e.g., “we will close X leads per month from Y salespeople”) and a top-down analysis (e.g., “we will capture Z% of the total available market”).

Underestimating Expenses and Startup Costs

Entrepreneurs are often so focused on revenue that they underestimate their expenses. Be meticulous in listing every potential cost, from major items like rent and salaries to smaller ones like office supplies and bank fees. It’s also wise to include a contingency fund—typically 10-20% of your total startup costs—to cover unexpected expenses that will inevitably arise.

Confusing Profit with Cash Flow

As mentioned earlier, profit does not equal cash. You can be profitable but run out of money if your customers don’t pay you on time or if you have to make large upfront investments in inventory. Pay very close attention to your cash flow statement to ensure you always have enough working capital to operate your business.

Neglecting to Document Your Assumptions

Your financial projections are a story told through numbers, and the “Assumptions” section is where you explain the plot. Every key number in your forecast should be backed by a clear assumption. Why do you expect to grow at 15% per quarter? What is your customer acquisition cost based on? Documenting these assumptions in a separate tab or document shows that you’ve done your homework and allows others to understand the logic behind your numbers.

Beyond the Template: Customizing Your Financial Story

A template is an excellent starting point, but the best financial projections are tailored to tell the unique story of your business.

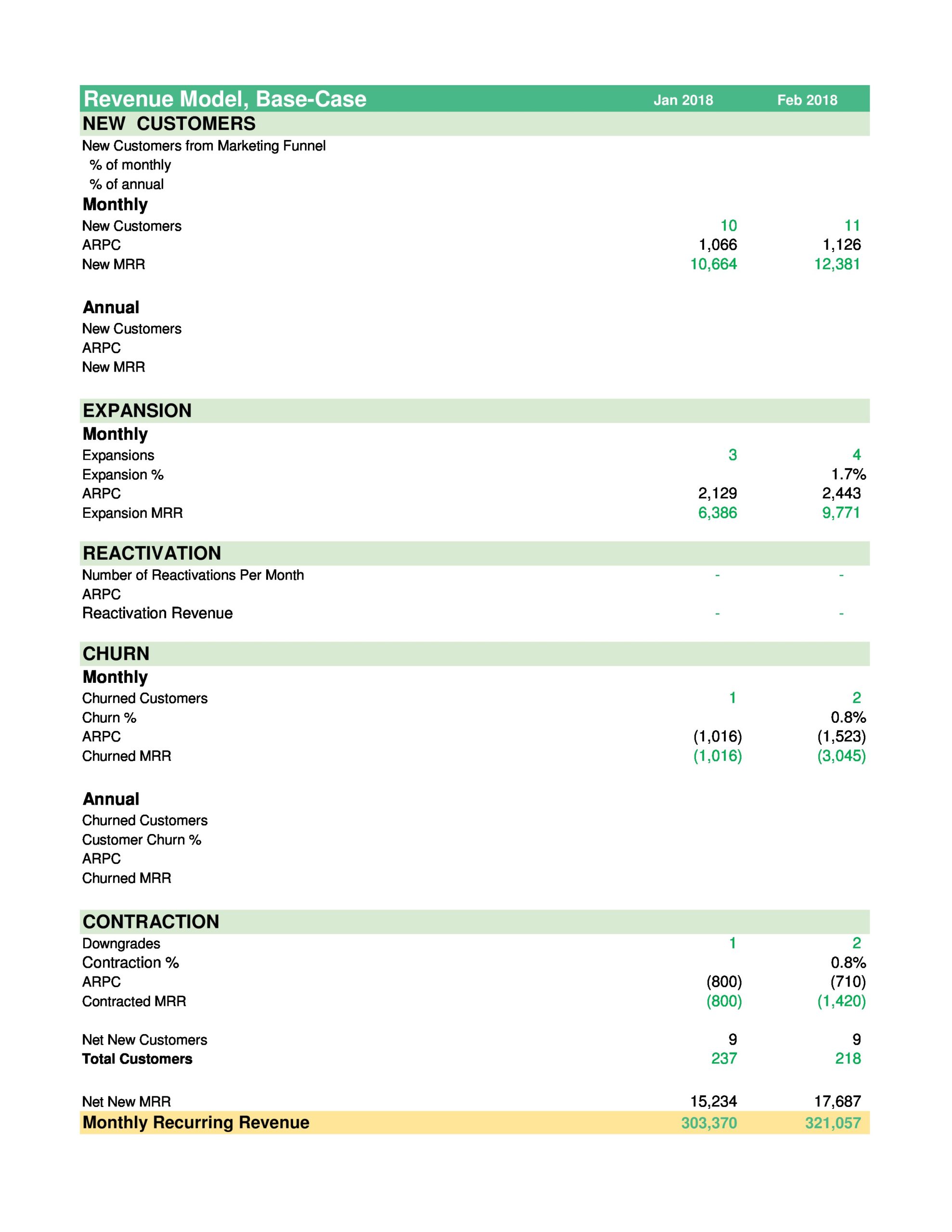

Tailoring Projections to Your Specific Industry

Different industries have different financial models. A SaaS (Software-as-a-Service) business will be focused on metrics like Monthly Recurring Revenue (MRR) and customer churn, while a retail business will be more concerned with inventory turnover and gross margin per square foot. Customize your template and your narrative to reflect the key performance indicators (KPIs) that matter most in your industry.

Creating Multiple Scenarios (Best, Worst, and Realistic Case)

A single set of projections presents a single possible future. A more sophisticated approach is to create three scenarios: a realistic case (your most likely outcome), a best-case (optimistic) scenario, and a worst-case (pessimistic) scenario. This demonstrates to investors that you have considered potential risks and have contingency plans in place. It shows that you are a pragmatic and prepared leader.

Presenting Your Projections Effectively

Raw spreadsheets full of numbers can be overwhelming. To present your financials effectively in your business plan, use charts and graphs to visualize key trends. Include a summary narrative that walks the reader through the key takeaways. Highlight your projected path to profitability, your key assumptions, and your funding requirements. The goal is to make your financial story as clear, compelling, and easy to understand as possible.

Conclusion

Creating solid financial projections is an essential and empowering step in your entrepreneurial journey. It transforms your business idea from a qualitative concept into a quantitative, actionable plan. By leveraging a Business Plan Financial Projections Template Free of charge, you can demystify this process and build a forecast that provides immense value, whether for securing a loan, pitching to investors, or simply guiding your own strategic decisions.

Remember that the template is just the framework. The real strength of your projections comes from diligent research, realistic assumptions, and a deep understanding of the key financial statements: the income statement, the cash flow statement, and the balance sheet. By avoiding common pitfalls like unchecked optimism and by tailoring your projections to your specific business, you create a financial roadmap that is not only credible but also an indispensable tool for navigating the path to success. Ultimately, these numbers tell the most important story of your business—its potential to thrive and grow.

]]>